Korean shipping firm Hanjin Shipping Co. filed for bankruptcy and court protection on August 31th after lenders withdrew their support. This Korean company experienced an operating loss of $246 million in April-June only and debt piled up to $5.5 billion or 6.1 trillion Korean won. Hanjin was the biggest shipping company in South Korea, ranked 7th largest in the world, with 141 vessels in service (97 container ships and 44 bulk carriers), a 3% market share worldwide and with a 7.8% share in the trans-Pacific market. Now Hanjin fleet has downsized to almost a tenth of their original size and most of the ships are stranded at docks or in the middle of the sea as the company does not have the money to fill fuel tanks or pay crews.

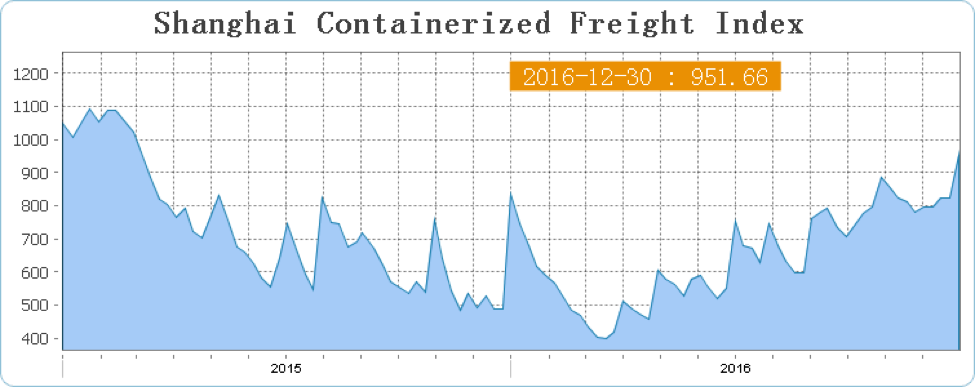

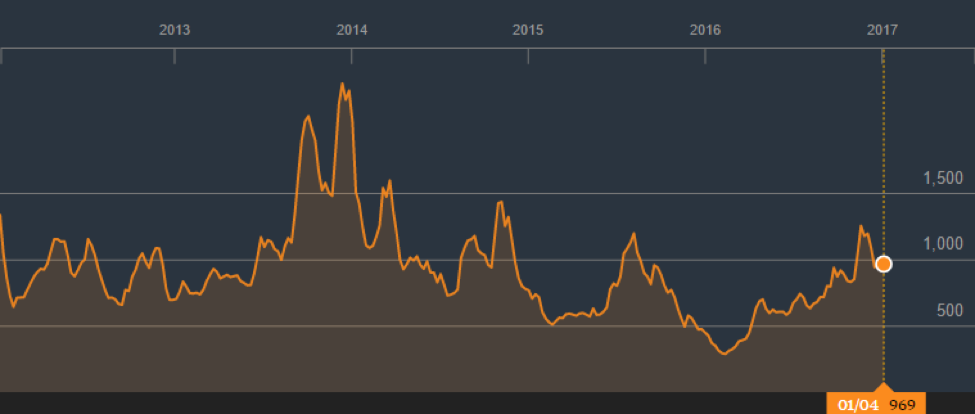

Recent years have presented many challenges for the shipping industry including a loss in demand and declining freight rates due to slow world economic growth. This change in economic pace has caused increased pressure on shipping companies, which has lead them to pile up debt and to “taking on water”. The Shanghai Containerized Freight Index is a commonly used measure of global trade’s health and shipping rates used by most shipping companies such as A.P. Moeller-Maersk A/S. The SCFI Index fell dramatically since the economic crisis of 2008 as fleets’ capacity is increasing but the volume of global trade is stagnant. The recent partial rebound of the index is due to merger operations in act between shipping companies and the outcome of the presidential election, which is expected to lead to an increase in commodity trade to feed the $100 billion/year Trump’s infrastructure plan.

