Introduction to Commercial Real Estate and implications of COVID-19

The uncertainty on the short-term path of the world economy is affecting dramatically the process of decisions among various industries across the globe. And unfortunately, the Commercial Real Estate sector is not immune to the relative impact of this crisis. The COVID-19 pandemic is causing a major impact on the CRE, even worse than the financial crisis of the past year.

The article is focused on Commercial Real Estate, which includes five main traditional categories as estabilished by the National Council of Real Estate Investment Fiduciaries : logistic, hotel, multifamily, retail, office. Each category identified is characterized by its peculiarity, starting from different demand drivers and a particular cash-flow cycle, to the different impact of the market conditions.

Even though the macroeconomics aspects for the CRE sector are not favorable, some categories are proving more resilience than others during the pandemic. It is evident that warehousing and data centres are better positioned compared to the hotels and retails to survive this crisis.

It is difficult to forecast how CRE will restore after the pandemic. There is evidence for thinking that the sector will look different than before. For example, we could take into consideration offices. The sector relies heavily on businesses making their rent, and undoubtedly the COVID-19 has caused widespread slowdown in the demand for spaces. It is difficult to predict if also after the pandemic, the work-from-home will become a normal routine in businesses, leading to a sharp decrease in demand for office space.

The recovery phase will take different speeds if we consider industries, regions and property types. The pandemic will lead to the acquisition of new importance of services as property management, space design, construction, appraisal and analytics to the detriment of consultative advice and strategic planning.

We have highlighted the hospitality sector as the hardest hit category, and mentioned "Data Centers" as an emerging category between the traditional ones. In conclusion, we have provided an outlook of the CRE sector in the following decade.

The uncertainty on the short-term path of the world economy is affecting dramatically the process of decisions among various industries across the globe. And unfortunately, the Commercial Real Estate sector is not immune to the relative impact of this crisis. The COVID-19 pandemic is causing a major impact on the CRE, even worse than the financial crisis of the past year.

The article is focused on Commercial Real Estate, which includes five main traditional categories as estabilished by the National Council of Real Estate Investment Fiduciaries : logistic, hotel, multifamily, retail, office. Each category identified is characterized by its peculiarity, starting from different demand drivers and a particular cash-flow cycle, to the different impact of the market conditions.

Even though the macroeconomics aspects for the CRE sector are not favorable, some categories are proving more resilience than others during the pandemic. It is evident that warehousing and data centres are better positioned compared to the hotels and retails to survive this crisis.

It is difficult to forecast how CRE will restore after the pandemic. There is evidence for thinking that the sector will look different than before. For example, we could take into consideration offices. The sector relies heavily on businesses making their rent, and undoubtedly the COVID-19 has caused widespread slowdown in the demand for spaces. It is difficult to predict if also after the pandemic, the work-from-home will become a normal routine in businesses, leading to a sharp decrease in demand for office space.

The recovery phase will take different speeds if we consider industries, regions and property types. The pandemic will lead to the acquisition of new importance of services as property management, space design, construction, appraisal and analytics to the detriment of consultative advice and strategic planning.

We have highlighted the hospitality sector as the hardest hit category, and mentioned "Data Centers" as an emerging category between the traditional ones. In conclusion, we have provided an outlook of the CRE sector in the following decade.

Hospitality sector: Turbulent Macroeconomic Environment and changing consumer travel preferences

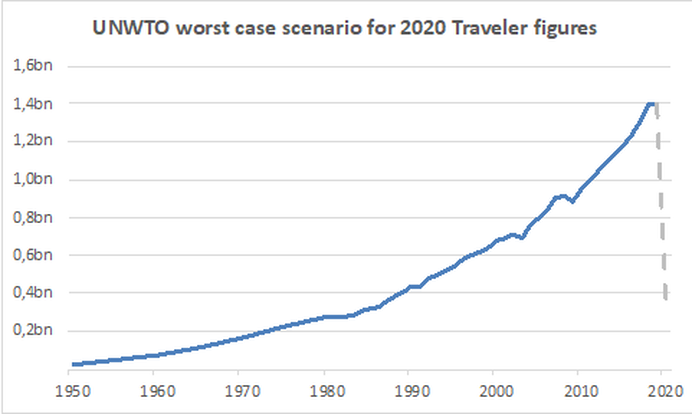

Looking at UNWTO (United Nations World Travel Organization) Forecasts for international travelers it becomes clear just how immense the impact of the global pandemic was on the hotel and leisure travel industry.

The impact on this industry has large ripple effects throughout the economy, as a steep drop in the global sales of USD 600bn and the USD 9trn of indirect economic effects is expected. To last year’s US GDP, the industry contributed USD 580bn in direct and indirect economic effects. Despite the severe impact on the industry, the long-term business rationale is not in danger. The US alone saw the construction of 5800 new properties, with the development of new infrastructure remaining #1 priority for owners, according to UNWTO.

