Introduction

In corporate finance, takeovers fall under the umbrella of Mergers and Acquisitions (M&A) and occur when a company, called acquirer, assumes control of another, usually smaller company, referred to as target. There can be a multitude of ways in which a takeover is structured, depending on, among other things, on whether the target is publicly listed or private, and whether it welcomes the acquisition attempt or not. Different types of takeovers will be examined in this article, before focusing on a very recent and massively publicized one: Elon Musk’s ongoing acquisition of Twitter.

It should be considered why a company would want to perform a takeover of another one in the first place. A first reason could be a belief that the target is underpriced and that there is opportunity for long-term value creation by acquiring it. This could take place in the form of economies of scale, cost reduction and higher profits through synergies. This type of takeover is usually referred to as opportunistic takeover. A second type of takeovers are strategic ones, which benefit the acquirer by providing for diversification of business risk or the ability to enter a new market quickly and easily. Alternatively, a strategic takeover could also be aimed at eliminating competition and increasing market power. Finally, and this is the case for Elon Musk and Twitter, an acquisition may be performed by an activist investor wishing to influence how the target company is run and hoping to initiate change in its strategy and governance, often by taking it private (in case it’s public initially) after the deal.

In terms of structure, a takeover is essentially complete once the acquirer obtains controlling interest, i.e. a majority of the target’s voting shares. That means that while there are certainly times where the entire company is bought, this is not a necessary condition for an acquisition. In the case of friendly takeovers, meaning that management and board of the target agree with being bought out, the acquirer makes a public offer for the company’s shares. The offer needs to be approved by the target’s shareholders, which usually happens once the board recommends accepting the proposed deal. As the price per share is ultimately the main factor considered by shareholders, the acquirer is incentivized to offer a premium on the current share price and corresponding market value of the company. Moreover, there are other factors beyond the monetary value of the offer the acquirer needs to consider, such as how to finance the bid and what to do with the target if the acquisition is successful. In particular, a takeover can be financed with cash, stock (of the acquiring company) or debt. It is not uncommon to find a combination of these methods being used at the same time. Especially popular, in private equity in particular, are leveraged-buyouts (LBOs), acquisitions financed mostly through debt, with just little own capital invested. They are among the rare cases in which a smaller company can buy a larger one, and often involve the use of the acquired company’s assets as collateral for the debt as well as its cash flows for interest payments . LBOs typically involve taking the target private after the takeover, which is indeed the first option one has after completing the acquisition. Other options include merging the acquired company into the existing one, thus creating a single entity in an attempt to exploit synergies, or consolidating it as a subsidiary.

While friendly takeovers, as just seen, are relatively straightforward in theory, things get much more complicated in cases where the target’s management and board are not willing to be bought out. These cases are referred to as hostile takeovers, and are seen as particularly controversial in their dynamics and also long-term prospects. The acquiring company, in these cases, has a few options. The first is the most straightforward and the most aggressive method of buying enough shares on the open market to attempt to reach controlling interest. The method is flawed as, especially if people realize what you are doing, the stock price of the intended target will increase significantly, making the operation way more expensive. A second, slightly more diplomatic approach, is through a so-called tender offer: the acquiring party makes a public offer to existing shareholders to sell their shares to them at a specified price within a certain time window. If the offer is attractive enough, there is the possibility that shareholders overrule essentially the board’s will to not sell. This is the approach that Elon Musk has opted for, by announcing his bid to purchase twitter for $54.20 a share, but more on that later. Finally, a third strategy consists in what is called a proxy fight, where the acquirer will try to convince current shareholders to vote out board members or management opposed to the takeover, and replace them with someone who is in favor of it and will approve the acquisition.

