DropBox, the online storage and syncing company, filed for an initial public offering on the 27th of February. The company co-founded in 2007 by Drew Houston was ready to go public seeking for a valuation of $7-$7.9 billion, below its $10 billion valuation given in earlier funding rounds. Dropbox was expected to raise $756 million as reported by “The Wall Street Journal”. The underwriters of this transaction include: Goldman Sachs, J.P. Morgan, Deutsche Bank, Allen & Company, Bank of America Merrill Lynch and others.

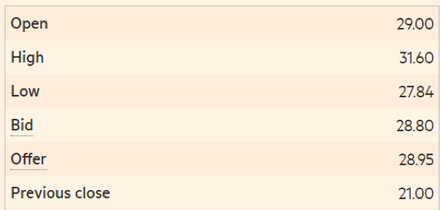

On the 23rd of March, DropBox shares (DBX) started trading on the NASDAQ 38% higher in their market debut. The stock opened at $29, significantly higher than the $21 IPO price. At the end of the session, the shares closed at $28.48 (+35.62%), after peaking at $31.6. The table shows a clear overview of the first day of trading of the company.

Source: Financial Times

THE COMPANY’S GROWTH AND THE INDUSTRY

In terms of financial results, the San Francisco-based company reported a loss of $111.7 million which is however lower than the 2016 loss of 201.2 million. Revenues are rapidly growing and represent $1,106.8 billion for 2017, a 31% increase compared to the previous year. Furthermore, the company generated a positive free cash flow of $305 million in 2017, up from $210.2 million in 2016. Similarly to other tech companies and former unicorns, DropBox has yet to post a profit.

The company has over 500 million users, but only 2% of them are paying subscribers. Interestingly, as stated in a SEC filing (Form S-1), “As of December 31, 2017, approximately 92% of Fortune 500 companies had paying Dropbox users within their organization, and approximately 56% had at least one paying Dropbox Business team. We had more than 300,000 paying Dropbox Business teams as of December 31, 2017”.

DropBox has many competitors in the “cloud-storage” field, such as the well-known Alphabet, Apple and Amazon. Other companies such as Box focus on implementing data security and compliance features, which represents a concrete threat for DropBox to attract corporate customers. Although competition is fierce, investors truly believe in this company, as demonstrated by the remarkable demand for its shares.

IPO MARKET AND UNICORNS

According to the EY Global IPO trends: Q4 2017, “Global IPO activity for 2017 is the most active year since 2007 by deal number (1,974 IPOs, which raised $338.4b)”. Total proceeds were $188.8 billion, up 40% compared to the previous year. In terms of regional share by proceeds, Americas represented 39%, which is still the biggest region compared with EMEIA and Asia-Pacific, but down from its 54% share in 2016. The outlook for 2018 remains positive according to the EY Global IPO trends. Indeed, “Lower volatility across regions, equity indices still hitting all-time highs and steady investor confidence are encouraging a healthy pipeline of market-ready companies to build up across sectors and markets. On the downside, geopolitical risks in many regions remain visible points on the radar”.

DropBox is another of the so-called unicorns to go public. In fact, this has been one of the most anticipated IPOs in the tech sector of 2018, just a year after the IPO of Snap, which raised $3.4bn. Its shares trade at $16.36 (as of 24/03/2018), slightly below the $17 IPO price. Another much awaited deal is the Spotify listing which has the peculiarity of being a “direct listing” skipping the traditional IPO route. This means that the company will not require the services of intermediaries to price and sell its shares. This type of transaction has the benefit of being cheaper and faster. However, potential downsides include low protection from volatility (given the absence of a lock-up period).

GOVERNANCE ISSUES AND DUAL-CLASS SHARES

According to an SEC filing, DropBox has a multi-class share structure which translates into a type of share giving 10 votes (Class B), and another with only one vote (Class A). To be thorough, the company has also Class C shares, which have no voting rights. This has been a widely discussed and controversial topic in previous notable IPOs, such as the Snap initial public offering, in which the company issued no-voting shares exclusively. Interestingly, Snap CEO Evan Spiegel controls 48.3% of voting power in the company, and co-founder Bobby Murphy 47.4%. However, this is not the case of the DropBox IPO, given that the company issued Class A shares.

The main reason why this type share structure is highly criticized by investors is because it gives the owners of these “special” shares a significantly higher voting power with respect to regular shareholders. Structures such as the one adopted by Snap give large freedom to founders, while shareholders have little say in board decisions.

A last aspect to bear in mind is that companies with a dual-class (or multi-class) share structure will be unable to join the S&P 500. The inclusion in such an index provides more trading volumes and popular instruments such as ETF would be forced to buy this stock as well to track the index. However, companies such as Alphabet and Berkshire Hathaway which already have this structure will remain in the index.