Source: Statista

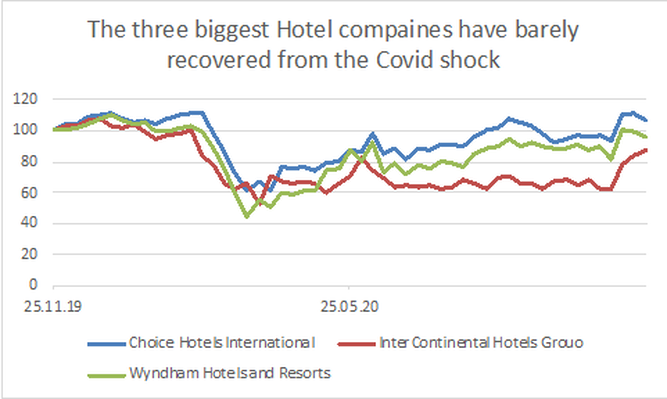

Nevertheless, the short- and medium-term effects weigh on stock prices of share prices in the industry. Looking at the three biggest players in the market (Wyndham Hotel, Choice Hotels and InterContinental Hotels) stock prices have barely recovered from the drop this year. Hotel giant Wyndham, with more than 9000 properties, lost around 50% of equity value earlier this year and so far returned -6% YTD, far away from new all-time highs of the broader market. Where possible, operators try to introduce new hygiene concepts to encourage travelers to come back or at least make deposits for vacations next spring and summer, by offering additional rebates. Nevertheless, UNWTO forecasts a return to 2019 levels of travel only in 2.5 to 4 years, which should make investor cautious when locking at current prices levels as buying opportunities. Even with the start of vaccinations close, valuations remain depressed. Currently the STOXX® Europe 600 Travel & Leisure Index is valued with an average PE ratio of 16.1 and at Price-to-Book ratio of less than two, compared to the S&P 500 with an average PE of 36 and an average Price to Book ratio of 4.

Source: Yahoo Finance

Overall, this year brought a dramatic decline to the hotel industry from which many operators and owners will not recover. The ripple effects of this shock to the broader economy are yet to be determined. Overall, the sector has very low probability of offering a good return to investors in the medium term, so even though valuations look attractive to the general market, the segment should be engaged with caution.

Data Center Real Estate: Surge in Demand in light of COVID-19

Investments in Data Centers are one of the emerging sectors in the Real Estate space. These investments encompass brick-and-mortar facilities as well as computing infrastructure and the operational management of facilities.

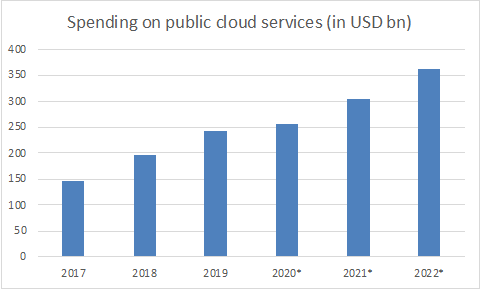

Although the big number of moving parts in the value chain lead to higher complexity, the asset class has experienced fast paced growth. Mainly with the demand for computing power rising dramatically through more and more cloud applications (see graph), especially now with many people working from home.

As companies are bringing more digital solutions to their businesses and are building out their remote working capabilities, providers of this digital infrastructure try to centralize as much of the computational work as possible, in order to benefit from economies of scale. The Facebooks and Googles of this world get the luxury of building out their own proprietary facilities for this purpose, tailored to their needs, but it goes without saying that this is not true for the vast majority of companies. The majority of companies in comparison relies on either pooling their resources with others or buying their computing power from dedicated providers. Specialized in building and maintaining large scale server facilities, these providers develop huge, warehouse-like properties filled with computers, where companies rent out capacities.

Data Center Real Estate: Surge in Demand in light of COVID-19

Investments in Data Centers are one of the emerging sectors in the Real Estate space. These investments encompass brick-and-mortar facilities as well as computing infrastructure and the operational management of facilities.

Although the big number of moving parts in the value chain lead to higher complexity, the asset class has experienced fast paced growth. Mainly with the demand for computing power rising dramatically through more and more cloud applications (see graph), especially now with many people working from home.

As companies are bringing more digital solutions to their businesses and are building out their remote working capabilities, providers of this digital infrastructure try to centralize as much of the computational work as possible, in order to benefit from economies of scale. The Facebooks and Googles of this world get the luxury of building out their own proprietary facilities for this purpose, tailored to their needs, but it goes without saying that this is not true for the vast majority of companies. The majority of companies in comparison relies on either pooling their resources with others or buying their computing power from dedicated providers. Specialized in building and maintaining large scale server facilities, these providers develop huge, warehouse-like properties filled with computers, where companies rent out capacities.

