Last year, the Eurozone headline inflation hit a 40-year high of 10.6%. Even though it has slightly declined in the last few months, price pressures are still persistent. In addition, two major threats may determine a higher inflation rate for longer than expected, namely the tight labor market in the Euro Area and China’s reopening. Starting from the current macroeconomic scenario, we will analyze the impact of these factors and the forecasts for the short and medium term.

Macroeconomic Scenario

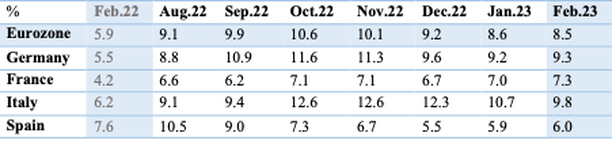

The Eurozone all-items inflation rate fell in February, which signalized the fourth consecutive month of ease in price rises since October. Despite the overall positive trend, in some of the largest Eurozone members (Germany, France, Spain) the inflation accelerated, showing that there is a long way ahead in pursuit of the targets that central banks have set.

Table 1: All-Items Inflation in Eurozone and Its Biggest Members | Source: Eurostat

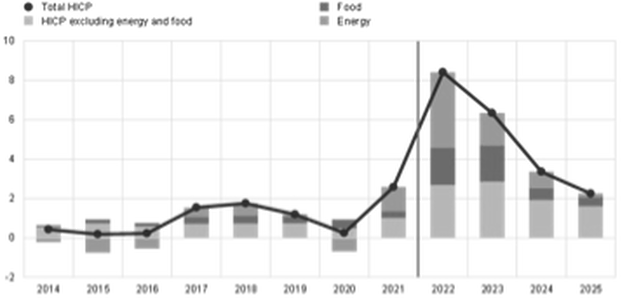

However, to fully understand the nature of the dynamics of headline inflation in the Eurozone it is worth looking at its components. Each component contributes to headline inflation to a varying degree, depending on the structure of the households’ final monetary consumption expenditure. For example, for 2023 services represent the largest component and account for around 43.5%. It is followed by non-energy industrial goods, which account for 26.3%. Food, alcohol, and tobacco constitute around 20.0%. Lastly, energy makes up 10.2%. The two latter categories, constituting together around 30% of HICP, can be characterized by high price volatility and, thus, have a significant impact on the headline inflation, the effect that we could observe in 2022, when the inflation was to a large extend boosted by energy supply shocks. Hence, to observe the long-run trends in price levels, it might appear more reasonable to refer to Core inflation, which is defined by Eurostat as the percentage change in the euro area HICP special aggregate “all items excluding energy, food, alcohol, and tobacco”.

It is interesting to notice that, despite a decrease in the broadest measure of inflation, the core inflation in Eurozone in February has jumped to a record high of 5.6% from 5.3% in January. The explanation may be twofold. Firstly, the decrease in headline inflation was mostly due to the settlement of energy prices (the inflation in the energy component experienced a major decline from 18.9% to 13.7%). The positive trend in energy prices even offset a considerable increase in food prices (inflation in February reached 15% from 14.1% in January). Secondly, the increase in core inflation was caused by a rise in services inflation from 4.4% in January to 4.8%. That trend is particularly significant since services prices are believed to be a sound indicator of inflation pressures generated in the Euro Area itself, as they do not depend on international trade.

It is interesting to notice that, despite a decrease in the broadest measure of inflation, the core inflation in Eurozone in February has jumped to a record high of 5.6% from 5.3% in January. The explanation may be twofold. Firstly, the decrease in headline inflation was mostly due to the settlement of energy prices (the inflation in the energy component experienced a major decline from 18.9% to 13.7%). The positive trend in energy prices even offset a considerable increase in food prices (inflation in February reached 15% from 14.1% in January). Secondly, the increase in core inflation was caused by a rise in services inflation from 4.4% in January to 4.8%. That trend is particularly significant since services prices are believed to be a sound indicator of inflation pressures generated in the Euro Area itself, as they do not depend on international trade.

