Introduction

At the end of January, markets witnessed a very peculiar chain of events that have caught investors on Wall Street by surprise and have since received plenty of media attention. We are talking about the so-called “Reddit Rally”: since January 22nd and for about two weeks, billions of dollars were poured into stocks of heavily shorted companies GameStop (GME), AMC Entertainment (AMC) and several others, causing a historical rally that made the price of these securities increase multiple times in a few days. GameStop’s market cap reached $33.7bn on January 28th, up from just above $1.2bn at the beginning of the month. Similarly, AMC’s market cap increased from around $0.5bn to over $6.7bn in just a few days. Such unexpected turn of events was organised by a group of retail investors, mainly gathering on a popular subreddit, that counted 2.2 million users but has since then reached more than 8 million users, named WallStreetBets. The massive inflows even made several trading apps (incl. Robinhood) halt buy orders of certain securities for a short period of time and raise additional funding of several billions of dollars in order to meet collateral requirements and made hedge funds like Melvin Capital require billions in liquidity to cover their short positions.

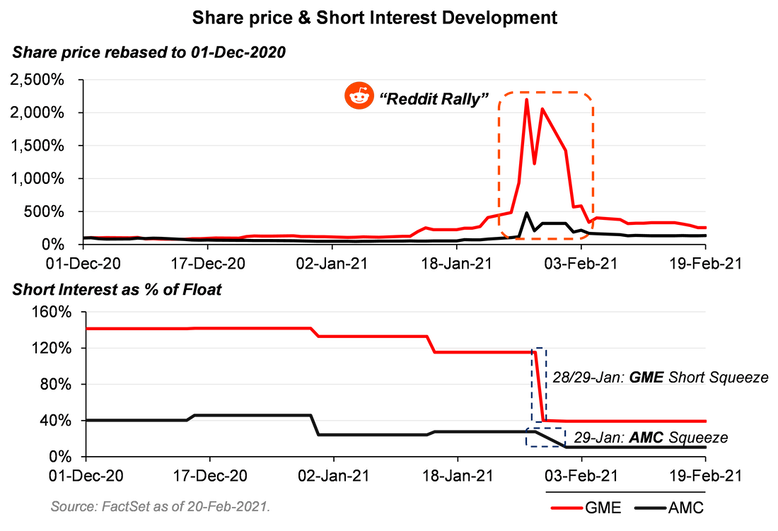

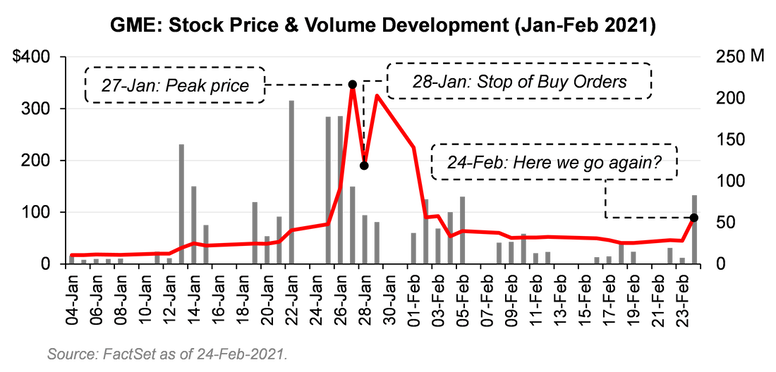

GameStop price went up by more than 1,000% in January, from below $10 to $483 (at top moment, while $347 at closing), offsetting a downward trend that had continued for more than five years. The price rapidly plunged back down in February, but it is still three times higher than in December 2020. Similarly, the percentage of short positions on the company compared to the total trading volume reached more than 100% in January.

The same dynamics can be seen for other stocks like AMC, whose price went up by almost 600%, from $3.50 on January 22nd to $19.90 on January 27th.

High Shorts on GME and AMC and Potential for the Future

GME and AMC have been among the stocks with the highest short interest in the US market. As of the 26th of January 2021, GME had a 139.6% short interest as a percentage of float (1st in the US), amounting to a total of more than $5.5bn, while AMC correspondingly had 49.7% short interest as a percentage of float (9th in the US), corresponding to $730.1m.

Specifically, GameStop has been at the centre of a David vs. Goliath story: with retail investors taking on hedge fund managers and winning. In the last years, the number of shorted shares of GME increased dramatically. But already around summer 2019, the stock was starting to become popular in the retail investing community, and it was around this time that Keith Gill, one of the most famous users on the WallStreetBets Reddit who attracted attention to GME, first invested in the stock and started talking about it. At the time, the value of the share was around $4, and in Gill’s opinion, the market was overestimating the speed of the shift towards e-commerce. Gill has declared during a US Congress hearing on the subject that at the time he believed the stock to be worth between $20 and $25. The stock hit a low of $2.8 in 2020 and then started an increasing trend in December 2020. As of February 19th, 2021, the stock was trading above $40.

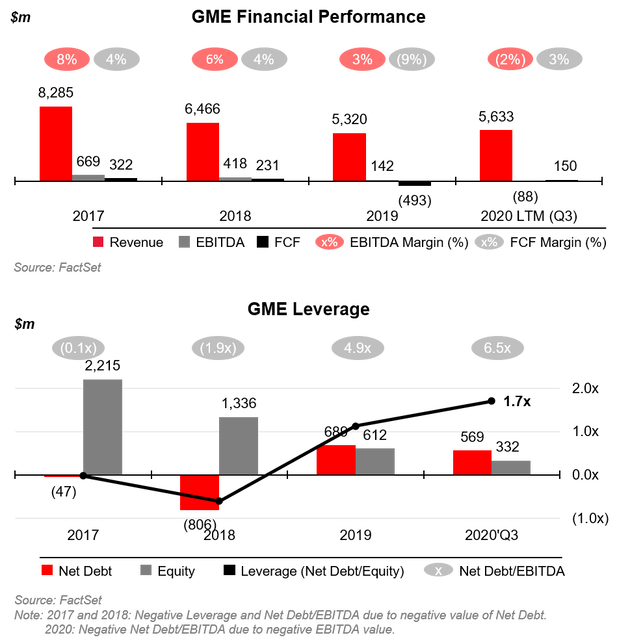

On the other side of the battle, Andrew Left of Citron Research, one of the most active short sellers of the stock called GameStop “a mall-based retailer that’s actually failing, doing poor, trading at all-time highs when it comes to valuation”. He also added: ”If you believe they’re going to hit their numbers, they’re trading at next 12 months 42 times EBITDA, and normally it would trade at 4”. Although he may be excessively pessimistic, his claims lay on solid grounds, as the company has been closing down shops and its leverage increased.

