In early October, oil and gas giant ExxonMobil announced its acquisition of Pioneer Natural Resources in a $59.5bn all-stock deal. This forms part of Exxon’s inorganic growth strategy, with companies in the US oil sector seeking to consolidate amid geopolitical tensions and upward pressure on global oil prices. This article looks at the current context of the global oil market and forms an analysis of the deal’s rationale and implications.

Introduction to the oil market: context analysis

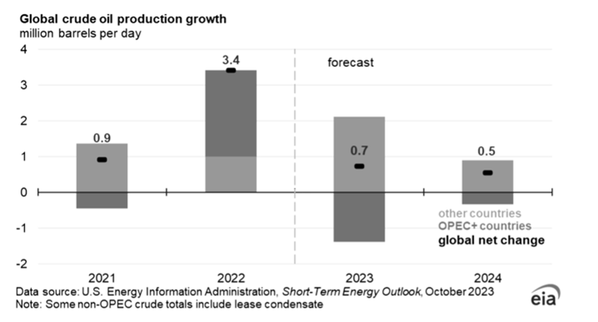

In a recent move, Riyadh has extended its oil production cuts until December, holding back 1 million barrels per day. This decision coupled with additional cuts from the OPEC+, which were initially set to expire in the summer, now extend through the end of the year. Saudi Arabia's strategic aim is clear: to push oil prices beyond $100 per barrel level. This ambition is grounded in funding their extensive investment projects, acknowledging that oil continues to be a crucial revenue stream for the Kingdom. This deliberate reduction in oil production carries significant implications. OPEC+ is currently struggling to meet its agreed-upon production levels, falling short by roughly 3.3 million barrels per day. This shortfall has the potential to disrupt global supplies, prompting concerns about a potential inflationary wave particularly in vulnerable countries, namely Europe.

Global crude oil production growth. Source: EIA

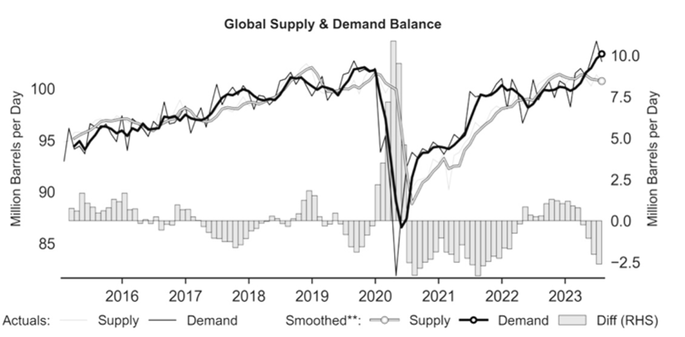

Additionally, the strong backwardation observed in the oil market, influenced by supply and demand factors and escalating geopolitical tensions, raises concerns about the continuation of an upward trend in 2024. Global demand is reaching record highs and is set to expand further. On the other side, OPEC+ production cuts are set to keep oil supply tight and globally recorded oil inventories fell by 17.3 million barrels and preliminary data indicates a further draw this summer. Such a scenario could mirror the oil shocks of the late 1970s, when the world grappled with surging oil prices and the subsequent wave of inflation.

Global Supply & Demand balance of Oil. Source: World Bank

Further complicating the global oil landscape, Russia has made a significant and worrying move by restricting the export of diesel and petrol as crude oil prices steadily climb towards the $100 per barrel threshold. This action raises disturbing questions about Moscow's intentions and whether it intends to weaponize its oil supplies as a response to Western sanctions. Moscow blamed local shortages when it imposed the ban on diesel and gasoline exports last month, after cutting the amount of subsidies it provides to Russian oil companies for selling cut-price fuel domestically. The ban was perceived by traders as a warning shot to Russia’s oil companies to make sure domestic prices do not rise too much, with Putin facing his own election next year. The Kremlin had described the ban as “temporary” when it was introduced but gave no timeframe for when the measures would end.

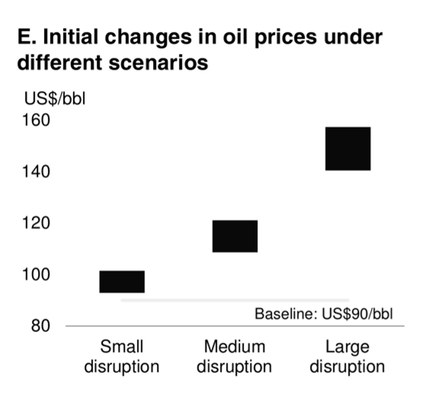

In its recent commodity market outlook, the World Bank presented three scenarios for global oil supply disruptions due to conflicts in the Middle East and their potential effects. In the case of a "small disruption," where the conflict remains limited, oil prices are expected to decrease from the current level of approximately $90 per barrel to an average of $81 per barrel next year, as estimated by the World Bank. However, in a "medium disruption" scenario, similar to the disruptions experienced during the Iraq war, the global oil supply of about 100 million barrels per day could decrease by 3 to 5 million barrels per day, potentially leading to a 35% increase in oil prices.

