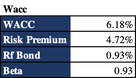

Despite the ongoing pandemic slashed earnings for a lot of businesses, few companies have experienced a surge in profits, and this is particularly true for Garmin Ltd., which has been able to reap record profits as its revenue jumped 11.4% from 2019, reaching a spectacular level of 4.19 billion dollars.

Notwithstanding the increase in profitability, we think that the market has not properly priced in the bright prospects of the business, and according to our analysis, it is undervalued by approximately 29%.

We conducted our analysis examining the Company both from the qualitative and quantitative (both fundamental and technical) point of view.

Notwithstanding the increase in profitability, we think that the market has not properly priced in the bright prospects of the business, and according to our analysis, it is undervalued by approximately 29%.

We conducted our analysis examining the Company both from the qualitative and quantitative (both fundamental and technical) point of view.

Qualitative analysis

Business Overview

Garmin produces GPS-enabled hardware and software for five verticals: fitness, outdoors, auto, aviation, and marine. The Company relies on licensing mapping data to enable its hardware specialized for often niche activities like scuba diving or sailing. Garmin operates in 100 countries and sells its products via distributors as well as relationships with Original Equipment Manufacturers (OEM).

The Company is a disruptive player across a range of industries. Its vertically integrated business model is a key competitive advantage, as it enables faster response to rapidly changing market dynamics plus cost controls. Garmin’s robust performance in 2020 can be attributed to its strong position in the Marine, Fitness, and outdoor business segments that were net beneficiaries of the COVID-19 environment.

The Company is a disruptive player across a range of industries. Its vertically integrated business model is a key competitive advantage, as it enables faster response to rapidly changing market dynamics plus cost controls. Garmin’s robust performance in 2020 can be attributed to its strong position in the Marine, Fitness, and outdoor business segments that were net beneficiaries of the COVID-19 environment.

Industry Overview

Garmin is part of the consumer discretionary sector in the consumer electronics sub-industry. Rapidly increasing penetration of internet connectivity & services in several developed and developing economies across the globe is providing robust growth opportunities for the consumer electronics market. Revenue is expected to show an annual growth rate (CAGR 2021-2025) of 4.03%, resulting in a projected market volume of USD 487'191m by 2025. The rapid spread of COVID-19 has adversely impacted the consumer electronics industry. While there were disruptions in supply chain and logistics, restrictions on trade and production capacity, the industry is expected to continue to gain momentum in Q1 2021. Additionally, the government policies within the industry require strict licensing and legal requirements to be fulfilled before a company can start selling. This makes it difficult for new entrants to join the industry.

Porter 5 Forces

Analyzing the strategic position of the Company, it is fundamental to examine what are its contributing factors.

According to Porter’s model, Garmin’s strategic forces are:

According to Porter’s model, Garmin’s strategic forces are:

- Threat of New Entrants: WEAK. The economies of scale are fairly difficult to achieve in the industry in which Garmin Ltd operates. This makes it easier for those producing large capacitates to have a cost advantage. It also makes production costlier for new entrants.

- Bargaining Power of Suppliers: WEAK. The number of suppliers in the industry in which Garmin Ltd operates is a lot compared to the buyers. The products that these suppliers provide are fairly standardized, less differentiated, and have low switching costs.

- Bargaining Power of Buyers: WEAK. The number of suppliers in the industry in which Garmin Ltd operates is a lot more than the number of firms producing the products.

- Threat of Substitutes: WEAK. The very few substitutes available are of high quality but are more expensive.

- Competitive Rivalry: STRONG. The exit barriers within the industry are particularly high due to the high investment required in capital and assets to operate. Exit barriers are also high due to government regulations and restrictions. This makes firms within the industry reluctant to leave the business, and these continue to produce even at low profits.

Business opportunities

Garmin is currently under a heavy investment cycle in its auto business segment, as it expands its OEM manufacturing facility in Europe. While it is expected that there will be additional losses at Auto., as investment continues, revenue will ramp up towards the end of 2021. Additionally, the Aviation segment will continue to be pressured by the persistent impact of the pandemic. Despite this, Garmin is expected to position itself in the small/mid-size and owner flown aircraft segments of the market.

Risks

- Faster-than-expected commoditization of Garmin's core GPS-enabled business.

- Increased cannibalization of stand-alone Personal Navigation Devices (PNDs) by GPS enabled smartphones, such as free mapping software from Google or Apple.

- Macroeconomic risks in consumer and industrial spending that could impact Garmin's very profitable non-PND Aviation, Marine, Outdoor, and Fitness business segments.

- Development risks with aircraft certification programs.

