Planning the economy is a crucial aspect of Chinese Socialism and every five years the Communist Party’s Central Committee drafts the economic guidelines for the country. Last October, the Communist Party announced the topics that will be discussed for the fourteenth 5-year plan (2021-2025): great attention will be given to new technologies and green energy. In this article, we first analyze why 5-year plans are a fundamental element of the Chinese economy. Then, we focus on the fourteenth 5-year plan from a market perspective.

Economic Planning: the hidden driver behind China’s growth?

China is a country with $14.4 trillion in GDP (2019) and a population of 1.4 billion people. These characteristics make this economy unique. With such a large population, policymakers need to coordinate economic agents in some ways, otherwise the risk would be to have some serious economic and social unbalances. This risk is particularly concrete if an economy has grown very fast in a very short period of time. Let’s see why this is the case for China.

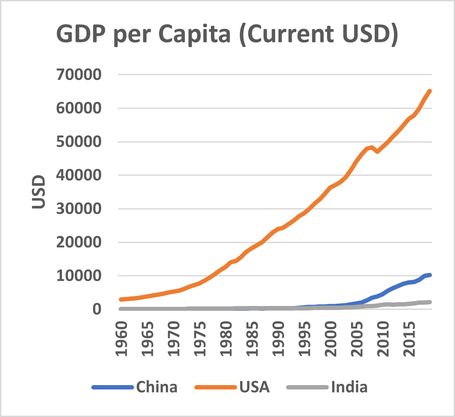

China, despite being the second-largest world economy (the first one in terms of GDP adjusted for purchasing power), is still classified as a developing economy. The reason is that the main indicator to distinguish between developing and developed economies is GDP per capita. Given its immensely large population, China’s GDP per capita is relatively small, only $10.261 in 2019, compared to $65.118 for the US. Nevertheless, the status of developing economy turned out to be particularly useful during the globalization wave of the early 2000s. In fact, the Chinese economy is undoubtedly the winner of this globalization wave, as proved by the explosion of its GDP per Capita in relative terms: nowadays, a young Chinese enjoys a GDP per Capita 114 times higher than the one of his grandparents in the 1960s. To put this number into context, the cumulative growth rates for the US and India are “only” 2165% and 2560% respectively.

China is a country with $14.4 trillion in GDP (2019) and a population of 1.4 billion people. These characteristics make this economy unique. With such a large population, policymakers need to coordinate economic agents in some ways, otherwise the risk would be to have some serious economic and social unbalances. This risk is particularly concrete if an economy has grown very fast in a very short period of time. Let’s see why this is the case for China.

China, despite being the second-largest world economy (the first one in terms of GDP adjusted for purchasing power), is still classified as a developing economy. The reason is that the main indicator to distinguish between developing and developed economies is GDP per capita. Given its immensely large population, China’s GDP per capita is relatively small, only $10.261 in 2019, compared to $65.118 for the US. Nevertheless, the status of developing economy turned out to be particularly useful during the globalization wave of the early 2000s. In fact, the Chinese economy is undoubtedly the winner of this globalization wave, as proved by the explosion of its GDP per Capita in relative terms: nowadays, a young Chinese enjoys a GDP per Capita 114 times higher than the one of his grandparents in the 1960s. To put this number into context, the cumulative growth rates for the US and India are “only” 2165% and 2560% respectively.

GDP per Capita and its Cumulative Growth Rate for China, India and USA. Source: World Bank

It is interesting to notice how the Chinese GDP per capita really picked up at the beginning of the 2000s. In fact, it grew from $89.52 to $959.37 in the period 1960-2000, corresponding to an average 23.63% annual growth rate, a figure in line with a fast-growing developing economy of relatively small size (China GDP was $1.211 trillion in 2000). However, from 2000 onwards China experienced an astonishing economic growth: GDP per capita grew from $959.37 to $10,261 in only 20 years, meaning that the current generation enjoys lives in an economic system that is 10 times larger than the ones of their parents. Economists agree that the key moment for this economic success was a Tuesday of 18 years ago: Indeed, on 11 December 2001 China entered the WTO, de facto changing the course of modern history.

