As markets experience one of their most volatile periods in its history, plunging into a new bear market, there are several losers and few winners. In particular, the consumer staple sector belongs to the second group, along with telecommunications. The reasons are obvious: as the coronavirus crisis becomes a pandemic and more countries decide to proceed with strict lockdowns, companies like Walmart, Kroger, and others see a greater demand of essential goods due to the fear of running short of supplies, which translates in higher sales. Pictures of empty shelves, from all over the world, are powerful witnesses of this troubled situation. Is this backed by data?

Source: Bloomberg

Source: Bloomberg

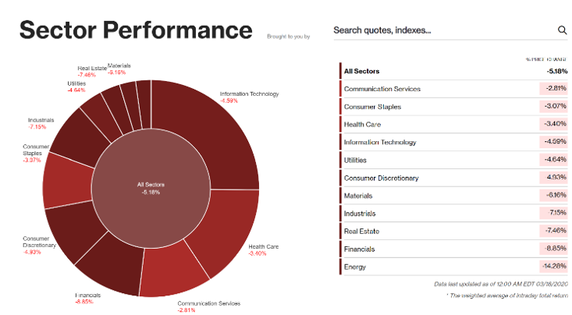

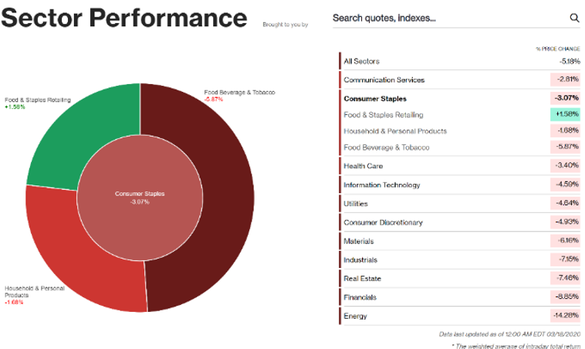

The Consumer Staples index is currently beating the S&P500 index during this month. Although the index lost some of its value, and it is now in the red, it has performed better than the S&P500. Last week, while all sectors lost, in average, 5.18% of their values, Consumer Staples lost only 3.07%, the second-best performance, with the first being telecommunication (only -2.81%). Looking at the disaggregated data, the sector showed a -5.87% in Food Beverage and Tobacco, a -1.68% in Household and Personal Products and a +1.58% in Food and Staples Retailing. This has been reflected also in the stock performance of many important companies in the sector, starting from the largest food retail chains.

Source: Bloomberg

Source: Bloomberg

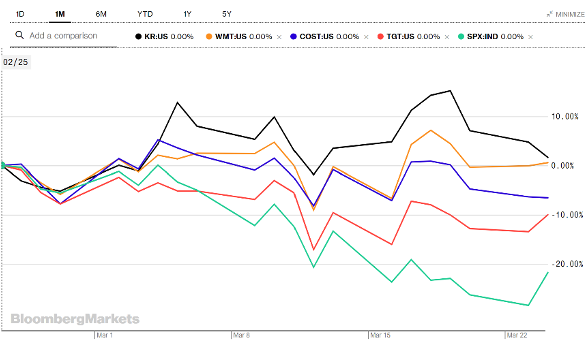

Stocks of Walmart (NYSE: WMT), Costco (NASDAQ: COST), Target (NYSE: TGT), Kroger (NYSE: KR), and many others have outperformed a bearish S&P500 Index in this month. This appears quite a victory for stocks that have been overlooked by financial markets, and it mirrors a real economy situation in which restaurants close, tourism is no longer feasible, and the only permitted places in many countries are becoming the grocery shops and pharmacies. However, what seems like a reversal of fortunes might easily become a Pyrrhic victory for the sector, which suffers from short and long-term challenges.

On the short-term side, the huge increase in demand is not being matched with an equivalent surge in offer, and not for unwillingness of the companies. As the panic spreads, groceries have to face a lot of hardship in order to keep up with the demand. From the risk of employees getting infected (two at Kroger already tested positive) to the need to enact the necessary measures to restock supplies and sanitize stores, these companies are increasingly taking actions against store overcrowding. Some are shortening hours of operation; others are limiting the goods that can be purchased only to necessities. Other companies, like Albertson, are hiring more workers, both in-store and on the inventory side.

Another short-term problem is how companies are going to handle shipment of goods and their conservation. While food processers like Sanderson Farms Inc. are ramping up their production scale to keep up with the rising demand, moving these perishable products from one part to the other of the country seems the real challenge. Therefore, the Transportation Department’s Federal Motor Carrier Safety Administration has suspended the daily limit of driving hours for truckers in an effort to help fast shipments of goods. Lineage Logistics LLC, the largest US producer of refrigerated warehouses, saw an increase between 20% and 50% of its shipments, according to its CEO Mr. Lehmkuhl. This is putting the overall supply chain of food retailers under pressure, thus creating even more distress in trying to meet demand of customers.

Another worrying factor is the rising demand for online purchases, which has been incentivized even more by the need of isolation. Not only companies like Walmart and Kroger are experiencing challenges in providing goods through online service, but even Amazon is starting to limit the purchases on its platform only to six categories, which include all household staples, medical supplies, and other high-demand products. Target and others are pausing their online services to ensure adequate delivery, while others like Fresh Direct are already warning about possible delays in delivery.

