In this article we are going to analyse how Indonesia is a potential hub to new startups and how GoTo was able to develop its business in the country until its IPO, discussing its competitors and what challenges the company could face.

Introduction and Indonesian start-up market

Indonesia, with the world’s fourth largest population and a rapidly growing middle class, has one of the most flourishing economic outlooks in Asia: a report by the IMF and the World Bank projects that it will become the 5th largest economy by 2024. Being an attractive market for foreign businesses is due to the country’s size, growth opportunities, a dynamic startup ecosystem and a fast-growing internet economy, factors that have also seemed to accelerate Indonesia’s own growth.

Introduction and Indonesian start-up market

Indonesia, with the world’s fourth largest population and a rapidly growing middle class, has one of the most flourishing economic outlooks in Asia: a report by the IMF and the World Bank projects that it will become the 5th largest economy by 2024. Being an attractive market for foreign businesses is due to the country’s size, growth opportunities, a dynamic startup ecosystem and a fast-growing internet economy, factors that have also seemed to accelerate Indonesia’s own growth.

It is a fact that investment in Indonesian startups has been trending upwards for years. The country’s wellbeing, despite the impact of COVID-19, not only permitted Indonesian tech startups to manage and overcome the outbreak’s challenges, but also to play a crucial role in helping the country’s economy to recover from the pandemic’s impact. The mobile and fintech sectors are currently experiencing an explosion in popularity and financing, with the latter being one of the main businesses of the company GoTo, which we are going to analyse in this article.

Other factors helped the advancement of this trend. Firstly, Indonesia’s internet economy soaring at an average growth rate of 49% a year since 2015 has positioned the country as the largest, fastest growing internet economy in Southeast Asia, well on track to cross $130 billion by 2025. Secondly, the number of internet users in Indonesia went from only $30 million in 2009, to more than $150 million today, making the country an attractive market for internet-enabled businesses.

Importance must also be placed onto the opportunities in the capital city of Indonesia, Jakarta. Jakarta’s estimated overall ecosystem value stands at $26.3 billion, making it the world’s most valuable emerging ecosystem. Furthermore, a total of $845.9 million in total early stage-funding was raised in the city, in 2020; this ensured Jakarta’s ranking as second overall in a list of over 100 emerging ecosystems, well ahead of popular hubs like Barcelona, Dubai and Zurich.

The recent increase in Venture Capital activity, led by Indonesia-based VC East Ventures (one of Asia most active startup investors, which funded approximately 300 startups worldwide, including about 170 located in Indonesia), had a positive social impact on the country’s micro-finance sector, particularly regarding the aspect of financial inclusion. This is fundamental for a country like Indonesia, where around 47 million adults lack access to mainstream financial services and products, and 92 million people have never used a bank.

Indonesia is the second largest VC market in Southeast Asia regions, only preceded by Singapore; it also hosts a total of 2,100 startups and holds the fifth position worldwide for number of startups, only preceded by the USA, India, Great Britain, and Canada.

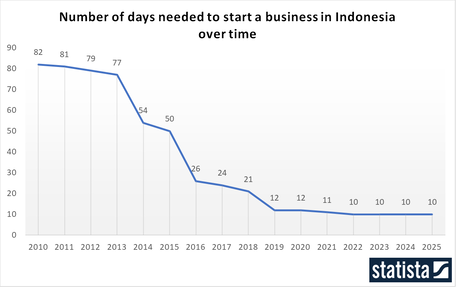

Another key factor enabling the growth in terms of launches of new companies is the constantly decreasing average number of days needed to start a business in the country. From 2010 to date, the days to launch a startup have decreased eightfold, as we can see in the graph below.

Other factors helped the advancement of this trend. Firstly, Indonesia’s internet economy soaring at an average growth rate of 49% a year since 2015 has positioned the country as the largest, fastest growing internet economy in Southeast Asia, well on track to cross $130 billion by 2025. Secondly, the number of internet users in Indonesia went from only $30 million in 2009, to more than $150 million today, making the country an attractive market for internet-enabled businesses.