In a "large disruption" scenario, comparable to the Arab oil embargo of 1973, the global oil supply could contract by 6 to 8 million barrels per day, resulting in a price increase of 56% to 75%, reaching $140 to $157 per barrel, according to the report. The ongoing conflict in Ukraine has already had disruptive effects on the global economy, and an escalation could create a dual energy shock, affecting both Ukraine and the Middle East. This could impact not only energy markets but also food prices, intensifying food insecurity, particularly in developing countries.

In its recent commodity market outlook, the World Bank presented three scenarios for global oil supply disruptions due to conflicts in the Middle East and their potential effects. In the case of a "small disruption," where the conflict remains limited, oil prices are expected to decrease from the current level of approximately $90 per barrel to an average of $81 per barrel next year, as estimated by the World Bank. However, in a "medium disruption" scenario, similar to the disruptions experienced during the Iraq war, the global oil supply of about 100 million barrels per day could decrease by 3 to 5 million barrels per day, potentially leading to a 35% increase in oil prices.

In a "large disruption" scenario, comparable to the Arab oil embargo of 1973, the global oil supply could contract by 6 to 8 million barrels per day, resulting in a price increase of 56% to 75%, reaching $140 to $157 per barrel, according to the report. The ongoing conflict in Ukraine has already had disruptive effects on the global economy, and an escalation could create a dual energy shock, affecting both Ukraine and the Middle East. This could impact not only energy markets but also food prices, intensifying food insecurity, particularly in developing countries.

Changes in oil prices under different scenarios. Source: World Bank

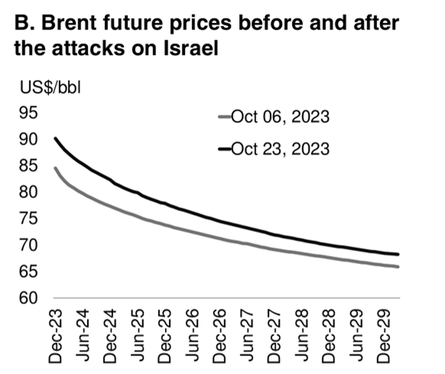

Brent Oil future prices before and after the attacks on Israel. Source: World Bank

While the consensus among analysts suggests that the United States may not face severe oil shortages due to its substantial oil production, the situation remains uncertain. Treasury Secretary Janet Yellen has affirmed that the Biden administration is carefully tracking the economic repercussions of conflicts, recognizing that the potential expansion of these conflicts could have more pronounced global implications. Finally, the surge in oil prices presents a new challenge to central banks. Their capacity to control inflation is being scrutinized, as heightened fuel expenses have the potential to impede economic growth. The delicate balance between promoting economic expansion and reining in inflation is becoming increasingly precarious, placing central banks in a sensitive position.

Evolution of the oil market and the big oil industry

A big debate revolves around the future of oil companies and how they will react to the changes in the energy sector. This is not the first time in history that we witness a consolidation of oil companies. A notable instance of such consolidation occurred in the late 1990s when industry giants such as Exxon, Shell, BP, and TotalEnergies in France joined forces with their rivals, resulting in the formation of colossal integrated corporations. The acquisitions followed a collapse in oil prices that weakened many companies.

Today, the majors are sitting on piles of cash after a surge in energy prices linked to the Ukraine war pushed profits to record highs last year. The phenomenon we have seen is the energy sector in the last couple of years is what Goldman Sachs analysts called “the revenge of the old economy”. Because of the focus on ESG and green energy, certain sectors like solar and wind have been profoundly overinvested and overbuilt to a point that you run power prices negative in certain situations. It is areas like oil, gas and mining that have been severely underinvested. We used to spend around 2 trillion dollars globally per annum on the energy sector, whereas in the last couple of years it was just over 1 trillion per annum. This underinvestment, combined with a lack of diversification, has shown many weaknesses in the energy sector in the last couple of years. For these reasons, it makes sense for investments through consolidation and new explorations to take place in the oil sector.