China’s incredible economic miracle comes with some challenges. First, despite the incredible growth in GDP per capita, poverty is still widespread in China: the country’s GDP per capita is still very low compared to high-income countries (approximately one quarter) and more than 350 million people live below the upper-middle-income poverty line of US$5.50 a day. Second, poverty comes together with inequality. The most measure for income inequality is the Gini coefficient: taking values between 0 and 100, the higher the value of the index, the higher the dispersion of the variable (in this case, income). According to the United Nations, a Gini coefficient above 40 is a warning sign. China is one of the most unequal countries in the world, with a Gini coefficient ranging between 46 and 49 over the last ten years (46.5 in 2019). An IMF paper (Inequality in China – Trends, Drivers and Policy Remedies) suggests that the Gini Index for China has been rising since the 1980s, with only a partial leveling off from 2008 onwards. However, this last reduction in the Gini coefficient was due to an increase of the middle class at the expenses of the top 20% in terms of income, and not to a rise of the bottom percentiles. An IMF study shows how the top 10 percentile increased its portion of income share from 26% in 1980 to 41.7% in 2008.

So, China grew extremely fast, and so did inequality. However, how is possible that 1.4 billion people experienced such rapid economic growth in such a short period of time? The answer probably relies on two words: coordination and planning. In fact, China is not a mixed economy (e.g. the US), but it is defined as mixed socialist market economy, or, as defined during the 12th National Congress of the Communist Party of China of 1982, Socialism with Chinese characteristics. In this economic environment, the Chinese government plays a fundamental role in the economy, both in terms of state-owned enterprises (they produced 40% of the GDP in 2019) and in terms of planning.

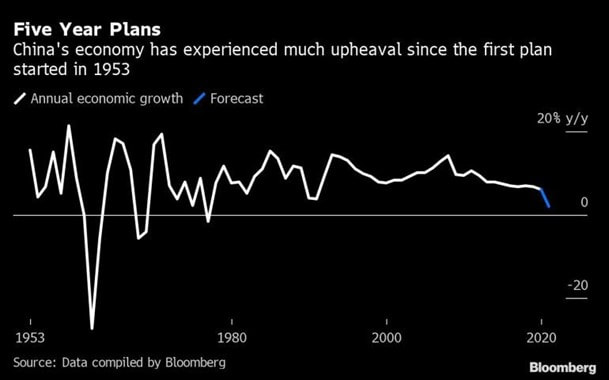

Planning the economy is a crucial aspect of Chinese Socialism. The economic development of the country is decided by the central government every five years. Indeed, every five years the Communist Party’s Central Committee draft the economic guidelines for the next five years. The first 5-year plan dates back to 1953 and focused on developing industrial production in an underdeveloped China. The latest plans have broadened the scope of action also to other industries. For instance, the 2016-2020 plan included Made In China 2025, a strategic plan aimed at the further development of the manufacturing sector. Last month, the Communist Party announced the topics that will be discussed for the fourteenth plan (2021-2025). With this plan, China aims at becoming a "moderately developed" economy by 2035 (per capita GDP above $30,000), nearly three times the current level. Other two important topics are technological development and the transition to green energy. In the following sections of the article, we will analyze these two aspects of the 2021-2025 Chinese 5-year Plan. We will also give an overview of how the different asset classes related to these sectors have performed in the recent past.

2021-2025 Chinese 5-year Plan: Energy Transition

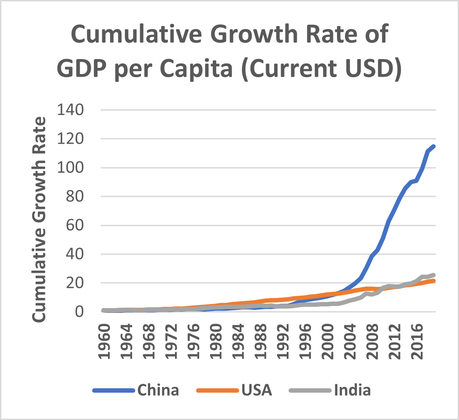

Analysts and experts speculated that one of the chief topics in the plan is energy transition. As stated in the official communique released after the fifth plenum of the Chinese Communist Party (CCP)’s 19th Central Committee, “the plenary session proposed to promote green development and the harmonious coexistence of man and nature [...] accelerate the promotion of green and low-carbon development, continue to improve environmental quality, enhance the quality and stability of the ecosystem, and comprehensively improve resource utilization efficiency”. As the world’s top coal consumer, China is foreseen to curb its fossil fuel use and boost green energy to accomplish its goal of reaching a peak in carbon emissions in 2030 and carbon neutrality by 2060, according to experts, requiring China to bring the share of coal in its total energy mix from 58% last year to less than 50% by 2025. Consultancy Wood Mackenzie said that for China to reach its goal, solar, wind and storage capacities must increase eleven-fold to 5,040 gigawatts (GW) by 2050 compared with 2020 levels. Overall, China’s expected efforts to transition to clean energies, are foreseen to boost the green sector, which especially in the past six months, has been outperforming overall China and global markets, as tracked by Solactive China Clean Index NTR (an equity index achieving more than 70% return from its April lows), a spectacular result, indicating strong expectations and investments in the sector.