Importance must also be placed onto the opportunities in the capital city of Indonesia, Jakarta. Jakarta’s estimated overall ecosystem value stands at $26.3 billion, making it the world’s most valuable emerging ecosystem. Furthermore, a total of $845.9 million in total early stage-funding was raised in the city, in 2020; this ensured Jakarta’s ranking as second overall in a list of over 100 emerging ecosystems, well ahead of popular hubs like Barcelona, Dubai and Zurich.

The recent increase in Venture Capital activity, led by Indonesia-based VC East Ventures (one of Asia most active startup investors, which funded approximately 300 startups worldwide, including about 170 located in Indonesia), had a positive social impact on the country’s micro-finance sector, particularly regarding the aspect of financial inclusion. This is fundamental for a country like Indonesia, where around 47 million adults lack access to mainstream financial services and products, and 92 million people have never used a bank.

Indonesia is the second largest VC market in Southeast Asia regions, only preceded by Singapore; it also hosts a total of 2,100 startups and holds the fifth position worldwide for number of startups, only preceded by the USA, India, Great Britain, and Canada.

Another key factor enabling the growth in terms of launches of new companies is the constantly decreasing average number of days needed to start a business in the country. From 2010 to date, the days to launch a startup have decreased eightfold, as we can see in the graph below.

To summarise, Indonesia is an overall growing economy with a consistent influx of capital into startups. The country’s internet penetration increases year over year, and its ecosystem attracts great interest from VC firms. Jakarta, the capital city, ranks as the world’s second most promising emerging startup ecosystem, and starting a business there is becoming an incredibly fast process.

GoTo as a Company

GoTo’s history

The name GoTo is a product of the merger of the two apps Gojek and Tokopedia. Tokopedia was founded in 2009, as an e-commerce platform connecting small merchants with buyers: its services were offered through the Tokopedia app, starting from 2014. Gojek was founded in 2010, as a call centre for arranging transportation, especially motorbike taxis and courier deliveries.

The companies started operating together in 2015, making Gojek’s drivers deliver Tokopedia products on the same day of the order, during their off-peak riding hours. This was the first partnership between an on-demand platform and an e-commerce platform.

In May 2021 they finally merged, in an astonishing $18 billion deal (Indonesia’s largest ever up to this point) and created the GoTo group, the most valuable tech-company of Indonesia, which contributes 2% to the country’s $1 trillion GDP; GoTo’s services also address nearly two-thirds of the country’s household consumption. The merger was substantial also to get closer to the size of GoTo’s competitors, Grab and Sea.

Already in November 2021 a private funding round was held, and raised $1.3 billion, implying a value of $28.5 billion of the company.

GoTo’s business model

GoTo has three big segments (in the following called verticals) of business, two of which originating from the companies that were merged. The three verticals are ride-hailing (Gojek), e-commerce (Tokopedia), and payment services (GoTo financial). Today, GoTo’s business verticals are each market leaders in their respective fields in Indonesia, a result that is also due to the benefits gained from the synergies of them cooperating.

GoTo as a Company

GoTo’s history

The name GoTo is a product of the merger of the two apps Gojek and Tokopedia. Tokopedia was founded in 2009, as an e-commerce platform connecting small merchants with buyers: its services were offered through the Tokopedia app, starting from 2014. Gojek was founded in 2010, as a call centre for arranging transportation, especially motorbike taxis and courier deliveries.

The companies started operating together in 2015, making Gojek’s drivers deliver Tokopedia products on the same day of the order, during their off-peak riding hours. This was the first partnership between an on-demand platform and an e-commerce platform.

In May 2021 they finally merged, in an astonishing $18 billion deal (Indonesia’s largest ever up to this point) and created the GoTo group, the most valuable tech-company of Indonesia, which contributes 2% to the country’s $1 trillion GDP; GoTo’s services also address nearly two-thirds of the country’s household consumption. The merger was substantial also to get closer to the size of GoTo’s competitors, Grab and Sea.