Exxon’s Pioneer acquisition suggests that U.S. companies are looking to buy the best acreage, rather than grow at any cost, Amrita Sen, founder and director of research of Energy Aspects, told BNN Bloomberg on Wednesday. “You are seeing a far more kind of concerted growth, better quality acreage only being exploited rather then any random piece of land being drilled,” she said in a television interview. “I think that is really here to stay.” This approach will result is slower production growth from U.S. shale producers, Sen explained. “Shale production growth, or U.S. production growth, is going to be slower and it’s going to be more sustainable,” she said.

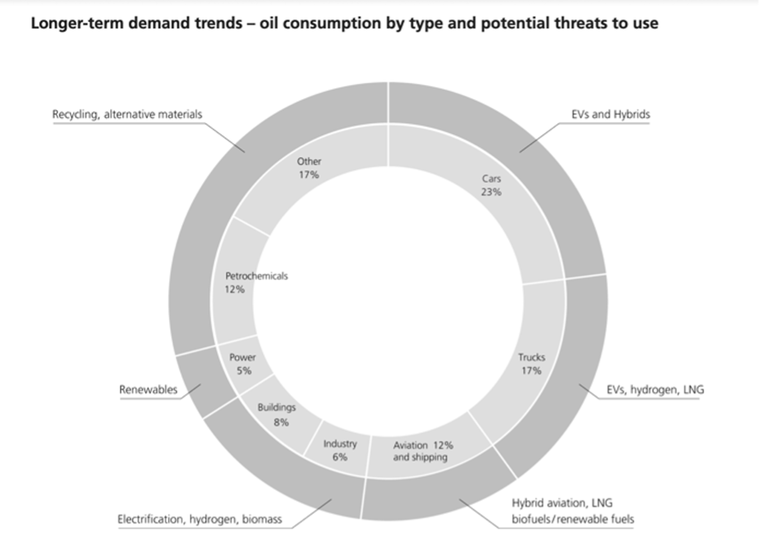

Long-term oil demand trends by type and potential threats to use. Source: UBS

Something that became clear in recent years is that oil and gas use is not going away completely. There are pockets of demand that will be difficult to abate. There could easily be up to gross 10 gigatons of CO2 still being emitted in 2050, even in the IEA’s Sustainable Development Scenario. To address this, green hydrogen for combustion, and carbon capture, utilization and storage (CCUS) for offsetting emissions, will be critical to achieving the Paris goals. Large-scale industrial projects involving significant capital costs, the blending of engineering, manufacturing and distribution, chemistry and, in the case of CCUS, sub surface geological disciplines are all highly familiar to Big Oil firms. These companies have been around for much of the industry’s history: ExxonMobil and Chevron originated as Standard Oil, founded in 1870, and Royal Dutch Shell was founded in 1907. During these centuries the oil market has evolved and so has the industry with its constituents. This process of change will continue and will become even more crucial as we progress with the transition to clean energy. It will be interesting to see if Big Oil companies will attempt to diversify and slowly move away from petrol and gas, or whether they will slowly decrease in size in order to fulfill a pocket of demand that is destined to shrink.

Deal structure

ExxonMobil is an American multinational oil and gas company headquartered in Houston, Texas that had a net income of $55.7bn in 2022. Pioneer Natural Resources is a smaller oil and gas exploration and production company headquartered in Irving, Texas that had 2022 net income of $7.8bn. Pioneer operates in the Permian Basin, the largest-producing oil field in the US, located in the South-West of the country across Texas and New Mexico.