Figure 1: Euro Area Inflation and Its Main Components | Source: Eurostat

The factor that might further add to the persistent core inflation is the situation in the labor market. Despite the economic slowdown, the rate of unemployment in the Eurozone, which for the past months has stably been at a record low level of 6.6%, shows that workers are in a strong bargaining position. Pressures from trade unions are evident in Europe, where strikes are becoming more and more widespread. Bargaining power, together with the fact that real hourly wages in the Euro Area have dropped by 7% since the start of 2021, signalize that wages might soon catch up, which will generate additional price pressures, especially, in labor-intensive services.

Therefore, even with decreasing overall inflation, the core measures show that the long-term trends in price rises are not that univocal. The tight labor market, pressures from trade unions, and the possibility of an accelerated wage-adjustment process can partly explain the ongoing concern of the central banks. Additional concerns come from external macroeconomic shocks, especially China’s reopening.

The impact of China’s reopening

Since China's rapid economic reopening in December 2022, which occurred earlier than expected, and after a shorter-than-anticipated major wave of COVID-19 infections, leading indicators suggest that a domestic economic revival has commenced. The recovery is anticipated to be driven by domestic services consumption, such as hospitality and entertainment, similar to other countries' reopenings. This recovery differs from previous Chinese downturns which were mainly led by investment, making it more difficult to assess the probable impacts on economies using historical comparisons. A smaller growth rebound is expected in China this year than in past cycles, clear examples are the 10.6% GDP growth in 2010 following the Global Financial Crisis and the 8.1% growth in 2021 following the first pandemic crisis. Spillover effects on growth and inflation in other regions may propagate through three main components:

The recovery of economic activity in China could lead to a general increase in demand for goods and services, fueling industry and further boosting demand for commodities that are expected to be a key channel for inflationary pressures, as China represents the largest global consumer of commodities. Even if the recovery is less investment-driven and commodity-intensive than previous cycles, higher energy demand may push up prices for commodities such as oil. For instance, the Oxford Economics macro model projects a 20 basis-points increase in Euro Area inflation this year due to higher oil prices and Chinese private consumption, holding all else constant. Price pressures may also rise in Europe's still capacity-constrained travel and entertainment sectors as Chinese tourist flows return to pre-pandemic levels. This implies that claims costs for the European insurance industries may be higher at the margin than anticipated this year.

Therefore, even with decreasing overall inflation, the core measures show that the long-term trends in price rises are not that univocal. The tight labor market, pressures from trade unions, and the possibility of an accelerated wage-adjustment process can partly explain the ongoing concern of the central banks. Additional concerns come from external macroeconomic shocks, especially China’s reopening.

The impact of China’s reopening

Since China's rapid economic reopening in December 2022, which occurred earlier than expected, and after a shorter-than-anticipated major wave of COVID-19 infections, leading indicators suggest that a domestic economic revival has commenced. The recovery is anticipated to be driven by domestic services consumption, such as hospitality and entertainment, similar to other countries' reopenings. This recovery differs from previous Chinese downturns which were mainly led by investment, making it more difficult to assess the probable impacts on economies using historical comparisons. A smaller growth rebound is expected in China this year than in past cycles, clear examples are the 10.6% GDP growth in 2010 following the Global Financial Crisis and the 8.1% growth in 2021 following the first pandemic crisis. Spillover effects on growth and inflation in other regions may propagate through three main components:

- increased Chinese domestic demand for foreign goods and services;

- higher Chinese demand for global commodities;

- the stabilization of China-focused supply chains.