China’s incredible economic miracle comes with some challenges. First, despite the incredible growth in GDP per capita, poverty is still widespread in China: the country’s GDP per capita is still very low compared to high-income countries (approximately one quarter) and more than 350 million people live below the upper-middle-income poverty line of US$5.50 a day. Second, poverty comes together with inequality. The most measure for income inequality is the Gini coefficient: taking values between 0 and 100, the higher the value of the index, the higher the dispersion of the variable (in this case, income). According to the United Nations, a Gini coefficient above 40 is a warning sign. China is one of the most unequal countries in the world, with a Gini coefficient ranging between 46 and 49 over the last ten years (46.5 in 2019). An IMF paper (Inequality in China – Trends, Drivers and Policy Remedies) suggests that the Gini Index for China has been rising since the 1980s, with only a partial leveling off from 2008 onwards. However, this last reduction in the Gini coefficient was due to an increase of the middle class at the expenses of the top 20% in terms of income, and not to a rise of the bottom percentiles. An IMF study shows how the top 10 percentile increased its portion of income share from 26% in 1980 to 41.7% in 2008.

So, China grew extremely fast, and so did inequality. However, how is possible that 1.4 billion people experienced such rapid economic growth in such a short period of time? The answer probably relies on two words: coordination and planning. In fact, China is not a mixed economy (e.g. the US), but it is defined as mixed socialist market economy, or, as defined during the 12th National Congress of the Communist Party of China of 1982, Socialism with Chinese characteristics. In this economic environment, the Chinese government plays a fundamental role in the economy, both in terms of state-owned enterprises (they produced 40% of the GDP in 2019) and in terms of planning.

Planning the economy is a crucial aspect of Chinese Socialism. The economic development of the country is decided by the central government every five years. Indeed, every five years the Communist Party’s Central Committee draft the economic guidelines for the next five years. The first 5-year plan dates back to 1953 and focused on developing industrial production in an underdeveloped China. The latest plans have broadened the scope of action also to other industries. For instance, the 2016-2020 plan included Made In China 2025, a strategic plan aimed at the further development of the manufacturing sector. Last month, the Communist Party announced the topics that will be discussed for the fourteenth plan (2021-2025). With this plan, China aims at becoming a "moderately developed" economy by 2035 (per capita GDP above $30,000), nearly three times the current level. Other two important topics are technological development and the transition to green energy. In the following sections of the article, we will analyze these two aspects of the 2021-2025 Chinese 5-year Plan. We will also give an overview of how the different asset classes related to these sectors have performed in the recent past.

2021-2025 Chinese 5-year Plan: Energy Transition

Analysts and experts speculated that one of the chief topics in the plan is energy transition. As stated in the official communique released after the fifth plenum of the Chinese Communist Party (CCP)’s 19th Central Committee, “the plenary session proposed to promote green development and the harmonious coexistence of man and nature [...] accelerate the promotion of green and low-carbon development, continue to improve environmental quality, enhance the quality and stability of the ecosystem, and comprehensively improve resource utilization efficiency”. As the world’s top coal consumer, China is foreseen to curb its fossil fuel use and boost green energy to accomplish its goal of reaching a peak in carbon emissions in 2030 and carbon neutrality by 2060, according to experts, requiring China to bring the share of coal in its total energy mix from 58% last year to less than 50% by 2025. Consultancy Wood Mackenzie said that for China to reach its goal, solar, wind and storage capacities must increase eleven-fold to 5,040 gigawatts (GW) by 2050 compared with 2020 levels. Overall, China’s expected efforts to transition to clean energies, are foreseen to boost the green sector, which especially in the past six months, has been outperforming overall China and global markets, as tracked by Solactive China Clean Index NTR (an equity index achieving more than 70% return from its April lows), a spectacular result, indicating strong expectations and investments in the sector.