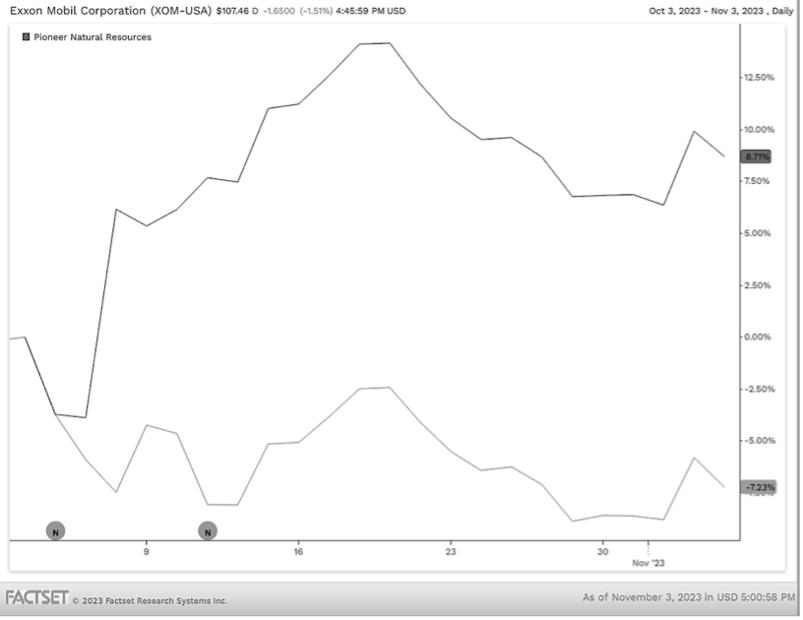

Big blow from Exxon Mobil buying shale giant Pioneer Natural Resources in a stock deal valued at $60bn – a move that will tie the energy giant's future to fossil fuels and is expected to kick off a wave of consolidation in the oil sector. It is its largest buyout since the acquisition of Mobil two decades ago for $75bn in December 1998. The value of the transaction, including debt, is about $65bn. The consideration represents a premium of about 18% over Pioneer's undisturbed closing price on the 5th of October, before rumors began circulating in the U.S. media, and a premium of 9% over its average price for the previous 30 days. On Wednesday, October 11, when Exxon Mobil announced a definitive agreement to acquire Pioneer, Pioneer's shares rose more than 1% while Exxon's shares fell less than 4%.

Exxon Mobil stock price – Pioneer stock price. Source: FactSet

Citi and Centerview Partners acted as financial advisors to Exxon Mobil and Davis Polk & Wardwell acted as legal advisor to ExxonMobil. Goldman Sachs, Morgan Stanley, Petrie Partners and Bank of America Securities acted as financial advisors to Pioneer; Gibson, Dunn & Crutcher LLP acted as legal advisor to Pioneer. The boards of directors of both companies unanimously approved the transaction, which is still subject to regulatory reviews and approvals. The approval of Pioneer's shareholders is also pending. The transaction is expected to close in the first half of 2024.

Exxon, valued at $442bn, has put up $253 per share for the shale producer based in Irving, Texas. This means that the price of $60.27bn is based on the exchange of 2.32 Exxon shares for each Pioneer share, valued at Exxon's pre-day share price of $110.45. The buyer has estimated that foregoing just over one-tenth of its outstanding shares is worth it. This allows the company to collect a portion of the Permian's real estate assets, related cash flows and estimated annual synergies.

Exxon, valued at $442bn, has put up $253 per share for the shale producer based in Irving, Texas. This means that the price of $60.27bn is based on the exchange of 2.32 Exxon shares for each Pioneer share, valued at Exxon's pre-day share price of $110.45. The buyer has estimated that foregoing just over one-tenth of its outstanding shares is worth it. This allows the company to collect a portion of the Permian's real estate assets, related cash flows and estimated annual synergies.

Deal rationale

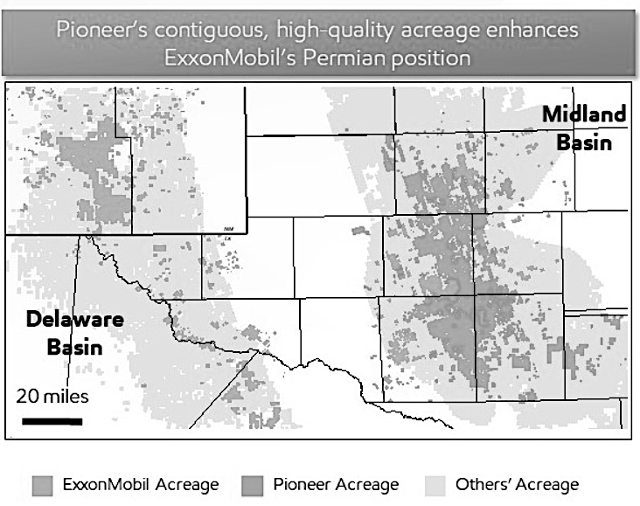

The merger between ExxonMobil and Pioneer is expected to be immediately accretive and to have a strong medium-to-long-term positive impact on ExxonMobil's earnings per share and free cash flow, with a long cash flow transition period.The transaction will combine Pioneer's 850,000 net acres in the Midland Basin with Exxon's 570,000 net acres in the Delaware and Midland basins, creating the leading location of high-quality undeveloped inventory in the United States.

As a result of the deal, according to JPMorgan Chase, about 45% of Exxon's barrels will come from the United States. The companies will have a total of 16bn barrels of oil equivalent in the Permian Basin. At closing, ExxonMobil's Permian production volume is expected to more than double to 1.3mln barrels of oil equivalent per day (MOEBD), based on 2023 volumes, and is expected to increase to about 2 MOEBD in 2027.