The recovery of economic activity in China could lead to a general increase in demand for goods and services, fueling industry and further boosting demand for commodities that are expected to be a key channel for inflationary pressures, as China represents the largest global consumer of commodities. Even if the recovery is less investment-driven and commodity-intensive than previous cycles, higher energy demand may push up prices for commodities such as oil. For instance, the Oxford Economics macro model projects a 20 basis-points increase in Euro Area inflation this year due to higher oil prices and Chinese private consumption, holding all else constant. Price pressures may also rise in Europe's still capacity-constrained travel and entertainment sectors as Chinese tourist flows return to pre-pandemic levels. This implies that claims costs for the European insurance industries may be higher at the margin than anticipated this year.

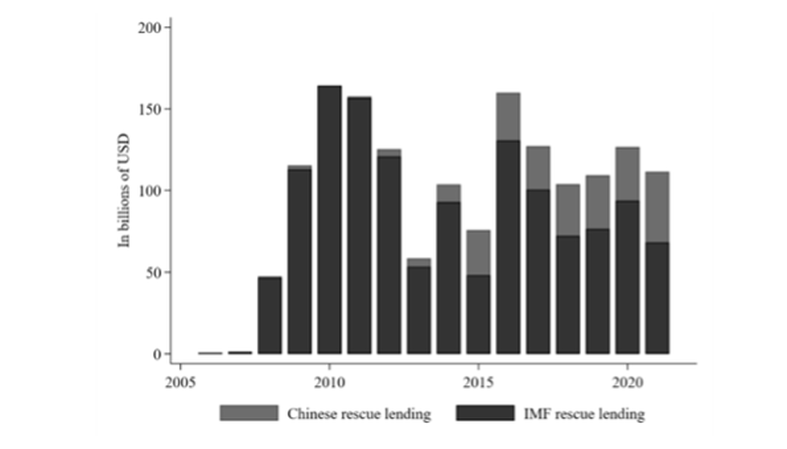

Figure 2: China’s Share of Global Commodity Consumption | Source: Bank of America Merrill Lynch

Finally, there is a short-term risk that the demand rebound could cause supply chains to tighten again. The price of shipping goods from China to Europe has risen significantly since last year due to supply chain bottlenecks and container shortages. These disruptions could lead to shortages of goods and raw materials, ultimately leading to higher prices for consumers in major importing countries. As it is visible from the Purchasing Managers’ Index (PMI) chart – one of the most important measures of economic activity in the manufacturing sector of a country –, an increase in the PMI in China can lead to an increase in the shipments and its relative costs, as manufacturers work to meet the increased demand for goods and services, leading to higher transportation and production costs both domestically and internationally.

Figure 3: China’s Manufacturing and Services PMI (2019-23) | Source: Bloomber

Given the ongoing concern of central banks regarding the long-term trends in price rises, the recent increase in key rates by the ECB on March 16th to 3%, following previous increases in February and December, was not surprising. As we have mentioned before, factors such as a tight labor market, pressures from trade unions, and the possibility of an accelerated wage-adjustment process can partly explain these concerns. Moreover, the growing inflationary pressures related to China's reopening could provide the ECB with further leeway to continue its restrictive monetary policy to achieve its primary goal of price stability, potentially representing a threat to the already deteriorated economic environment in the Eurozone.

How Eurozone Countries Are Reacting

Following the action taken by the Chinese state, the impact it will have may be different depending on the country and geographical positioning. An improvement in China's economic cycle typically benefits Europe as it triggers increased investment by manufacturers to meet the rising demand for goods. However, we anticipate that the recovery will primarily favor services instead of manufacturing.

Moreover, due to prior robust investment and weak external demand, the revival is unlikely to initiate a fresh investment cycle in manufacturing that attracts imports from Europe and other regions. Finally, although the Zero-Covid Policy (ZCP) might have postponed foreign direct investment (FDI), it remains uncertain whether multinational companies will raise their investment in China amid geopolitical tensions that urge supply chain diversification.