GameStop has been negatively affected by the shift of the videogame market towards digital purchases. This trend is likely going to be exacerbated by the diffusion of new consoles, such as the PS5, which have cheaper models without a disc reader, and could only be partially hedged by the firm’s online platform. If GameStop wants to survive in the long term, it will have to change its business model. Retail shopping for goods that are so easy to acquire online will have to be focused on consumer experience and convenience. If this is not the case, GameStop may become the new Blockbusters. The firm’s leverage has been increasing in the last years, especially in 2018 and 2019, mostly due to a goodwill impairment worth $1.3bn cumulatively. This led to a strong reduction in equity and in the firm’s ability to absorb losses.

GME and AMC have been among the stocks with the highest short interest in the US market. As of the 26th of January 2021, GME had a 139.6% short interest as a percentage of float (1st in the US), amounting to a total of more than $5.5bn, while AMC correspondingly had 49.7% short interest as a percentage of float (9th in the US), corresponding to $730.1m.

Specifically, GameStop has been at the centre of a David vs. Goliath story: with retail investors taking on hedge fund managers and winning. In the last years, the number of shorted shares of GME increased dramatically. But already around summer 2019, the stock was starting to become popular in the retail investing community, and it was around this time that Keith Gill, one of the most famous users on the WallStreetBets Reddit who attracted attention to GME, first invested in the stock and started talking about it. At the time, the value of the share was around $4, and in Gill’s opinion, the market was overestimating the speed of the shift towards e-commerce. Gill has declared during a US Congress hearing on the subject that at the time he believed the stock to be worth between $20 and $25. The stock hit a low of $2.8 in 2020 and then started an increasing trend in December 2020. As of February 19th, 2021, the stock was trading above $40.

On the other side of the battle, Andrew Left of Citron Research, one of the most active short sellers of the stock called GameStop “a mall-based retailer that’s actually failing, doing poor, trading at all-time highs when it comes to valuation”. He also added: ”If you believe they’re going to hit their numbers, they’re trading at next 12 months 42 times EBITDA, and normally it would trade at 4”. Although he may be excessively pessimistic, his claims lay on solid grounds, as the company has been closing down shops and its leverage increased.

GameStop has been negatively affected by the shift of the videogame market towards digital purchases. This trend is likely going to be exacerbated by the diffusion of new consoles, such as the PS5, which have cheaper models without a disc reader, and could only be partially hedged by the firm’s online platform. If GameStop wants to survive in the long term, it will have to change its business model. Retail shopping for goods that are so easy to acquire online will have to be focused on consumer experience and convenience. If this is not the case, GameStop may become the new Blockbusters. The firm’s leverage has been increasing in the last years, especially in 2018 and 2019, mostly due to a goodwill impairment worth $1.3bn cumulatively. This led to a strong reduction in equity and in the firm’s ability to absorb losses.

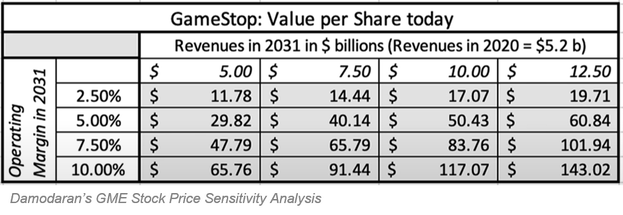

In the best-case scenario, GameStop would therefore have to turn itself into a digital gaming hub, levering on its existing platforms. The brick-and-mortar business model is obsolete and the probability that the company can extract good value from it is really slim. However, as mentioned by Gill, recent good senior management hires are going to help the firms transition. This is likely not enough to make the stock a buy. On January 26th, the famous NYU finance professor Aswath Damodaran has published his own opinion on GameStop, which included in the best-case scenario a valuation of $47 per share, which is around the current stock price (as of end of February). Furthermore, under an empirical analysis of the company’s credit rating, it has a 12% probability of default.

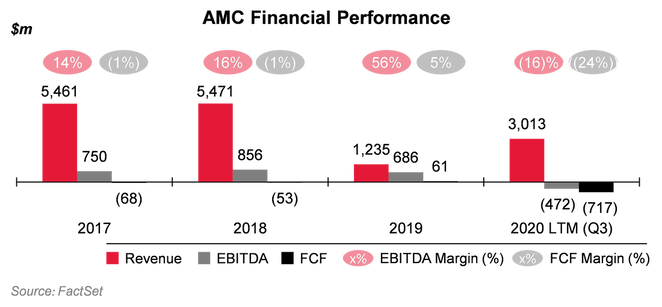

Although the short interest in AMC has not been as strong as for GME, it is easy to see how the market-leading movie theatre chain has been severely damaged by the outbreak of COVID-19. The reduced attendance, in conjunction with around 40% of its cost structure corresponding to fixed costs has led the company to a cash burn rate of $120m per month since the outbreak of the pandemic.

The company’s business has strongly been hit in the last years by the surge in popularity of streaming services, which together with the prolonged effects of COVID-19, present the biggest threat for the future of the firm. Producers have been reluctant to release new films in theatres during the pandemic and have increasingly looked at digital platforms as a medium to profit from their new movies. The large investments in streaming by a large player like Disney and premieres on streaming services such as the one of “Wonder Woman 1984” on HBO Max (what Netflix has been doing successfully for years) could generate a contraction of the movie theatre market from its pre-pandemic levels on a long-term perspective. This has materialized in large drop in expected financial results for 2020: a $1.2bn free cash outflow and a net loss of $4.2bn in 2020. The expectations for 2021 are bleak, with only a partial catch up in revenues and substantial losses.

