Introduction

In the past few months the European ETF market has witnessed a high resurgence in demand, with investors being particularly keen on “value” stock ETFs. According to data provided by MorningStar Direct, investors injected more than 3.7 billion EUR in the European value ETFs marketplace in just three months from July to September. This showed an incredible recovery after the outflows witnessed in the first quarter of 2020, which were mainly caused by investors’ fear for the initial spread of the pandemic.

In this article, we propose a detailed analysis of the latest trends in the European ETF marketplace covering aspects of the industry.

In the past few months the European ETF market has witnessed a high resurgence in demand, with investors being particularly keen on “value” stock ETFs. According to data provided by MorningStar Direct, investors injected more than 3.7 billion EUR in the European value ETFs marketplace in just three months from July to September. This showed an incredible recovery after the outflows witnessed in the first quarter of 2020, which were mainly caused by investors’ fear for the initial spread of the pandemic.

In this article, we propose a detailed analysis of the latest trends in the European ETF marketplace covering aspects of the industry.

ETFs: general overview

ETFs are collections of assets whose shares are traded on a stock market. These instruments blend the characteristics and potential advantages of stocks, mutual funds, and bonds. Just like individual stocks, ETF shares are continuously traded during the day at different prices matching supply and demand. ETF shares, like mutual fund shares, represent a portion of ownership in a professionally managed portfolio. There are a variety of ETFs available, each with a distinct investing objective. Some of the most popular ETFs are listed below:

ETFs are collections of assets whose shares are traded on a stock market. These instruments blend the characteristics and potential advantages of stocks, mutual funds, and bonds. Just like individual stocks, ETF shares are continuously traded during the day at different prices matching supply and demand. ETF shares, like mutual fund shares, represent a portion of ownership in a professionally managed portfolio. There are a variety of ETFs available, each with a distinct investing objective. Some of the most popular ETFs are listed below:

- Diversified passive equity ETFs are meant to track the performance of popular stock market indices including the S&P 500, Dow Jones Industrial Average, and MSCI Europe Australasia Far East (EAFE) indexes

- Niche passive equity ETFs, such as those that track S&P 500 sector subgroups or Russell 2000 SMEs, may provide investors with targeted exposure to assist them fine-tune their portfolio strategy

- Instead of closely pegging to a benchmark index, active equity ETFs enable their managers to apply their own judgment in choosing assets. Active ETFs have the ability to beat the market, but they also come with a higher risk and expense

- Fixed-income exchange-traded funds invest in bonds rather than equities. Major fixed-income ETFs are often actively managed, although their portfolios have low turnover and are generally stable.

Evaluating ETFs

Among the advantages linked to ETF investments we find:

- Tax efficiency - while a mutual fund management may trade equities to meet redemption requests from investors or to achieve the fund's goals, redeeming ETFs is not a cause of concern. Managers of index-based ETFs only conduct transactions in response to changes in their index, which might result in higher tax efficiency

- Lower costs - passively managed ETFs may have lower yearly expenditures than actively managed funds (managers typically just move shares to reflect underlying benchmarks)

- Pricing - ETFs are offered at real-time prices and traded throughout the day, much like stocks. By contrast, mutual funds’ pricing is based on trade prices at the end of the day

- Leverage - ETFs may be sold short and bought on leverage since they trade like stocks. This allows investors to employ them in a variety of investing methods, including selling short and purchasing on margin

- No minimum investment requirement - most ETFs allow investors to buy as few or as many shares as they like

- Diversification – diversification to your portfolio using ETFs. Acquiring shares of a technology sector ETF, for example, may be less hazardous than purchasing shares of a single technology company because an ETF may own shares of a variety of technology firms.

As other investments, ETFs also come with risks and disadvantages. Among these:

- The ease with which ETFs may be traded may encourage more frequent trading and chances that the investor times the market incorrectly increase

- Brokerage commissions must be paid, which make ETFs more suited for a buy-and-hold investor or someone buying a large number of shares at once than for someone who follows a systematic investing plan

- Capital gains may be distributed; some ETFs have dispersed taxable capital gains in the past, mainly as a result of the managers' requirement to purchase or sell equities to match their underlying benchmarks

Having analysed the main advantages and disadvantages linked to this type of investment, we now look further at the European ETF industry picture.

European ETF marketplace

One of the most significant differences with respect to the US is that European ETFs are almost never traded on exchange, but mainly over-the-counter on smaller platforms, which cannot be accessed by retail investors. One of the most important advantages of ETFs going OTC is that the European market is highly fragmented and liquidity is split across different stock exchanges in different locations. Therefore, trading OTC allows investors to benefit from liquidity across European exchanges, rather than just the single liquidity of one stock exchange only.

Europe’s ETF marketplace has witnessed a fast-growing phase in the last decade. Total asset under management (AUM) have been growing at a double-digit annual compound rate of ~20%, raising from 100 billion EUR in total assets at the end of the 2008 financial crisis to about 760 billion EUR by the end of the first quarter 2019. The only exceptions to this trend occurred in 2011 and 2018, two years of high volatility for the stock market. However, in 2019 the exceptionally high growth trend in total AUM was back by the first quarter of 2019.