Historical Performance Solactive China Clean Index NTR. Source: FactSe

Additionally, industry regulators and experts believe China’s latest development plan will stimulate quality over scale in the new energy vehicle (NEV) sector, with a particular focus on technological innovations to promote stable development in the automotive industry, facing a sharp global downturn. As Xin Guobin, vice-minister of industry and information technology, confirmed, “With the new plan, the competitiveness of the country's NEV industry is expected to be greatly enhanced by 2025, with significant breakthroughs in key technologies such as power batteries, drive motors and vehicle operating systems”.

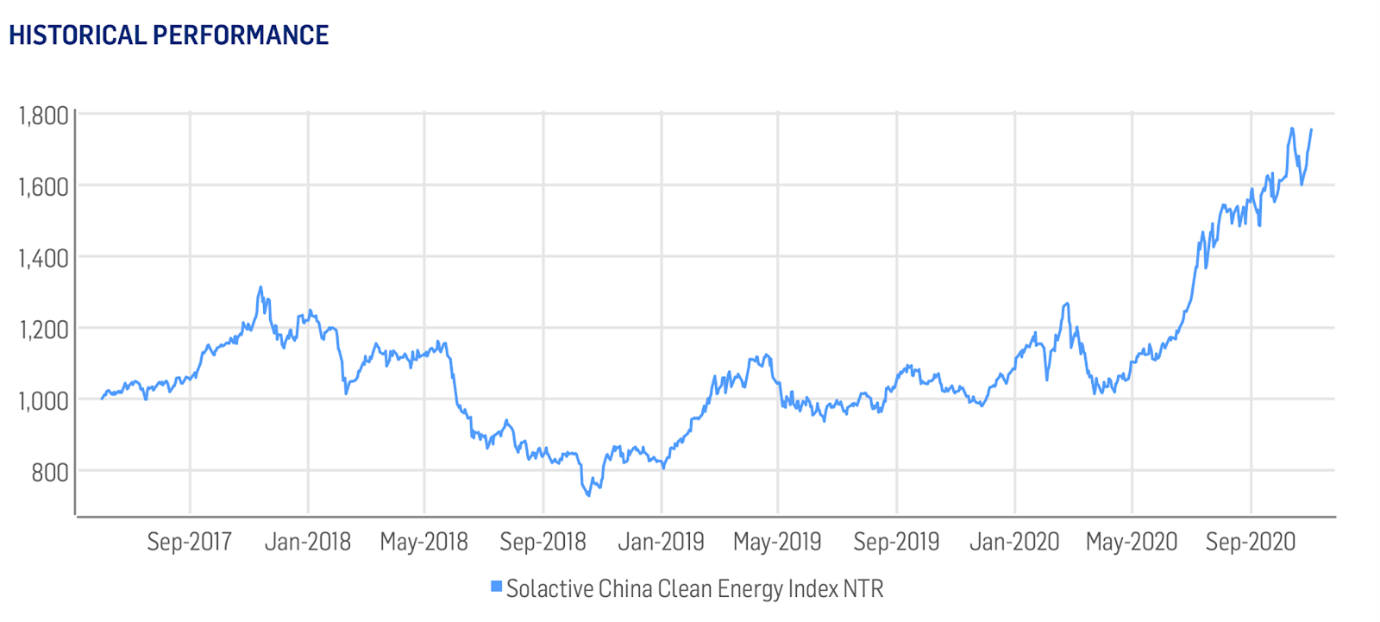

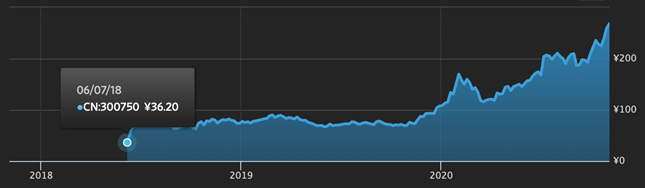

A firm that will probably reap the most benefits from this is Contemporary Amperex Technology Co., Ltd. (CATL), the global market leader in electric vehicle batteries, with a 2019 global market share of 26.6%, according to Bloomberg New Energy Finance. China’s largest automotive battery manufacturer has a strong presence in its domestic market, with approximately 41.5% (an astonishing proportion) of the 4,600 new energy vehicles approved by the China Ministry of Industry and Information Technology in 2019, equipped with CATL batteries.