The company’s business has strongly been hit in the last years by the surge in popularity of streaming services, which together with the prolonged effects of COVID-19, present the biggest threat for the future of the firm. Producers have been reluctant to release new films in theatres during the pandemic and have increasingly looked at digital platforms as a medium to profit from their new movies. The large investments in streaming by a large player like Disney and premieres on streaming services such as the one of “Wonder Woman 1984” on HBO Max (what Netflix has been doing successfully for years) could generate a contraction of the movie theatre market from its pre-pandemic levels on a long-term perspective. This has materialized in large drop in expected financial results for 2020: a $1.2bn free cash outflow and a net loss of $4.2bn in 2020. The expectations for 2021 are bleak, with only a partial catch up in revenues and substantial losses.

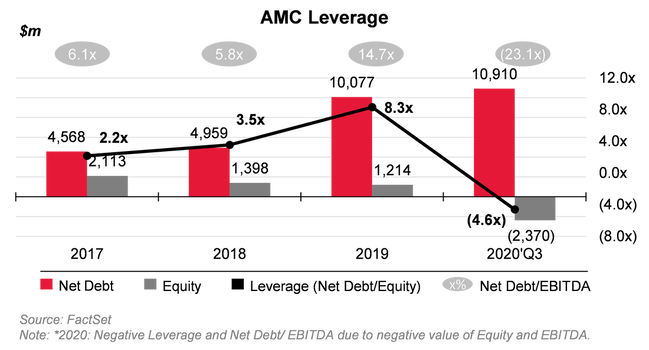

In addition to the effects of the pandemic, the rationale of a short position on AMC can be explained by the steep surge in leverage that the firm has gone through in the past years. By the end of 2019, before the pandemic hit, the firm already has already been heavily leveraged. Furthermore, most of its long-term debt is maturing between 2025 and 2026. This may be hard to refinance both because of its lumpiness and the prospects of the firm, which is already paying in excess of 10% on its debt.

The recent surge in price has also generated the sales of large stakes by illustrious investors, such as the $534.7m sale of AMC shares in the market by Silver Lake Group LLC at a price of $16.05 per share. The shares were obtained by Silver Lake through the conversion of a bond, thus the move has increased the firm’s capital and made it more resilient towards further losses in the near term.

Other Issued Instruments

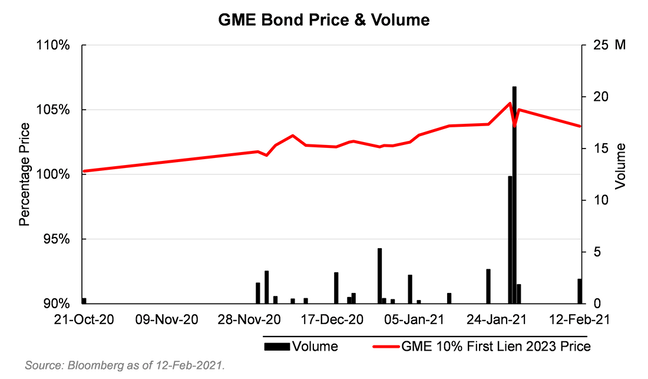

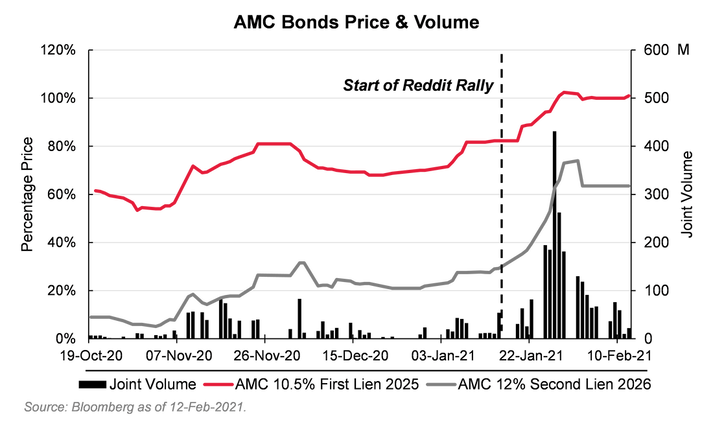

To better understand the consequences of the event, it might be reasonable to have a look at other traded financial instruments of the above-mentioned companies. In particular, a GME first-lien 10% fixed coupon bond maturing in March 2023, an AMC first-lien 10.5% fixed coupon bond maturing in April 2025 and an AMC second-lien 12% pay-in-kind bond maturing in June 2026. The sample analysed contains all trade prices between the 19th of October 2020 and the 16th of February 2021. The changes in prices between the two companies display different patterns, and therefore must be analysed separately.

The analysis of these patterns may be particularly meaningful in assessing whether the frenzy has had a tangible effect on the companies at hand. This may be the case as most retail investors (which have been the key factor in the jump of prices) are not able to access fixed income instruments through the most popular zero-commission channels (e.g. Robinhood, eToro etc.), and most trades in the fixed-income markets are made by institutional investors.

The situation is different between the two companies. For what pertains to GME, although the company has been declining even pre-pandemic, it stands on somewhat sounder fundaments and has a credit rating of B+ (S&P). This crystallized in the company’s bond trading around par in late 2020. The change in value following the surge in the stock price is not particularly significant. Lastly, it is also necessary to highlight that the trading volume for this instrument has been quite low, although there was a spike in the days where the stock price was more volatile.

Other Issued Instruments

To better understand the consequences of the event, it might be reasonable to have a look at other traded financial instruments of the above-mentioned companies. In particular, a GME first-lien 10% fixed coupon bond maturing in March 2023, an AMC first-lien 10.5% fixed coupon bond maturing in April 2025 and an AMC second-lien 12% pay-in-kind bond maturing in June 2026. The sample analysed contains all trade prices between the 19th of October 2020 and the 16th of February 2021. The changes in prices between the two companies display different patterns, and therefore must be analysed separately.