Source: Statista

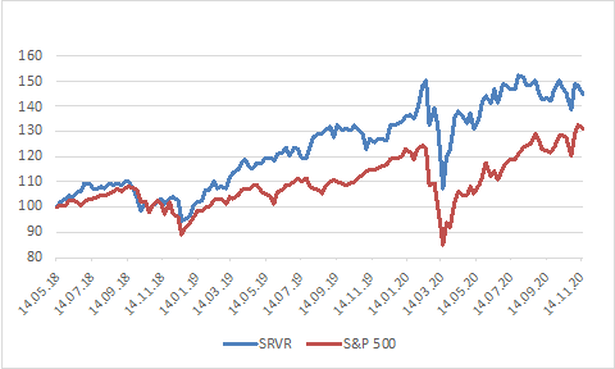

As demand for these capacities grew in the last decade, investors poured capital into companies developing and managing these facilities. The graph below shows a comparison of the S&P 500 with the Pacer Benchmark Data & Infrastructure ETF (Ticker: SRVR), an ETF comprising a number of datacenter REITs and similar assets. The industry ETF outran the broader S&P 500 by a wide margin and recovered almost 30% within three weeks from its March lows, as investors saw the need for more computing power.

Source: Yahoo finance

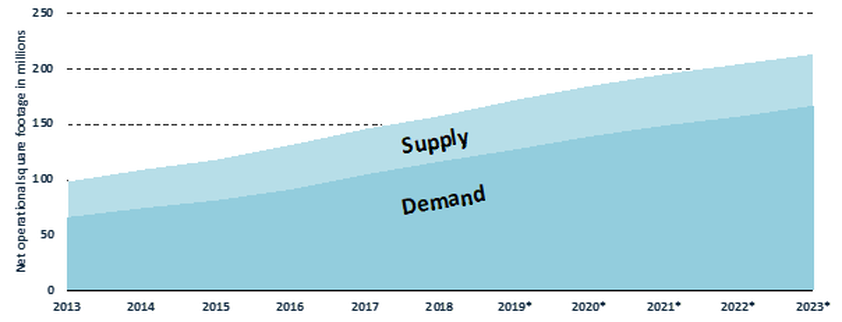

As tempting as it might seem, the future for Datacenter infrastructure is not one of superior returns without any risk. Looking at the period from 2013 to 2023 we see that through the massive inflows of capital a small margin of oversupply is created every year. Therefore, the future returns on this asset class might be very dependent on how Covid and the new smart working culture will influence the demand for computing power in the near term future.

Source: Statista

In conclusion, Data Center investments promise to supply the new, hot commodity everybody needs: Computing Power. In the near term, through digitalization and the smart working culture, this commodity will be in great demand. Investors should be cautious though, large capital inflows in the past might have created small margins of oversupply every year, that could add up and diminish returns in the medium term.

The five Megatrends beyond the pandemic

While 2020 has brought many challenges to the world’s economies, it has also unveiled new opportunities or strengthened the importance of existing ones. For the real estate sector, the following five megatrends stand out and are likely to last beyond the pandemic:

