During the last period Hong Kong property market, one of the most unaffordable in the world, has been under pressure, firstly because of violent pro-democracy protests and the uncertainty connected to trade war between US and China, but mainly due to the outbreak of coronavirus. Indeed, home values of Hong Kong are following a declining trend, and, in February, home prices recorded the biggest drop in the last 15 months. The index compiled by the city’s Rating and Valuation Department fell down by 2.1% last month, marking the biggest monthly fall since December 2018.

Since the second half of 2003, after the severe acute respiratory syndrome (Sars), property values of Hong Kong have increased dramatically, except for some short declines due to macroeconomic causes, such as the Global Financial Crisis of 2008. On the report of a price index for used homes, compiled by the city’s Rating and Valuation Department, the value of Hong Kong homes, during the first 7 months of 2003 Sars crisis, dropped by more than 8%, but the decreasing trend was actually very short, as it soon shifted to a positive upward trend in the following months.

Since then, the tendency has been overall increasing. One exception occurred, as mentioned above, during the Global Financial Crisis of 2008, when a price fall by 17% was recorded in the second half of the year. Soon after, at the beginning of 2009, housing prices rebounded, with an incredible increase of 25.7%. From 2009 to 2013, Hong Kong property prices skyrocketed by 134% (95.7% inflation-adjusted), driven by a flood of money in the wake of the 2008 Financial Crisis. During 2016, however, another market price slowdown arose, but home prices surged again by 41.5% (35.5% inflation-adjusted) in the second half of 2016 and this increasing trend persisted until 2018.

The index recorded an all-time high peak in May 2019, before falling down again by 4.6% in December.

Since the second half of 2003, after the severe acute respiratory syndrome (Sars), property values of Hong Kong have increased dramatically, except for some short declines due to macroeconomic causes, such as the Global Financial Crisis of 2008. On the report of a price index for used homes, compiled by the city’s Rating and Valuation Department, the value of Hong Kong homes, during the first 7 months of 2003 Sars crisis, dropped by more than 8%, but the decreasing trend was actually very short, as it soon shifted to a positive upward trend in the following months.

Since then, the tendency has been overall increasing. One exception occurred, as mentioned above, during the Global Financial Crisis of 2008, when a price fall by 17% was recorded in the second half of the year. Soon after, at the beginning of 2009, housing prices rebounded, with an incredible increase of 25.7%. From 2009 to 2013, Hong Kong property prices skyrocketed by 134% (95.7% inflation-adjusted), driven by a flood of money in the wake of the 2008 Financial Crisis. During 2016, however, another market price slowdown arose, but home prices surged again by 41.5% (35.5% inflation-adjusted) in the second half of 2016 and this increasing trend persisted until 2018.

The index recorded an all-time high peak in May 2019, before falling down again by 4.6% in December.

Source: Rating and Valuation Department - The Government of Hong Kong Special Administrative Region

Hong Kong’s property sector has proved largely resilient during the trade war between China and US and the anti-government protests last year, which both pushed Hong Kong into its first recession in a decade. Overall, Hong Kong´s economy contracted by 1.2% in 2019.

Source: Global Property Guide

The year of 2019 was defined by a “South China Morning Post” article as a “roller-coaster ride” for the property market. Prices, after escalating 9.9% from January to May, month in which they were able to reach their historical peak, started to fall dramatically, decreasing by up to 5.2 per cent in October, as people general sentiment was truly hurt by the protests and an escalation in the trade war. Overall, Hong Kong home values have risen 3.4% in 2019, according to the report of the Centa-City Leading Index, which tracks home prices in 100 housing estates in Hong Kong.

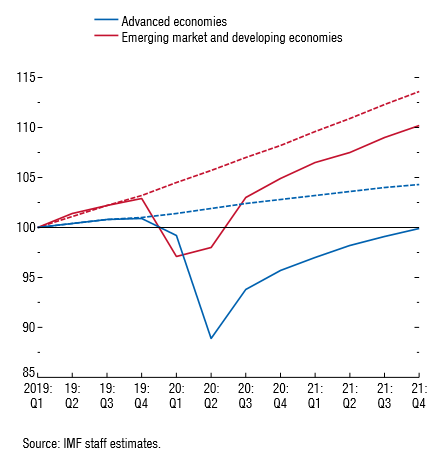

For what concerns the first months of 2020, the Rating and Valuation Department said that the home prices reached their lowest point in 15 months, as the index compiled by them decreased by up to 2.1%, and it is expected to recede from June 2019 by 20%. Moreover, also the S&P Global Ratings retain that prices will fall consistently because of measures adopted to fight coronavirus, as they have pushed the global economy into recession.

It is also important to underline that, until now, the most important HK’s property agencies have registered their worst financial results in years, and the explanation to that can be seen in the Hong Kong economy recession and the outbreak of coronavirus in the first months of 2020.

Some analysts expect that the market will reply what happened during the 2003 Sars crisis, believing that the property values at first will inevitably fall and then they will rebound in a very short time. Others think that it is unlikely for the homes used index to reach Sars levels.