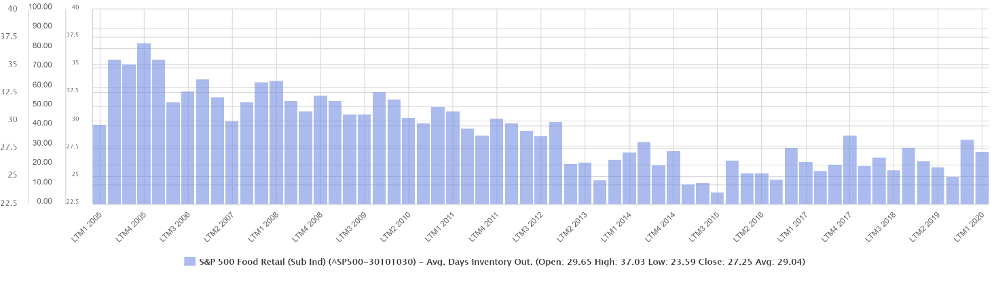

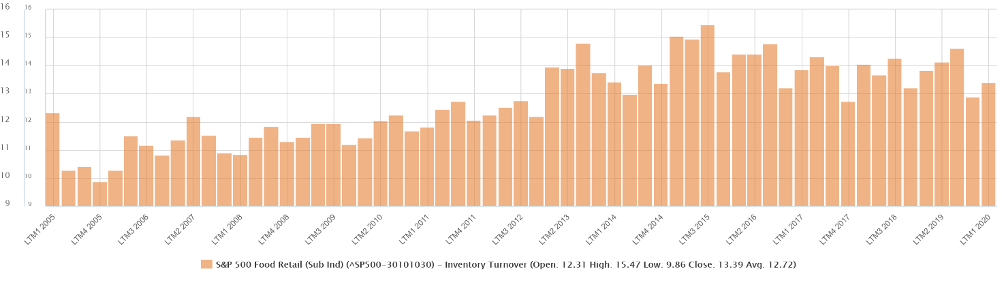

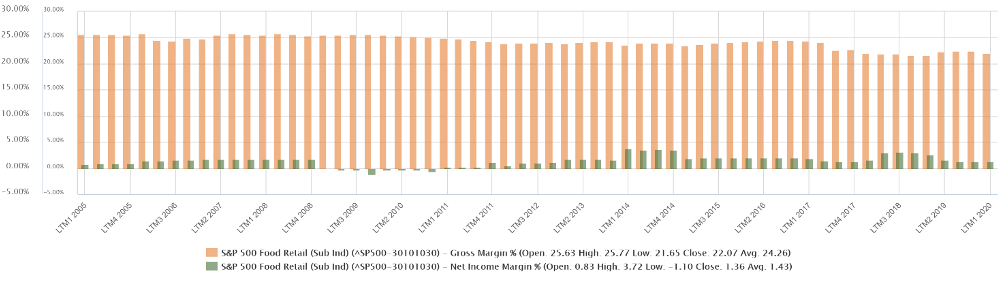

On the long-term side, grocery stores and food chain might need to change their business model, especially inventory management. In the last decades, almost every food retail company decided to adopt a business model that tried to reduce as much as possible stock piling and inventory. This “just in time” model aimed to improve profit margins, but it seems to backlash now. Indeed, the inventories that were meant to last for 4-6 weeks were empty in days, and that meant scaling up capacity rapidly for these companies. However, this could mean a further erosion in margins which are already under pressure and considered a long-time problem of the sector. Having to choose between efficiency in inventory management and capability of reacting fast to future surges in demand might be the new challenge of the food retail sector.

On the short-term side, the huge increase in demand is not being matched with an equivalent surge in offer, and not for unwillingness of the companies. As the panic spreads, groceries have to face a lot of hardship in order to keep up with the demand. From the risk of employees getting infected (two at Kroger already tested positive) to the need to enact the necessary measures to restock supplies and sanitize stores, these companies are increasingly taking actions against store overcrowding. Some are shortening hours of operation; others are limiting the goods that can be purchased only to necessities. Other companies, like Albertson, are hiring more workers, both in-store and on the inventory side.

Another short-term problem is how companies are going to handle shipment of goods and their conservation. While food processers like Sanderson Farms Inc. are ramping up their production scale to keep up with the rising demand, moving these perishable products from one part to the other of the country seems the real challenge. Therefore, the Transportation Department’s Federal Motor Carrier Safety Administration has suspended the daily limit of driving hours for truckers in an effort to help fast shipments of goods. Lineage Logistics LLC, the largest US producer of refrigerated warehouses, saw an increase between 20% and 50% of its shipments, according to its CEO Mr. Lehmkuhl. This is putting the overall supply chain of food retailers under pressure, thus creating even more distress in trying to meet demand of customers.

Another worrying factor is the rising demand for online purchases, which has been incentivized even more by the need of isolation. Not only companies like Walmart and Kroger are experiencing challenges in providing goods through online service, but even Amazon is starting to limit the purchases on its platform only to six categories, which include all household staples, medical supplies, and other high-demand products. Target and others are pausing their online services to ensure adequate delivery, while others like Fresh Direct are already warning about possible delays in delivery.

On the long-term side, grocery stores and food chain might need to change their business model, especially inventory management. In the last decades, almost every food retail company decided to adopt a business model that tried to reduce as much as possible stock piling and inventory. This “just in time” model aimed to improve profit margins, but it seems to backlash now. Indeed, the inventories that were meant to last for 4-6 weeks were empty in days, and that meant scaling up capacity rapidly for these companies. However, this could mean a further erosion in margins which are already under pressure and considered a long-time problem of the sector. Having to choose between efficiency in inventory management and capability of reacting fast to future surges in demand might be the new challenge of the food retail sector.

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Food retailers’ stocks have been many times safe heaven assets in times of financial crisis, mostly due to the intrinsic features of the sector. However, the sector faces both short term and long-term challenges that might void its victory, and make it a simple momentum.

Lilit Sarucanian

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

Lilit Sarucanian

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.