The analysis of these patterns may be particularly meaningful in assessing whether the frenzy has had a tangible effect on the companies at hand. This may be the case as most retail investors (which have been the key factor in the jump of prices) are not able to access fixed income instruments through the most popular zero-commission channels (e.g. Robinhood, eToro etc.), and most trades in the fixed-income markets are made by institutional investors.

The situation is different between the two companies. For what pertains to GME, although the company has been declining even pre-pandemic, it stands on somewhat sounder fundaments and has a credit rating of B+ (S&P). This crystallized in the company’s bond trading around par in late 2020. The change in value following the surge in the stock price is not particularly significant. Lastly, it is also necessary to highlight that the trading volume for this instrument has been quite low, although there was a spike in the days where the stock price was more volatile.

AMC’s debt has dramatically increased in value in the period observed. At the end of 2020, the fate of the company was unknown. The reduced theatre attendance derived from the impact of COVID-19 has put tremendous pressure on AMC. The company’s CCC- credit rating (S&P) may be used as a proxy to assess the distress faced by the company, which was estimated to have 6 months to either raise new capital or improve attendance to avoid bankruptcy already in April 2020. However, the frenzy hitting the company’s stock in the equity market also expanded to the debt markets, bringing large increases in trading volume. The company’s first-lien bond now trading above par and the second lien trading at more than six times the price it was trading in October 2020.

Thanks to this increased interest in the stock, AMC has been able to secure $917m in additional financing (including Silver Lake’s bond conversion), which should cover near-term cash needs. The company’s medium and long-term survival may however still be threatened by a slow vaccine roll-out and wider streaming adoption.

Thanks to this increased interest in the stock, AMC has been able to secure $917m in additional financing (including Silver Lake’s bond conversion), which should cover near-term cash needs. The company’s medium and long-term survival may however still be threatened by a slow vaccine roll-out and wider streaming adoption.

Closer Look at GME Rally

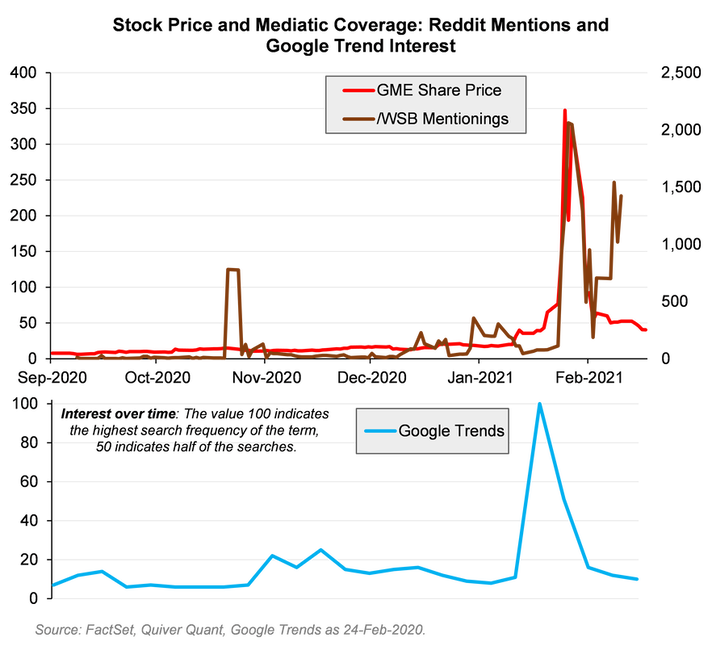

A clear driver of the momentum that GME experienced between the 17th and 24th of January was the overall sentiment that allowed the stock to virtually monopolize the financial news landscape in that particular window. Nowadays, the Internet and social media provide an important source of news for an important part of the population, therefore it might not come as a surprise that particular types of announcements can briefly influence returns at the aggregate level as well as for an individual stock.

Even though the fact that GME was experiencing an increasing number of short positions from hedge funds was already known, it was specifically noted by a group of niche retail investors gathered in the subreddit “WallStreetBets”.

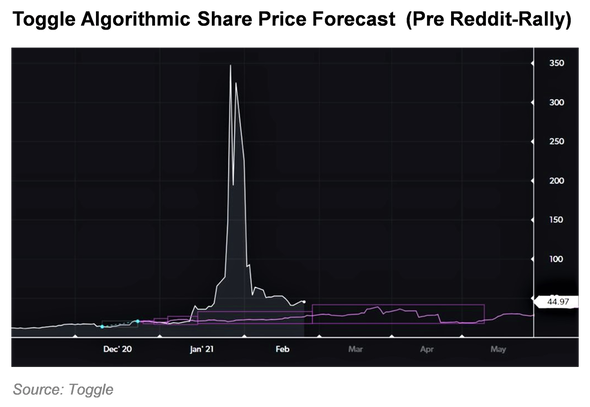

For example, sourcing the site Quiver Quant the number of mentions of GME in WallStreetBets Daily Discussion initially peaked in October, reaching almost 800 daily discussions each day. Nonetheless, the stock price did not experience particular perturbations. For example, utilizing the TOGGLE app, that can provide useful insights into future market developments based on fundamental and technical data, we could see that the overall trend of GME was, although slightly increasing, nothing out of the ordinary if considered the overall slow recovery of the US economy after the restrictive measures adopted to counter the COVID 19 spread.

A clear driver of the momentum that GME experienced between the 17th and 24th of January was the overall sentiment that allowed the stock to virtually monopolize the financial news landscape in that particular window. Nowadays, the Internet and social media provide an important source of news for an important part of the population, therefore it might not come as a surprise that particular types of announcements can briefly influence returns at the aggregate level as well as for an individual stock.

Even though the fact that GME was experiencing an increasing number of short positions from hedge funds was already known, it was specifically noted by a group of niche retail investors gathered in the subreddit “WallStreetBets”.