In addition, ExxonMobil believes that the merger grants the opportunity to further increase U.S. energy security as it brings the best technologies, operational excellence, environmental best practices, and financial capability to a major national supply source, benefiting the U.S. economy and its consumers. According to ExxonMobil's CEO Darren Woods, the combined capabilities of the two companies will enable greater long-term value creation than the two companies would have achieved independently. Similarly, Pioneer CEO Scott Sheffield gave his opinion and stated that the acquisition will create a diversified energy company with a long-term success due to a size and scale that spans the globe and offers product diversity and exposure to the full energy value chain. Among the other achievable benefits, the combination will ensure higher production at low supply cost (supply cost is expected to be less than $35 per barrel for Pioneer's operations) and short-term capital flexibility. By 2027, short-cycle barrels will account for more than 40% of total upstream volumes, allowing the company to react more quickly to changes in demand and capture more of the increase in prices and volumes. Finally, there will be an acceleration toward net zero in the Permian. Indeed, ExxonMobil has an industry-leading plan to achieve zero greenhouse gas emissions from its unconventional operations in the Permian by 2030 and it aims to leverage its plans to reduce greenhouse gas emissions in the Permian, accelerating Pioneer's net zero emissions plan by 15 years to 2035 (rather than 2050). Therefore, when considering the synergies and benefits of the transaction, it can be said that this merger represents a unique opportunity to create the largest oil and natural gas producer in the Permian Basin, accounting for more than 40% of U.S. oil production.

Following ExxonMobil’s acquisition, competitor Chevron displayed similar intentions with its $53bn acquisition of Hess, resulting in a projected increase of its shale oil production by 40%. As a result, ExxonMobil and Chevron’s projected shale oil production after their respective deals reaches similar levels and highlights potential competition between the two dominant players in the US market. Interestingly, the expansion strategies employed by US oil producers run contrary to that of their European counterparts, such as Shell and BP, who have been reducing oil production in recent years amid the transition to renewable energy and EU legislation.

In addition, ExxonMobil believes that the merger grants the opportunity to further increase U.S. energy security as it brings the best technologies, operational excellence, environmental best practices, and financial capability to a major national supply source, benefiting the U.S. economy and its consumers. According to ExxonMobil's CEO Darren Woods, the combined capabilities of the two companies will enable greater long-term value creation than the two companies would have achieved independently. Similarly, Pioneer CEO Scott Sheffield gave his opinion and stated that the acquisition will create a diversified energy company with a long-term success due to a size and scale that spans the globe and offers product diversity and exposure to the full energy value chain. Among the other achievable benefits, the combination will ensure higher production at low supply cost (supply cost is expected to be less than $35 per barrel for Pioneer's operations) and short-term capital flexibility. By 2027, short-cycle barrels will account for more than 40% of total upstream volumes, allowing the company to react more quickly to changes in demand and capture more of the increase in prices and volumes. Finally, there will be an acceleration toward net zero in the Permian. Indeed, ExxonMobil has an industry-leading plan to achieve zero greenhouse gas emissions from its unconventional operations in the Permian by 2030 and it aims to leverage its plans to reduce greenhouse gas emissions in the Permian, accelerating Pioneer's net zero emissions plan by 15 years to 2035 (rather than 2050). Therefore, when considering the synergies and benefits of the transaction, it can be said that this merger represents a unique opportunity to create the largest oil and natural gas producer in the Permian Basin, accounting for more than 40% of U.S. oil production.

Following ExxonMobil’s acquisition, competitor Chevron displayed similar intentions with its $53bn acquisition of Hess, resulting in a projected increase of its shale oil production by 40%. As a result, ExxonMobil and Chevron’s projected shale oil production after their respective deals reaches similar levels and highlights potential competition between the two dominant players in the US market. Interestingly, the expansion strategies employed by US oil producers run contrary to that of their European counterparts, such as Shell and BP, who have been reducing oil production in recent years amid the transition to renewable energy and EU legislation.

Conclusion

ExxonMobil’s acquisition of Pioneer Natural Resources represents a significant expansion attempt amid the wave of consolidation in the US oil industry. With the potential synergies, positive projections for EPS and cashflows and the outlook of the oil market, the deal seems promising for ExxonMobil. Nevertheless, the company must balance its commitments to reducing greenhouse gas emissions and carefully assess the state of the renewable energy transition for the deal to be a success.

By Anna Rosaria Manni, Giorgio Gusella, Enrico Dametto, Neil Pinto

SOURCES:

- Financial Times

- Bloomberg

- ExxonMobil

- Reuters

- UBS

- World Bank

- EIA

- FactSet

- New York Times

- Wall Street Journal

- Morningstar