1. Real Estate and E-commerce

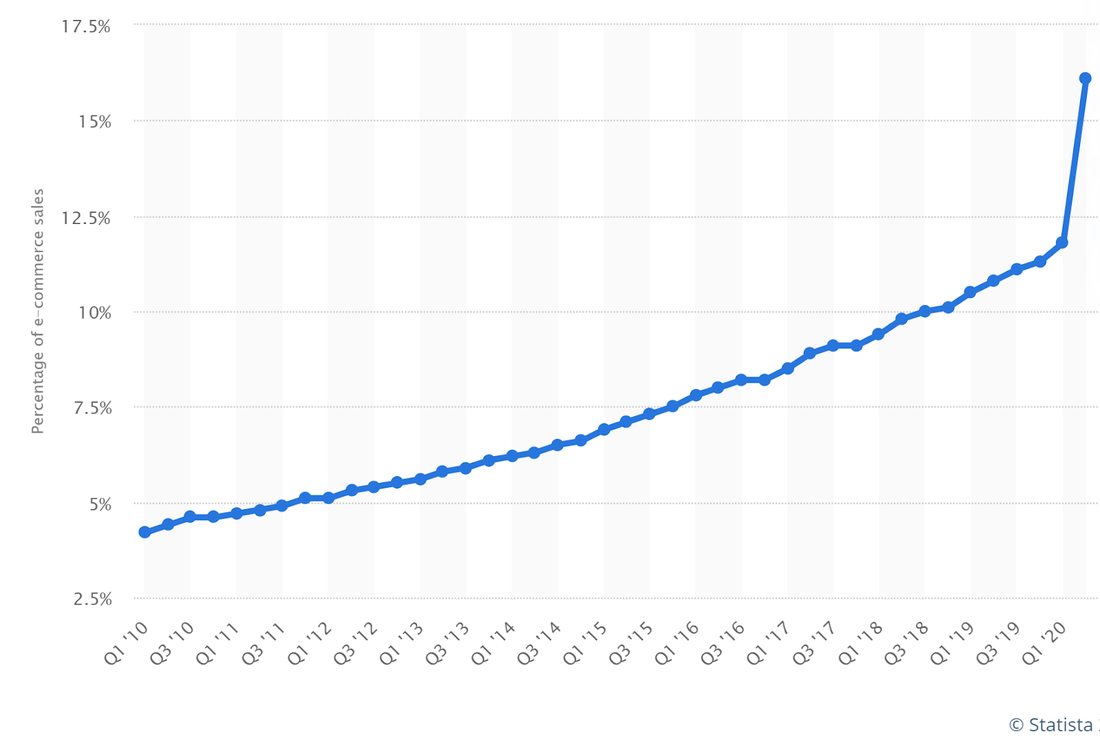

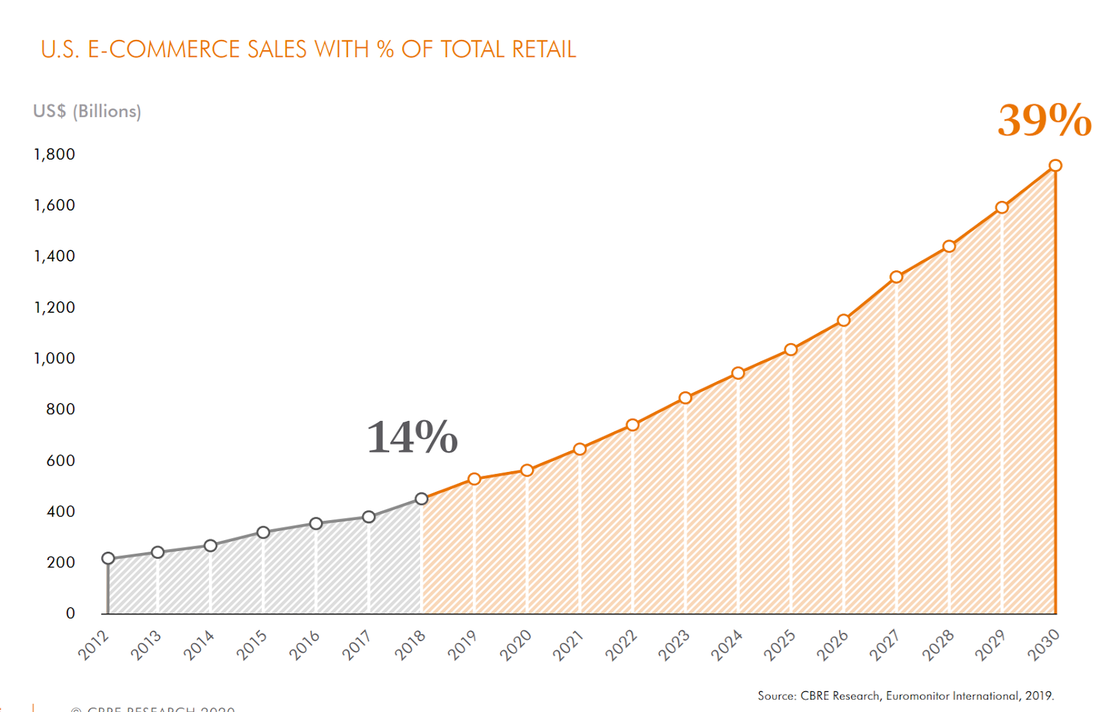

The current pandemic has accelerated the growing trend of outsourcing, specifically in the “on demand warehousing” which operates on a “pay as you go basis”. This approach has become very popular in the last year given the uncertainty regarding the supply chains which makes it hard for companies to make long term distribution decisions. In addition to an already growing trend, online sales as a percentage of total retail sales reached a record 16% of total retail sales in Q2 of 2020 and are predicted to rech 39% as of 2030, further fueling the demand for smart warehousing.

- Real Estate and E-commerce

- Growth in corporate outsourcing

- Life sciences & Medical real estate

- Urbanization & Sustainability

- Technology & increased allocation to real estate

1. Real Estate and E-commerce

The current pandemic has accelerated the growing trend of outsourcing, specifically in the “on demand warehousing” which operates on a “pay as you go basis”. This approach has become very popular in the last year given the uncertainty regarding the supply chains which makes it hard for companies to make long term distribution decisions. In addition to an already growing trend, online sales as a percentage of total retail sales reached a record 16% of total retail sales in Q2 of 2020 and are predicted to rech 39% as of 2030, further fueling the demand for smart warehousing.

