On March 10 it was announced that AerCap Holdings, via AerCap US Aviation LLC, has entered into a definitive agreement to acquire 100% stake in GECAS from GE, via GE Capital US Holdings Inc. As consideration, AerCap will issue 111.5 million shares worth approximately $6 billion, pay cash of about $24 billion and a further $1 billion to be settled in notes, cash or a combination of both. The total deal value can be estimated as roughly $31 billion. Upon completion, GE will hold a 46% stake in AerCap, which will continue its activity under the AerCap name. Citigroup and Goldman Sachs are supporting the noteworthy transaction providing most of the debt financing to AerCap. The deal, already approved by both the board of directors of AerCap and GE, is subject to shareholder and regulatory approvals, the satisfaction of customary closing conditions and is expected to complete in Q4 2021.

GECAS

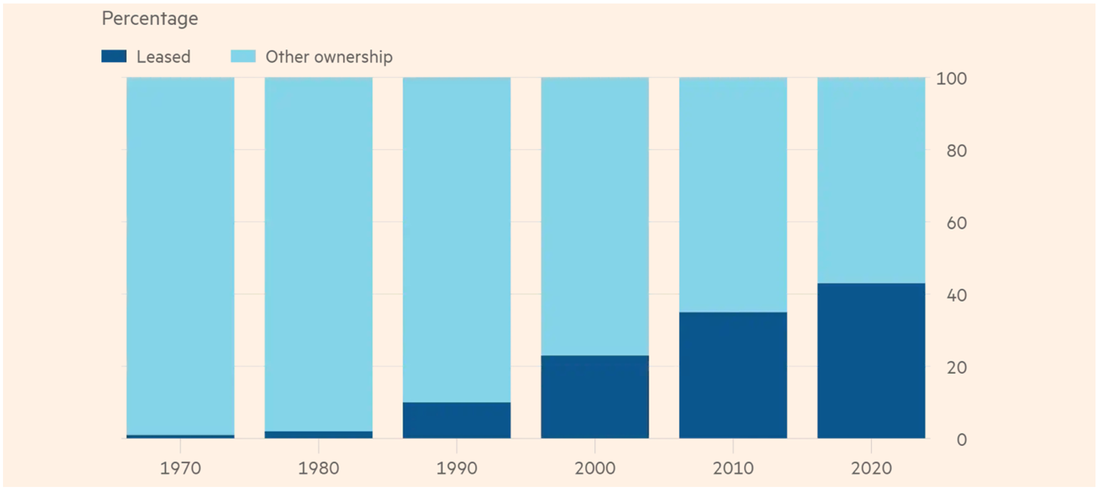

GECAS (GE Capital Aviation Services), a subsidiary of GE Capital – the finance arm of the conglomerate GE (General Electric) – is an Irish–American commercial aviation financing and leasing company. It is the largest commercial airline leasing/financing company in the world by number of aircraft. It offers many aviation financing services, including aircraft leasing, aircraft lending, engine leasing, asset management, and aircraft consulting. In terms of aircraft leasing, GECAS purchases aircraft from manufacturers (e.g. Boeing and Airbus) and then leases them to airlines. Contracts have a typical length of 8 years and are characterized as “dry lease contracts”. GECAS also offers purchase leasebacks. The company has two global headquarters located in Shannon, County Clare, and Norwalk, Connecticut and it has nearly 600 employees and 26 offices throughout the world. Available data shows that GECAS in Q4 2020 generated revenue of $3.9 billion, down 19% Y/Y ($4.9 billion in Q4 2019). Also, it reported a loss of $786 million versus a segment profit of $1 billion in Q4 2019.

