Foot Locker Inc. [NYSE: FL] is a leading retailer in the athletic shoes and apparel market, with more than 3,300 specialty stores across the globe. While the group is present in 23 countries, 71% of its revenues come from the US alone, mainly through the brand Foot Locker, #1 seller of NIKE athletic footwear in the US. Other brands include Lady Foot Locker, Kids Foot Locker, Footaction, Champs Sports, SIX:02, Runners Point, and Sidestep. 87% of the group’s revenues come from retail stores, but the company has been growing its direct-to-customer units, through Eastbay and Footlocker.com.

Recent disappointing earnings reports, along with litigation charges resultant from unexpected developments in a lawsuit filed in 2007 regarding employee’s pensions, caused Foot Locker Inc.’s share price to decrease by over 60% since May. The following top-down analysis intends to explain what investors might be overlooking and why the stock may be oversold.

Industry

First, the high-end athletic footwear and apparel industry has very high barriers to entry, as companies need to have strong branding and make large real estate and inventory investments. Given Foot Locker’s partnerships with world leading brands, and that the group has over 3,000 retail stores across the globe, it’s unlikely that new companies will cause major damage to the group’s performance. Second, prices in this industry are extremely sticky, compared to most of the discretionary sector, as main players such as Foot Locker are famous for providing unique and thus hardly replaceable experiences to customers. While companies like Amazon can be dangerous competitors for low-end products, in the high-end segment most customers have strong preferences for specific stores. This allows companies to retain some of their market power in an increasingly competitive market.

Foot Locker: Comparative Advantages

Not only is the industry robust overall, Foot Locker itself has strong comparative advantages that make it stand out from its competitors from an investor’s perspective. The group’s access to the newest models through its long-term relationship with major brands guarantees very solid protection against the main competitors, which struggle to provide such items. The firm is also able to leverage its large size and these relationships with suppliers to get special deals and offer competitively priced apparel to customers. Moreover, Foot Locker is much more efficient than its peers, whose operating margins range from 1.12% to 7.3% (with an average of 3%), much lower than the 11.7% of the large retailer. This is mainly due to the firm’s efficiency in managing sales and administration costs, which represent less than 20% of sales, extremely lower than the 30% industry average. Even after the recent fall in earnings, this still allows the group to generate 20.2% return on invested capital, as well as 21.1% return on equity, while the average competitor generates ROIC and ROE below 10% - using trailing 12-month figures.

Where is the market wrong?

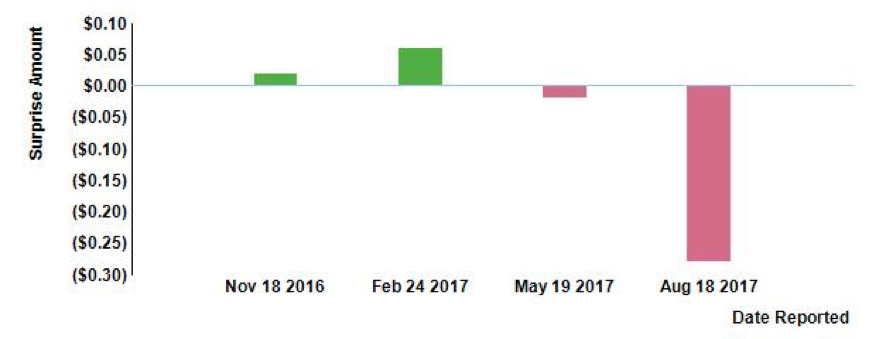

Foot Locker Inc. has seen its share price go down by 60%, mainly due to the last 2 quarterly reports. The company quoted earnings per share of $1,36 in Q1 and $0.39 ($0.62 not taking litigation charges into consideration) in Q2, which were below the analyst’s estimates of $1.38 and $0.9 respectively. Not accounting for the litigation charges, this implies a -1% and -31% surprise, and represents a -2.2% and -34% year-on-year change.