Source: Statista

Source: CBRE Research

Adding to that, the fastest growing e-commerce category continues to be the food and beverage, as a result of continuing rising demand for online grocery shopping. For example, Florida’s food and beverage warehousing leasing has tripled from 1 million square feet (between 2010 and 2015) leased to 3.1 million (from 2015 to 2019).

Consequently retailers need larger distribution hubs with cold storage facilities, reiterating the big opportunity for real estate developers focusing on this niche.

Consequently retailers need larger distribution hubs with cold storage facilities, reiterating the big opportunity for real estate developers focusing on this niche.

Source: NKF Research

2. Growth in corporate outsourcing

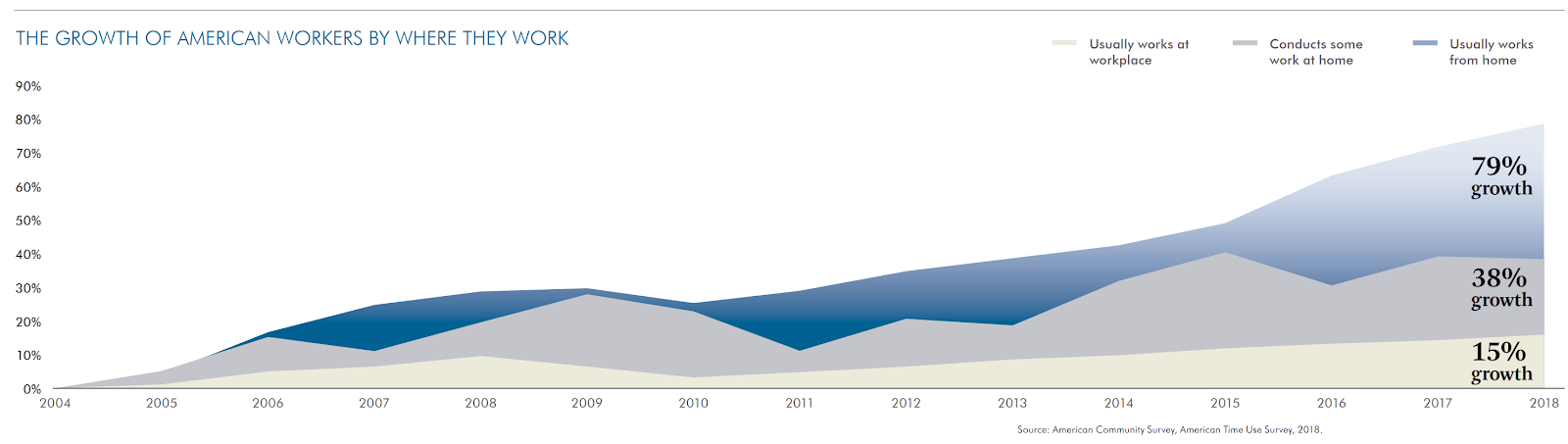

With a sizable growth of 79% employees working from home and 38% working partially from outside of the office, real estate developers have to offer a menu of working locations that are flexible enough to meet the varied personal and professional needs that employees juggle. Moreover, this growth is likely to accelerate post COVID-19, as the pandemic has forced both employees and employers to rethink their working approach and it seems that this trend is likely to persist. Recently, BlackRock’s CEO Larry Fink said on CNBC the following:“I don’t believe BlackRock will ever be 100% back in office. I actually believe maybe 60% or 70%, and maybe that’s a rotation of people, but I don’t believe we’ll ever have a full cadre of people in the office”.

With a sizable growth of 79% employees working from home and 38% working partially from outside of the office, real estate developers have to offer a menu of working locations that are flexible enough to meet the varied personal and professional needs that employees juggle. Moreover, this growth is likely to accelerate post COVID-19, as the pandemic has forced both employees and employers to rethink their working approach and it seems that this trend is likely to persist. Recently, BlackRock’s CEO Larry Fink said on CNBC the following:“I don’t believe BlackRock will ever be 100% back in office. I actually believe maybe 60% or 70%, and maybe that’s a rotation of people, but I don’t believe we’ll ever have a full cadre of people in the office”.

