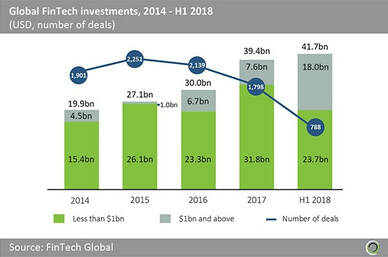

The FinTech industry has been surely one of the most dynamic industries last year with huge investments in start-ups on record reaching a total value of $41.7 BN. Only in 2018, this industry faced a total of 349 M&A transactions and this trend does not seem to end soon. FinTech start-ups offer technology which can revolutionize how companies operate and how people interact with their bank. This business is fundamentally changing how financial services work.

The merger that we will analyze in this article confirms how big digital payments companies are now.

The merger that we will analyze in this article confirms how big digital payments companies are now.

A Deal to confirm the global leadership at scale

Fidelity National Information Services, or FIS is a financial technology leader firm that provides services to clients in the retail and institutional banking, payments, capital markets, asset management and wealth and retirement markets. It serves clients in more than 130 countries and employs more than 47000 people. To respond to its rival Fiserv who bought First Data for 22BN in 2018, or FIS, decided to acquire WorldPay in a $43 billion deal. With this acquisition, the fintech giant will reduce the threaten of growing competition and expand its market presence confirming its leading position in the industry.

WorldPay concentrates its strength on innovations and makes technology that underpins credit card and other transactions for e-commerce users. It serves around 40 billion transactions a year and this deal will expand their presence into new markets.

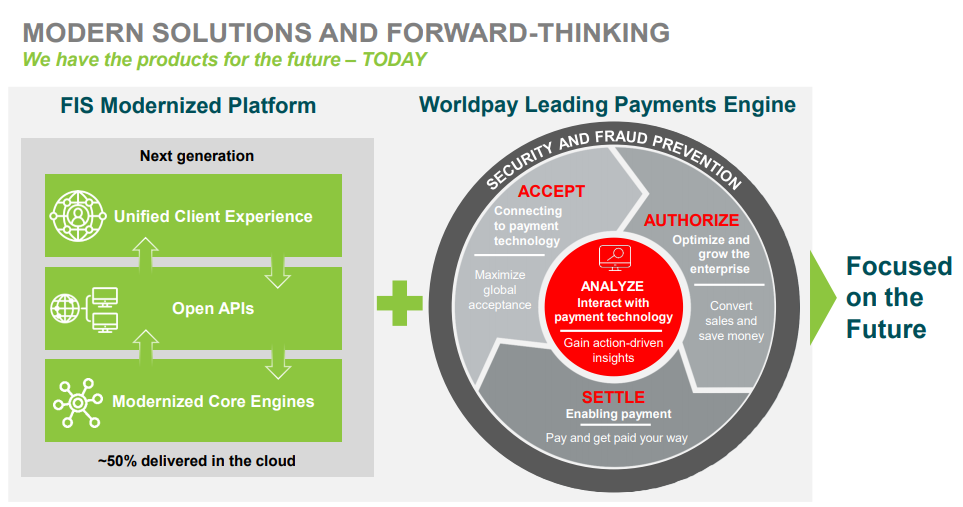

The two companies have clear goals aiming to create a “one-stop shop”, providing an improved financial technology solution to merchants and banks and capitalizing on the growing e-commerce payments industry. The global E-commerce payments industry is expecting to be a $3 trillion market within the next five years.

FIS CEO Gary Norcross stressed in the importance of scale in this rapidly changing industry and announced the goal of bringing “the most modern solutions targeted at the highest growth markets.”

Fidelity National Information Services, or FIS is a financial technology leader firm that provides services to clients in the retail and institutional banking, payments, capital markets, asset management and wealth and retirement markets. It serves clients in more than 130 countries and employs more than 47000 people. To respond to its rival Fiserv who bought First Data for 22BN in 2018, or FIS, decided to acquire WorldPay in a $43 billion deal. With this acquisition, the fintech giant will reduce the threaten of growing competition and expand its market presence confirming its leading position in the industry.

WorldPay concentrates its strength on innovations and makes technology that underpins credit card and other transactions for e-commerce users. It serves around 40 billion transactions a year and this deal will expand their presence into new markets.

The two companies have clear goals aiming to create a “one-stop shop”, providing an improved financial technology solution to merchants and banks and capitalizing on the growing e-commerce payments industry. The global E-commerce payments industry is expecting to be a $3 trillion market within the next five years.

FIS CEO Gary Norcross stressed in the importance of scale in this rapidly changing industry and announced the goal of bringing “the most modern solutions targeted at the highest growth markets.”

Transaction Terms

Worldpay shareholders are offered with a mix of cash and stock to approve the deal. Under the terms of the deal, Worldpay shareholders will get 0.9287 FIS shares and $11.00 in cash for each share of Worldpay.

FIS will assume Worldpay’s debt as part of the agreement that will ultimately lead to a $43 billion valuation of the company. As a result, FIS shareholders will hold 53% of the newly merged company while the rest of the shares (47%) will be owned by Worldpay shareholders.

Gary Norcross will remain in his position of CEO while WorldPay’s CEO Mr. Drucker will be the executive vice-chairman in a new 12-member board (7 from the board of FIS and 5 from the board of Worldpay). The transaction is expected to close during the second half of 2019 and will be subject to customary closing conditions including regulatory and shareholder approvals.

Riccardo Celani

Worldpay shareholders are offered with a mix of cash and stock to approve the deal. Under the terms of the deal, Worldpay shareholders will get 0.9287 FIS shares and $11.00 in cash for each share of Worldpay.

FIS will assume Worldpay’s debt as part of the agreement that will ultimately lead to a $43 billion valuation of the company. As a result, FIS shareholders will hold 53% of the newly merged company while the rest of the shares (47%) will be owned by Worldpay shareholders.

Gary Norcross will remain in his position of CEO while WorldPay’s CEO Mr. Drucker will be the executive vice-chairman in a new 12-member board (7 from the board of FIS and 5 from the board of Worldpay). The transaction is expected to close during the second half of 2019 and will be subject to customary closing conditions including regulatory and shareholder approvals.

Riccardo Celani