It’s equally interesting to look at how companies may try to fend off a hostile takeover. From a general perspective, to decrease the likelihood of a hostile takeover attempt, firms may adopt an ownership structure consisting of different types of shares with differential voting rights (DVR). If the shares that carry greater voting rights are, let’s say, held by the historic founder of the company and not traded on the open market, it will be more difficult for any third party to acquire controlling interest. Alternatively, a company may include a provision in its bylaws that triggers the sale of the company’s most valuable assets in case of unauthorized takeovers, to dissuade potential acquirers. This is called the crown jewel defense. A third possible point is the golden parachute, where the board and management, per their contract, are given substantial compensation in case of termination. Since, in a hostile takeover, the new owners will likely seek to replace the people that were opposed to it, knowing that this would be very expensive is supposed to serve as a deterrent against the operation.

Once a hostile takeover is underway, the target has some extreme measures of last resort it can employ. One is the shareholder rights plan, commonly known as the poison pill. It works by allowing shareholders, except for the attempting acquirer, to purchase additional shares at a discount. This effectively dilutes the acquirer and makes it almost impossible for him/her to obtain a majority interest. Such a plan, as we’ll see later, had initially been announced by Twitter after Musk made his tender offer public. The name of this strategy is inspired by the poison pills that spies carried with them to avoid being questioned by the enemy. Indeed, while in the corporate world we are not talking about actual suicide, a sharehloder rights plan is very unattractive in general, as it forces shareholders to acquire new stock if they don’t want to get diluted with the acquirer and severly dilutes the stock value. A final, and maybe the most extreme, strategy to react to a hostile takeover, is called the Pac-Man defense. It consists in the target reacting to the acquisition attempt by buying back its shares or even start buying shares of the acquirer in an attempt to scare it off. The target will usually resort to available cash reserves, including the so-called war chest, as well as often outside borrowings to finance its counter-attack. Clearly this is a rare occurence and for this to happen the companies need to be of similar sizes, but a fairly recent example is the dealings between Men’s Warehouse and its competitor Jos. A. Bank, where, while intially the latter attempted a takeover of Men’s Warehouse, it ended up being Men's Warehouse that acquired Jos. A. Bank.

Twitter takeover by Elon Musk

Now, having a clear understanding of the different types and proceedings of takeovers, let us focus on a very recent example: Elon Musk’s planned acquisition of Twitter. The deal has not been finalized yet but all signs seem to point that Musk’s bid for $54.20 will be successful. While initially it had been reported that Twitter’s board was opposed to the move and ready to deploy the poison pill strategy, there seems to have been a change of mind and the takeover should be concluded in a friendly manner.

Here is a timeline/overview of the events that marked Elon Musk’s latest incredibly publicized venture:

As it happens most of the time with Elon Musk, everything began with some simple tweets. "Worried about de facto bias in the Twitter algorithm having a major effect on the public; Twitter algorithm should be open source," Musk tweeted on March 24. "Free speech is essential to a functioning democracy. Do you believe Twitter rigorously adheres to this principle?" Musk asked his Twitter followers in a poll posted on March 25. "Is a new platform needed?" Musk asked in a tweet on March 26. "Am giving serious thought to this.”

On April 4th he publicly disclosed, according to SEC rules, that he had acquired a 9.2% stake in Twitter. It should however be noted that he missed the deadline to inform the SEC by 10 days. After the stake was disclosed he started to tweet about changes on the platform and he was invited to join the board of directors. He also signaled that he would have signed an agreement that would not let him own more than 14,9% of the company’s stock. The next day several members of the board congratulated Elon on his decision to join the board. Elon refiled his disclosure to classify himself as an active investor and he implied that he would have accepted the seat on the board.

On April 9th Elon Musk informed twitter that he would not have joined the board and during the day he shared harsh criticism towards the company and some jokes like suggesting to remove the “w” in Twitter. The next day Twitter makes the news public without giving any reason about his decision and the day after Elon files an amended disclosure with the SEC that lets him purchase as many shares as he wants since he no longer has a board seat and doesn’t need to act in the best interest of shareholders.

