Germany’s largest bank, Deutsche Bank, is currently facing major pressure and is subject of speculation regarding its liquidity position and whether the bank can achieve a turnaround or not.

The challenges Deutsche Bank faces are manifold and include political headwinds that the bank cannot influence. First of all, the zero interest rate policy of the European Central Bank squeezes profits in the classic credit business of the bank. In a highly unusual behavior, leading Deutsche Bank managers, including CEO John Cryan and Chief Economist David Folkerts-Landau, repeatedly criticized the ECB for its monetary policy in the past months. Deutsche Bank also suffers from increased regulation for its operations in investment banking. Especially the stricter regulations in sales and trading (e.g. the ban of proprietary trading in the US and higher capital requirements) have a large impact on the bank due to its strong fixed income trading operations.

The above are problems that affect every major bank, undermine their profitability and challenge their business model, but were certainly not threatening the stability of the bank. The loss in confidence rapidly accelerated after an announcement of a possible fine of $14 billion to settle mortgage securities probes with the US Department of Justice relating to the global financial crisis. At the time of the announcement, the fine would have been close to Deutsche Bank’s market capitalization, which was at around €16 billion at the time of the announcement. J.P. Morgan analyst Kian Abouhossein estimates that Deutsche Bank currently has $9.4 billion available through provisions for litigations and reserves for the about 7,800 legal disputes it faces. He estimates the bank plans to pay about $5.4 billion for all legal disputes, except the most recent penalty. Therefore, about $4 billion would be left for the fine without the need to raise capital, considerable less than $14 billion.

Almost all market participants were stunned by the large amount the Department of Justice is fining Deutsche Bank, which led many people to believe the fine could be politically motivated. Two factors are indeed striking: the penalty was announced shortly after the EU ordered Apple to pay additional €13 billion in taxes, which caused some commentators to speculate if the large penalty for Deutsche Bank is a “revenge”. Another accusation was that the US wants their own investment banks to dominate the market entirely and therefore try to harm one of their main competitors. Deutsche Bank indeed was, until recently, probably the only non-US investment bank among the top tier global investment banks.

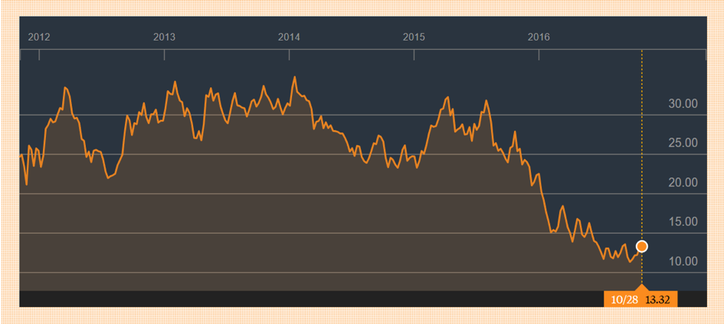

The situation got worse when German news magazine Focus published an article in which it claimed John Cryan asked chancellor Merkel in an informal meeting whether Germany would bail out the bank if things got out of hands, which she reportedly declined. The meeting has never been confirmed, but the article caused market participants to increasingly get nervous. Nobody ever thought about the possibility that Deutsche Bank could be allowed to go bust because of its systemic relevance to Germany, Europe and the global economy. Within the same week news broke that some leading hedge funds reportedly reduced their trading exposure to Deutsche Bank in the derivatives clearing. This led the stock to plunge to an all-time low of €9.90 during trading on Friday, 30 September 2016 due to speculation regarding the liquidity position of the bank and increased uncertainty among investors. The stock bounced back on the same day during trading hours due to rumors of a settlement with the Department of Justice at around $5.4 billion.

The challenges Deutsche Bank faces are manifold and include political headwinds that the bank cannot influence. First of all, the zero interest rate policy of the European Central Bank squeezes profits in the classic credit business of the bank. In a highly unusual behavior, leading Deutsche Bank managers, including CEO John Cryan and Chief Economist David Folkerts-Landau, repeatedly criticized the ECB for its monetary policy in the past months. Deutsche Bank also suffers from increased regulation for its operations in investment banking. Especially the stricter regulations in sales and trading (e.g. the ban of proprietary trading in the US and higher capital requirements) have a large impact on the bank due to its strong fixed income trading operations.

The above are problems that affect every major bank, undermine their profitability and challenge their business model, but were certainly not threatening the stability of the bank. The loss in confidence rapidly accelerated after an announcement of a possible fine of $14 billion to settle mortgage securities probes with the US Department of Justice relating to the global financial crisis. At the time of the announcement, the fine would have been close to Deutsche Bank’s market capitalization, which was at around €16 billion at the time of the announcement. J.P. Morgan analyst Kian Abouhossein estimates that Deutsche Bank currently has $9.4 billion available through provisions for litigations and reserves for the about 7,800 legal disputes it faces. He estimates the bank plans to pay about $5.4 billion for all legal disputes, except the most recent penalty. Therefore, about $4 billion would be left for the fine without the need to raise capital, considerable less than $14 billion.

Almost all market participants were stunned by the large amount the Department of Justice is fining Deutsche Bank, which led many people to believe the fine could be politically motivated. Two factors are indeed striking: the penalty was announced shortly after the EU ordered Apple to pay additional €13 billion in taxes, which caused some commentators to speculate if the large penalty for Deutsche Bank is a “revenge”. Another accusation was that the US wants their own investment banks to dominate the market entirely and therefore try to harm one of their main competitors. Deutsche Bank indeed was, until recently, probably the only non-US investment bank among the top tier global investment banks.