AerCap

AerCap is an independent aircraft leasing company. It focuses on acquiring in-demand aircraft, funding them, hedging interest rate risk and using its platform to deploy these assets. AerCap operates its business on a global basis, leasing aircraft to customers in various geographical regions. The company is engaged in leasing, financing, sales and management of commercial aircraft and engines. AerCap owns approximately more than 1,300 aircraft. Its owned and managed aircraft were leased to approximately 200 customers in approximately 80 countries. It categorizes its aircraft services into aircraft asset management, administrative services and cash management services. AerCap provides aircraft asset management and corporate services to securitization vehicles, joint ventures and other third parties. In FY 2020, the company generated revenue of $4.4 billion ($1 billion in Q4) down 7.25% Y/Y ($4.75 billion revenues in FY 2019, of which $1.2 billion in Q4). Moreover, it reported a loss of $298.57 million ($62 million profit in Q4) compared to a net profit of $1.15 billion in 2019 ($351 million in Q4). Most current ratios show a gross margin of 93.73% and an operating margin of 22.42%. In FY 2020, AerCap increased its cash reserves by $194.94 million. Also, it earned $2.13 billion from its operations for a Cash Flow Margin of 48.37%. The company used $712.29 million on investing activities and paid $1.23 billion in financing cash flows. AerCap has a Debt to Total Capital ratio of 76.29% (total assets of $42.05 billion and total debt of $28.74 billion), lower than FY 2019.

GECAS

GECAS (GE Capital Aviation Services), a subsidiary of GE Capital – the finance arm of the conglomerate GE (General Electric) – is an Irish–American commercial aviation financing and leasing company. It is the largest commercial airline leasing/financing company in the world by number of aircraft. It offers many aviation financing services, including aircraft leasing, aircraft lending, engine leasing, asset management, and aircraft consulting. In terms of aircraft leasing, GECAS purchases aircraft from manufacturers (e.g. Boeing and Airbus) and then leases them to airlines. Contracts have a typical length of 8 years and are characterized as “dry lease contracts”. GECAS also offers purchase leasebacks. The company has two global headquarters located in Shannon, County Clare, and Norwalk, Connecticut and it has nearly 600 employees and 26 offices throughout the world. Available data shows that GECAS in Q4 2020 generated revenue of $3.9 billion, down 19% Y/Y ($4.9 billion in Q4 2019). Also, it reported a loss of $786 million versus a segment profit of $1 billion in Q4 2019.

AerCap

AerCap is an independent aircraft leasing company. It focuses on acquiring in-demand aircraft, funding them, hedging interest rate risk and using its platform to deploy these assets. AerCap operates its business on a global basis, leasing aircraft to customers in various geographical regions. The company is engaged in leasing, financing, sales and management of commercial aircraft and engines. AerCap owns approximately more than 1,300 aircraft. Its owned and managed aircraft were leased to approximately 200 customers in approximately 80 countries. It categorizes its aircraft services into aircraft asset management, administrative services and cash management services. AerCap provides aircraft asset management and corporate services to securitization vehicles, joint ventures and other third parties. In FY 2020, the company generated revenue of $4.4 billion ($1 billion in Q4) down 7.25% Y/Y ($4.75 billion revenues in FY 2019, of which $1.2 billion in Q4). Moreover, it reported a loss of $298.57 million ($62 million profit in Q4) compared to a net profit of $1.15 billion in 2019 ($351 million in Q4). Most current ratios show a gross margin of 93.73% and an operating margin of 22.42%. In FY 2020, AerCap increased its cash reserves by $194.94 million. Also, it earned $2.13 billion from its operations for a Cash Flow Margin of 48.37%. The company used $712.29 million on investing activities and paid $1.23 billion in financing cash flows. AerCap has a Debt to Total Capital ratio of 76.29% (total assets of $42.05 billion and total debt of $28.74 billion), lower than FY 2019.

Deal features and rationale

The main structure of the deal was described above. It is worth noting that General Electric will transfer $34 billion of GECAS’ net assets (including its engine leasing and Milestone helicopter leasing businesses) to AerCap. Current GECAS purchase obligations will transfer to AerCap, and GECAS’ more than 400 employees also will transfer to AerCap upon completion of the operation. Furthermore, under a shareholders’ agreement between the two companies, at closing GE will be entitled to nominate two directors to newly created seats on AerCap’s board. General Electric will be subject to a staged lock-up agreement allowing it to dispose a portion of its stake after 9 months and the entirety of its stake only after 15 months. Finally, GE will be subject to a customary standstill and other non-specified provisions.