Therefore, as we anticipated before, European countries will be most impacted by the rise in Chinese consumer demand. The effects will be more evident in tourism and the luxury industry. As a result, the countries more exposed to those sectors, especially the most popular tourist destinations, are expected to suffer from additional price pressures which may delay the path to price stability. We now analyze more in-depth the macroeconomic effects on the four biggest economies in the Eurozone.

Italy is likely to be heavily impacted by China's reopening in 2023. A resumption of economic activity in China could lead to increased demand for Italian exports, particularly in sectors such as luxury goods and machinery, which are among the country's key exports to China. However, Italy could also face some challenges: if China's economy grows rapidly and demand for its products surges, Italian companies could face increased competition from Chinese firms in global markets. Additionally, rising Chinese production could hurt some domestic industries in Italy, such as textiles and fashion, due to cheaper labor costs. Overall, while there are potential opportunities for Italy's economy with China's reopening in 2023, there are also risks and challenges that need to be monitored and managed.

The German economy will react similarly, being a highly export-oriented economy and a major trading partner of China. An increase in economic activity in China could lead to a surge in demand for German exports, especially in sectors such as machinery, automobiles, and chemicals, which are among the country's key exports to China. This would boost Germany's economic growth and job creation in these industries. Germany could also face some challenges from China's reopening. Apart from increased competition in the manufacturing sector, Germany may be negatively impacted by the increase in commodity prices.

We now consider France. In this case, the industry sectors with the highest exposure to China are luxury goods, cosmetics, and aerospace. Again, we expect higher demand for their products, which will result in a growth in output and labor demand, and in turn, increase inflationary pressures. France remains more resilient to commodity price rises than France and Italy, given its lower reliance on fossil fuels.

Finally, we analyze Spain. In this country, the tourism industry will be the most affected. Indeed, Spain – along with Italy – represents the favorite destination of Chinese tourists (in Europe), and, as travel restrictions are scrapped, the number of Chinese citizens willing to travel abroad has increased to over 50%. This is reflected in job market data, which show that the growth in employment in the hospitality sector is helping drive down unemployment figures.

Overall, all these Eurozone countries are likely to be impacted similarly, with some differences depending mostly on the greater or lower contribution of certain sectors to the overall economic activity. All these factors are taken into account to estimate short- to medium-term inflation.

Future Outlook

The European Commission has published its revised economic forecasts in February 2023, which hint at expected growth of almost 1% in the bloc for 2023, while inflation is expected to slow down but remain high, a little more so outside the eurozone. The European Commissioner for Economy Paolo Gentiloni said: "And we have entered 2023 on a firmer footing than anticipated: the risks of recession and gas shortages have faded and unemployment remains at a record low”.

For 2023, inflation was forecast to be 5.6% within the eurozone and 6.3% across the entire EU. Furthermore, the HICP is projected to decrease to 3.4% in 2024 and 2.3% in 2025. This profile for inflation reflects the decline in the annual rates of all main components of inflation to varying degrees, as we see from the chart below.

How Eurozone Countries Are Reacting

Following the action taken by the Chinese state, the impact it will have may be different depending on the country and geographical positioning. An improvement in China's economic cycle typically benefits Europe as it triggers increased investment by manufacturers to meet the rising demand for goods. However, we anticipate that the recovery will primarily favor services instead of manufacturing.

Moreover, due to prior robust investment and weak external demand, the revival is unlikely to initiate a fresh investment cycle in manufacturing that attracts imports from Europe and other regions. Finally, although the Zero-Covid Policy (ZCP) might have postponed foreign direct investment (FDI), it remains uncertain whether multinational companies will raise their investment in China amid geopolitical tensions that urge supply chain diversification.

Therefore, as we anticipated before, European countries will be most impacted by the rise in Chinese consumer demand. The effects will be more evident in tourism and the luxury industry. As a result, the countries more exposed to those sectors, especially the most popular tourist destinations, are expected to suffer from additional price pressures which may delay the path to price stability. We now analyze more in-depth the macroeconomic effects on the four biggest economies in the Eurozone.