- Increased competition in the wearables market could pressure revenue growth and profit margins.

Catalysts

- Faster-than-expected growth from new products like smart-wearables in the fitness and outdoor segment and the development of an innovative category-making product.

- Increased demand for wearables could provide further upside to current estimates.

- FAA’s (Federal Aviation Administration) modernization of regulation may make certifications more difficult to obtain due to sensitive equipment transitions, leading to proportionally more avionics certification for Garmin.

Quantitative analysis

DCF Valuation

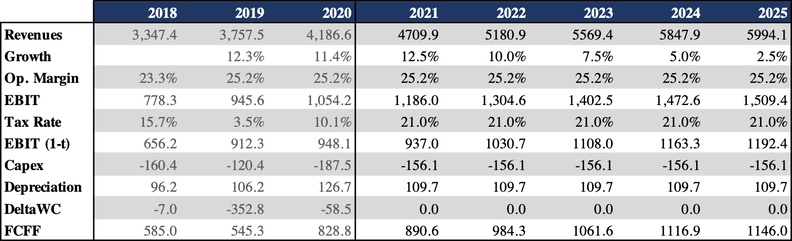

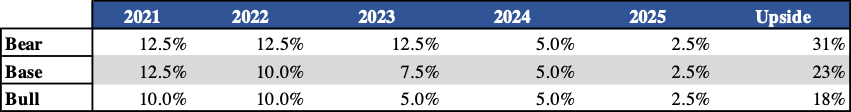

In order to provide a range of possible prices, a DCF valuation has been carried out, taking into consideration the performance of the company in the past three years, and forecasting FCFF for a period of 5 years in three different scenarios.

Source: FactSet

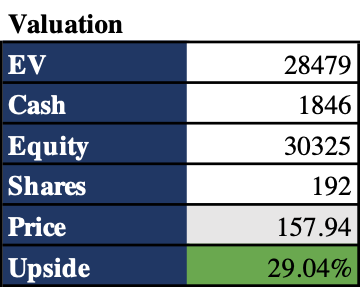

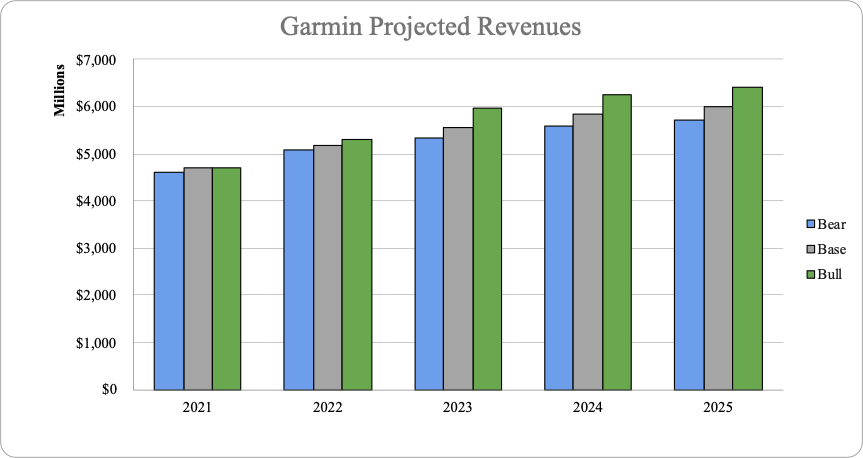

Considering a WACC of 6.18% (which is equal to the cost of equity, due to the absence of debt outstanding), the present value of FCFF is 28.479 bn USD, which leads to a price per share of 158$. This base scenario considers a period of high growth that linearly declines until stability in perpetuity (2.5%). In particular, revenues in the fitness, outdoor and marine segments are expected to increase following the trend of 2020, as visible in the table below. As tax rate, the marginal US corporate tax rate has been applied, while DeltaWC has been assumed to be 0. Capex and Depreciation were calculated as the average in the past three years; the operating margin is kept constant at 25.2%. The upside estimated is therefore 29%.

Source: Garmin

Two other scenarios have been analyzed, a more conservative one and a more optimistic one. The first one takes into consideration the potential impact of a further reduction in revenues in the aviation and auto segment, while in the second the growth rate declines less rapidly. In particular, the fitness segment will benefit from the growth of advanced wearables and cycling products and from strategic acquisitions that are planned in the next few years. The outdoor segment will instead capitalize on increased consumer interest in outdoor activities. Moreover, the marine market is also expanding and Garmin is innovating in the field. On the other side, risks are represented by the aviation and auto segments, hardly hit by Covid-19.