To conclude, the first day of trading has been without any doubt a success. Demand was strong, and the stock closed its first session +35.62%. While this is a great result we must remember that even Snap had a strong first day of trading (+44% at $24.48) and now trades at $16.36, as of March 23.

Despite the necessary caution related to IPOs, DropBox is a successful company with rapidly growing revenues (+31% this year) and with losses that are narrowing year after year.

Riccardo Lizzi

On the 23rd of March, DropBox shares (DBX) started trading on the NASDAQ 38% higher in their market debut. The stock opened at $29, significantly higher than the $21 IPO price. At the end of the session, the shares closed at $28.48 (+35.62%), after peaking at $31.6. The table shows a clear overview of the first day of trading of the company.

Source: Financial Times

THE COMPANY’S GROWTH AND THE INDUSTRY

In terms of financial results, the San Francisco-based company reported a loss of $111.7 million which is however lower than the 2016 loss of 201.2 million. Revenues are rapidly growing and represent $1,106.8 billion for 2017, a 31% increase compared to the previous year. Furthermore, the company generated a positive free cash flow of $305 million in 2017, up from $210.2 million in 2016. Similarly to other tech companies and former unicorns, DropBox has yet to post a profit.

The company has over 500 million users, but only 2% of them are paying subscribers. Interestingly, as stated in a SEC filing (Form S-1), “As of December 31, 2017, approximately 92% of Fortune 500 companies had paying Dropbox users within their organization, and approximately 56% had at least one paying Dropbox Business team. We had more than 300,000 paying Dropbox Business teams as of December 31, 2017”.

DropBox has many competitors in the “cloud-storage” field, such as the well-known Alphabet, Apple and Amazon. Other companies such as Box focus on implementing data security and compliance features, which represents a concrete threat for DropBox to attract corporate customers. Although competition is fierce, investors truly believe in this company, as demonstrated by the remarkable demand for its shares.

IPO MARKET AND UNICORNS

According to the EY Global IPO trends: Q4 2017, “Global IPO activity for 2017 is the most active year since 2007 by deal number (1,974 IPOs, which raised $338.4b)”. Total proceeds were $188.8 billion, up 40% compared to the previous year. In terms of regional share by proceeds, Americas represented 39%, which is still the biggest region compared with EMEIA and Asia-Pacific, but down from its 54% share in 2016. The outlook for 2018 remains positive according to the EY Global IPO trends. Indeed, “Lower volatility across regions, equity indices still hitting all-time highs and steady investor confidence are encouraging a healthy pipeline of market-ready companies to build up across sectors and markets. On the downside, geopolitical risks in many regions remain visible points on the radar”.

DropBox is another of the so-called unicorns to go public. In fact, this has been one of the most anticipated IPOs in the tech sector of 2018, just a year after the IPO of Snap, which raised $3.4bn. Its shares trade at $16.36 (as of 24/03/2018), slightly below the $17 IPO price. Another much awaited deal is the Spotify listing which has the peculiarity of being a “direct listing” skipping the traditional IPO route. This means that the company will not require the services of intermediaries to price and sell its shares. This type of transaction has the benefit of being cheaper and faster. However, potential downsides include low protection from volatility (given the absence of a lock-up period).

GOVERNANCE ISSUES AND DUAL-CLASS SHARES

According to an SEC filing, DropBox has a multi-class share structure which translates into a type of share giving 10 votes (Class B), and another with only one vote (Class A). To be thorough, the company has also Class C shares, which have no voting rights. This has been a widely discussed and controversial topic in previous notable IPOs, such as the Snap initial public offering, in which the company issued no-voting shares exclusively. Interestingly, Snap CEO Evan Spiegel controls 48.3% of voting power in the company, and co-founder Bobby Murphy 47.4%. However, this is not the case of the DropBox IPO, given that the company issued Class A shares.

The main reason why this type share structure is highly criticized by investors is because it gives the owners of these “special” shares a significantly higher voting power with respect to regular shareholders. Structures such as the one adopted by Snap give large freedom to founders, while shareholders have little say in board decisions.

A last aspect to bear in mind is that companies with a dual-class (or multi-class) share structure will be unable to join the S&P 500. The inclusion in such an index provides more trading volumes and popular instruments such as ETF would be forced to buy this stock as well to track the index. However, companies such as Alphabet and Berkshire Hathaway which already have this structure will remain in the index.

To conclude, the first day of trading has been without any doubt a success. Demand was strong, and the stock closed its first session +35.62%. While this is a great result we must remember that even Snap had a strong first day of trading (+44% at $24.48) and now trades at $16.36, as of March 23.

Despite the necessary caution related to IPOs, DropBox is a successful company with rapidly growing revenues (+31% this year) and with losses that are narrowing year after year.

Riccardo Lizzi