As Europe finds itself at the epicenter of a second Covid-19 crisis, with two of the major economies of the Eurozone that are imposing imminent national lockdowns, European Central Bank’s president Christine Lagarde has indicated the necessity of providing additional stimulus in December.

While France and Germany are closing all the non-essential activities, leaving only schools and businesses open, also Spain and Italy are facing an alarming state of emergency and the count of infections has risen well above 9.5 million, with more than 260.000 deaths.

Before the announcement of the new “light-lockdowns”, Europe’s businesses were already fighting a harsh decline in their activities and now the expectations of an economic downtrend for the last quarter of 2020 are higher than ever.

Considering the current situation, the ECB’s September prediction of an estimated contraction of 8% of the Eurozone GDP, could even worsen; leaving the central bank with no other option than to intervene on the basis of December’s economic projections. The main focus of a future intervention would be the protection of the economy, especially in the short term, since the wait for a hypothetical vaccine to be operational is still long.

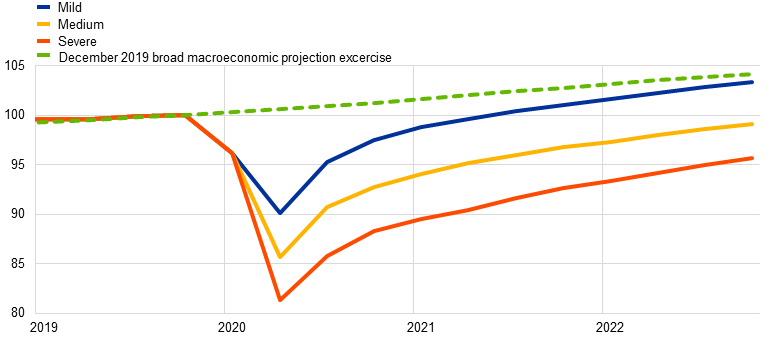

Euro area real GDP under the mild, medium, and severe scenarios (Source: ECB calculations)

While France and Germany are closing all the non-essential activities, leaving only schools and businesses open, also Spain and Italy are facing an alarming state of emergency and the count of infections has risen well above 9.5 million, with more than 260.000 deaths.

Before the announcement of the new “light-lockdowns”, Europe’s businesses were already fighting a harsh decline in their activities and now the expectations of an economic downtrend for the last quarter of 2020 are higher than ever.

Considering the current situation, the ECB’s September prediction of an estimated contraction of 8% of the Eurozone GDP, could even worsen; leaving the central bank with no other option than to intervene on the basis of December’s economic projections. The main focus of a future intervention would be the protection of the economy, especially in the short term, since the wait for a hypothetical vaccine to be operational is still long.

Euro area real GDP under the mild, medium, and severe scenarios (Source: ECB calculations)

The first intervention of the European Central Bank goes back to the announcement of a €750 Billion Pandemic Emergency Purchase Program (PEPP) on 18 March 2020, which was incremented by €600 billion to a total of €1,350 billion, on 4 June 2020. Now president Lagarde has underlined that the ECB “is not going to just stand still”, but is willing to use all the power and instruments in its possession to react to this second wave, as they did for the first one.

At the moment, Thursday’s meeting reinforced the current PEPP, leaving the asset purchase program at €1.35 trillion and the interest rates of the main refinancing operations, of the deposit facility and of the marginal lending facility, respectively unchanged at 0%, -0.5% and 0.25%; still allowing indebted countries to borrow money and confirming that PEPP will last until the end of the “critical phase”.

During the press conference, following the meeting, president Lagarde stated that “the Eurozone economy was losing momentum faster than expected, after a partial but surprising rebound during summer”, which destroyed the probabilities for the growth to continue in the last quarter of 2020 and calls for further economic intervention.

Analysts consider as given the release of an updated package from the ECB in December, and some of them even sooner, observing the severity of the situation. The prediction involves an extension of the program, not only with respect to the expiration date but also regarding its size. “The Central Bank could go even further by extending the current terms of the actual third version of the targeted long-term refinancing operations (TLTRO III)”, as reported by Marco Valli, head of macro research at UniCredit, referring to the lowering of borrowing costs for banks. However, it’s too soon to determine how large the proposal from the Central Bank will be, as we still can’t tell how badly the impending stricter measures, required for the containment of the virus, will impact September’s economic projections for the end of 2020.

As for the inflation projection path, analysts expect it to remain negative until 2021, but demand could increase in the medium-term, thanks to both an eventual alleviation of Covid-19 effects and the counteraction measures implemented by the ECB.

Another concern of the European Central Bank is the strengthening of the euro, which suffered a loss against the U.S. dollar of 0.6% after the above-mentioned declarations of president Lagarde, and broadly has dropped by 5% since the beginning of the pandemic. But, if from one side, action from the ECB is needed; from the other, we knew that it’s a really delicate topic, as the Eurozone economic activity relies heavily on exportations.

The only thing left to do is wait for further developments of the current situation, in order to verify if the analysts’ predictions will be confirmed by the ECB’s December meeting.

Tommaso Tenti

At the moment, Thursday’s meeting reinforced the current PEPP, leaving the asset purchase program at €1.35 trillion and the interest rates of the main refinancing operations, of the deposit facility and of the marginal lending facility, respectively unchanged at 0%, -0.5% and 0.25%; still allowing indebted countries to borrow money and confirming that PEPP will last until the end of the “critical phase”.

During the press conference, following the meeting, president Lagarde stated that “the Eurozone economy was losing momentum faster than expected, after a partial but surprising rebound during summer”, which destroyed the probabilities for the growth to continue in the last quarter of 2020 and calls for further economic intervention.

Analysts consider as given the release of an updated package from the ECB in December, and some of them even sooner, observing the severity of the situation. The prediction involves an extension of the program, not only with respect to the expiration date but also regarding its size. “The Central Bank could go even further by extending the current terms of the actual third version of the targeted long-term refinancing operations (TLTRO III)”, as reported by Marco Valli, head of macro research at UniCredit, referring to the lowering of borrowing costs for banks. However, it’s too soon to determine how large the proposal from the Central Bank will be, as we still can’t tell how badly the impending stricter measures, required for the containment of the virus, will impact September’s economic projections for the end of 2020.

As for the inflation projection path, analysts expect it to remain negative until 2021, but demand could increase in the medium-term, thanks to both an eventual alleviation of Covid-19 effects and the counteraction measures implemented by the ECB.

Another concern of the European Central Bank is the strengthening of the euro, which suffered a loss against the U.S. dollar of 0.6% after the above-mentioned declarations of president Lagarde, and broadly has dropped by 5% since the beginning of the pandemic. But, if from one side, action from the ECB is needed; from the other, we knew that it’s a really delicate topic, as the Eurozone economic activity relies heavily on exportations.

The only thing left to do is wait for further developments of the current situation, in order to verify if the analysts’ predictions will be confirmed by the ECB’s December meeting.

Tommaso Tenti