The bear scenario considers that these last two segments will take longer to recover from the pandemic: in fact, the ICAO (International Civil Aviation Organization) estimates only a 49% return with respect to 2019 levels in flight. The bull scenario considers instead a faster recovery thanks to the spread of vaccines and the continuous increment in fitness interest. Results are summarized in the table and graph below.

The bear scenario considers that these last two segments will take longer to recover from the pandemic: in fact, the ICAO (International Civil Aviation Organization) estimates only a 49% return with respect to 2019 levels in flight. The bull scenario considers instead a faster recovery thanks to the spread of vaccines and the continuous increment in fitness interest. Results are summarized in the table and graph below.

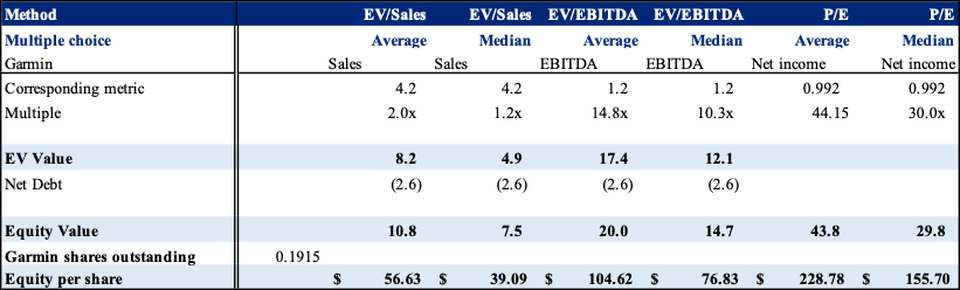

Trading Multiples Valuation

Source: FactSet

Having carried out the DCF valuation, it would be useful to evaluate Garmin by examining the performance of its competitors by their multiples valuation. The competitors analyzed are part of the consumer electronics industry, and, compared to its peers, Garmin seems to be (not considering the P/E multiple) expensively valued, but with high potentials for growth. The P/E multiples and EV/EBITDA show two different opinions: Garmin’s price over earning ratio is 24.59x while the average is 44.15 leading to a multiple price-per-share valuation between 156$ and 229$ which is above the actual value. On the other hand, looking at the EV/EBITDA multiples, Garmin looks higher than his competitors with a multiple of 18.27x even though it shows an operational value lower than the actual one. Indeed, the equity value obtained from the EV multiples has a maximum value of 105, still lower than the actual value. Hence, under these metrics, Garmin seems overvalued compared to its peers, but it could be due to the fact that the company competes across industries and it is hard to find a perfect competitor. Because Garmin is a flexible company, its potential growth is higher with respect to the others and reaches almost 7% long-term growth (source: FactSet). For instance, Panasonic, the only peer that has a similar market cap, has just a 4% long-term growth rate (source: reports from FactSet). Overall, by judging both multiple valuations, Garmin’s actual value is suitable for a medium/short-term investment.

Technical Analysis

Having conducted fundamental analysis on Garmin, supporting our findings with technical analysis would further reduce uncertainty and add a different point of view regarding the rationale of our stock’s recommendation.