Already in November 2021 a private funding round was held, and raised $1.3 billion, implying a value of $28.5 billion of the company.

GoTo’s business model

GoTo has three big segments (in the following called verticals) of business, two of which originating from the companies that were merged. The three verticals are ride-hailing (Gojek), e-commerce (Tokopedia), and payment services (GoTo financial). Today, GoTo’s business verticals are each market leaders in their respective fields in Indonesia, a result that is also due to the benefits gained from the synergies of them cooperating.

GoTo earned revenues of one billion USD in 2021, which marks a CAGR of 56% from the fiscal year of 2018 on.

The company also reports 100 million monthly users: this number especially surged during lockdown, since 37% of all digital service consumers in Indonesia are using said services due to COVID-19. However, these numbers are also not expected to go down, as 93% of new digital service consumers intend to continue using the services also post-pandemic.

Neither Gojek nor Tokopedia are profitable yet, but the growth prospects for the Indonesian markets look great. According to a study by Google, Temasek and Bain, the world’s fourth-most populous nation has a lot of potential when it comes to the total addressable market size of GoTo’s subverticals up to 2025. In the graph below you can see that the markets are all expected to at least triple in size, with especially high growth rates for the financial technology sector.

The company also reports 100 million monthly users: this number especially surged during lockdown, since 37% of all digital service consumers in Indonesia are using said services due to COVID-19. However, these numbers are also not expected to go down, as 93% of new digital service consumers intend to continue using the services also post-pandemic.

Neither Gojek nor Tokopedia are profitable yet, but the growth prospects for the Indonesian markets look great. According to a study by Google, Temasek and Bain, the world’s fourth-most populous nation has a lot of potential when it comes to the total addressable market size of GoTo’s subverticals up to 2025. In the graph below you can see that the markets are all expected to at least triple in size, with especially high growth rates for the financial technology sector.

However, GoTo is also aware of its responsibility towards bringing more sustainability in the e-commerce and transportation environment. As GoTo is active in the logistics sector, there are a lot of emissions coming from transportation, packaging as well as scope three emissions from their merchants and consumers. The company committed to zero waste and zero emissions by 2030, to sustain the planet for the next generations.

Gojek is an on-demand platform empowering entrepreneurs to make cities more accessible and engaging. Initially, Gojek operated as call centre which enabled motorcycle taxi drivers (ojek) to navigate the often traffic-clogged cities. In the meantime, the company developed into a service provider for mobility, food delivery and logistics, connecting more than 2.5 million drivers of motorcycle and cars as well as over one million GoFood merchants in Indonesia, Vietnam, and Singapore.

Tokopedia is an e-commerce platform that is connecting 12 million registered merchants to 270 million consumers, spread across 17,000 islands in Indonesia. Prior to Tokopedia, consumers located in various parts of the country paid different prices for the same products: well-connected city-inhabitants were paying less than consumers in rural regions. Tokopedia and their mission to offer equal prices to everyone wants to help reducing social inequalities between various parts of the country. To achieve its goal, Tokopedia is also active in the logistics and fulfilment industry, allowing consumers to get groceries delivered within two hours, while aggregating orders from multiple merchants into one shipment. It also offers marketing and advertising technology to its merchants.

Additionally, GoTo’s financial services are accessible to the rural population within Indonesia, which previously often had problems accessing banking services. The World bank reports, for example, that in 2017 only 31% of Indonesian adults owned either a debit or credit card, and only 49% owned a transaction account. A joint study by Google, Bain & Company and Temasek found that 56% of new consumers to digital services were from non-metropolitan regions. As almost every citizen has a smartphone, and therefore the possibility to access the world wide web, digitalizing banking and financial services can bring substantial benefits for a country, benefits such as accelerated economic growth and decreased social inequalities.