Starting from the first quarter of 2020, market volatility resulting from the spread of COVID-19 pandemic presented ETFs with the most difficult resilience test they have faced since the 2008 financial crisis. As liquidity in both equity and fixed income securities markets was eroded, ETFs continued to trade efficiently, showing how they can add stability to capital markets. Furthermore, they played a key role for both institutional and retail investors for what concerns price discovery, since they shed light on the values at which investors were willing to exchange risk.

Analysis

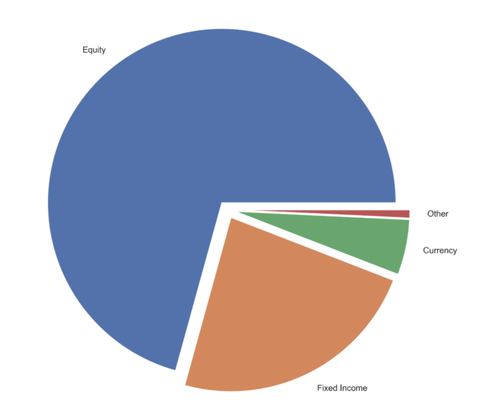

We propose a more detailed analysis of the main players in the European ETF marketplace. The dataset, based on FactSet data, comprises 1735 ETFs focused on the European market which represent five different asset classes, namely, Equity, Fixed Income, Currency, Alternatives and Commodities. On one hand, Equity is the subject of more than 1200 ETFs, on the other, only 13 ETFs, less than 1% of the total, deal with Alternatives and Commodities.

One of the most significant differences with respect to the US is that European ETFs are almost never traded on exchange, but mainly over-the-counter on smaller platforms, which cannot be accessed by retail investors. One of the most important advantages of ETFs going OTC is that the European market is highly fragmented and liquidity is split across different stock exchanges in different locations. Therefore, trading OTC allows investors to benefit from liquidity across European exchanges, rather than just the single liquidity of one stock exchange only.

Europe’s ETF marketplace has witnessed a fast-growing phase in the last decade. Total asset under management (AUM) have been growing at a double-digit annual compound rate of ~20%, raising from 100 billion EUR in total assets at the end of the 2008 financial crisis to about 760 billion EUR by the end of the first quarter 2019. The only exceptions to this trend occurred in 2011 and 2018, two years of high volatility for the stock market. However, in 2019 the exceptionally high growth trend in total AUM was back by the first quarter of 2019.

Starting from the first quarter of 2020, market volatility resulting from the spread of COVID-19 pandemic presented ETFs with the most difficult resilience test they have faced since the 2008 financial crisis. As liquidity in both equity and fixed income securities markets was eroded, ETFs continued to trade efficiently, showing how they can add stability to capital markets. Furthermore, they played a key role for both institutional and retail investors for what concerns price discovery, since they shed light on the values at which investors were willing to exchange risk.

Analysis

We propose a more detailed analysis of the main players in the European ETF marketplace. The dataset, based on FactSet data, comprises 1735 ETFs focused on the European market which represent five different asset classes, namely, Equity, Fixed Income, Currency, Alternatives and Commodities. On one hand, Equity is the subject of more than 1200 ETFs, on the other, only 13 ETFs, less than 1% of the total, deal with Alternatives and Commodities.

Source: FactSet

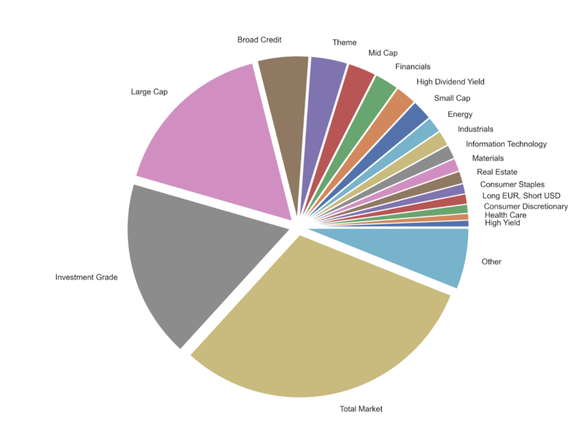

Moreover, each ETF is associated with a topic on which it is focused, for instance, Large Cap, Energy and Real Estate. There are 56 different topics, which aren’t distributed uniformly, with 3 of them, specifically, Total Market, Investment Grade and Large Cap, having more than half of the total share. The “Other” segment is mainly constituted by Currency related ETFs such as “Long USD, Short EUR”.