On April 14th Musk offered to buy the whole company and announced it through a tweet with a link to the official SEC filing. The offer was for $54.20 a share paid in cash and that would value the deal at $43 billion. The price he offered was a 54% premium compared to the price of the stock before he started to build his stake. The next day, Twitter responds to his offer by enacting a ‘poison pill’ to ward off Musk’s takeover. A poison pill allows shareholders to purchase shares at a discount if any shareholder exceeds 15% ownership. Therefore making an open-market acquisition very costly if not impossible. In the next few days Elon started to complain that the board owned almost no shares and so their interests are not aligned with those of the shareholders.

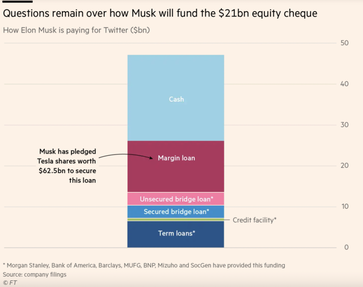

On April 21st, Musk lined up $46.5 billion in funding and explored a tender offer for Twitter. The deal has been structured as a merger between Twitter Inc. and X Holdings II Inc. Another company called X Holdings I Inc. will be the parent company if the Twitter bid succeeds. The SEC filings showed that he had a $25.5 billion funding from Morgan Stanley and other financial institutions, including margin loans backed by his equity stake in Tesla and $21 billion in equity financing from himself. It is still debated how he will come up with $21 billion since it is estimated that he owns around $3 billions in liquid assets per Bloomberg. During the week ending Friday 29th he revealed that he had sold $8.5 billion worth of Tesla shares. He has also announced on Twitter that he is not planning on selling more shares.

In corporate finance, takeovers fall under the umbrella of Mergers and Acquisitions (M&A) and occur when a company, called acquirer, assumes control of another, usually smaller company, referred to as target. There can be a multitude of ways in which a takeover is structured, depending on, among other things, on whether the target is publicly listed or private, and whether it welcomes the acquisition attempt or not. Different types of takeovers will be examined in this article, before focusing on a very recent and massively publicized one: Elon Musk’s ongoing acquisition of Twitter.

It should be considered why a company would want to perform a takeover of another one in the first place. A first reason could be a belief that the target is underpriced and that there is opportunity for long-term value creation by acquiring it. This could take place in the form of economies of scale, cost reduction and higher profits through synergies. This type of takeover is usually referred to as opportunistic takeover. A second type of takeovers are strategic ones, which benefit the acquirer by providing for diversification of business risk or the ability to enter a new market quickly and easily. Alternatively, a strategic takeover could also be aimed at eliminating competition and increasing market power. Finally, and this is the case for Elon Musk and Twitter, an acquisition may be performed by an activist investor wishing to influence how the target company is run and hoping to initiate change in its strategy and governance, often by taking it private (in case it’s public initially) after the deal.

In terms of structure, a takeover is essentially complete once the acquirer obtains controlling interest, i.e. a majority of the target’s voting shares. That means that while there are certainly times where the entire company is bought, this is not a necessary condition for an acquisition. In the case of friendly takeovers, meaning that management and board of the target agree with being bought out, the acquirer makes a public offer for the company’s shares. The offer needs to be approved by the target’s shareholders, which usually happens once the board recommends accepting the proposed deal. As the price per share is ultimately the main factor considered by shareholders, the acquirer is incentivized to offer a premium on the current share price and corresponding market value of the company. Moreover, there are other factors beyond the monetary value of the offer the acquirer needs to consider, such as how to finance the bid and what to do with the target if the acquisition is successful. In particular, a takeover can be financed with cash, stock (of the acquiring company) or debt. It is not uncommon to find a combination of these methods being used at the same time. Especially popular, in private equity in particular, are leveraged-buyouts (LBOs), acquisitions financed mostly through debt, with just little own capital invested. They are among the rare cases in which a smaller company can buy a larger one, and often involve the use of the acquired company’s assets as collateral for the debt as well as its cash flows for interest payments . LBOs typically involve taking the target private after the takeover, which is indeed the first option one has after completing the acquisition. Other options include merging the acquired company into the existing one, thus creating a single entity in an attempt to exploit synergies, or consolidating it as a subsidiary.