Source: American Company Survey, American Time Use Survey

3.Life sciences & Medical Retail

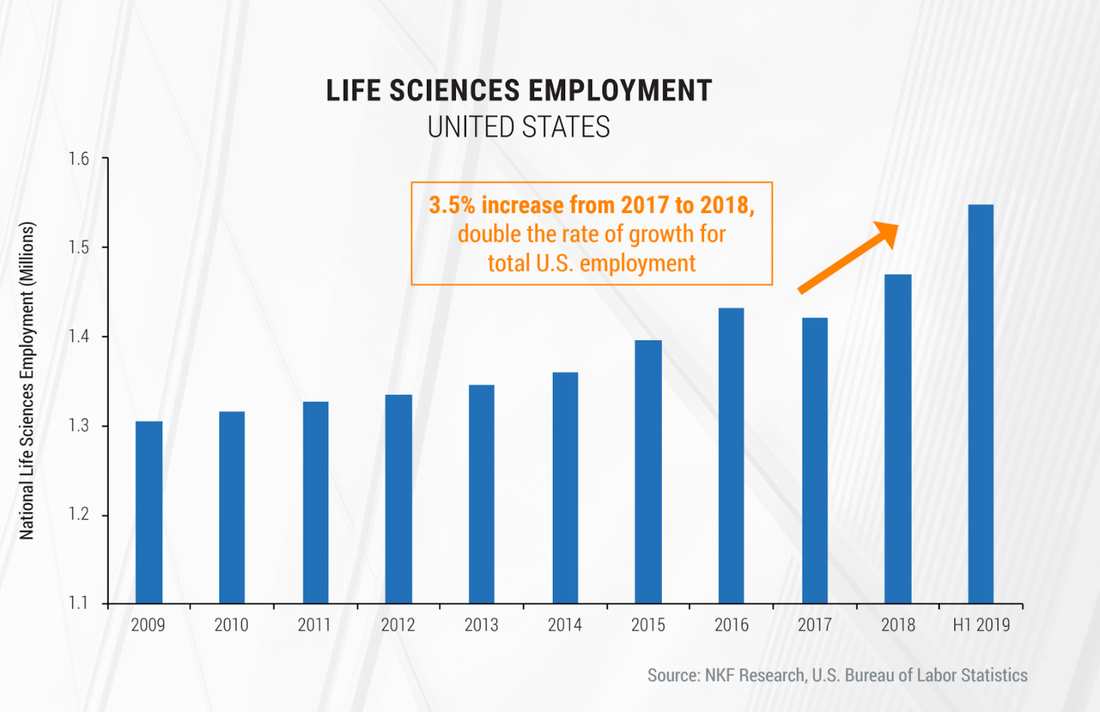

The current pandemic has only further fueled the expansion of an already growing industry, driven by capital investments, technological advancements and a growing older US population. And as the Life sciences sector grows (industry employment between 2018-2019 grew at a double rate of the national employment), so does the demand for advanced labs, specialized research or manufacturing facilities. Therefore, investors looking to diversify their portfolios can invest in life sciences real estate as they can generate higher yields compared to investments in office or industrial facilities.

The current pandemic has only further fueled the expansion of an already growing industry, driven by capital investments, technological advancements and a growing older US population. And as the Life sciences sector grows (industry employment between 2018-2019 grew at a double rate of the national employment), so does the demand for advanced labs, specialized research or manufacturing facilities. Therefore, investors looking to diversify their portfolios can invest in life sciences real estate as they can generate higher yields compared to investments in office or industrial facilities.