GoTo Financial was initially a part of Gojek, but with the merger of Gojek and Tokopedia the business segment was established as a separate branch of the GoTo group. GoTo Financials’ key product is the app GoPay, which was created in 2016, and allowed Gojek’s customers to wire transfer money in Jakarta. Nowadays, the service range of the app was vastly expanded, and offers not only digital payments, but also financial services like purchases on credit and insurance products, as well as investment opportunities for consumers all over Indonesia. Moreover, GoTo Financials does not only focus on consumers anymore, but also on businesses of all sizes. Midtrans is, for example, one of Indonesia’s leading payment gateways, processing online and offline payments for merchants. Working capital solutions as well as webstores’ builder platforms that integrate with Instagram’s, Facebook’s, and Google’s shops, are part of the services that GoTo Financial offers.

The IPO

On March 15, 2022, GoTo announced its IPO on the Indonesian stock exchange, planning to raise a minimum of $1.1 billion. The valuation of the company would thereby go up to 29 bn USD.

The proceeds will be used for supporting the working capital demands of the group, contributing to GoTo’s growth strategy. The book building process was originally scheduled to last from March 15 to March 21 but was extended to March 24. The reason for this decision is the Gotong Royong Share Program, which was introduced by GoTo: it is part of GoTo’s ongoing commitment to deliver social impact as well. By introducing the project GoTo’s drivers, its consumers and merchants now get the opportunity to become shareholders in the company and influence the further development of the business in the future themselves.

The public offering itself is set for the first week of April 2022. The company announced a total number of 48 billion Series A share (upsizeable to 52 billion shares) with a price range of 316 to 346 IDR. The new capital would make up 4.35% of the enlarged capital upon completion of the IPO, and the transaction is set up with a green shoe option, which could bring in additional capital of $160 million. The underwriters of the transaction are PT Indo Premier Sekuritas, PT Mandiri Sekuritas, and PT Trimegah Sekuritas Indonesia Tbk.

The decision for listing the stock on the Indonesian Stock Exchange is a big win for the Stock Exchange itself. The regulators had previously tried to convince local tech start-ups to IPO in their home market instead of abroad. One big disadvantage that this has for the companies there is that the Indonesian stock market experiences less liquidity than more developed western stock markets, making companies more hesitant to choose it. The success of GoTo’s IPO, as well as that of its rival Grab, will determine whether more tech start-ups will IPO in their local markets in South-East Asia as investor appetite will grow and thereby fulfil the regulators’ mission.

GoTo’s main competitors

Resilient economic growth, low government debt and a young population make Indonesia one of the most promising countries in terms of economic development. Being the world’s fourth most populous nation, with a median age of 29.7 years, the country presents auspicious conditions for the development of companies. For this reason, GoTo faces a lot of competitors that we will analyse in the following paragraphs.

Sea Limited

Sea Limited is a tech conglomerate established in Singapore. The company presents a market capitalisation of $67 billion, and its revenues saw a huge increase from $827 million in 2018 to $9.96 billion in 2021. However, the company is still unprofitable, reporting losses of more than $2 billion in 2021.

Sea provides 3 different products: Garena, Shopee and SeaMoney, and only the last two products compete with GoTo.

Garena was founded in 2009, and is an online game developer and publisher, operating in more than 130 markets. This product gained an enormous success in the world, and Garena is the developer of Free Fire, which was the most downloaded mobile game in 2019, 2020 and 2021 across the world.

Shopee is a leading e-commerce platform in Southeast Asia and Taiwan and was founded in 2015. In 2021, it continued to rank first in the shopping category, in terms of average monthly active users and total time spent in app according to data.ai (the source was mentioned in the full year 2021 report of the company).

SeaMoney is a digital payments and financial services provider, operating in Southeast Asia from 2014. The product allows customers to access to mobile wallet services, payment processing, credit, digital financial services, and products. This segment is enjoying robust growth and is expected to generate a positive cash flow in 2022. Even more, in 2021 SeaMoney products and services were up 89.7% year-on-year.

