The cruise industry is probably the sector hit the hardest by the Covid-19 outbreak.

News of quarantined ships, people dying on board and port authorities denying docking have irreparably stained cruise operators’ reputation.

But beyond reputation another problem may cause the collapse of the industry in the near time: financial distress. Indeed, with all ships blocked in ports and expenses mainly driven by fixed costs, many players are struggling to survive.

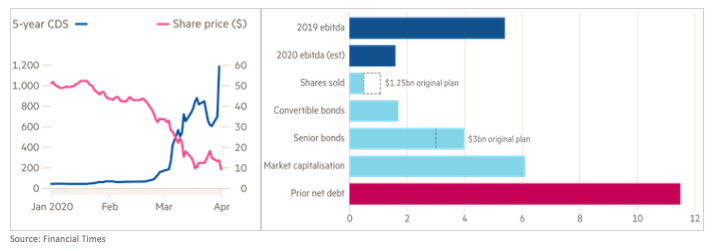

One of the most important cruise operators, Carnival Corporation, is losing a billion dollars a month and has witnessed to an 85% drop in its stock price in the last weeks.

The company was able to raise $6bn, through a combination of bonds, convertibles and newly issued stocks.

The bond issuance represents the bulk of this new round of financings, with $4bn raised. Characterizing this operation was the mindblowing coupon offered, an 11,5% yield that is even more impressive when considering the issuer’s investment grade rating and that six months ago it had raised $ 500mln with a cost of only 1%. Besides, the slight discount to par value makes the yield increase to roughly 12%, while the callable with penalty feature makes the bond potentially even more rewarding for investors.

Thanks to its features, the issuance was warmly received by investors, which pushed the order book to $17bn and convinced the company to raise to $4bn the initially planned issuance of $3bn.

But all that glitters is not gold.

In fact, the positive reception was also driven by hedge funds looking for arbitrage through the resale of their stakes and by institutional investors asking for larger tranches than actually wanted, hoping to get as big a piece of the pie as possible. This distorting effect was clear few days after the issuance, when the bond price fell below its issue price.

Through the convertible bond, Carnival was able to get a further $1,75bn, even if it offered a remarkable 5.75% annual coupon with a very low premium.

The final $ 500m tranche resulted from stock issuance and was the most painful in terms of costs and reputation. In fact, new shares were issued at an 85% discount to where the stock traded on mid-January and provided a clear sign of the market skepticism toward cruise industry future.

News of quarantined ships, people dying on board and port authorities denying docking have irreparably stained cruise operators’ reputation.

But beyond reputation another problem may cause the collapse of the industry in the near time: financial distress. Indeed, with all ships blocked in ports and expenses mainly driven by fixed costs, many players are struggling to survive.

One of the most important cruise operators, Carnival Corporation, is losing a billion dollars a month and has witnessed to an 85% drop in its stock price in the last weeks.

The company was able to raise $6bn, through a combination of bonds, convertibles and newly issued stocks.

The bond issuance represents the bulk of this new round of financings, with $4bn raised. Characterizing this operation was the mindblowing coupon offered, an 11,5% yield that is even more impressive when considering the issuer’s investment grade rating and that six months ago it had raised $ 500mln with a cost of only 1%. Besides, the slight discount to par value makes the yield increase to roughly 12%, while the callable with penalty feature makes the bond potentially even more rewarding for investors.

Thanks to its features, the issuance was warmly received by investors, which pushed the order book to $17bn and convinced the company to raise to $4bn the initially planned issuance of $3bn.

But all that glitters is not gold.

In fact, the positive reception was also driven by hedge funds looking for arbitrage through the resale of their stakes and by institutional investors asking for larger tranches than actually wanted, hoping to get as big a piece of the pie as possible. This distorting effect was clear few days after the issuance, when the bond price fell below its issue price.

Through the convertible bond, Carnival was able to get a further $1,75bn, even if it offered a remarkable 5.75% annual coupon with a very low premium.

The final $ 500m tranche resulted from stock issuance and was the most painful in terms of costs and reputation. In fact, new shares were issued at an 85% discount to where the stock traded on mid-January and provided a clear sign of the market skepticism toward cruise industry future.

The fact that even a company in one of the most severely hit industries was able to raise this amount of funds with such a warm reception, has ignited hope that many other players in cruise as well as other industries can survive the crisis tapping the bond market.

But this is just an illusion. First, even after the successful debt issuance, Carnival has admitted that, will the Covid-19 emergency continue, it will run out of cash in 8 months. Secondly, Carnival enjoyed a peculiar sound financial situation. It indeed wasn’t very indebted, had few collateralized loans thanks to its investment grade rating and therefore could put $ 28bn in collateral for this $4bn bond. Finally, drawing down its $3bn revolving facility limited the need of funds.

In conclusion, this transaction should not be taken as an example of the possibility to survive the crisis through external funding, but rather as a measure of the magnitude of the crisis, which has disrupted flourishing businesses while forcing sound companies to tap the market at very harsh conditions.

Francesco Curioni

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here

But this is just an illusion. First, even after the successful debt issuance, Carnival has admitted that, will the Covid-19 emergency continue, it will run out of cash in 8 months. Secondly, Carnival enjoyed a peculiar sound financial situation. It indeed wasn’t very indebted, had few collateralized loans thanks to its investment grade rating and therefore could put $ 28bn in collateral for this $4bn bond. Finally, drawing down its $3bn revolving facility limited the need of funds.

In conclusion, this transaction should not be taken as an example of the possibility to survive the crisis through external funding, but rather as a measure of the magnitude of the crisis, which has disrupted flourishing businesses while forcing sound companies to tap the market at very harsh conditions.

Francesco Curioni

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here