Source: NKF Research

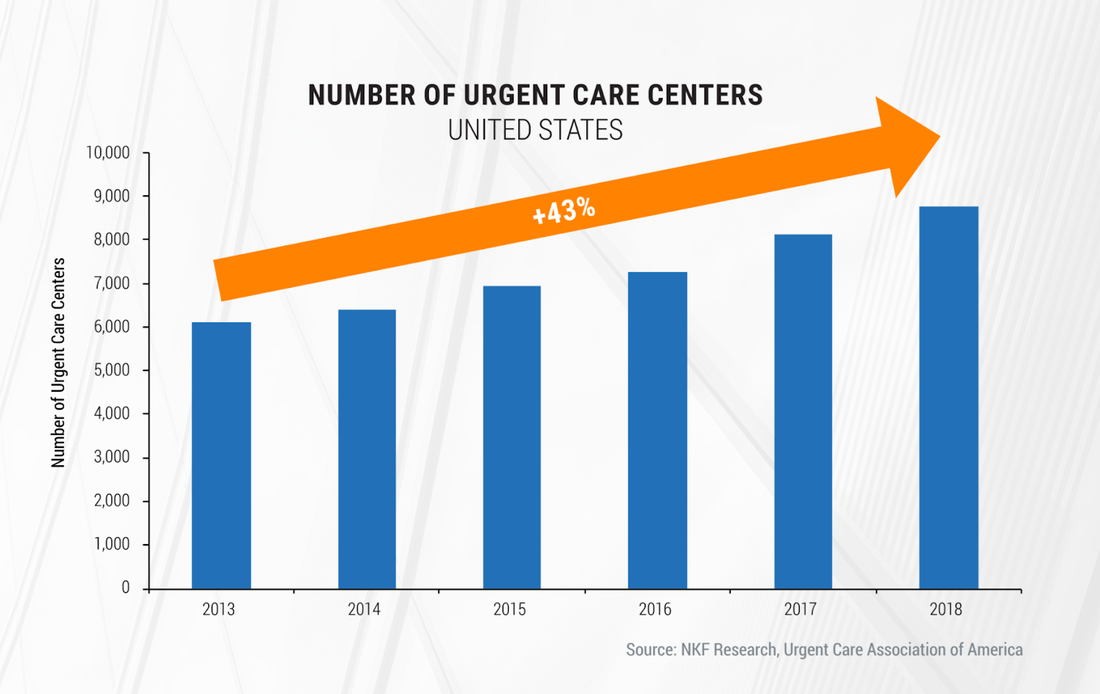

In addition, medical service providers such as dentists, physical therapy providers, eye centers and dialysis have grown considerably due to an increase in consumer spending on healthcare of 20% in the past five years. In particular, urgent care centers have experienced a dramatic growth in the US – 43% since 2013 according to the graph below – and given the current COVID-19 pandemic this trend is likely to continue beyond 2020.

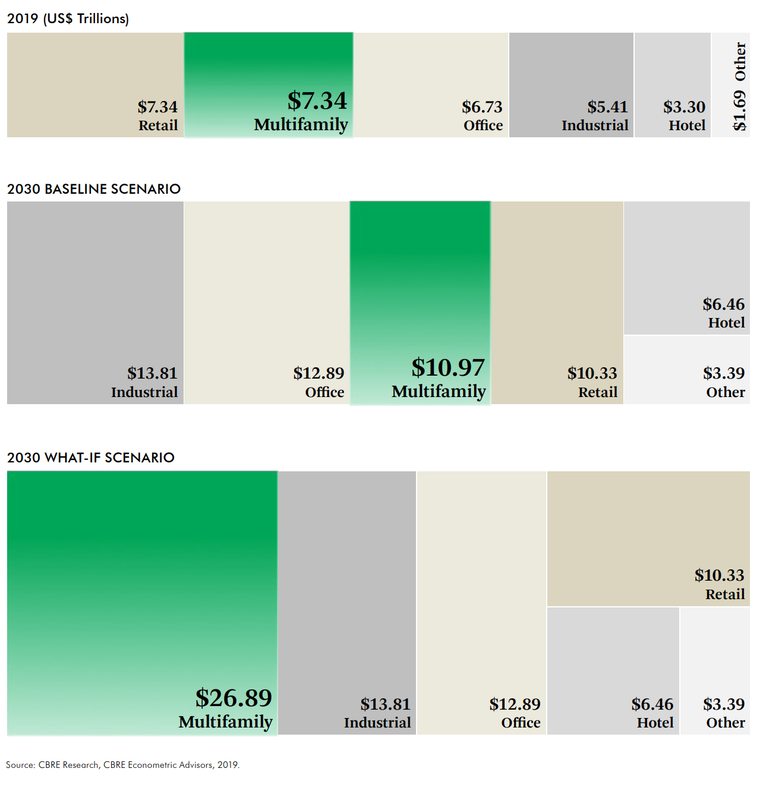

4.Urbanization & Sustainability & Multifamily

In the U.S., investors have created a robust multi-family real estate industry that provides efficient and affordable housing solutions. The term “multifamily” refers to apartment blocks or campus style developments in single ownership with market-level rents and professional management, which eliminates the reputational risk represented by bad landlords. Recently, this trend stretched to show significant growth outside the US too. In a world with excess private capital, not enough housing, cash-strapped governments and increasing emphasis on sustainability, the American multifamily model provides a way forward.

The Asian markets seem the natural stop for the multifamily model, given that the Asian region is experiencing the world’s fastest urbanization rate with 414 million people being expected to move to cities, and 22 cities ready to become megacities with populations of 10 million plus residents. CBRE expects that this trend will make Asian governments invest $23 trillion into infrastructure which will spur real estate construction and increase the Asian region’s global real estate share to 35%.

In the U.S., investors have created a robust multi-family real estate industry that provides efficient and affordable housing solutions. The term “multifamily” refers to apartment blocks or campus style developments in single ownership with market-level rents and professional management, which eliminates the reputational risk represented by bad landlords. Recently, this trend stretched to show significant growth outside the US too. In a world with excess private capital, not enough housing, cash-strapped governments and increasing emphasis on sustainability, the American multifamily model provides a way forward.