Source: FactSet

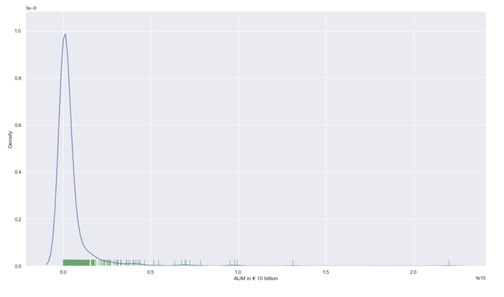

One additional factor to consider is the Asset under management (AUM), which indicates the size of an ETF. Regarding the ETFs denominated in euro, the average AUM is €357 million and its coefficient of variation is 2.33, which is relatively high.

Source: FactSet

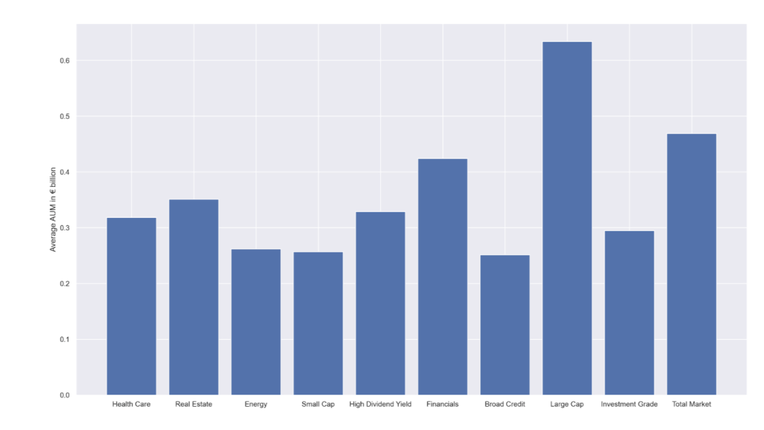

This bar chart depicts the sectors with an average AUM in excess of €250 million; examples of ETFs in the Large Cap sector include iShares Core DAX UCITS ETF (DE) or XTRACKERS EURO STOXX 50 UCITS ETF 1C, while iShares STOXX Europe 600 UCITS ETF (DE) and Lyxor Core Stoxx Europe 600 (DR) deal with Total Market.

Source: FactSet

Regarding the ESG criteria, each ETF is described by two scores, namely, MESG Fund Quality Overall and MESG Fund Carbon Intensity, which are negatively correlated, with a -0.46 Pearson coefficient. While there is no correlation between the Fund Quality index and price-to-earnings ratio (P/E), a weak negative correlation is established between P/E and Carbon Intensity index, with a -0.18 Spearman coefficient.

A recent trend: ESG ETFs

More and more investors have increased interest for socially responsible investing (SRI) in the last few decades. With awareness and ideas about sustainable investment products rising day by day, the main idea is that these ecological and social responsible investments ensure companies more sustainable returns in the long run.

As a consequence of this trend, an increasing number of ETFs is becoming available for socially responsible investing. These are normally more suitable for investors who are interested in ethics or ecology, than the alternatives. One of the main promoters of the ESG ETF trend is certainly UBS which, only in the last year, has launched 17 sustainable ETFs benchmarks.

Clemens Reuter, global head of ETFs at UBS AM, said that clients were also “switching mandates to sustainable”. “Sustainable is a key critical success factor for today’s investment products. At UBS they are convinced that the integration of environmental, social and governance (ESG) factors is a megatrend that will have a decisive impact in the long term. As with COVID-19, which took the whole world by surprise, companies will have to be ready to adapt their business model to Esg aims, setting changes able to overcome markets turmoil. Precisely in periods as those of crisis and great turbulence in the macroeconomic equilibrium that companies with a robust ESG framework, focused on aspects such as business continuity, worker health and safety and supply chain management, will be most resilient.

When the first socially responsible ETF was launched by UBS within the company, doubts and perplexities reigned but 10 years later, according to Reuter, the initiative has performed absolutely well. Actually, UBS's ETF owns beyond $ 100 billion in assets globally, of which $2.2bn “Light-green” products include the $2.2bn UBS S&P 500 ESG ETF.

UBS, compared to its main European competitors, is able to raise more sustainable goals funds than anyone in the European market. UBS competitors, such as DWS, iShares, Lyxor, Vanguard and Invesco, have seen far more inflows into unsustainable ETFs than sustainable this year. A survey carried out by Responsible Investor in collaboration with UBS-AM in 2019 revealed that 78% of global asset owners are already integrating ESG factors into their investment processes, while 17% are interested in the topic and are considering how to proceed with the integration and only 5% are not interested.

In conclusion, it is clear that Europe ETF industry has grown at a very fast pace in the last few decade. What is remarkable is the fact that this positive trend was not even interrupted significantly during the pandemic crisis, showing the high level of resilience of these instruments. Thus, under the positive assumptions of upward-trending inflows and recovering market prices, the overall outlook of the industry remains positive, especially for the ESG-focused ETFs.

Sources

- FactSet

- Investopedia

- Financial Times

- MorningStar Direct

- Reuters

Federico Russo, Leonardo Grandini and George Lavas