Italy is likely to be heavily impacted by China's reopening in 2023. A resumption of economic activity in China could lead to increased demand for Italian exports, particularly in sectors such as luxury goods and machinery, which are among the country's key exports to China. However, Italy could also face some challenges: if China's economy grows rapidly and demand for its products surges, Italian companies could face increased competition from Chinese firms in global markets. Additionally, rising Chinese production could hurt some domestic industries in Italy, such as textiles and fashion, due to cheaper labor costs. Overall, while there are potential opportunities for Italy's economy with China's reopening in 2023, there are also risks and challenges that need to be monitored and managed.

The German economy will react similarly, being a highly export-oriented economy and a major trading partner of China. An increase in economic activity in China could lead to a surge in demand for German exports, especially in sectors such as machinery, automobiles, and chemicals, which are among the country's key exports to China. This would boost Germany's economic growth and job creation in these industries. Germany could also face some challenges from China's reopening. Apart from increased competition in the manufacturing sector, Germany may be negatively impacted by the increase in commodity prices.

We now consider France. In this case, the industry sectors with the highest exposure to China are luxury goods, cosmetics, and aerospace. Again, we expect higher demand for their products, which will result in a growth in output and labor demand, and in turn, increase inflationary pressures. France remains more resilient to commodity price rises than France and Italy, given its lower reliance on fossil fuels.

Finally, we analyze Spain. In this country, the tourism industry will be the most affected. Indeed, Spain – along with Italy – represents the favorite destination of Chinese tourists (in Europe), and, as travel restrictions are scrapped, the number of Chinese citizens willing to travel abroad has increased to over 50%. This is reflected in job market data, which show that the growth in employment in the hospitality sector is helping drive down unemployment figures.

Overall, all these Eurozone countries are likely to be impacted similarly, with some differences depending mostly on the greater or lower contribution of certain sectors to the overall economic activity. All these factors are taken into account to estimate short- to medium-term inflation.

Future Outlook

The European Commission has published its revised economic forecasts in February 2023, which hint at expected growth of almost 1% in the bloc for 2023, while inflation is expected to slow down but remain high, a little more so outside the eurozone. The European Commissioner for Economy Paolo Gentiloni said: "And we have entered 2023 on a firmer footing than anticipated: the risks of recession and gas shortages have faded and unemployment remains at a record low”.

For 2023, inflation was forecast to be 5.6% within the eurozone and 6.3% across the entire EU. Furthermore, the HICP is projected to decrease to 3.4% in 2024 and 2.3% in 2025. This profile for inflation reflects the decline in the annual rates of all main components of inflation to varying degrees, as we see from the chart below.

Figure 4: Eurozone Inflation Projections (Dec 2022) | Source: European Central Bank

Energy inflation is expected to fall sharply in 2023, contributing significantly to the decline of the headline inflation rate from 10% in December 2022 to 3.6% in the last quarter of 2023. It will nevertheless remain an important factor, being significantly above the Central Bank’s inflation target in 2024.

If we look at the short-term inflation outlook, it remains surrounded by high uncertainty. Nevertheless, the expected decline in headline inflation is largely driven by energy base effects, easing pipeline pressures, and aided by government measures.

As we saw, the surge in inflation in 2022 was caused by the large increase in energy and food prices, non-energy industrial goods prices, and service prices. These price increases were reflected in producer prices, coupled with still rather robust demand until the middle of 2022.

Despite the expected settlement in oil prices, electricity, and gas price assumptions imply further initial increases in inflation before contributing to the declines as well.

Food inflation was also particularly high in the last month of 2022, because of continued strong pipeline pressures from the past increases in food commodity prices and other input costs, intensified by the effects of the depreciation of the euro, as well as by increases in wages. Food inflation is expected to start moderating later in 2023 as these cost pressures subside.

Price pressures are expected to be more persistent in services inflation than in non-energy industrial goods inflation.