The Asian markets seem the natural stop for the multifamily model, given that the Asian region is experiencing the world’s fastest urbanization rate with 414 million people being expected to move to cities, and 22 cities ready to become megacities with populations of 10 million plus residents. CBRE expects that this trend will make Asian governments invest $23 trillion into infrastructure which will spur real estate construction and increase the Asian region’s global real estate share to 35%.

Source: CBRE Research

5.Technology and increase allocation to real estate

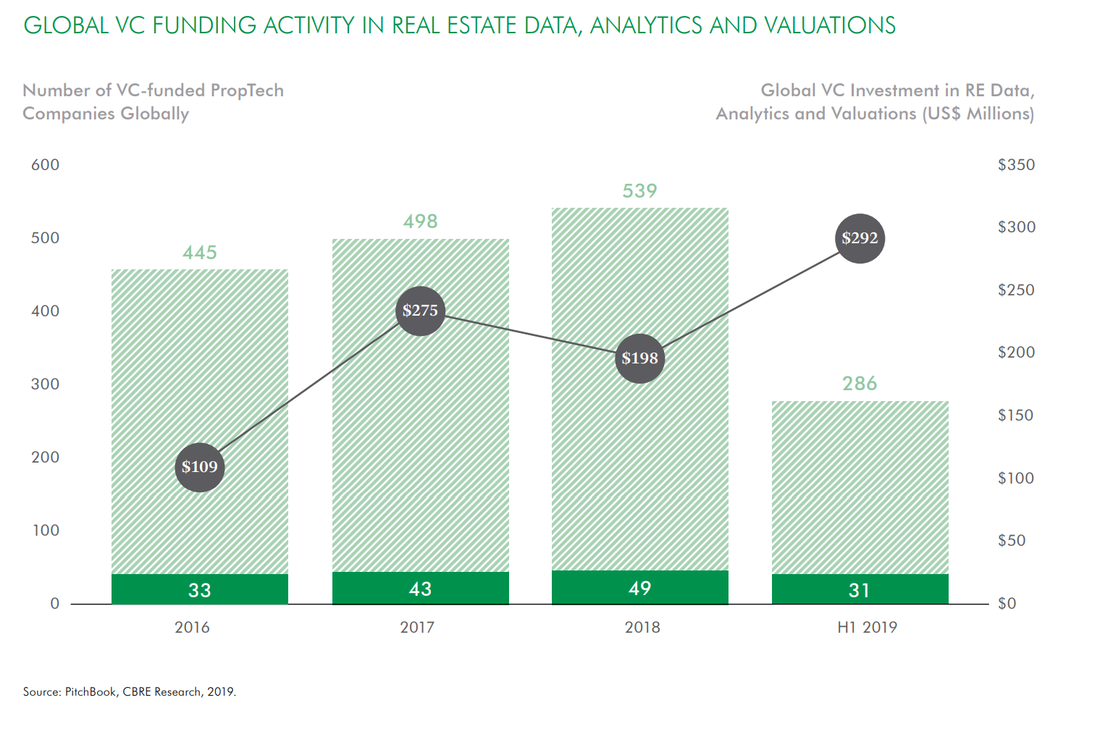

Even though it might seem unlikely, technology has had a great impact in real estate. Combining AI development with the success of residential-property platforms such as Zillow, Redfin, Domain, SRX and GharValue, venture capitalists have invested about US$80 billion over the past half-decade into more than 1,800 startups that create technological innovations to help manage, assess and transact commercial real estate. According to VentureScanner, these “PropTech” companies are revolutionizing how real estate is bought, sold and managed by creating timeliness, accurate and transparent real estate valuations. AVMs (automated valuation models) are expected to play a huge role in the future, and according to CBRE research 90% of commercial real estate will be appraised using AVMs by 2030. This is poised to increase transaction volume and transform commercial real estate into a more liquid investment, attracting new capital away from traditional liquid investments such as stocks and bonds.

Even though it might seem unlikely, technology has had a great impact in real estate. Combining AI development with the success of residential-property platforms such as Zillow, Redfin, Domain, SRX and GharValue, venture capitalists have invested about US$80 billion over the past half-decade into more than 1,800 startups that create technological innovations to help manage, assess and transact commercial real estate. According to VentureScanner, these “PropTech” companies are revolutionizing how real estate is bought, sold and managed by creating timeliness, accurate and transparent real estate valuations. AVMs (automated valuation models) are expected to play a huge role in the future, and according to CBRE research 90% of commercial real estate will be appraised using AVMs by 2030. This is poised to increase transaction volume and transform commercial real estate into a more liquid investment, attracting new capital away from traditional liquid investments such as stocks and bonds.

Source: CBRE Research

Analysts:

Matilde Lomaglio

Daniel Mitoiu

Tobias Schmidt

Matilde Lomaglio

Daniel Mitoiu

Tobias Schmidt