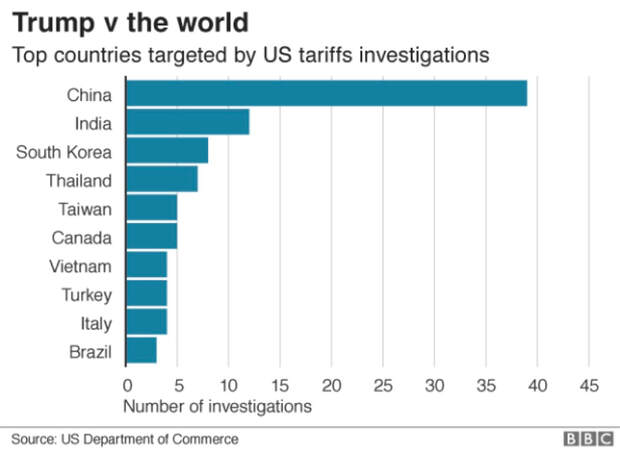

The past year has been marked by an ever-increasing amount of trade disputes between global forces. US President Donald Trump has tried, more or less successfully, to leverage the United States’ predominant economic power and influence to force other countries into more favorable deals. His disputes with China and North Korea, which have caused quite an effect on global markets, have been the most notable, causing a widespread sense of unease and uncertainty that affected trade sentiment for the better part of the last six months.

The current US commander in chief didn’t just stop there though; last month he announced that the US will put an end to all Iran oil waivers aiming to drive the country’s oil export to zero and raising question over the sufficiency of the global supply of oil now that “driving season” has come. With the disputes related to China seemingly reaching an end, President Trump has expressed the possibility of imposing tariffs on as much as $11 billion worth of European products. The products in question range from aircrafts to agricultural goods, and in particular, the US is trying to level the competitive field after the WTO has found that subsidies to Airbus are hurting the US.

The current US commander in chief didn’t just stop there though; last month he announced that the US will put an end to all Iran oil waivers aiming to drive the country’s oil export to zero and raising question over the sufficiency of the global supply of oil now that “driving season” has come. With the disputes related to China seemingly reaching an end, President Trump has expressed the possibility of imposing tariffs on as much as $11 billion worth of European products. The products in question range from aircrafts to agricultural goods, and in particular, the US is trying to level the competitive field after the WTO has found that subsidies to Airbus are hurting the US.

In the second half of last year the US already imposed steel and aluminum tariffs on Europe that are currently affecting European manufacturers. Moreover, there is the looming threat of additional tariffs on cars and car parts. All these factors have exasperated EU leaders that feel they are negotiating a trade agreement with “a gun to the head”.

Speaking to Foreign Policy about the negotiations behind a free trade agreement with the US, EU trade commissioner Cecilia Malmstrom, said that, before talks can be successfully completed, the US must remove all tariffs on steel and aluminum and that, in case further sanctions were to be imposed on cars or car parts, negotiations will be interrupted immediately. With regards to the Airbus vs Boeing dispute, which has been dragging on for already 14 years, Mrs. Malmstrom confirmed that the EU is ready to match possible tariffs by the US with its own, in accordance to the terms established by the WTO.

For the time being, EU Commission president Jean-Claude Junker has struck a deal with President Trump to continue trade talks and halt any further tariffs, but these negotiations are yet to formally begin. The sticking point seems to be the inclusion of agricultural products in the agreement which the EU has clearly stated it is not willing to do under any circumstance. Furthermore, there is a belief that as soon as matters with China will be officially settled, the pressure on the EU will be increased even further.

Since all disputes seem to arise from the breach of conduct by the EU with regards to the subsidies to Airbus, the EU has requested a WTO-appointed arbitrator to determine its retaliation right in the event of further escalations. Even though final figures are likely to be well below the $11 billion before-mentioned, this situation has the potential to cause a considerable rift between the two parties and degenerate into something close to the trade war that just passed between the US and China. Especially considering the precarious state of the global economy which, despites recent strong signs of recovery, is still well on the lookout for signs of a possible regression, tensions between the EU and the US can become the tipping point that revives uncertainty and volatility on the market, possibly ending the decade-long bull market.

Enrico Ortolani

Speaking to Foreign Policy about the negotiations behind a free trade agreement with the US, EU trade commissioner Cecilia Malmstrom, said that, before talks can be successfully completed, the US must remove all tariffs on steel and aluminum and that, in case further sanctions were to be imposed on cars or car parts, negotiations will be interrupted immediately. With regards to the Airbus vs Boeing dispute, which has been dragging on for already 14 years, Mrs. Malmstrom confirmed that the EU is ready to match possible tariffs by the US with its own, in accordance to the terms established by the WTO.

For the time being, EU Commission president Jean-Claude Junker has struck a deal with President Trump to continue trade talks and halt any further tariffs, but these negotiations are yet to formally begin. The sticking point seems to be the inclusion of agricultural products in the agreement which the EU has clearly stated it is not willing to do under any circumstance. Furthermore, there is a belief that as soon as matters with China will be officially settled, the pressure on the EU will be increased even further.

Since all disputes seem to arise from the breach of conduct by the EU with regards to the subsidies to Airbus, the EU has requested a WTO-appointed arbitrator to determine its retaliation right in the event of further escalations. Even though final figures are likely to be well below the $11 billion before-mentioned, this situation has the potential to cause a considerable rift between the two parties and degenerate into something close to the trade war that just passed between the US and China. Especially considering the precarious state of the global economy which, despites recent strong signs of recovery, is still well on the lookout for signs of a possible regression, tensions between the EU and the US can become the tipping point that revives uncertainty and volatility on the market, possibly ending the decade-long bull market.

Enrico Ortolani