Grab

Grab is a super app providing services including digital financial services, mobility, and deliveries in Southeast Asia. The company reported a GMV of $16,061 million in 2021, with revenues of $675 million and a loss of $3,555 million. It operates in three segments: deliveries, payment services and mobility; it is also one of the main competitors of Goto in Indonesia.

The segment deliveries allow customers to receive cravings and groceries in just a few minutes, and to send packages or documents. In 2021, GMV was 8.5$ billion, representing a growth of 56% based on 2020 results. The importance of this segment is growing rapidly, as Grab is forging partnerships with global brands: in the fourth quarter of 2021, for example, Grab announced partnerships with McDonald’s and Starbucks.

Payment services provide customers insurance and investment products, as well as the possibility of making secure and cashless payments online and in-store. Total payments volume was $12.1 billion in 2021, registering a growth of 37% YoY.

Even more, Grab offers mobility services too, which enable customers to move safely with the liberty of choosing from a variety of vehicles. GMV for 2021 was $2.8 billion, registering a decline of 14% year-over-year. However, revenue grew to $456 million in 2021.

Bukalapak

Bukalapak is an e-commerce business, operating in Indonesia from 2010. Originally, it enabled small and medium companies to get on the world wide web, but it then started making investments to support small family-run businesses. As Bukalapak’s CEO told CNBC, in Indonesia “every maybe 50 or 100 houses, there will be one of these guys who opens a shop in their house, and they sell basic goods”. The risk of these small businesses is that, as they economy grows, they will be facing big challenges. Therefore, Bukalapak is thought to help small businesses come online and grow.

Achmad Zaky founded Bukalapak in 2010, with a small capital that was around the $5 needed for the registration fee to the website. During the years, the company saw an outstanding growth, and in 2021 it raised more than $1.5 billion through the IPO. Serving more than 100 million customers and 13.5 million enterprises, it is one of the leading e-commerce businesses in Indonesia, and is certainly one of the biggest competitors of Tokopedia, GoTo’s e-commerce.

Lazada

Lazada is an e-commerce company, founded in 2012 in Singapore and controlled by the Alibaba group. It operates in Asia, with a strong presence in Indonesia, Thailand, Singapore, and the Philippines. As declared in the December Quarter 2021 report of Alibaba Group, in the last quarter of 2021 the commerce retail business of the Group grew strongly, achieving 301 million annual active users, primarily due to Lazada, which saw a growth of 52%. These strong results are a consequence of Alibaba Group’s huge investments in growth initiatives, including the aforementioned company, whose spending in marketing and promotion for registered an increase in the past year.

Conclusion

Operating in one of the countries with the highest growth and in an industry that is registering remarkable results, GoTo has certainly the potential of delivering strong performance for investors. The importance of the IPO is certainly linked to the size of the deal but above all, it is a great opportunity for Indonesia stock exchange to improve its reputation. Only time will show if GoTo is able to develop a sustainable business model and the potential of Indonesia and its stock exchange

Sources

Asia Link Business

Bain

Bloomberg

CNBC

Deloitte

Financial Times

GoTo Company website

Greenhouse.co

Linkedin

Statista

Wikipedia

World Bank

Written by Davide Savarino, Emanuele Virno Lamberti and Nelly Eggert

Gojek is an on-demand platform empowering entrepreneurs to make cities more accessible and engaging. Initially, Gojek operated as call centre which enabled motorcycle taxi drivers (ojek) to navigate the often traffic-clogged cities. In the meantime, the company developed into a service provider for mobility, food delivery and logistics, connecting more than 2.5 million drivers of motorcycle and cars as well as over one million GoFood merchants in Indonesia, Vietnam, and Singapore.

Tokopedia is an e-commerce platform that is connecting 12 million registered merchants to 270 million consumers, spread across 17,000 islands in Indonesia. Prior to Tokopedia, consumers located in various parts of the country paid different prices for the same products: well-connected city-inhabitants were paying less than consumers in rural regions. Tokopedia and their mission to offer equal prices to everyone wants to help reducing social inequalities between various parts of the country. To achieve its goal, Tokopedia is also active in the logistics and fulfilment industry, allowing consumers to get groceries delivered within two hours, while aggregating orders from multiple merchants into one shipment. It also offers marketing and advertising technology to its merchants.