A firm that will probably reap the most benefits from this is Contemporary Amperex Technology Co., Ltd. (CATL), the global market leader in electric vehicle batteries, with a 2019 global market share of 26.6%, according to Bloomberg New Energy Finance. China’s largest automotive battery manufacturer has a strong presence in its domestic market, with approximately 41.5% (an astonishing proportion) of the 4,600 new energy vehicles approved by the China Ministry of Industry and Information Technology in 2019, equipped with CATL batteries.

Global market share of top EV battery makers. Source: Bloomberg, EqualOcean Analysi

Prospected with a spectacular 2020-2023 revenue CAGR of 16%, according to Fitch, and operating in an industry with high barriers to entry, CATL is expected to have a stable and strong position in its markets and this is reflected by its first-time issuer rating of Baa1 by Moody's, a rating that is likely to be upgraded in case the firm strengthens further its global position (by diversifying more, both in terms of geography and product offered), maintaining its strong net cash position (as of Sep 2020 of about $10.35 Billion, against an Enterprise Value of about $4.71 Billion), and increasing its EBITDA margin to more than 16% (as of current FY, it is around 14%).

On the other hand, the major risks that could lead to CATL being downgraded are an unexpected drop in EV production or in CATL Free Cash Flow generation, leading to a potential loss in its net cash position. Additionally, given its robust reliance on strongly regulated markets, such as Chinese’s one, regulatory changes are a high threat to the battery producer, given that these changes have usually important investment needs.

On the other hand, the major risks that could lead to CATL being downgraded are an unexpected drop in EV production or in CATL Free Cash Flow generation, leading to a potential loss in its net cash position. Additionally, given its robust reliance on strongly regulated markets, such as Chinese’s one, regulatory changes are a high threat to the battery producer, given that these changes have usually important investment needs.

CATL’s stock performance. Source: Bloomber

Currently, investors have high expectations for CATL’s stock issue, given its 641% rise from its IPO in June 2018, gaining 127% since its March lows, and valuated at a P/E ratio of 134.

Whether or not China will clearly outline and pursue its goals on clean energy will be crucial for the enterprise, which wills surely be affected by the government’s plans and decisions, a risk it can hedge by diversifying and expanding its already strong customer base abroad (with the risk, of course, of facing high losses due to foreign tariffs, especially during a trade war).

2021-2025 Chinese 5-year Plan: Technology

Another key initial insight of China’s targeted economic plan is the goal to transform the nation into a tech giant and the focus of the plan would be more on the quality of growth over its speed. The Communist party expressed in September the significance of developing a robust domestic market as well as the importance of striving towards sustainable growth, however there was no specification regarding the targeted pace of these goals.

This growth plan relies on the country’s ability to domestically elevate its technology self-reliably. More specifically, China needs to figure out how to set up a sufficient source of chips, as they are the epicenter for innovations ranging from AI to autonomous vehicles and 5th gen networking. According to Xinhua “making major breakthroughs in core technologies in key areas, China will become a global leader in innovation”.

Whether or not China will clearly outline and pursue its goals on clean energy will be crucial for the enterprise, which wills surely be affected by the government’s plans and decisions, a risk it can hedge by diversifying and expanding its already strong customer base abroad (with the risk, of course, of facing high losses due to foreign tariffs, especially during a trade war).

2021-2025 Chinese 5-year Plan: Technology

Another key initial insight of China’s targeted economic plan is the goal to transform the nation into a tech giant and the focus of the plan would be more on the quality of growth over its speed. The Communist party expressed in September the significance of developing a robust domestic market as well as the importance of striving towards sustainable growth, however there was no specification regarding the targeted pace of these goals.

This growth plan relies on the country’s ability to domestically elevate its technology self-reliably. More specifically, China needs to figure out how to set up a sufficient source of chips, as they are the epicenter for innovations ranging from AI to autonomous vehicles and 5th gen networking. According to Xinhua “making major breakthroughs in core technologies in key areas, China will become a global leader in innovation”.

China's Annual Economic Growth with respect to time. Source: Bloomberg

The impact of China’s technological development can be illustrated with the protectionism that it has been receiving from the U.S., who pressured allied partners to avoid using materials coming from Huawei Technologies Co. In addition to that, the US completely disabled many large Chinese technology corporations from buying U.S. materials and even went as far as to propose bans of massively popular Chinese apps such as Tik Tok or WeChat.

Thus, in the following section, the possible outlooks and importance for growth in technology will be analyzed and evaluated.