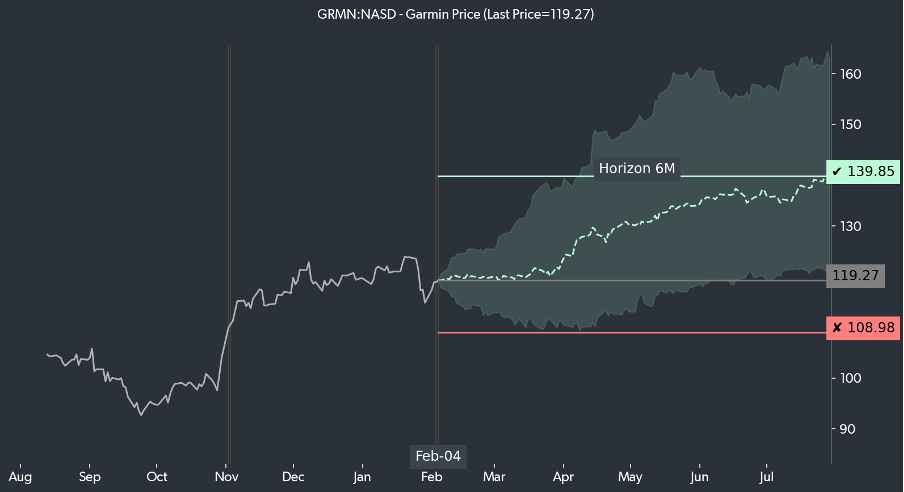

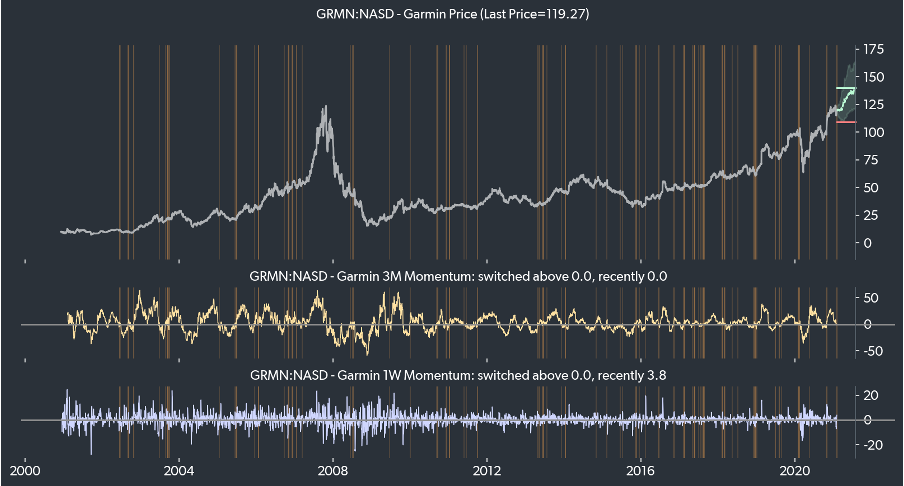

Using data taken from TOGGLE, an innovative AI-powered investment research platform, we analyzed a peculiar insight about Garmin, automatically generated by the system. Particularly, the platform, by scanning through the behavior of the stock in relation to several variables, recognized a significant consistency between GRMN’s 1-week and 3-month momentum turning positive and a subsequent increase in the Company’s share price in the following 6 months, leading to a median return of 17.25%.

Using data taken from TOGGLE, an innovative AI-powered investment research platform, we analyzed a peculiar insight about Garmin, automatically generated by the system. Particularly, the platform, by scanning through the behavior of the stock in relation to several variables, recognized a significant consistency between GRMN’s 1-week and 3-month momentum turning positive and a subsequent increase in the Company’s share price in the following 6 months, leading to a median return of 17.25%.

Source: TOGGLE

The projection above shows the expected price path (dotted line) derived from the past episodes TOGGLE examined. The shaded area represents confidence intervals. The horizontal red line signifies when price action is too far from the expected path and the insight is invalidated. The horizontal green line indicates the level the stock is expected to reach (following the last occurrence of the signal, the analysis points to a predicted price of 139.85, a 14.2% upside from the last price of March 5th, 2021).

Source: TOGGLE

The chart above displays when the drivers (Garmin 3-month and 1-week Momentum both switching above 0.0) previously triggered this condition. There have been 46 distinct episodes comprising a total of 125 trading days. 82% of those days resulted in an upward move over a 6M horizon.

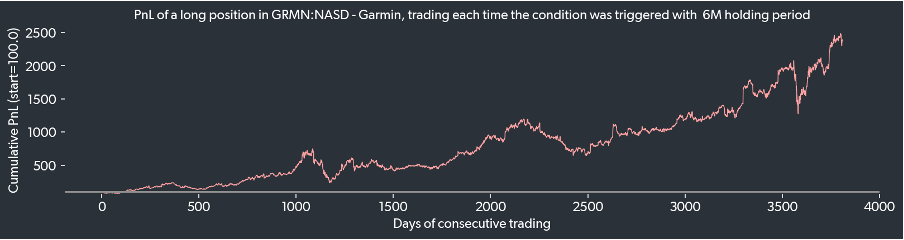

Notably, as shown by the graph below, if a (long) trade was executed on GRMN (with a 6-month holding period) each time the stated condition was active, the strategy would have had a spectacular annualized return of 33.7%.

Notably, as shown by the graph below, if a (long) trade was executed on GRMN (with a 6-month holding period) each time the stated condition was active, the strategy would have had a spectacular annualized return of 33.7%.

Source: TOGGLE

Conclusions

Garmin is benefiting from strong demand for advanced wearables and cycling products while new product releases and rising interest in fishing are supporting marine sales. The Company employs a corporate strategy that emphasizes continuous innovation, development, and introduction of new products. The process of coming to the market quickly with new technology is where Garmin has a competitive advantage. Our 12-month price target is based on our DCF valuation and P/E multiple analysis and equates to 158$ (an upside of about 29%).

Mattia Baroni

Nicolas Lockhart

Guglielmo Palmieri

Nicolas Lockhart

Guglielmo Palmieri

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.