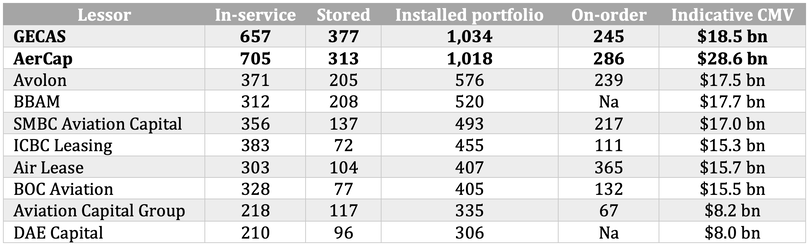

In my opinion, the several reasons backing the deal can be divided into operational/strategic motives and specific objectives pursued by GE. On the one side, the transaction is expected to enhance AerCap’s most valuable key credit metrics, as the newborn entity will have more resilient cash flows and a more diversified revenue and customer base (with limited overlap). AerCap plans to maintain its current investment grade credit ratings (and connected cost of financing) with global rating companies. At closing, the adjusted D/E ratio of the combined entity is expected to be 3.0x while AerCap will maintain its target adjusted D/E ratio of 2.7x and will work to return to this level quickly. The operation will establish a best-in-class trading platform with deep market insight and relationships (over the past four years AerCap and GECAS have sold on average over $5 billion of assets per year). The focus will be on narrowbody and new technology aircraft which will represent respectively 60% of the combined aircraft fleet and 56% of the combined in-service fleet (expected to grow to approximately 75% in the next three years). There will be an attractive order book of more than 490 new technology aircraft, 90%+ of which will be narrowbodies. Additionally, the premier engine leasing business will add revenue diversification and greater ability to provide innovative solutions to the new firm’s customers.

On the other side, GE will benefit from this deal by being able to get rid of the money-losing divisions. As we unfortunately know, the Covid-19 pandemic hit hard the global economy and had particularly brutal effects on the aviation business. Passenger demand fell deeply and, according to Boston Consulting Group (BCG) estimates, travel and the related-use/need for aircraft leasing may not rebound to pre-Covid levels until 2022/2023. Selling GECAS to AerCap, GE will therefore obtain significant short-term results in terms of improved profitability. However, thanks to its 46% stake in the newborn entity, it will still be able to benefit from the upside when things will eventually start to go back to normal. Moreover, this deal will allow GE to simplify its balance sheet and to focus on its industrial core (Power, Renewable Energy, Aviation, and Healthcare) while concretely reducing GE Capital assets and generating proceeds to further de-risk and de-lever. In Q1 2021 GE will record an approximate $3 billion non-cash charge and report GECAS as a discontinued operation. The rest of GE Capital (including Energy Financial Services – EFS) and the company’s run-off insurance operations, will move to GE Corporate. That is GE will report industrial-only financials and transit from 3-column to simpler 1-column financial statement reporting. After the closing, GE will use the proceeds and its existing cash sources to reduce its debt by around $30 billion, for an expected total reduction of more than $70 billion since the end of FY 2018. GE will also keep executing debt reduction and increasing earnings to reach its Industrial leverage target <2.5x Net Debt/EBITDA over the next few years.

Advisors of the parties

GECAS will be assisted by PJT Partners LP, Goldman Sachs and Evercore as financial advisors and by Paul, Weiss, Rifkind, Wharton & Garrison LLP, Clifford Chance LLP and A&L Goodbody as legal advisors on the transaction. On the other side, AerCap will be supported by Citi and Morgan Stanley as financial advisors and by Cravath, Swaine & Moore LLP, NautaDutilh NV and McCann Fitzgerald as legal advisors.

Riccardo Locatelli