While friendly takeovers, as just seen, are relatively straightforward in theory, things get much more complicated in cases where the target’s management and board are not willing to be bought out. These cases are referred to as hostile takeovers, and are seen as particularly controversial in their dynamics and also long-term prospects. The acquiring company, in these cases, has a few options. The first is the most straightforward and the most aggressive method of buying enough shares on the open market to attempt to reach controlling interest. The method is flawed as, especially if people realize what you are doing, the stock price of the intended target will increase significantly, making the operation way more expensive. A second, slightly more diplomatic approach, is through a so-called tender offer: the acquiring party makes a public offer to existing shareholders to sell their shares to them at a specified price within a certain time window. If the offer is attractive enough, there is the possibility that shareholders overrule essentially the board’s will to not sell. This is the approach that Elon Musk has opted for, by announcing his bid to purchase twitter for $54.20 a share, but more on that later. Finally, a third strategy consists in what is called a proxy fight, where the acquirer will try to convince current shareholders to vote out board members or management opposed to the takeover, and replace them with someone who is in favor of it and will approve the acquisition.

It’s equally interesting to look at how companies may try to fend off a hostile takeover. From a general perspective, to decrease the likelihood of a hostile takeover attempt, firms may adopt an ownership structure consisting of different types of shares with differential voting rights (DVR). If the shares that carry greater voting rights are, let’s say, held by the historic founder of the company and not traded on the open market, it will be more difficult for any third party to acquire controlling interest. Alternatively, a company may include a provision in its bylaws that triggers the sale of the company’s most valuable assets in case of unauthorized takeovers, to dissuade potential acquirers. This is called the crown jewel defense. A third possible point is the golden parachute, where the board and management, per their contract, are given substantial compensation in case of termination. Since, in a hostile takeover, the new owners will likely seek to replace the people that were opposed to it, knowing that this would be very expensive is supposed to serve as a deterrent against the operation.

Once a hostile takeover is underway, the target has some extreme measures of last resort it can employ. One is the shareholder rights plan, commonly known as the poison pill. It works by allowing shareholders, except for the attempting acquirer, to purchase additional shares at a discount. This effectively dilutes the acquirer and makes it almost impossible for him/her to obtain a majority interest. Such a plan, as we’ll see later, had initially been announced by Twitter after Musk made his tender offer public. The name of this strategy is inspired by the poison pills that spies carried with them to avoid being questioned by the enemy. Indeed, while in the corporate world we are not talking about actual suicide, a sharehloder rights plan is very unattractive in general, as it forces shareholders to acquire new stock if they don’t want to get diluted with the acquirer and severly dilutes the stock value. A final, and maybe the most extreme, strategy to react to a hostile takeover, is called the Pac-Man defense. It consists in the target reacting to the acquisition attempt by buying back its shares or even start buying shares of the acquirer in an attempt to scare it off. The target will usually resort to available cash reserves, including the so-called war chest, as well as often outside borrowings to finance its counter-attack. Clearly this is a rare occurence and for this to happen the companies need to be of similar sizes, but a fairly recent example is the dealings between Men’s Warehouse and its competitor Jos. A. Bank, where, while intially the latter attempted a takeover of Men’s Warehouse, it ended up being Men's Warehouse that acquired Jos. A. Bank.

Twitter takeover by Elon Musk

Now, having a clear understanding of the different types and proceedings of takeovers, let us focus on a very recent example: Elon Musk’s planned acquisition of Twitter. The deal has not been finalized yet but all signs seem to point that Musk’s bid for $54.20 will be successful. While initially it had been reported that Twitter’s board was opposed to the move and ready to deploy the poison pill strategy, there seems to have been a change of mind and the takeover should be concluded in a friendly manner.