For example, sourcing the site Quiver Quant the number of mentions of GME in WallStreetBets Daily Discussion initially peaked in October, reaching almost 800 daily discussions each day. Nonetheless, the stock price did not experience particular perturbations. For example, utilizing the TOGGLE app, that can provide useful insights into future market developments based on fundamental and technical data, we could see that the overall trend of GME was, although slightly increasing, nothing out of the ordinary if considered the overall slow recovery of the US economy after the restrictive measures adopted to counter the COVID 19 spread.

However, after the second reign of interest in December, during January 2021 GME broke the walls of Reddit and became a mediatic phenomenon worldwide, even searched more than the COVID-19 Vaccine on Google, leading to a surge of popularity of the stock with a direct effect on the stock trading price. The fact that also traditional news outlets started to write articles about the surge of GME and the uncovering of the cult-like mentality of those holding the shares contributed further to the frenzy, pushing the price even higher. In the period from January 20th to January 30th 72 articles were published containing the word “GameStop”. For comparison, in the entire 2020 the number of articles was 40. Furthermore, the hedge funds with short positions on GME in order to cut their losses started to untangle their position and began purchasing the underlying stocks on the market. By doing so, the hedge funds contributed to the increase of the price. The self-perpetuating momentum of the demand, seemingly unstoppable brought GME close to $350 per share on 27th January, up almost 2,000% from the previous year.

Block of GME Buy and Flip of Media

On January 28th Robinhood communicated that traders would not be able to open new positions on GME anymore, but only to close them. Even stating that it would automatically close some position if the client did not have enough collateral to back them. To understand the reasoning behind this block we need to introduce the concept of clearinghouse and explain how trades are executed in the market. When someone decides to acquire/sell a certain stock using a broker (e.g. Robinhood or E*Trade) the latter sends the client’s request to the stock exchange (New York Stock Exchange or the Nasdaq). Once the request is met by an opposite order, the operation is considered completed. However, the amount of daily transactions occurring in a stock exchange makes it impossible to settle the trade at the same time, which is actually exchanging cash for the security. Indeed, in the US the settlement date for stocks and bonds is usually two business days after the execution date. To accommodate for the delay, the exchanges communicate the trade to a clearinghouse, in our case the DTCC (Depository Trust & Clearing Corporation). Clearinghouses are fundamental for the functioning and the stability of the financial markets and their main role is to act as a middleman in each trade. Most importantly, they ensure investors that, in the time between the execution and the settlement date, their counterparts will remain solvent and thus that they will be able to fulfil their obligations. To do so clearinghouses require investors to deposit collaterals to ensure they have the assets necessary to complete the transaction. Without going into the specific formula used by DTCC to compute the collateral requirements, we can say that the amount required is proportionate to the volatility of the asset traded and its nominal value.

The main problem with Robinhood and GameStop is that in many cases trades were performed on margin. That is investors were able to leverage their positions and thus putting up only between 50% and 90% of the price of the share. Robinhood had to provide the rest. On top of that, as we said previously, brokers have to provide collateral and meeting margin calls to the clearinghouse in the period between the execution and the settlement day. The volatility of GameStop stock, together with many others, drastically increased the amount of collateral Robinhood had to deposit to the clearing house, forcing the broker to look for cash from its investors. On Thursday 28th, Robinhood was raising a cash infusion of more than $1B from its investors. Over the following weekend, an additional $2.4B was raised. However, once the amount of collateral required became unsustainable, Robinhood was forced to restrict buying on these high volatility stocks. As a result, the GME closed down more than 44% that day.

After this event, the stock partially regained its loss on the 29th. Nonetheless, the 30th of January marks the start of the free-fall of the stock which then settled at the 50/40$ mark.

Most Recent Update: However, despite the downfall of the price and decrease in volatility post-January rally, starting from the end of February and beginning of March 2021, GME share price as well as trade volume demonstrated an abnormal growth with share price adding ~150%, potentially indicating repetition of the situation.

Fallout

GameStop’s price had been constantly decreasing for more than five years and although it was not in such a critical situation like other heavily shorted companies like AMC, thanks to WallStreetBets and “Reddit rally” the company was provided with an opportunity to benefit from the situation by raising additional capital, but was not able to capitalize on the surge in its stock price; in order to sell shares at peak price in January, GameStop had to publish its earnings for its fiscal fourth quarter to comply with SEC regulations, but the company could not prepare the information in time. Moreover, it did not want to risk incurring in regulatory sanctions by the SEC, which could have questioned the company’s decision to take advantage of trading volatility without informing investors of the potential risk; the same investors would have probably later sued GameStop for the losses occurring due to acquiring stocks at such a high and volatile price. These fears, coupled with the logistic hurdles required by the process, discouraged GameStop from selling its shares during the “Reddit rally”.

On the other hand, AMC, which was on a verge of bankruptcy due to the negative effect of the COVID-19 pandemic on the entertainment industry and was intensively raising capital even prior to the rally in the share price, managed to sell $300m worth of shares on January 25th and 26th but missed out on the biggest increase in its stock price that happened on the 27th, which would have allowed them to raise more than $1.2bn. Moreover, private equity firm Silver Lake converted $600 of convertible bonds into AMC’s equity, making $100m in profits and simultaneously taking the talks of an imminent bankruptcy “completely off the table”, in the words of the company’s CEO Adam Aron. Still, AMC has $5.8bn of debt and in its third quarter reported negative cash flows for almost $400m.

The importance of retail investors is conspicuous: retail trading as a fraction of total activity in the US has doubled between 2019 and 2020, from 15% to 30%, on the wave of no-commission trading and stimulus checks being available to millions of people. Low margins on investment banking activity, curbed after the Global Financial Crisis by tighter regulations and fierce competition, have convinced many big players in the investment banking industry to switch to more profitable wealth management and private banking. The biggest players on Wall Street quickly took action: Morgan Stanley acquired trading app E-trade and asset manager Eaton Vance in 2020, repositioning itself more towards wealth management. On the same line, Goldman Sachs’s Marcus, the investment bank’s own retail banking app, will allow deposits starting from only $1,000 and money management features; moreover, according to Goldman’s Global Co-Head of Wealth Management Division, Stephanie Cohen, the bank may allow trading on Marcus like on other apps as Robinhood.