The situation got worse when German news magazine Focus published an article in which it claimed John Cryan asked chancellor Merkel in an informal meeting whether Germany would bail out the bank if things got out of hands, which she reportedly declined. The meeting has never been confirmed, but the article caused market participants to increasingly get nervous. Nobody ever thought about the possibility that Deutsche Bank could be allowed to go bust because of its systemic relevance to Germany, Europe and the global economy. Within the same week news broke that some leading hedge funds reportedly reduced their trading exposure to Deutsche Bank in the derivatives clearing. This led the stock to plunge to an all-time low of €9.90 during trading on Friday, 30 September 2016 due to speculation regarding the liquidity position of the bank and increased uncertainty among investors. The stock bounced back on the same day during trading hours due to rumors of a settlement with the Department of Justice at around $5.4 billion.

Source: Bloomberg

A major contributor to investors’ uncertainty is the bank’s massive derivatives book. The bank has €46 trillion notional amount of derivatives on its books. The major problem with this number is that there is no easy way of estimating the real risk for the bank. Theoretically, the book could consist mainly of simple and liquid derivatives, which are easy to value. An example are interest rate swaps, in which the actual payments can be very small compared to the notional amount and hence the risk is much smaller than the notional amount suggests. Moreover, the bank probably hedged a very large part of its exposure by entering into derivative contracts with other counterparties, offsetting the whole or at least parts of the first transaction. Therefore, the bank’s chief risk officer Stuart Lewis complained in an interview “the number 46 trillion is completely misleading”. He estimates the risk for the bank from derivatives to be net €41 billion, at a lower level than some competitors. Lewis points out that the bank has a very good risk management and, different to many other major banks, did not need taxpayers money during the 2008 crisis. He believes the litigation risk and the risks arising from individual misconduct are larger than the risk from the derivatives book.

Going forward there is no scenario in which Deutsche Bank will likely fail. On October 27 the Bank presented its quarterly earnings and posted a surprising net income for the quarter of 256 million euros, compared to an average analyst forecast of a 394 million euro loss. With higher revenues, strong trading results, lower than expected litigation expenses and lower than expected costs the bank showed a surprisingly strong quarter taking into account the rough circumstances. These could be the first positive sign of the revamp of the business model. Deutsche Bank shares ended trading after their quarterly earnings announcement at €13.40, up substantially from their all-time low a few weeks earlier.

Even if one is not optimistic about the operational prospects of Deutsche Bank, Germany in the end will have no choice but to bail out the bank. In a report this year the International Monetary Fund said that Deutsche Bank “appears to be the most important net contributor to systemic risks”. Even though it is politically unpopular, a bail out would be necessary if the situation worsens dramatically. Politicians will not repeat the mistake they made with Lehman Brothers. Back then, no active politician had witnessed a financial crisis with the real threat of a complete breakdown of the financial system, but with the memories of 2008 in mind politicians will do everything to prevent a second Lehman Brothers moment. Also, since Deutsche Bank is considerably larger than Lehman Brothers was and additionally has global retail banking operations, a failure would cause much more damage to the financial system than Lehman Brothers did. Therefore, Deutsche Bank either will recover on its own – or will be bailed out by the German state.

Mathias Hoerl

A major contributor to investors’ uncertainty is the bank’s massive derivatives book. The bank has €46 trillion notional amount of derivatives on its books. The major problem with this number is that there is no easy way of estimating the real risk for the bank. Theoretically, the book could consist mainly of simple and liquid derivatives, which are easy to value. An example are interest rate swaps, in which the actual payments can be very small compared to the notional amount and hence the risk is much smaller than the notional amount suggests. Moreover, the bank probably hedged a very large part of its exposure by entering into derivative contracts with other counterparties, offsetting the whole or at least parts of the first transaction. Therefore, the bank’s chief risk officer Stuart Lewis complained in an interview “the number 46 trillion is completely misleading”. He estimates the risk for the bank from derivatives to be net €41 billion, at a lower level than some competitors. Lewis points out that the bank has a very good risk management and, different to many other major banks, did not need taxpayers money during the 2008 crisis. He believes the litigation risk and the risks arising from individual misconduct are larger than the risk from the derivatives book.

Going forward there is no scenario in which Deutsche Bank will likely fail. On October 27 the Bank presented its quarterly earnings and posted a surprising net income for the quarter of 256 million euros, compared to an average analyst forecast of a 394 million euro loss. With higher revenues, strong trading results, lower than expected litigation expenses and lower than expected costs the bank showed a surprisingly strong quarter taking into account the rough circumstances. These could be the first positive sign of the revamp of the business model. Deutsche Bank shares ended trading after their quarterly earnings announcement at €13.40, up substantially from their all-time low a few weeks earlier.

Even if one is not optimistic about the operational prospects of Deutsche Bank, Germany in the end will have no choice but to bail out the bank. In a report this year the International Monetary Fund said that Deutsche Bank “appears to be the most important net contributor to systemic risks”. Even though it is politically unpopular, a bail out would be necessary if the situation worsens dramatically. Politicians will not repeat the mistake they made with Lehman Brothers. Back then, no active politician had witnessed a financial crisis with the real threat of a complete breakdown of the financial system, but with the memories of 2008 in mind politicians will do everything to prevent a second Lehman Brothers moment. Also, since Deutsche Bank is considerably larger than Lehman Brothers was and additionally has global retail banking operations, a failure would cause much more damage to the financial system than Lehman Brothers did. Therefore, Deutsche Bank either will recover on its own – or will be bailed out by the German state.

Mathias Hoerl