In addition to that, gas and electricity prices are expected to have a protracted impact on headline inflation owing to the lagged pass-through of wholesale prices in some euro area countries, coupled with fiscal support measures which lower inflation in the short term while adding to its persistence later in the horizon. While the transport fuels component is already expected to make a negative contribution to inflation from the middle of 2023, consumer prices for electricity and gas are expected to continue to make a positive contribution into 2025.

Fiscal measures to compensate for high energy prices and inflation also play an important role in the inflation outlook. They are estimated to have dampened HICP inflation by 1.1 percentage points in 2022 and should again dampen inflation by 0.5 percentage points in 2023. Thereafter, however, the withdrawal of these measures is expected to put significant upward pressure on inflation, amounting to 0.7 percentage points in 2024 and 0.4 percentage points in 2025.

Indeed, fiscal measures in support of the green transition have also a small upward impact on the inflation outlook. They are estimated to contribute around 0.1 percentage points to HICP inflation in each year of the projection horizon.

On the other side, HICP inflation excluding energy and food is projected to moderate as supply bottlenecks and pipeline pressures fade while remaining elevated by historical standards on account of strong wage growth. The expected decline from 4.2% in 2023 to 2.4% in 2025 follows the unwinding of supply bottlenecks and the effects of the reopening of the economy. At the same time, the fact that HICP inflation excluding energy and food stands at 2.4% on average in 2025 reflects lagged impacts from the depreciation of the euro, as well as tight labor markets and inflation compensation effects on wages.

Concerning the fiscal measures adopted for the green transition, in the last months, many gave their opinion on what should be the appropriate response of the EU against the US Inflation Reduction Act (IRA), a significant climate law. It has led to some panic in Europe, due to concerns that the IRA’s incentives for US manufacturing of clean technologies will disadvantage European businesses.

In response, the European Commission has set out its own “Green Deal Industrial Plan” proposing, among other things, a significant relaxation of the EU’s state aid rules when it comes to investment in green technology. Aside from the expected effects of the deal on the EU competition playground, it is interesting to look also at the effects on inflation. There are several theoretical studies analyzing the macroeconomic impact of the green transition, modeled as an increase in carbon taxes.

In this case, we assume that the carbon tax gradually increases over time to capture the salient feature of the green transition, i.e., emissions decrease. This environmental policy exerts two opposite pressures on prices. On one hand, carbon taxes create inflationary pressures by raising firms’ production costs; on the other hand, the expectation of future carbon taxes reduces the consumption of households creating deflationary pressures. Under the assumption of perfect foresight, the second effect dominates, and the carbon tax is deflationary in the short term.

This result hinges on a crucial assumption, i.e., households are perfectly rational and fully believe the government’s environmental plan; if this is not the case – for example, consumers are not rational agents or the government is not credible – they do not factor in the future income fall, and the transition becomes inflationary in the short term.

Conclusion

In conclusion, even though the European Central Bank’s estimate for the short- and medium-term euro inflation rate is positive, there might be some additional uncertainty due to external factors including the reopening of China. Apart from a tightened labor market in the euro area, increased demand for commodities, restoration of tourism, and supply chain factors represent crucial factors that could add a volatility factor to the estimates of inflation, which is a key parameter in the ECB's monetary policy decisions.

If we look at the short-term inflation outlook, it remains surrounded by high uncertainty. Nevertheless, the expected decline in headline inflation is largely driven by energy base effects, easing pipeline pressures, and aided by government measures.

As we saw, the surge in inflation in 2022 was caused by the large increase in energy and food prices, non-energy industrial goods prices, and service prices. These price increases were reflected in producer prices, coupled with still rather robust demand until the middle of 2022.

Despite the expected settlement in oil prices, electricity, and gas price assumptions imply further initial increases in inflation before contributing to the declines as well.