Here is a timeline/overview of the events that marked Elon Musk’s latest incredibly publicized venture:

As it happens most of the time with Elon Musk, everything began with some simple tweets. "Worried about de facto bias in the Twitter algorithm having a major effect on the public; Twitter algorithm should be open source," Musk tweeted on March 24. "Free speech is essential to a functioning democracy. Do you believe Twitter rigorously adheres to this principle?" Musk asked his Twitter followers in a poll posted on March 25. "Is a new platform needed?" Musk asked in a tweet on March 26. "Am giving serious thought to this.”

On April 4th he publicly disclosed, according to SEC rules, that he had acquired a 9.2% stake in Twitter. It should however be noted that he missed the deadline to inform the SEC by 10 days. After the stake was disclosed he started to tweet about changes on the platform and he was invited to join the board of directors. He also signaled that he would have signed an agreement that would not let him own more than 14,9% of the company’s stock. The next day several members of the board congratulated Elon on his decision to join the board. Elon refiled his disclosure to classify himself as an active investor and he implied that he would have accepted the seat on the board.

On April 9th Elon Musk informed twitter that he would not have joined the board and during the day he shared harsh criticism towards the company and some jokes like suggesting to remove the “w” in Twitter. The next day Twitter makes the news public without giving any reason about his decision and the day after Elon files an amended disclosure with the SEC that lets him purchase as many shares as he wants since he no longer has a board seat and doesn’t need to act in the best interest of shareholders.

On April 14th Musk offered to buy the whole company and announced it through a tweet with a link to the official SEC filing. The offer was for $54.20 a share paid in cash and that would value the deal at $43 billion. The price he offered was a 54% premium compared to the price of the stock before he started to build his stake. The next day, Twitter responds to his offer by enacting a ‘poison pill’ to ward off Musk’s takeover. A poison pill allows shareholders to purchase shares at a discount if any shareholder exceeds 15% ownership. Therefore making an open-market acquisition very costly if not impossible. In the next few days Elon started to complain that the board owned almost no shares and so their interests are not aligned with those of the shareholders.

On April 21st, Musk lined up $46.5 billion in funding and explored a tender offer for Twitter. The deal has been structured as a merger between Twitter Inc. and X Holdings II Inc. Another company called X Holdings I Inc. will be the parent company if the Twitter bid succeeds. The SEC filings showed that he had a $25.5 billion funding from Morgan Stanley and other financial institutions, including margin loans backed by his equity stake in Tesla and $21 billion in equity financing from himself. It is still debated how he will come up with $21 billion since it is estimated that he owns around $3 billions in liquid assets per Bloomberg. During the week ending Friday 29th he revealed that he had sold $8.5 billion worth of Tesla shares. He has also announced on Twitter that he is not planning on selling more shares.

On April 24th, the board of directors started talks with Musk as they began to take his offer more seriously. The next day, the board agreed to sell Twitter for his original offer of $54.20 a share. The deal is expected to close by the end of 2022.

On April 28th, it was reported that the FTC was examining whether Elon Musk’s initial 9.2% stake acquisition violated disclosure rules.

The deal has raised an enormous amount of chaos regarding what will happen to Twitter under Musk’s control since he has announced that he is planning substantial changes regarding how free speech is handled on the platform. This has led to criticism from users of the platform and politicians all around the world. It is still to be seen if the deal will go through or if Musk will back out. It is very interesting to notice that in case he backs out he will have to pay as little as $1 bn which is a significantly lower penalty than the typical leveraged buyout.

Sources:

By Federico Longhi and Matthias Puricella

On April 28th, it was reported that the FTC was examining whether Elon Musk’s initial 9.2% stake acquisition violated disclosure rules.

The deal has raised an enormous amount of chaos regarding what will happen to Twitter under Musk’s control since he has announced that he is planning substantial changes regarding how free speech is handled on the platform. This has led to criticism from users of the platform and politicians all around the world. It is still to be seen if the deal will go through or if Musk will back out. It is very interesting to notice that in case he backs out he will have to pay as little as $1 bn which is a significantly lower penalty than the typical leveraged buyout.

Sources:

- Financial Times

- Business Insider

- Investopedia

By Federico Longhi and Matthias Puricella