Hedge funds will have to be warier about what stocks they will be willing to short. Melvin Capital lost 53% percent and needed to be bailed out by Citadel and Point72 with an injection of almost $3bn, and while other funds like New York-based Senvest Management made instead $700m in profits from GameStop, the whole industry will be more cautious after these events, also in the wake of regulators. The US Security and Exchange Commission is looking into tightening the rules related to short selling and in particular the lending and borrowing associated with it. The major drawback that has made the SEC reluctant to do so earlier is related to the fear that by imposing the monthly disclosure on the size and cost of short positions assumed by investors, as ordered by the Dodd-Frank Act 11 years ago, others could quickly follow and cause a surge in the cost to borrow stocks for short-sellers. Moreover, short selling is an important tool in the market to keep share prices close to fair value and hedge risk and putting a curb on this activity could be risky. Another important factor to take into consideration is that several pension funds have large stakes in hedge funds: in recent years US pension funds have been investing more into riskier assets, hoping to find higher returns than the historically low yields in the bond market. In the US, around 7% of the $4.5 trillion of pension funds’ money is invested in hedge funds, with some allocating as much as 40% of their portfolio. For instance, the State of Michigan Retirement Systems, which covers more than 50,000 civil service employees in Michigan, has $12bn (or 16.3% of its assets) invested in several hedge funds.

Nevertheless, not only the SEC, but also the Treasury’s Financial Stability Oversight Council (FSOC) has been investigating the role of hedge funds and non-banking financial institutions on the US economy, and already in 2016 highlighted the risk related to leveraged hedge funds and their possible role as forced sellers during market stress. During Trump’s presidency, FSOC’s activity on this matter has been halted, but it may possibly resume under Biden’s new agenda. Moreover, the new Treasury secretary and former FED chair Janet Yellen has been a strong advocate of FSCO’s activity and described the risk reported by the Council in 2016 as “real and serious”. Regulators could also address brokering apps like Robinhood or E-Trade, which allow many people, some without any professional knowledge of markets, to invest very easily also through complex instruments like options, leading to what has been deemed as a “gamification” of investing. On this matter, CEOs from Robinhood, Reddit, Melvin Capital and Citadel have been heard on February 18th by the Financial Service Committee of the US House of Representatives and will later be heard by the Senate Committee on Banking as well. In Thursday’s hearing, the main issues highlighted by US Representatives were related to the risks of such easy access to trading on platforms like Robinhood, which was asked to offer better support and customer service to its users, and proposals to curb risky trading activity, like Republican Representative Rashida Tlaib’s proposal of a 0.1% tax on all financial transactions.

At the same time, the SEC is looking at possible market manipulation by Reddit users, which could be accused of hyping up some stocks in order to profit from the increase in stocks’ prices. By looking at trading data and social media posts, regulators will investigate if among the 2 million users on the subreddit WallStreetBets some were involved in fraudulent and manipulative actions, aimed at profiting by convincing other users to invest with false or misleading information. The SEC will also look into Robinhood and other brokerages’ decision to halt trading and whether this was due to risk management issues or it was an infringement of the right to fair access to markets. Finally, from February 8th the SEC will require public companies that “are in distress, face on-going concerns or liquidity challenges, or have smaller public floats” to provide “tailored information about market events and conditions, the company’s situation and the potential impact on investors” in order to allow investors to make informed decisions.

Other players are in regulators sights: money market funds, open-ended funds and brokers like Citadel Securities will probably come into the discussion; Citadel in particular accounts for 39 percent of all retail trades of US-listed equity, and any regulation will probably look into diminishing its market power.

Appendix: GME in the Context of Sentimental Analysis

The journey of GME represents one of the most powerful examples of how traders can be influenced by the decisions of others. In behavioral finance, this concept is known as herding, which is the tendency of investors to simply follow what others are doing. This, together with the fear of missing out, has forced millions of traders, many of whom completely novice, to enter the financial world and start trading mindlessly. In many cases, this led to huge losses for those investors who entered late.

In this line of reasoning, an important role was played by social networks, in particular Reddit. These online forums allow the exchange of a continuous feed of information that has the power to enhance potentially false claims and make the viral, thus influencing people's decisions. In finance knowledge is fundamental and being able to predict trends in the market might lead to substantial profit. Therefore, it may not come as a surprise that, after the case of GME, many institutional investors and retail ones are looking at these nonstop feeds of text as a possible source of predictive information or, in a less honorable light, as a way to possibly sway the decisions of people.

The use of natural language processing techniques to try to understand the meaning of certain texts is called sentimental analysis. This procedure allows the use of algorithms to read and assess whether a tweet or a Reddit post is talking about a particular stock or market and, most importantly if, on an aggregate level, there is a positive or negative consensus on it. This data could be used to predict trends in the market and thus profit.

However, the effect of sentimental analysis and in particular the possibility that social media feeds can be used to predict the future path of the market and thus generate positive returns is still ambiguous. Recent research conducted by Beckers, executive fellow and chair of the AQR Asset Management Institute at the London Business School in London showed that, in the past 20 years, the social media-based sentiment was generally already captured in the news and thus was not able to generate a substantial competitive advantage in terms of higher returns. The possible reasons for this phenomenon are multiples. Indeed, professional news sources are typically considered more reliable by investors since they have to be constantly fact-checked in order to preserve journalistic integrity and therefore unexpected announcement can directly impact the stock market. On the other hand, we all know that social media feeds contain mostly unregulated and unstructured information that could be potentially meaningless. Nonetheless, the situation with GameStop and AMC showed that there are some individual exceptions when social media far outpace news resource and can generate additional abnormal returns.