Additionally, GoTo’s financial services are accessible to the rural population within Indonesia, which previously often had problems accessing banking services. The World bank reports, for example, that in 2017 only 31% of Indonesian adults owned either a debit or credit card, and only 49% owned a transaction account. A joint study by Google, Bain & Company and Temasek found that 56% of new consumers to digital services were from non-metropolitan regions. As almost every citizen has a smartphone, and therefore the possibility to access the world wide web, digitalizing banking and financial services can bring substantial benefits for a country, benefits such as accelerated economic growth and decreased social inequalities.

GoTo Financial was initially a part of Gojek, but with the merger of Gojek and Tokopedia the business segment was established as a separate branch of the GoTo group. GoTo Financials’ key product is the app GoPay, which was created in 2016, and allowed Gojek’s customers to wire transfer money in Jakarta. Nowadays, the service range of the app was vastly expanded, and offers not only digital payments, but also financial services like purchases on credit and insurance products, as well as investment opportunities for consumers all over Indonesia. Moreover, GoTo Financials does not only focus on consumers anymore, but also on businesses of all sizes. Midtrans is, for example, one of Indonesia’s leading payment gateways, processing online and offline payments for merchants. Working capital solutions as well as webstores’ builder platforms that integrate with Instagram’s, Facebook’s, and Google’s shops, are part of the services that GoTo Financial offers.

The IPO

On March 15, 2022, GoTo announced its IPO on the Indonesian stock exchange, planning to raise a minimum of $1.1 billion. The valuation of the company would thereby go up to 29 bn USD.

The proceeds will be used for supporting the working capital demands of the group, contributing to GoTo’s growth strategy. The book building process was originally scheduled to last from March 15 to March 21 but was extended to March 24. The reason for this decision is the Gotong Royong Share Program, which was introduced by GoTo: it is part of GoTo’s ongoing commitment to deliver social impact as well. By introducing the project GoTo’s drivers, its consumers and merchants now get the opportunity to become shareholders in the company and influence the further development of the business in the future themselves.

The public offering itself is set for the first week of April 2022. The company announced a total number of 48 billion Series A share (upsizeable to 52 billion shares) with a price range of 316 to 346 IDR. The new capital would make up 4.35% of the enlarged capital upon completion of the IPO, and the transaction is set up with a green shoe option, which could bring in additional capital of $160 million. The underwriters of the transaction are PT Indo Premier Sekuritas, PT Mandiri Sekuritas, and PT Trimegah Sekuritas Indonesia Tbk.

The decision for listing the stock on the Indonesian Stock Exchange is a big win for the Stock Exchange itself. The regulators had previously tried to convince local tech start-ups to IPO in their home market instead of abroad. One big disadvantage that this has for the companies there is that the Indonesian stock market experiences less liquidity than more developed western stock markets, making companies more hesitant to choose it. The success of GoTo’s IPO, as well as that of its rival Grab, will determine whether more tech start-ups will IPO in their local markets in South-East Asia as investor appetite will grow and thereby fulfil the regulators’ mission.

GoTo’s main competitors

Resilient economic growth, low government debt and a young population make Indonesia one of the most promising countries in terms of economic development. Being the world’s fourth most populous nation, with a median age of 29.7 years, the country presents auspicious conditions for the development of companies. For this reason, GoTo faces a lot of competitors that we will analyse in the following paragraphs.

Sea Limited

Sea Limited is a tech conglomerate established in Singapore. The company presents a market capitalisation of $67 billion, and its revenues saw a huge increase from $827 million in 2018 to $9.96 billion in 2021. However, the company is still unprofitable, reporting losses of more than $2 billion in 2021.

Sea provides 3 different products: Garena, Shopee and SeaMoney, and only the last two products compete with GoTo.