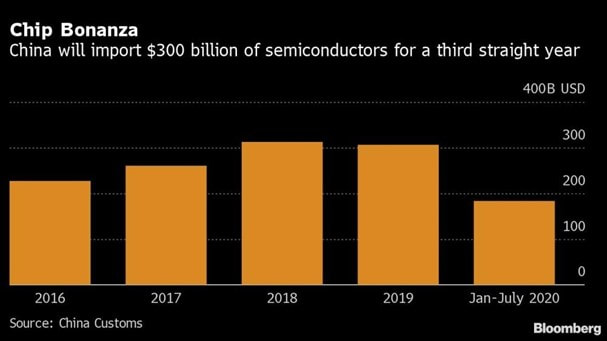

Chips

China tends to import on average around $300 billion in value of chips and other needed tools for the development of semiconductors and other manufacturing technologies. Nevertheless, with the mounting geopolitical tensions between the US and China, it would be more inefficient to rely on the U.S. for production process and development. In other words, supply chain risk is increasing, and this is going to be true also under Biden’s administration.

In order to respond to Trump’s restrictive administrations, China has adapted by producing a number of new growth policies focusing on developing a domestic semiconductor industry. President Xi Jinping is preparing a generous support for the third generation semiconductors for the five-year plan to an estimated $1.4 trillion to go for the development and production of the so needed rising industry in order to ensure the country’s self-sufficiency.

Thus, in the following section, the possible outlooks and importance for growth in technology will be analyzed and evaluated.

Chips

China tends to import on average around $300 billion in value of chips and other needed tools for the development of semiconductors and other manufacturing technologies. Nevertheless, with the mounting geopolitical tensions between the US and China, it would be more inefficient to rely on the U.S. for production process and development. In other words, supply chain risk is increasing, and this is going to be true also under Biden’s administration.

In order to respond to Trump’s restrictive administrations, China has adapted by producing a number of new growth policies focusing on developing a domestic semiconductor industry. President Xi Jinping is preparing a generous support for the third generation semiconductors for the five-year plan to an estimated $1.4 trillion to go for the development and production of the so needed rising industry in order to ensure the country’s self-sufficiency.

China's imports of semiconductors over time. Source: Bloomber

Artificial Intelligence

Another tech industry that China plans to focus on within its 5-year plan is the investment and innovative development of artificial intelligence. With a drastic wake-up call originating from the operational changes created due to COVID-19, AI investments are estimated to have reached an annual growth rate of 41.2% and to have reached $18.8 billion by 2027.

Estimators show that AI has the potential to contribute as much as $15.7 trillion to the world economy within the next 10 years, of which the $6.6 trillion is predicted to come from increased productivity rising from much better innovation and development of the industry. China will be the country to enjoy the largest economic gains from AI development, $7 trillion within 2030, accounting for 26% of GDP; to put this into perspective, the runner up in the larges prospected profit gains is North America, with a $3.7 trillion projected gain.

Tech Stock Analysis

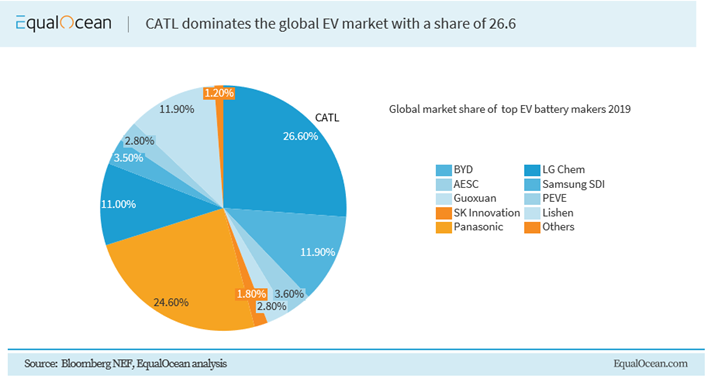

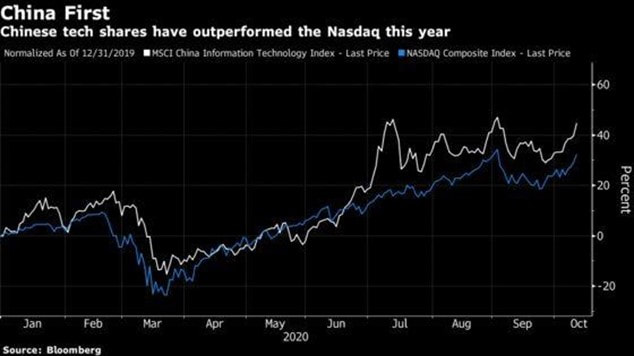

Chinese tech stocks as of now have the absolute potential to keep outperforming their U.S. competitors in the near future as regulations to U.S. tech giants are subject to stricter regulation, making investments in their Chinese counterparts a much more attractive investment.