"Sars and the coronavirus outbreak have occurred at completely different points of the housing cycle," said Phillip Zhong, senior equity analyst for Hong Kong and China real estate at Morningstar Investment Management. This point of view is based on the fact that, when Sars hit prices in 2003,

the market had just left the Asian financial crisis, while now it is at an extreme high level.

In addition to that, Vincent Cheung, managing director of Vincorn Consulting and Appraisal, said: “People in Hong Kong nowadays have also learned their lesson from the Sars outbreak, and have taken much greater safety precautions than they did during the Sars outbreak.”

Definitely, Hong Kong property market represent a very interesting area for all investors, which are, indeed, all waiting for prices to fall so as to have the opportunity to join this market, in the belief that, in the future, it will certainly rebound. Thus, knowing that the prices are expected to fall but investors can be considered in a “buy-mood”, it is likely that in the next months we will see a market ruled by volatility and instability.

Gloria Urbini Capanni

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

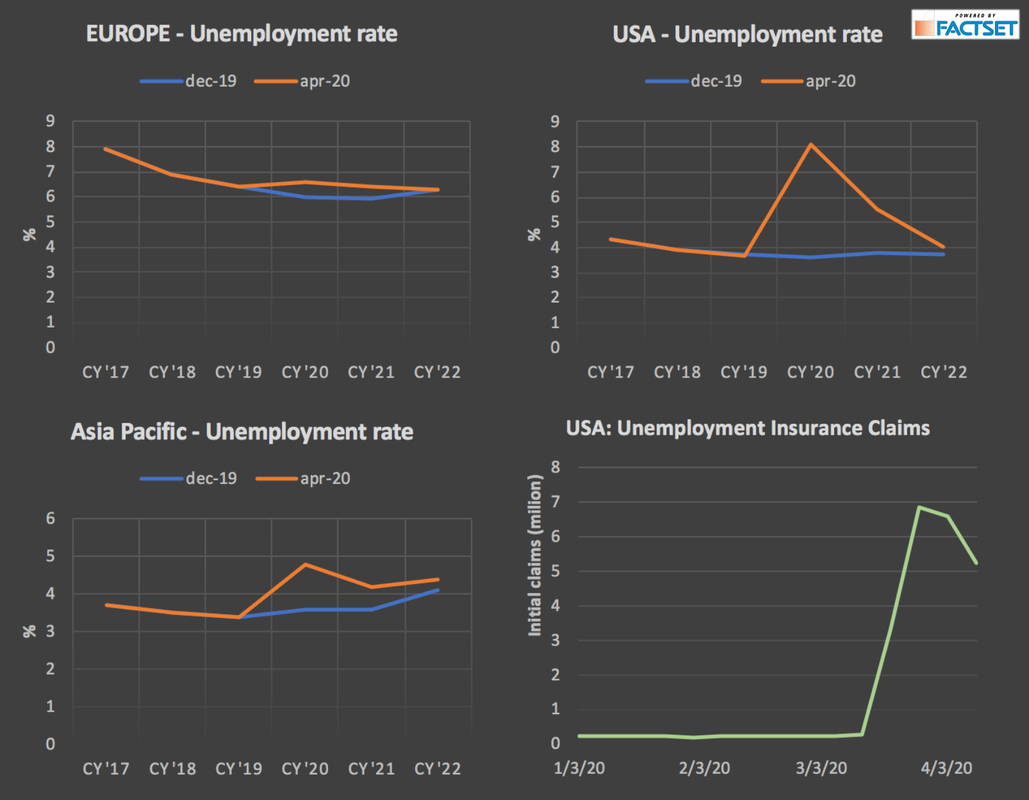

For what concerns the first months of 2020, the Rating and Valuation Department said that the home prices reached their lowest point in 15 months, as the index compiled by them decreased by up to 2.1%, and it is expected to recede from June 2019 by 20%. Moreover, also the S&P Global Ratings retain that prices will fall consistently because of measures adopted to fight coronavirus, as they have pushed the global economy into recession.

It is also important to underline that, until now, the most important HK’s property agencies have registered their worst financial results in years, and the explanation to that can be seen in the Hong Kong economy recession and the outbreak of coronavirus in the first months of 2020.

Some analysts expect that the market will reply what happened during the 2003 Sars crisis, believing that the property values at first will inevitably fall and then they will rebound in a very short time. Others think that it is unlikely for the homes used index to reach Sars levels.

"Sars and the coronavirus outbreak have occurred at completely different points of the housing cycle," said Phillip Zhong, senior equity analyst for Hong Kong and China real estate at Morningstar Investment Management. This point of view is based on the fact that, when Sars hit prices in 2003,

the market had just left the Asian financial crisis, while now it is at an extreme high level.

In addition to that, Vincent Cheung, managing director of Vincorn Consulting and Appraisal, said: “People in Hong Kong nowadays have also learned their lesson from the Sars outbreak, and have taken much greater safety precautions than they did during the Sars outbreak.”

Definitely, Hong Kong property market represent a very interesting area for all investors, which are, indeed, all waiting for prices to fall so as to have the opportunity to join this market, in the belief that, in the future, it will certainly rebound. Thus, knowing that the prices are expected to fall but investors can be considered in a “buy-mood”, it is likely that in the next months we will see a market ruled by volatility and instability.

Gloria Urbini Capanni

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.