Garena was founded in 2009, and is an online game developer and publisher, operating in more than 130 markets. This product gained an enormous success in the world, and Garena is the developer of Free Fire, which was the most downloaded mobile game in 2019, 2020 and 2021 across the world.

Shopee is a leading e-commerce platform in Southeast Asia and Taiwan and was founded in 2015. In 2021, it continued to rank first in the shopping category, in terms of average monthly active users and total time spent in app according to data.ai (the source was mentioned in the full year 2021 report of the company).

SeaMoney is a digital payments and financial services provider, operating in Southeast Asia from 2014. The product allows customers to access to mobile wallet services, payment processing, credit, digital financial services, and products. This segment is enjoying robust growth and is expected to generate a positive cash flow in 2022. Even more, in 2021 SeaMoney products and services were up 89.7% year-on-year.

Grab

Grab is a super app providing services including digital financial services, mobility, and deliveries in Southeast Asia. The company reported a GMV of $16,061 million in 2021, with revenues of $675 million and a loss of $3,555 million. It operates in three segments: deliveries, payment services and mobility; it is also one of the main competitors of Goto in Indonesia.

The segment deliveries allow customers to receive cravings and groceries in just a few minutes, and to send packages or documents. In 2021, GMV was 8.5$ billion, representing a growth of 56% based on 2020 results. The importance of this segment is growing rapidly, as Grab is forging partnerships with global brands: in the fourth quarter of 2021, for example, Grab announced partnerships with McDonald’s and Starbucks.

Payment services provide customers insurance and investment products, as well as the possibility of making secure and cashless payments online and in-store. Total payments volume was $12.1 billion in 2021, registering a growth of 37% YoY.

Even more, Grab offers mobility services too, which enable customers to move safely with the liberty of choosing from a variety of vehicles. GMV for 2021 was $2.8 billion, registering a decline of 14% year-over-year. However, revenue grew to $456 million in 2021.

Bukalapak

Bukalapak is an e-commerce business, operating in Indonesia from 2010. Originally, it enabled small and medium companies to get on the world wide web, but it then started making investments to support small family-run businesses. As Bukalapak’s CEO told CNBC, in Indonesia “every maybe 50 or 100 houses, there will be one of these guys who opens a shop in their house, and they sell basic goods”. The risk of these small businesses is that, as they economy grows, they will be facing big challenges. Therefore, Bukalapak is thought to help small businesses come online and grow.

Achmad Zaky founded Bukalapak in 2010, with a small capital that was around the $5 needed for the registration fee to the website. During the years, the company saw an outstanding growth, and in 2021 it raised more than $1.5 billion through the IPO. Serving more than 100 million customers and 13.5 million enterprises, it is one of the leading e-commerce businesses in Indonesia, and is certainly one of the biggest competitors of Tokopedia, GoTo’s e-commerce.

Lazada

Lazada is an e-commerce company, founded in 2012 in Singapore and controlled by the Alibaba group. It operates in Asia, with a strong presence in Indonesia, Thailand, Singapore, and the Philippines. As declared in the December Quarter 2021 report of Alibaba Group, in the last quarter of 2021 the commerce retail business of the Group grew strongly, achieving 301 million annual active users, primarily due to Lazada, which saw a growth of 52%. These strong results are a consequence of Alibaba Group’s huge investments in growth initiatives, including the aforementioned company, whose spending in marketing and promotion for registered an increase in the past year.

Conclusion

Operating in one of the countries with the highest growth and in an industry that is registering remarkable results, GoTo has certainly the potential of delivering strong performance for investors. The importance of the IPO is certainly linked to the size of the deal but above all, it is a great opportunity for Indonesia stock exchange to improve its reputation. Only time will show if GoTo is able to develop a sustainable business model and the potential of Indonesia and its stock exchange

Sources

Asia Link Business

Bain

Bloomberg

CNBC

Deloitte

Financial Times

GoTo Company website

Greenhouse.co

Statista

Wikipedia

World Bank

Written by Davide Savarino, Emanuele Virno Lamberti and Nelly Eggert