European stocks have significantly underperformed for nearly a decade now. Furthermore, when compared to US stocks the underperformance is astounding. If 1 dollar was invested in the MSCI USA in 2006 would be worth 4.17 dollars today, while if invested in the MSCI Europe it would be worth 1.99 dollars. On an annualized basis the MSCI Europe compounded at 8.26% while the MSCI USA compounded at 11.16% (outperforming by 290 basis points). Europe has had the European currencies (mainly the euro and the pound) depreciate against the dollars. Furthermore, it has also dealt with more severe economic problems than the US, as exemplified by the European crisis of 2012.

Europe’s problems originated in the 2008 crisis, when economies across the globe weakened and the financial system was put in jeopardy. Furthermore, as the Icelandic banking system spiraled down it took the continent with it (primarily harming the so called “PIIGS”). As these countries dealt with an economic crisis after years of easy access to capital, they borrowed aggressively to sustain the Crisis. However, these countries were in awful financial condition and were further stigmatized by being called by the derogatory term “PIIGS”. Naturally this caused investors to avoid lending to these countries at any cost. Furthermore, these countries were unable to use monetary policy as a means to escape their issues, given that they were part of the eurozone. Despite the ECB’s and Draghi’s effort to lessen the blow, these countries were still in recovery in the subsequent decade coming out of the crisis.

These problems, coupled with weak fundamental performance from the businesses underlying the indexes would have been enough to underperform the American index. However, European multiples have also suffered given that the MSCI Europe trades at 16X forward earnings while the MSCI USA trades at 22X.

Europe’s problems originated in the 2008 crisis, when economies across the globe weakened and the financial system was put in jeopardy. Furthermore, as the Icelandic banking system spiraled down it took the continent with it (primarily harming the so called “PIIGS”). As these countries dealt with an economic crisis after years of easy access to capital, they borrowed aggressively to sustain the Crisis. However, these countries were in awful financial condition and were further stigmatized by being called by the derogatory term “PIIGS”. Naturally this caused investors to avoid lending to these countries at any cost. Furthermore, these countries were unable to use monetary policy as a means to escape their issues, given that they were part of the eurozone. Despite the ECB’s and Draghi’s effort to lessen the blow, these countries were still in recovery in the subsequent decade coming out of the crisis.

These problems, coupled with weak fundamental performance from the businesses underlying the indexes would have been enough to underperform the American index. However, European multiples have also suffered given that the MSCI Europe trades at 16X forward earnings while the MSCI USA trades at 22X.

The biggest disparity between the MSCI USA and the MSCI Europe is in the sector weighting of their indexes. In the past decade we have seen a bull market in growth equities in America, mainly technology stocks, something that is markedly untrue in Europe. Despite having declined over the past couple of weeks, many growth stocks are still trading at much higher valuation than they were a decade ago. As can be seen in the chart below, in 2006-2007 growth stocks were at its lowest valuation when compared to value stocks.

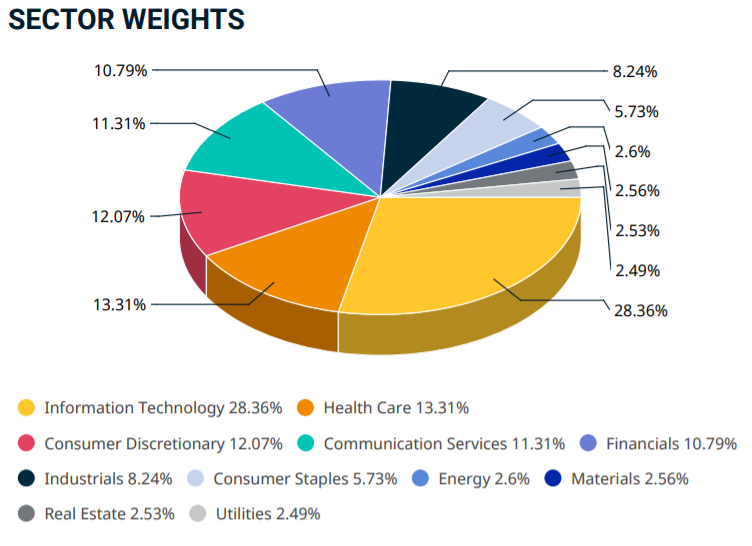

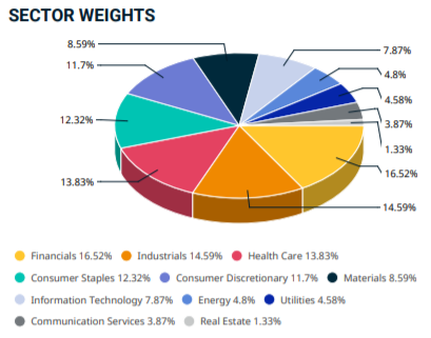

Information technology makes up an astounding 28.36% of the MSCI USA, meanwhile, its European counterpart only has a 7.87% weighting to that sector. If we consider technology and communications the American index stands at nearly 40% weighting, meanwhile the European index stands at a measly 11.87%. There are other significant differences in sector weightings, however, none as important as technology.

The Covid 19 global pandemic was a disaster, both socially and economically, all across the world. However, it provided hope to those who call for a fiscal union in the eurozone. In 2020 the pandemic caused countries across Europe to shut down, subsequently dealing with unemployment, increase in public debt, and slower growth. Thus, the ECB was compelled to intervene. They created the PEPP, a 1.85 trillion-euro asset purchasing program. In addition, the EU created the recovery fund and consequently the first joint debt instruments issued by the EU as a whole. This showed that despite being unwilling to lend money to individual distressed countries within the eurozone, investors are willing to lend to the EU. The success of the social bond is the first step towards fiscal union in the European Union, something which Draghi and many others have worked on for years. Lagarde has urged the European Union to make the 750-billion-euro recovery fund a permanent tool. The value of the fiscal union would be not only in the ability to provide funding to these countries, but in not needing to do so in the first place. Those who call for a fiscal union have argued that the sheer ability of the ECB of raising debt through the recovery fund should lower the risk premium and thus the borrowing costs for countries in the eurozone. Though we are far from having a fiscal union in the Eurozone, as the EU continues to create precedents and move closer to it, European equities should reflect a lower risk premium and thus a lower discount rate.

The silver lining for European stocks is that despite all of the issues it has dealt with, the outlook is strikingly more positive. On a relative basis, American stocks have profited from Covid 19 as the world moved online, interest rates declined, and the yield curve flattened. However, this is no longer true, as vaccination rise there is an expectation that the reopening will benefit old economy stocks (such as industrials which make up 14.59% of the European index). Not only that, but the Federal Reserve can’t continue to purchase assets forever. As the yield curve steepens again it is likely that financials will outperform other sectors (something which we have seen already in 2021 as long term rates rose). Thus, this is a good setup for European equities and should cause Europe’s relative performance to improve significantly. In essence, European equities may not outperform American equities over the next decade but they are also unlikely to underperform as significantly as it has over the past decade. As the chief market strategist for EMEA at JPMorgan Asset Management mentioned[1], “Europe still seems to be suffering from a case of excess pessimism”.

Bruno Badolato

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

[1] https://www.ft.com/content/7188de07-9d13-4081-b4ea-9ad105d00360