The Goldman Sachs Group, Inc., worth over $120 billion on the New York Stock Exchange (NYSE), is set to undergo a major reorganization, planning to reportedly combine its four main divisions into three. Needing little introduction, the American company has been leading the global banking industry for several years and still maintains its leadership position, as the firm’s 2022 Q3 results show. In fact, net revenues have reached $11.98 billion ($36.77 billion YTD), and the company ranked #1 worldwide in completed M&A deals and equity-related offerings. Nevertheless, the Wall Street giant aims at a further increase in revenues by focusing on fee-based clients and to embark on a new technology-oriented era of customer care. After an overview of the bank’s major activities, this article will focus on Goldman Sachs’ reshuffle, the rationales behind it, and the implications it will have on the future of the bank.

Overview

Goldman Sachs’s structure has not changed since a previous major internal reorganization in 2020. CEO David Solomon’s tendency to reform the company’s structure and culture is no secret. The main purposes of his plan were to “strengthen [the] core businesses, diversify products and services and operate more efficiently”. Following the 2020 reorganization, the bank is currently organized into four main divisions: Global Markets, Asset Management, Consumer & Wealth Management, and Investment Banking.

The reorganization

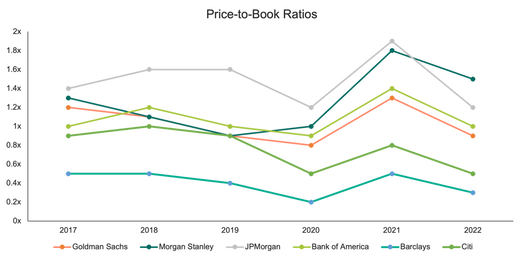

The goal is to transform Goldman’s culture and practices into something more streamlined and better oriented toward a “client-centric organizational structure”. By taking this decision, the business aims at increasing management fees, enlarging the share of business it captures from rivals, and expanding its vice to the largest clients with the most complex needs using a renewed digital platform. Furthermore, the reorganization aims at addressing Goldman Sachs’ low stock market valuation. In fact, even though the firm delivered record profits and its share price hit a record high last year, its price-to-book ratio, comparing the company’s stock price against the value of its assets, has lagged behind competitors such as Morgan Stanley, JPMorgan Chase, Bank of America, Barclays or Citi as the graphs below show*:

[INSERT PICTURE DESCRIPTION HERE]

Looking to the future

Global investment banks restructure all the time, but usually they are limited to movements of some teams internally within divisions. Instead, Goldman Sachs’ announced large reorganization highlights that the leading investment bank in the world has some qualms about its current business plan’s ability to create future growth.

By Analyst 1, Analyst 2, Analyst 3, Analyst 4

SOURCES

- The New York Times

- Reuters

- The Wall Street Journal

- Financial Times

- CNN

- Bloomberg

- CNBC

- Goldman Sachs’ 2020 Annual Report

- Goldman Sachs’ Q3 2022 Report

- Goldman Sachs’ Official Website