The idea that companies should adopt a broader perspective than simply maximising shareholders’ value is becoming highly popular, especially among socially responsible investors (SRI). The effects on community and environment has such an important impact on the brand of the company that ultimately it may also affect shareholders’ value. On the other hand, investors believe that stock picking techniques that embed Environmental Social and Governance (ESG) issues may create higher value for their clients. Despite not having enough evidence to support these choices in terms of extra-value creation, banks are adapting their array of services to match new corporations’ needs and some of them seem to be more innovative than others from this perspective.

The green bond market. Key players and trends

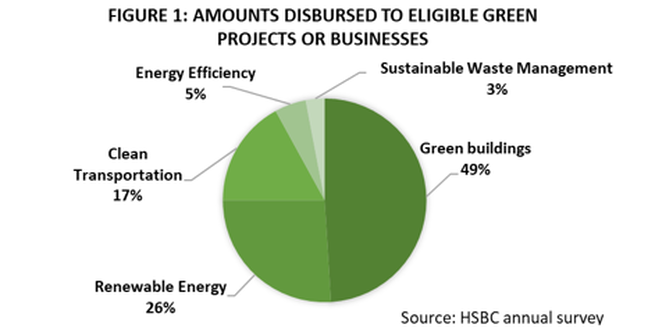

Green bonds are standard fixed income securities issued to finance a transition to low-carbon economy. The proceeds must be transferred to projects with low environmental impact or suitable to transform the business and make it more in line with a green economy. Up to now, proceeds have been mainly transferred to green buildings, renewable energy, and clean transportation as can be seen from figure 1 below.

The green bond market. Key players and trends

Green bonds are standard fixed income securities issued to finance a transition to low-carbon economy. The proceeds must be transferred to projects with low environmental impact or suitable to transform the business and make it more in line with a green economy. Up to now, proceeds have been mainly transferred to green buildings, renewable energy, and clean transportation as can be seen from figure 1 below.

After hitting record numbers in 2018, the green bond market is expected to grow at 80% in 2019 with new issues expected to reach USD 250 bn this year and a target of USD 1trillion in 2020, according to Climate Bond Initiative (CBI). This increasing trend keeps going up since 2013 and has been reinforced by international green-gas-emission mitigation plans as the Paris agreement.

Among non-financial corporations, the most relevant issuers are “super sovereigns” as the World Bank and Asian Development Bank, government-backed entities, local agencies, and energy and power firms which is not surprising given that the biggest energy companies are state-owned.

Starting from financials, major investment banks are part of the International Capital Market Association’s Executive Committee to define the green bond principles, which are a set of conditions that issuers should voluntarily adapt to in order to issue a bond belonging to this category. Plus, banks’ commitment towards sustainable finance increases, through both product creation and working with clients to structure financing for green projects. Moreover, banks are playing an essential role in tracking the use of proceeds to monitor whether the debt sold through their market divisions are generating the desired benefits desired, especially given the lack of a proper regulation that unequivocally categorize green bonds.

Concerning the public sectors, United States and China are the world’s largest issuers of green bonds and they allocate the proceeds to renewable plant constructions and clean coal projects. The recent decision of the People’s bank of China of converting coal fired power plant into cleaner sources of energy through the proceeds of green bonds issuances has been a radical starting point for a country that generates 60% of its electricity from coal. However, it has to be noticed that the concept of clean coal is loosely defined and a bit controversial as it generally simply refers to the use of higher-efficient technology to improve the energy-generation process. The risk is to see investors financing green development while proceeds will not be effectively dedicated towards low-carbon transition plans. For this reason, China is often seen as not serious about cutting emissions. Despite high amounts of green bonds issued, only half of them satisfy the green bond Principles (CBI), guidelines jointly defined by underwriters and issuers.

Among private entities, energy and power companies are the most concerned. A significant example is Enel SpA that placed three green bonds on the European market in January 2017 (€ 1.25bn), 2018 (€ 1.25 bn) and 2019 (€1 bn). The net issuance proceeds were used to finance the construction of renewable energy generation plants in Europe.

Why issue green bonds?

The first advantage for a company issuing green bonds consists of higher tax-deductible interest expenses. Green bonds issuance often comes with tax incentives such as tax credits aimed at making investments in special environmental projects more convenient for corporations compared to plain vanilla debt. The biggest risk associated with this advantage is the lack of a proper definition of green bonds. Despite having some reference guidelines defined by the Climate Bond Initiative (CBI), great flexibility is left to the individual company in defining the green development in which proceeds will be invested. This may lead to companies abusing these sources of financing to benefit of the related tax incentives without allocating the resources gathered in efficient green projects. In the past there has been many examples of companies investing green bond proceeds in a different direction from what originally expected by investors. One example is the EDF group that built a nuclear power plant issuing a multibillion green bond.

A second key driver justifying the positive trend of companies looking for green investments is the increasing market interest for this new investment products. Demand remains high among investors as green bonds allow them to sustainably invest without bearing additional risk and to eventually hedge against climate risk exposure from other assets in their portfolio. Moreover, recent researches rise the possibility of green bonds to be more secure than plain vanilla bonds because the environmental risk is already embedded in the security and in its pricing, while traditional securities do not take it into account. Investors’ appetite is also justifiable by a greater transparency of the company use of proceeds with respect to conventional bonds. The huge interest for green bonds is demonstrated by the track of most recent issues which all ended oversubscribed with most of purchases coming from institutional investors as Amundi, Aviva and specialist ESG such as Natixis.

The downside associated with the small size of this new market is represented by a lack of liquidity. Disinvesting your position on green bonds may not be so easy given the absence of an established market and this justifies why most purchases come from institutional investors and ESG specialists who are mostly interested in holding the position until maturity. However, we are seeing an increasing diversification in the field of sustainable financing with other types of labelled issuances (as social bonds and SDG bonds) recently accompanying the traditional green bonds.

The verdict…

Given the increasing importance that green movements are developing worldwide, and the increasing attention of consumers and investors for environmental-related issues, we should expect a further upward trend of green bond’ issuances.

From investors perspective, there is not enough empirical evidence to evaluate if it is convenient to do stock picking with ESG criteria. Recent studies demonstrate that the additional value created is offset by the costs of implementation.

We should expect to see an increasing regulation in this market to better define detailed requirements for a bond to be green and entail tax benefits consequently. Less misuse of this source of financing should therefore follow thanks to a higher harmonisation of taxonomies and well-defined guidelines.

Nicola Bulgarelli