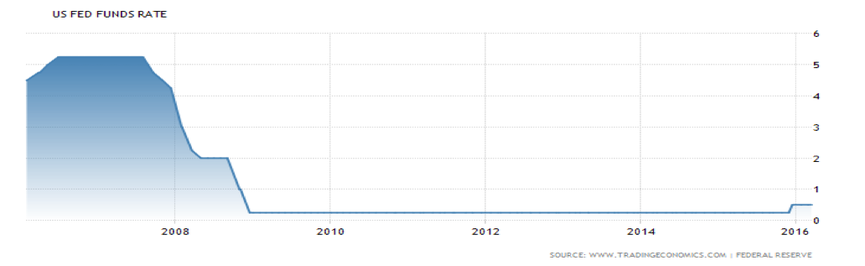

Nowadays short-term interest rates are very low. Undoubtedly, it is a positive stimulus for the economy as long as borrowers would take advantage of it. Emerging markets too, which retain a huge proportion of debt in dollars, benefit from a weaker currency of the dollar. US economy is gradually recovering and many indicators provides reassuring data. The US unemployment rate rose up slightly, only because participation rate increased. Crude oil is cheaper than it was in January. Manufacturing sectors in China and US eventually expanded again, “returning healthy” to their previous levels. Indeed, these are all positive signs but the fear of recession is still in the air.

However, interest rates cannot remain at this record low level forever. Therefore, they will increase without any doubt. When will the hike take place? Fed policymakers are now debating about this controversial issue animatedly. John Williams (San Francisco Fed) and Dennis Lockhart (Atlanta Fed) stated, “a move should be on the table” as soon as possible. Loretta Mester (Cleveland Fed) declared that the US economy has proven to be enough “resilient” and able to hold the burden of small “gradual” increases. In addition, inflation expectations, which are always a big concern for investors, will boil down. It seems that US is now ready. What are we waiting for?

However, interest rates cannot remain at this record low level forever. Therefore, they will increase without any doubt. When will the hike take place? Fed policymakers are now debating about this controversial issue animatedly. John Williams (San Francisco Fed) and Dennis Lockhart (Atlanta Fed) stated, “a move should be on the table” as soon as possible. Loretta Mester (Cleveland Fed) declared that the US economy has proven to be enough “resilient” and able to hold the burden of small “gradual” increases. In addition, inflation expectations, which are always a big concern for investors, will boil down. It seems that US is now ready. What are we waiting for?

In contrast, there many who still question about the efficacy of the manoeuvre. Actually, US is an open economy and it should care also about the rest of world. We should not forget that a hike is very likely to lead to an appreciation in the dollar, which is very likely to drag on net exports. Emerging economies account for 38 per cent of global gross domestic product. It is not an unreasonable fear given the weak growth rates overseas and Eurozone. You cannot deteriorate your major trading partners if you want to flourish. As we learn from the past, global financial conditions must be taken into account.

To sum up there is no hurry to lift rates. Janet Yellen, Fed chair, stressed the importance of patience. She will “proceed cautiously” and it is better to be “prudent to wait for additional information”. There is no need to rush ahead. Furthermore, the spectrum of Brexit is slowly approaching and it does not sound that good to markets.

Those who say that rising rates would “benefit elderly Americans on fixed incomes”(MacEachin) and “banks may have a greater incentive to loan out reserves at higher rates”(Snaith), which are rather questionable opinions, have to wait until the next Fed meeting in June. The hazards of over-tightening policy outweigh the advantages of a too-loosening one.

Nicola Maria Fiore