The company’s earnings have disappointed investors, indeed. However, is the 60% decrease in share price justified? The main reason share price decreased so abruptly is that investors fear the market for traditional retailers is shrinking, as designers and manufacturers may prefer going direct-to-customer. While this may seem obvious at first, given Nike’s recent deal with Amazon, it is indeed very questionable once we look closely into Foot Locker’s business. In fact, the deal is likely to be limited to the lower-end products, while Foot Locker’s typical customers look for high-end products, usually demanding in-store experiences. As Richard Johnson, CEO of Foot Locker, said, “There is no indication that any of our vendors intend to sell premium athletic product, $100-plus sneakers that we offer, directly via that sort of distribution channel”.

The other major consideration that investors are overlooking is the reason for the decrease in earnings. In the first quarter, earnings saw a slight year-on-year decrease, but not due to sales. In fact, revenue increased 0.5%, or 1.8% adjusting for currency fluctuations, as the company was hurt by a strong dollar. The reason for the decrease in earnings was mainly related to a 0.3 percentage points increase in sales and administration expense rate to 18.5% of sales, which is still very efficient compared to competitors. According to Richard Johnson, that quarter was actually one of the best for the retailer, but share price fell about 16% after the earnings report, which implies that investors punished the firm too much for slightly lower than expected revenues ($2B versus expected $2.02B).

In the second quarter, earnings decreased abruptly, for 2 main reasons: $50M pre-tax expense in litigation charges and a very significant decrease in revenue, to 1.7B. The litigation charges represent a $0.23 after-tax loss per share. While this certainly affected the quarterly EPS by a significant amount, it must not justify a large decrease in share price, as it’s a nonrecurring charge. The declining revenue, however, provides motive to cut the share price, even more so as investors are starting to confirm their already existing concerns regarding direct-to-customer channels. However, one must not confirm an assumption that was wrong to begin with, only because new data seem to point in the same direction. As shown above, sales of the first quarter were solid, having even increased despite the very strong dollar. Second quarter’s decrease seems problematic indeed, but it does not seem to be due to long-term changes. This is where the market might be making a big mistake. Investors are assuming revenues will be down forever, as Amazon will crush Foot Locker’s market share, but in reality, recent developments in the fashion world such as the lack of innovative products are most likely to blame, according to sell-side experts, as well as Richard Johnson, who warned shareholders that revenues are expected to be down 3-4% over the rest of the year for the same reason. However, since there is no technology which will make footwear and apparel redundant in the near future, we should not assume that demand will remain low forever. Given the outstanding amount of cash in the balance sheet and the almost inexistent debt, Foot Locker can sustain the blow for years. Analysts at Morgan Stanley, which had claimed that Foot Locker would be able to defend itself against Amazon, cut the target share price from $65 to $50, which is still well above the current share price of $30, maintaining an Overweight rating.

Valuation

Foot Locker, trading below $30 at the time of writing, has a forward price-to-earnings ratio of 7.6, based on 13 sell-side analysts’ estimates of 3.95 earnings-per-share for the current fiscal year, well below the industry average of 13.5 and median of 14. Even if we assume that earnings will not recuperate in a foreseeable future, and we allow for an extremely abrupt decrease in earnings, this stock is still very undervalued compared to peers. Even assuming a conservative average of $0.70 EPS per quarter in 2018 (implying a sudden 29% decrease in annual EPS to $2.8, from the $3.95 estimated by analysts for 2017), we would obtain a fair value of $37.9 to $39.2 per share one year into the future, implying gains of 26% to 31%, excluding dividends. Using price-to-free-cash-flow multiple, Foot Locker also seems very undervalued, with a 5.8 ratio, compared to the industry average of 7.7 and median of 7. This approach results in a fair price of $36.2 to $41 per share. Through either approach we get to a range of values around the analysts’ average estimate of $38 a share, which together with the current 4% dividend yield, would imply a return to investors of 31%. While no one can state with absolute certainty what will happen to this industry in the future, we can definitely state that Foot Locker Inc. is a much better bargain than its competitors, and eventually investors should recognize this, and share price should retrace back up.

João Coelho