It is then natural to ask what the future of sentimental analysis will be. It is undeniable that social media have the potential to form a consensus on a specific asset and thus generate movement in the respective market, but they still remain strongly unreliable. Furthermore, the boost in popularity of this technique experienced in the recent month might as well be its downfall since this tendency of people to source their news from the Internet can also be exploited. Indeed, bots could be used to generate a huge quantity of false and misleading posts to push people into the belief that a stock will grow in the future. The more bots are used to sway popular consensus, the less reliable and meaningful sentimental analysis becomes.

BSCM would like to thank FactSet and TOGGLE for providing us charts and data.

Carlo Geat

Simone Boldrini

Tommaso Pirozzi

Sources:

On January 28th Robinhood communicated that traders would not be able to open new positions on GME anymore, but only to close them. Even stating that it would automatically close some position if the client did not have enough collateral to back them. To understand the reasoning behind this block we need to introduce the concept of clearinghouse and explain how trades are executed in the market. When someone decides to acquire/sell a certain stock using a broker (e.g. Robinhood or E*Trade) the latter sends the client’s request to the stock exchange (New York Stock Exchange or the Nasdaq). Once the request is met by an opposite order, the operation is considered completed. However, the amount of daily transactions occurring in a stock exchange makes it impossible to settle the trade at the same time, which is actually exchanging cash for the security. Indeed, in the US the settlement date for stocks and bonds is usually two business days after the execution date. To accommodate for the delay, the exchanges communicate the trade to a clearinghouse, in our case the DTCC (Depository Trust & Clearing Corporation). Clearinghouses are fundamental for the functioning and the stability of the financial markets and their main role is to act as a middleman in each trade. Most importantly, they ensure investors that, in the time between the execution and the settlement date, their counterparts will remain solvent and thus that they will be able to fulfil their obligations. To do so clearinghouses require investors to deposit collaterals to ensure they have the assets necessary to complete the transaction. Without going into the specific formula used by DTCC to compute the collateral requirements, we can say that the amount required is proportionate to the volatility of the asset traded and its nominal value.

The main problem with Robinhood and GameStop is that in many cases trades were performed on margin. That is investors were able to leverage their positions and thus putting up only between 50% and 90% of the price of the share. Robinhood had to provide the rest. On top of that, as we said previously, brokers have to provide collateral and meeting margin calls to the clearinghouse in the period between the execution and the settlement day. The volatility of GameStop stock, together with many others, drastically increased the amount of collateral Robinhood had to deposit to the clearing house, forcing the broker to look for cash from its investors. On Thursday 28th, Robinhood was raising a cash infusion of more than $1B from its investors. Over the following weekend, an additional $2.4B was raised. However, once the amount of collateral required became unsustainable, Robinhood was forced to restrict buying on these high volatility stocks. As a result, the GME closed down more than 44% that day.

After this event, the stock partially regained its loss on the 29th. Nonetheless, the 30th of January marks the start of the free-fall of the stock which then settled at the 50/40$ mark.

Most Recent Update: However, despite the downfall of the price and decrease in volatility post-January rally, starting from the end of February and beginning of March 2021, GME share price as well as trade volume demonstrated an abnormal growth with share price adding ~150%, potentially indicating repetition of the situation.

Fallout

GameStop’s price had been constantly decreasing for more than five years and although it was not in such a critical situation like other heavily shorted companies like AMC, thanks to WallStreetBets and “Reddit rally” the company was provided with an opportunity to benefit from the situation by raising additional capital, but was not able to capitalize on the surge in its stock price; in order to sell shares at peak price in January, GameStop had to publish its earnings for its fiscal fourth quarter to comply with SEC regulations, but the company could not prepare the information in time. Moreover, it did not want to risk incurring in regulatory sanctions by the SEC, which could have questioned the company’s decision to take advantage of trading volatility without informing investors of the potential risk; the same investors would have probably later sued GameStop for the losses occurring due to acquiring stocks at such a high and volatile price. These fears, coupled with the logistic hurdles required by the process, discouraged GameStop from selling its shares during the “Reddit rally”.

On the other hand, AMC, which was on a verge of bankruptcy due to the negative effect of the COVID-19 pandemic on the entertainment industry and was intensively raising capital even prior to the rally in the share price, managed to sell $300m worth of shares on January 25th and 26th but missed out on the biggest increase in its stock price that happened on the 27th, which would have allowed them to raise more than $1.2bn. Moreover, private equity firm Silver Lake converted $600 of convertible bonds into AMC’s equity, making $100m in profits and simultaneously taking the talks of an imminent bankruptcy “completely off the table”, in the words of the company’s CEO Adam Aron. Still, AMC has $5.8bn of debt and in its third quarter reported negative cash flows for almost $400m.

The importance of retail investors is conspicuous: retail trading as a fraction of total activity in the US has doubled between 2019 and 2020, from 15% to 30%, on the wave of no-commission trading and stimulus checks being available to millions of people. Low margins on investment banking activity, curbed after the Global Financial Crisis by tighter regulations and fierce competition, have convinced many big players in the investment banking industry to switch to more profitable wealth management and private banking. The biggest players on Wall Street quickly took action: Morgan Stanley acquired trading app E-trade and asset manager Eaton Vance in 2020, repositioning itself more towards wealth management. On the same line, Goldman Sachs’s Marcus, the investment bank’s own retail banking app, will allow deposits starting from only $1,000 and money management features; moreover, according to Goldman’s Global Co-Head of Wealth Management Division, Stephanie Cohen, the bank may allow trading on Marcus like on other apps as Robinhood.

Hedge funds will have to be warier about what stocks they will be willing to short. Melvin Capital lost 53% percent and needed to be bailed out by Citadel and Point72 with an injection of almost $3bn, and while other funds like New York-based Senvest Management made instead $700m in profits from GameStop, the whole industry will be more cautious after these events, also in the wake of regulators. The US Security and Exchange Commission is looking into tightening the rules related to short selling and in particular the lending and borrowing associated with it. The major drawback that has made the SEC reluctant to do so earlier is related to the fear that by imposing the monthly disclosure on the size and cost of short positions assumed by investors, as ordered by the Dodd-Frank Act 11 years ago, others could quickly follow and cause a surge in the cost to borrow stocks for short-sellers. Moreover, short selling is an important tool in the market to keep share prices close to fair value and hedge risk and putting a curb on this activity could be risky. Another important factor to take into consideration is that several pension funds have large stakes in hedge funds: in recent years US pension funds have been investing more into riskier assets, hoping to find higher returns than the historically low yields in the bond market. In the US, around 7% of the $4.5 trillion of pension funds’ money is invested in hedge funds, with some allocating as much as 40% of their portfolio. For instance, the State of Michigan Retirement Systems, which covers more than 50,000 civil service employees in Michigan, has $12bn (or 16.3% of its assets) invested in several hedge funds.