Food inflation was also particularly high in the last month of 2022, because of continued strong pipeline pressures from the past increases in food commodity prices and other input costs, intensified by the effects of the depreciation of the euro, as well as by increases in wages. Food inflation is expected to start moderating later in 2023 as these cost pressures subside.

Price pressures are expected to be more persistent in services inflation than in non-energy industrial goods inflation.

In addition to that, gas and electricity prices are expected to have a protracted impact on headline inflation owing to the lagged pass-through of wholesale prices in some euro area countries, coupled with fiscal support measures which lower inflation in the short term while adding to its persistence later in the horizon. While the transport fuels component is already expected to make a negative contribution to inflation from the middle of 2023, consumer prices for electricity and gas are expected to continue to make a positive contribution into 2025.

Fiscal measures to compensate for high energy prices and inflation also play an important role in the inflation outlook. They are estimated to have dampened HICP inflation by 1.1 percentage points in 2022 and should again dampen inflation by 0.5 percentage points in 2023. Thereafter, however, the withdrawal of these measures is expected to put significant upward pressure on inflation, amounting to 0.7 percentage points in 2024 and 0.4 percentage points in 2025.

Indeed, fiscal measures in support of the green transition have also a small upward impact on the inflation outlook. They are estimated to contribute around 0.1 percentage points to HICP inflation in each year of the projection horizon.

On the other side, HICP inflation excluding energy and food is projected to moderate as supply bottlenecks and pipeline pressures fade while remaining elevated by historical standards on account of strong wage growth. The expected decline from 4.2% in 2023 to 2.4% in 2025 follows the unwinding of supply bottlenecks and the effects of the reopening of the economy. At the same time, the fact that HICP inflation excluding energy and food stands at 2.4% on average in 2025 reflects lagged impacts from the depreciation of the euro, as well as tight labor markets and inflation compensation effects on wages.

Concerning the fiscal measures adopted for the green transition, in the last months, many gave their opinion on what should be the appropriate response of the EU against the US Inflation Reduction Act (IRA), a significant climate law. It has led to some panic in Europe, due to concerns that the IRA’s incentives for US manufacturing of clean technologies will disadvantage European businesses.

In response, the European Commission has set out its own “Green Deal Industrial Plan” proposing, among other things, a significant relaxation of the EU’s state aid rules when it comes to investment in green technology. Aside from the expected effects of the deal on the EU competition playground, it is interesting to look also at the effects on inflation. There are several theoretical studies analyzing the macroeconomic impact of the green transition, modeled as an increase in carbon taxes.

In this case, we assume that the carbon tax gradually increases over time to capture the salient feature of the green transition, i.e., emissions decrease. This environmental policy exerts two opposite pressures on prices. On one hand, carbon taxes create inflationary pressures by raising firms’ production costs; on the other hand, the expectation of future carbon taxes reduces the consumption of households creating deflationary pressures. Under the assumption of perfect foresight, the second effect dominates, and the carbon tax is deflationary in the short term.

This result hinges on a crucial assumption, i.e., households are perfectly rational and fully believe the government’s environmental plan; if this is not the case – for example, consumers are not rational agents or the government is not credible – they do not factor in the future income fall, and the transition becomes inflationary in the short term.

Conclusion

In conclusion, even though the European Central Bank’s estimate for the short- and medium-term euro inflation rate is positive, there might be some additional uncertainty due to external factors including the reopening of China. Apart from a tightened labor market in the euro area, increased demand for commodities, restoration of tourism, and supply chain factors represent crucial factors that could add a volatility factor to the estimates of inflation, which is a key parameter in the ECB's monetary policy decisions.

Written by Giorgio Gusella, Polina Mednikova, Matilde Oliana, and Laurian David Pop

Sources

- Bloomberg

- DW

- Euractiv

- European Central Bank

- Eurostat

- Financial Times

- International Monetary Fund

- Reuters

- Swiss Re Institute

- Wall Street Journal