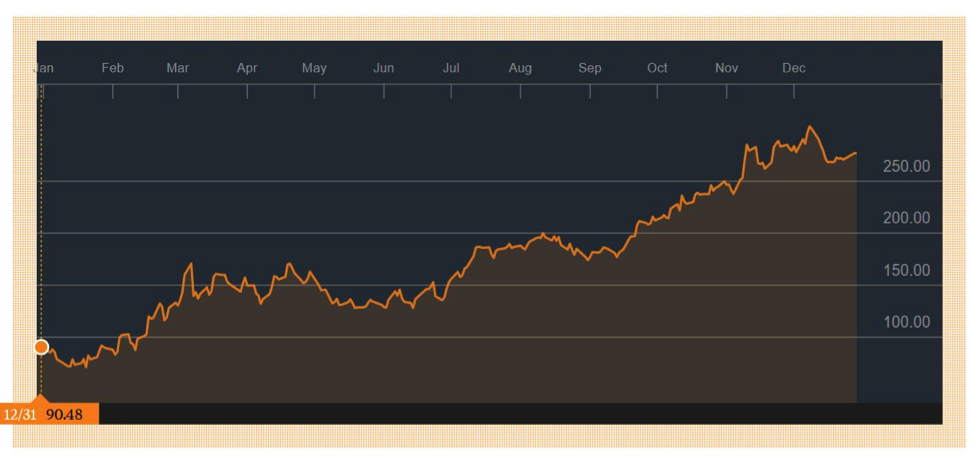

Glencore, the Swiss based mining and commodities company, was one of the best performing European stocks of 2016, returning 203.1% YTD (as of 29 December 2016). Even after this impressive performance the future looks promising.

Glencore is one of the world’s largest diversified commodities producers, processors and traders, with interests in agriculture, metals & mining and energy. In the fall of last year, when concerns about China’s growth sent financial markets tumbling, commodity and mining companies’ stocks experienced the largest losses. Glencore took a particular hard hit from the slump in commodity prices in 2015, when the stock lost 70% of its value. In Glencore’s case even CDS spreads widened, signaling fear of a possible bankruptcy by market participants. Like many other mining and commodity companies Glencore profited from the “commodities super cycle” that took place from the early 1990s until the financial crisis of 2008. During this phase commodity prices skyrocketed due to ever increasing demand from China and other emerging countries. Believing prices could not significantly decline, natural resource companies took on large amounts of debt and invested heavily in projects only profitable at high commodity prices. In 2015, when raw material prices declined, Glencore suffered a loss of $8.1bn.

Source: Bloomberg

After the experience of 2015, Glencore aggressively tried to strengthen its balance sheet in the past 15 months. The company started its efforts by raising $2.5bn equity in September 2015 and suspending dividend payments for 2016. It also focused on improving its cost structure by shutting down or reducing production in several mines. The company aggressively reduced its debt load in the past year, from $29.6bn in mid-2015 to about $17bn at the end of 2016. Glencore achieved this by buying back notes and selling assets deemed replaceable. The asset sales included a 40% stake in Glencore Agricultural Products to the Canada Pension Plan Investment Board for $2.5 billion, and the sale of the Australian coal transportation company GRail for $A 1.14 billion. Glencore raised $6.3bn in total through divestments.

Glencore is one of the world’s largest diversified commodities producers, processors and traders, with interests in agriculture, metals & mining and energy. In the fall of last year, when concerns about China’s growth sent financial markets tumbling, commodity and mining companies’ stocks experienced the largest losses. Glencore took a particular hard hit from the slump in commodity prices in 2015, when the stock lost 70% of its value. In Glencore’s case even CDS spreads widened, signaling fear of a possible bankruptcy by market participants. Like many other mining and commodity companies Glencore profited from the “commodities super cycle” that took place from the early 1990s until the financial crisis of 2008. During this phase commodity prices skyrocketed due to ever increasing demand from China and other emerging countries. Believing prices could not significantly decline, natural resource companies took on large amounts of debt and invested heavily in projects only profitable at high commodity prices. In 2015, when raw material prices declined, Glencore suffered a loss of $8.1bn.

Source: Bloomberg

After the experience of 2015, Glencore aggressively tried to strengthen its balance sheet in the past 15 months. The company started its efforts by raising $2.5bn equity in September 2015 and suspending dividend payments for 2016. It also focused on improving its cost structure by shutting down or reducing production in several mines. The company aggressively reduced its debt load in the past year, from $29.6bn in mid-2015 to about $17bn at the end of 2016. Glencore achieved this by buying back notes and selling assets deemed replaceable. The asset sales included a 40% stake in Glencore Agricultural Products to the Canada Pension Plan Investment Board for $2.5 billion, and the sale of the Australian coal transportation company GRail for $A 1.14 billion. Glencore raised $6.3bn in total through divestments.

Source: Bloomberg

Even after the significant stock price appreciation in 2016 Glencore looks poised for strong performance in the future. In December, several signs indicated better days ahead. The CEO and the second largest shareholder Ivan Glasenberg declared in the beginning of December that the company had “delivered on our commitments” to reduce leverage. After achieving the envisaged debt reduction in a short time period, Glencore surprisingly announced a dividend of $1 billion in 2017 for stockholders, signaling the management’s optimism for the upcoming year. Additionally, Glencore began investing again. The company teamed up with Qatar’s sovereign wealth fund to buy a 19.5% stake in Russia’s oil company Rosneft for $11bn, which would be the largest foreign investment in Russia since the beginning of the Ukraine crisis if the deal were closed. Although Glencore only provides $300m, the investment is a clear sign that the company is shifting its focus from restoring the balance sheet to investing. With recovering oil prices and the OPEC output cut this investment could be perfectly timed.

Glencore shares could continue to perform well in 2017. With a restored balance sheet, reduced costs and management signaling optimism for future prospects, the company is positioned to profit from an increase in commodity prices. Even though hard to forecast, commodity prices bottomed in 2015 and due to decreased investments and closure of mines by commodity companies, supply will not be increased significantly in the near future, which could drive prices back to higher levels. Therefore, Glencore could be a major winner of 2017, again.

Mathias Hoerl

Even after the significant stock price appreciation in 2016 Glencore looks poised for strong performance in the future. In December, several signs indicated better days ahead. The CEO and the second largest shareholder Ivan Glasenberg declared in the beginning of December that the company had “delivered on our commitments” to reduce leverage. After achieving the envisaged debt reduction in a short time period, Glencore surprisingly announced a dividend of $1 billion in 2017 for stockholders, signaling the management’s optimism for the upcoming year. Additionally, Glencore began investing again. The company teamed up with Qatar’s sovereign wealth fund to buy a 19.5% stake in Russia’s oil company Rosneft for $11bn, which would be the largest foreign investment in Russia since the beginning of the Ukraine crisis if the deal were closed. Although Glencore only provides $300m, the investment is a clear sign that the company is shifting its focus from restoring the balance sheet to investing. With recovering oil prices and the OPEC output cut this investment could be perfectly timed.

Glencore shares could continue to perform well in 2017. With a restored balance sheet, reduced costs and management signaling optimism for future prospects, the company is positioned to profit from an increase in commodity prices. Even though hard to forecast, commodity prices bottomed in 2015 and due to decreased investments and closure of mines by commodity companies, supply will not be increased significantly in the near future, which could drive prices back to higher levels. Therefore, Glencore could be a major winner of 2017, again.

Mathias Hoerl