As stated by the CIO of Covenant Capital Pte, Edward Lim, “The structural trend for China tech remains intact”. In Layman’s terms: the industry has the ability to trade on lower valuations as well as with higher growth potential in comparison to its American competition; and lastly, it is rather significant to state that it faces less regulatory risks from its domestic authorities.

Another tech industry that China plans to focus on within its 5-year plan is the investment and innovative development of artificial intelligence. With a drastic wake-up call originating from the operational changes created due to COVID-19, AI investments are estimated to have reached an annual growth rate of 41.2% and to have reached $18.8 billion by 2027.

Estimators show that AI has the potential to contribute as much as $15.7 trillion to the world economy within the next 10 years, of which the $6.6 trillion is predicted to come from increased productivity rising from much better innovation and development of the industry. China will be the country to enjoy the largest economic gains from AI development, $7 trillion within 2030, accounting for 26% of GDP; to put this into perspective, the runner up in the larges prospected profit gains is North America, with a $3.7 trillion projected gain.

Tech Stock Analysis

Chinese tech stocks as of now have the absolute potential to keep outperforming their U.S. competitors in the near future as regulations to U.S. tech giants are subject to stricter regulation, making investments in their Chinese counterparts a much more attractive investment.

As stated by the CIO of Covenant Capital Pte, Edward Lim, “The structural trend for China tech remains intact”. In Layman’s terms: the industry has the ability to trade on lower valuations as well as with higher growth potential in comparison to its American competition; and lastly, it is rather significant to state that it faces less regulatory risks from its domestic authorities.

Chinese Tech Stocks in comparison to Nasdaq over 2020. Source: Bloomber

The MSCI China Information Technology Index has risen 45% this year, versus a 32% gain in the Nasdaq Composite. It trades on 27 times 12-month forward earnings, compared to 32 times for its U.S. counterpart. Chinese tech stocks have proved to be a fierce prospect and alternative to investors who would want to diversify in further foreign markets, further boosting the magnitude of the potential the tech development can bring to its respective financial markets.

Tech Bond Analysis

As mentioned above, China’s tech development goals are straight at the epicenter of the country’s trade wars with the U.S. and it’s only natural to have impacted its bond markets.

Credit investors that purchased Chinese tech debt from the beginning of this year are now looking at a 13% return, which as shown by the Meryl Lynch indexes, is more than any other sector recorded as of this year.

Although due to trade tariffs tech producers such as Sunny Optical are planning to erect factories outside of China, the company’s revenues are significantly dependent on domestic customer demand. Domestic consumers as such, have accounted as part of 84 % of Sunny Optical’s gross revenues last year, whereas exports going to the US partook only 2.1%. Similarly, for JD.com and web supergiant Tencent, domestic demand was the source of 97% of revenues collected for that same year.

Lastly, the Chinese tech colossus Huawei generated a significant domestic yuan debut in October; more specifically the company’s dollar bonds that are due for 2026 and 2027 achieved an 18% return as of 2020, surpassing the indexed 11% for Asian emerging markets. Very similarly to the other cases also for Huawei more than half of the company’s revenues were generated by domestic demand.

As it can be observed the motif to a successful prospect has proven to be an integration of focusing and specializing in parts of technology with rising demand as well as internally focusing instead of trying to globalize to reach an end result, and Chinese tech companies have adopted that strategy exceptionally well and that is why they are looking as the leading sector of tech development for the next 5 years.

Article by Francesco Catanzariti and George Lavas.

Bibliography

“China Vows to Build ‘Fully Modern Army’ by 2027 as Beijing Policy Meeting Ends on Defiant Note | South China Morning Post.” South China Morning Post, 29 Oct. 2020, https://www.scmp.com/news/china/politics/article/3107686/policy-meeting-ends-defiant-note-chinese-leadership-insists.

“China’s Technology Bonds Offer Global Investors the Best Safe Haven as US-China Trade War Rages on for More than a Year | South China Morning Post.” South China Morning Post, 29 Oct. 2019, https://www.scmp.com/business/banking-finance/article/3035330/chinas-technology-bonds-offer-global-investors-best-safe.