Recent years have presented many challenges for the shipping industry including a loss in demand and declining freight rates due to slow world economic growth. This change in economic pace has caused increased pressure on shipping companies, which has lead them to pile up debt and to “taking on water”. The Shanghai Containerized Freight Index is a commonly used measure of global trade’s health and shipping rates used by most shipping companies such as A.P. Moeller-Maersk A/S. The SCFI Index fell dramatically since the economic crisis of 2008 as fleets’ capacity is increasing but the volume of global trade is stagnant. The recent partial rebound of the index is due to merger operations in act between shipping companies and the outcome of the presidential election, which is expected to lead to an increase in commodity trade to feed the $100 billion/year Trump’s infrastructure plan.

But the shipping industry is still increasing capacity exceeding demand, current orders for new ships are equivalent to 16% of the actual fleet capacity that will contribute to put even more pressure on freight rates in the future. Shipping companies started a war on freight rates to gain market shares, especially after the collapse of Hanjin that left 3% of world volumes to the highest bidder.

Talking about auctions, Hanjin Asia and U.S. assets, including a 54% share in the South Beach terminal, are being sold to the Korea Line after beating Hyundai Merchant Marine. This deal sets the entry of Korea Line, a bulk carrier, into the container industry. The irony stays in the fact that the Korea Line itself filed for bankruptcy five years ago, and now after restructuring, is ready to take over a way bigger collapsed container giant. Most of Hanjin’s ships are being returned to owners who leased them to the Korean company. Korea Line shares sank 14% at Seoul stock exchange the day after the deal while Hanjin stocks rallied 3.6%.

Korea Line is probably taking advantage of the recent rebound of bulk rates, which are represented by the Baltic Dry Index in the graph below. This brought optimism about bulk carriers’ profitability.

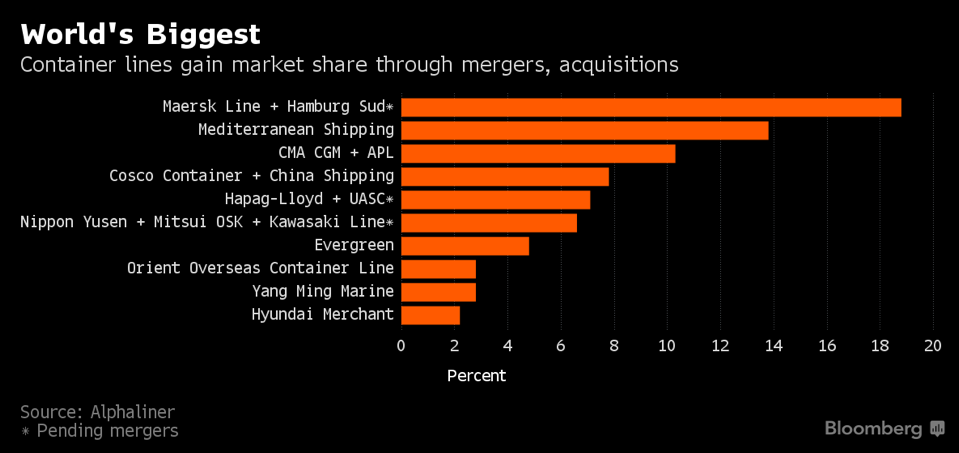

As mentioned before the shipping industry is consolidating to face weak demand and overcapacity. Most shipping executives agree that expanding capacity is no longer the leading path to improve companies’ performance and many firms have not been profitable for years so consolidation seems to be the only way to survive in the sector. In recent years, China merged its two biggest shipping companies, China Ocean Shipping Group and China Shipping Group, forming China Cosco Shipping, the biggest Asian player in the industry. In Japan Nippon Yusen KK, Mitsui O.S.K. Lines Ltd. and Kawasaki Kisen Kaisha Ltd. have now agreed to merge their container businesses.

On the acquisitions side of the market CMA CGM SA bought Singapore’s Neptune Orient Lines Ltd. in early 2016 to form the world’s third container operator.

On the other hand, some firms such as Evergreen, Yang Ming and Hyundai Merchant Marine do not plan mergers or acquisitions, instead, they are focusing on improving and boosting competitiveness of existing operations.

It is clear that the shipping industry in changing radically to face overcapacity and weak demand challenges. Every company is now putting into place a strategy of survival during these hard times and most of these strategies involve mergers or acquisitions. Companies that are continuing to follow the old path of shipping are doomed to collapse as it happened to Hanjin.

Tomaso Giorgi