Nevertheless, not only the SEC, but also the Treasury’s Financial Stability Oversight Council (FSOC) has been investigating the role of hedge funds and non-banking financial institutions on the US economy, and already in 2016 highlighted the risk related to leveraged hedge funds and their possible role as forced sellers during market stress. During Trump’s presidency, FSOC’s activity on this matter has been halted, but it may possibly resume under Biden’s new agenda. Moreover, the new Treasury secretary and former FED chair Janet Yellen has been a strong advocate of FSCO’s activity and described the risk reported by the Council in 2016 as “real and serious”. Regulators could also address brokering apps like Robinhood or E-Trade, which allow many people, some without any professional knowledge of markets, to invest very easily also through complex instruments like options, leading to what has been deemed as a “gamification” of investing. On this matter, CEOs from Robinhood, Reddit, Melvin Capital and Citadel have been heard on February 18th by the Financial Service Committee of the US House of Representatives and will later be heard by the Senate Committee on Banking as well. In Thursday’s hearing, the main issues highlighted by US Representatives were related to the risks of such easy access to trading on platforms like Robinhood, which was asked to offer better support and customer service to its users, and proposals to curb risky trading activity, like Republican Representative Rashida Tlaib’s proposal of a 0.1% tax on all financial transactions.

At the same time, the SEC is looking at possible market manipulation by Reddit users, which could be accused of hyping up some stocks in order to profit from the increase in stocks’ prices. By looking at trading data and social media posts, regulators will investigate if among the 2 million users on the subreddit WallStreetBets some were involved in fraudulent and manipulative actions, aimed at profiting by convincing other users to invest with false or misleading information. The SEC will also look into Robinhood and other brokerages’ decision to halt trading and whether this was due to risk management issues or it was an infringement of the right to fair access to markets. Finally, from February 8th the SEC will require public companies that “are in distress, face on-going concerns or liquidity challenges, or have smaller public floats” to provide “tailored information about market events and conditions, the company’s situation and the potential impact on investors” in order to allow investors to make informed decisions.

Other players are in regulators sights: money market funds, open-ended funds and brokers like Citadel Securities will probably come into the discussion; Citadel in particular accounts for 39 percent of all retail trades of US-listed equity, and any regulation will probably look into diminishing its market power.

Appendix: GME in the Context of Sentimental Analysis

The journey of GME represents one of the most powerful examples of how traders can be influenced by the decisions of others. In behavioral finance, this concept is known as herding, which is the tendency of investors to simply follow what others are doing. This, together with the fear of missing out, has forced millions of traders, many of whom completely novice, to enter the financial world and start trading mindlessly. In many cases, this led to huge losses for those investors who entered late.

In this line of reasoning, an important role was played by social networks, in particular Reddit. These online forums allow the exchange of a continuous feed of information that has the power to enhance potentially false claims and make the viral, thus influencing people's decisions. In finance knowledge is fundamental and being able to predict trends in the market might lead to substantial profit. Therefore, it may not come as a surprise that, after the case of GME, many institutional investors and retail ones are looking at these nonstop feeds of text as a possible source of predictive information or, in a less honorable light, as a way to possibly sway the decisions of people.

The use of natural language processing techniques to try to understand the meaning of certain texts is called sentimental analysis. This procedure allows the use of algorithms to read and assess whether a tweet or a Reddit post is talking about a particular stock or market and, most importantly if, on an aggregate level, there is a positive or negative consensus on it. This data could be used to predict trends in the market and thus profit.

However, the effect of sentimental analysis and in particular the possibility that social media feeds can be used to predict the future path of the market and thus generate positive returns is still ambiguous. Recent research conducted by Beckers, executive fellow and chair of the AQR Asset Management Institute at the London Business School in London showed that, in the past 20 years, the social media-based sentiment was generally already captured in the news and thus was not able to generate a substantial competitive advantage in terms of higher returns. The possible reasons for this phenomenon are multiples. Indeed, professional news sources are typically considered more reliable by investors since they have to be constantly fact-checked in order to preserve journalistic integrity and therefore unexpected announcement can directly impact the stock market. On the other hand, we all know that social media feeds contain mostly unregulated and unstructured information that could be potentially meaningless. Nonetheless, the situation with GameStop and AMC showed that there are some individual exceptions when social media far outpace news resource and can generate additional abnormal returns.

It is then natural to ask what the future of sentimental analysis will be. It is undeniable that social media have the potential to form a consensus on a specific asset and thus generate movement in the respective market, but they still remain strongly unreliable. Furthermore, the boost in popularity of this technique experienced in the recent month might as well be its downfall since this tendency of people to source their news from the Internet can also be exploited. Indeed, bots could be used to generate a huge quantity of false and misleading posts to push people into the belief that a stock will grow in the future. The more bots are used to sway popular consensus, the less reliable and meaningful sentimental analysis becomes.

BSCM would like to thank FactSet and TOGGLE for providing us charts and data.

Carlo Geat

Simone Boldrini

Tommaso Pirozzi

Sources:

- S3

- FT

- Reuters

- Benzinga

- CNBC

- NY Times

- “Roaring Kitty” (Gill Keith) YouTube

- Aswath Damodaran Blogpost & YouTube

- Google Trends

- Quiver Quantitative

- GameStop Public Disclosure

- AMC Entertainment Public Disclosure

- Stan Beckers (2019): Do Social Media Trump News? The Relative Importance of Social Media and News Based Sentiment for Market Timing