“---.” South China Morning Post, 29 Oct. 2019, https://www.scmp.com/business/banking-finance/article/3035330/chinas-technology-bonds-offer-global-investors-best-safe.

Hunter, Gregor Stuart, and Abhishek Vishnoi. “China Tech Stocks Seen as a Better Bet Than Under-Fire U.S. Peers.” BloombergQuint, Bloomberg Quint, 13 Oct. 2020, https://www.bloombergquint.com/markets/china-tech-stocks-seen-a-better-bet-than-u-s-peers-under-fire.

Jazeera, Al. “China Plans Huge Investment in Next-Generation Chips: Report | China News | Al Jazeera.” Breaking News, World News and Video from Al Jazeera, Al Jazeera, 4 Sept. 2020, https://www.aljazeera.com/economy/2020/9/4/china-plans-huge-investment-in-next-generation-chips-report.

Post, South China Morning. “China՚s 10 Goals for 2025.” SCMP Infographics, https://multimedia.scmp.com/widgets/china/mic2025/. Accessed 7 Nov. 2020.

IMF Working Paper: Inequality in China – Trends, Drivers and Policy Remedies

Tech Bond Analysis

As mentioned above, China’s tech development goals are straight at the epicenter of the country’s trade wars with the U.S. and it’s only natural to have impacted its bond markets.

Credit investors that purchased Chinese tech debt from the beginning of this year are now looking at a 13% return, which as shown by the Meryl Lynch indexes, is more than any other sector recorded as of this year.

Although due to trade tariffs tech producers such as Sunny Optical are planning to erect factories outside of China, the company’s revenues are significantly dependent on domestic customer demand. Domestic consumers as such, have accounted as part of 84 % of Sunny Optical’s gross revenues last year, whereas exports going to the US partook only 2.1%. Similarly, for JD.com and web supergiant Tencent, domestic demand was the source of 97% of revenues collected for that same year.

Lastly, the Chinese tech colossus Huawei generated a significant domestic yuan debut in October; more specifically the company’s dollar bonds that are due for 2026 and 2027 achieved an 18% return as of 2020, surpassing the indexed 11% for Asian emerging markets. Very similarly to the other cases also for Huawei more than half of the company’s revenues were generated by domestic demand.

As it can be observed the motif to a successful prospect has proven to be an integration of focusing and specializing in parts of technology with rising demand as well as internally focusing instead of trying to globalize to reach an end result, and Chinese tech companies have adopted that strategy exceptionally well and that is why they are looking as the leading sector of tech development for the next 5 years.

Article by Francesco Catanzariti and George Lavas.

Bibliography

“China Vows to Build ‘Fully Modern Army’ by 2027 as Beijing Policy Meeting Ends on Defiant Note | South China Morning Post.” South China Morning Post, 29 Oct. 2020, https://www.scmp.com/news/china/politics/article/3107686/policy-meeting-ends-defiant-note-chinese-leadership-insists.

“China’s Technology Bonds Offer Global Investors the Best Safe Haven as US-China Trade War Rages on for More than a Year | South China Morning Post.” South China Morning Post, 29 Oct. 2019, https://www.scmp.com/business/banking-finance/article/3035330/chinas-technology-bonds-offer-global-investors-best-safe.

“---.” South China Morning Post, 29 Oct. 2019, https://www.scmp.com/business/banking-finance/article/3035330/chinas-technology-bonds-offer-global-investors-best-safe.

Hunter, Gregor Stuart, and Abhishek Vishnoi. “China Tech Stocks Seen as a Better Bet Than Under-Fire U.S. Peers.” BloombergQuint, Bloomberg Quint, 13 Oct. 2020, https://www.bloombergquint.com/markets/china-tech-stocks-seen-a-better-bet-than-u-s-peers-under-fire.

Jazeera, Al. “China Plans Huge Investment in Next-Generation Chips: Report | China News | Al Jazeera.” Breaking News, World News and Video from Al Jazeera, Al Jazeera, 4 Sept. 2020, https://www.aljazeera.com/economy/2020/9/4/china-plans-huge-investment-in-next-generation-chips-report.

Post, South China Morning. “China՚s 10 Goals for 2025.” SCMP Infographics, https://multimedia.scmp.com/widgets/china/mic2025/. Accessed 7 Nov. 2020.

IMF Working Paper: Inequality in China – Trends, Drivers and Policy Remedies