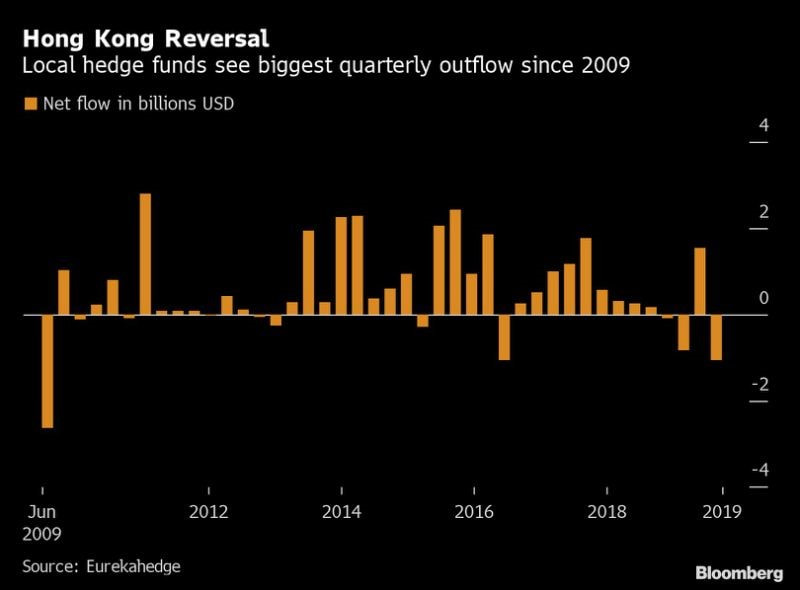

On 17th October 2019, the Hong Kong hedge funds shockingly announced the biggest outflow since the financial crisis from a decade ago. The investors pulled out no less than US$1 billion in the third quarter of 2019. Despite all that, this statement does not seem so significant when viewed against the US$121 billion that has flowed out of hedge funds globally over the course of this year. Hong Kong has been a major focal point within the Asia Pacific hedge fund industry, currently accounting for US$92.1 billion of assets under management-AUM, overseen by 449 hedge fund managers (data as of August 2019).

This dramatic shift of capital comes at the same time as the international hub is facing not only the aggressive US-China trade war, but also the most severe political crisis since 1997 (the year of British colony’s handover from the UK to China). It is believed that the numerous protests from the last period, that unnerved markets, also caused this decrease. As if it was not enough that the trust of investors was already low, this leads to even more concern regarding future stability. In addition, local equities sold off. The mass riots in the city began in March and have still not settled down. At first, people were unsatisfied with a bill that would have seen criminal suspects potentially extradited to mainland China for trial. However, the demands of protesters have since expanded and demonstrations have continued even after the bill’s full withdrawal.

This dramatic shift of capital comes at the same time as the international hub is facing not only the aggressive US-China trade war, but also the most severe political crisis since 1997 (the year of British colony’s handover from the UK to China). It is believed that the numerous protests from the last period, that unnerved markets, also caused this decrease. As if it was not enough that the trust of investors was already low, this leads to even more concern regarding future stability. In addition, local equities sold off. The mass riots in the city began in March and have still not settled down. At first, people were unsatisfied with a bill that would have seen criminal suspects potentially extradited to mainland China for trial. However, the demands of protesters have since expanded and demonstrations have continued even after the bill’s full withdrawal.

Analysts believe that the outflow was in keeping with redemptions from hedge funds globally after poor returns from some managers in 2018 were recorded. But apparently, the hedge funds are not the only figures going through a rough time. The local Hang Seng index dropped more than 10 percent in the past six months, while Fitch Ratings has recently downgraded the city's credit rating.

The total withdrawals from Hong Kong were modest in comparison to the total hedge fund assets in the city, which increased US$6.9 billion this year to US$92 billion as of August, thanks to positive market returns. The most affected were the small-sized and medium-sized hedge funds (managing sums less than or equal to US$500 million) that accounted for the bulk of client outflows. In contrast, bigger funds had been seeing positive allocations in the same period. The overall industry has seen net inflows every year, starting from 2009. However, the increase was mostly driven by fund performance rather than inflows. Hong Kong-focused hedge funds delivered an average return of 6% in the year to August, compared with the flat performance of the benchmark Hang Seng index during the same period.

The redemptions of the Q32019 matched the US$1 billion in outflows that were recorded in the second quarter of 2016. The largest quarterly outflows in the past decade were US$6.4 billion in the first quarter of 2009 and US$2.6 billion in the second quarter of that year, financial data showed.

How did the financial crisis affect the hedge fund industry in Asia?

Funds that are concentrated in the APAC region suffered their worst year in history in 2008, underperforming the ones in the West, as markets cratered and investors requested their money back. The size of the region’s hedge fund industry peaked in December 2007, reaching US$176 billion but the combined effect of withdrawals and performance-based losses brought the assets under management down to US$105 billion in April 2009. Asian hedge funds faced net outflows of US$19.1 billion in 2009. The list of funds that have closed includes: the Melchior Japan Fund, which was run by Dalton Strategic Partnership and The APAC Greater China Fund, which used to manage, at its peak, around US$55 million. In Singapore, Tantallon Capital liquidated one of its funds, which was known for managing US$18 million.

Around a decade ago, hedge funds managers used to typically earn the bulk of their fees by topping previous highs — levels that have been even harder to reach after the 2008’s dismal performance. These changes lead to even more fund closures. Nearly 900 hedge funds closed globally only in 2008, with Asian hedge funds making up to 20% of the total closure. Unfortunately, this trend continued also in 2009.

The level of Asian startups almost halved in 2008, from 157 in 2007. Moreover, while it is true that a bull market can breed laxity, it had also been proven that fund managers and investors tend to be more accurate and careful during rough times. Industry experts revealed that transparency and frequent communication between managers and investors were at a premium at that time.

Ana Cosciceru

The total withdrawals from Hong Kong were modest in comparison to the total hedge fund assets in the city, which increased US$6.9 billion this year to US$92 billion as of August, thanks to positive market returns. The most affected were the small-sized and medium-sized hedge funds (managing sums less than or equal to US$500 million) that accounted for the bulk of client outflows. In contrast, bigger funds had been seeing positive allocations in the same period. The overall industry has seen net inflows every year, starting from 2009. However, the increase was mostly driven by fund performance rather than inflows. Hong Kong-focused hedge funds delivered an average return of 6% in the year to August, compared with the flat performance of the benchmark Hang Seng index during the same period.

The redemptions of the Q32019 matched the US$1 billion in outflows that were recorded in the second quarter of 2016. The largest quarterly outflows in the past decade were US$6.4 billion in the first quarter of 2009 and US$2.6 billion in the second quarter of that year, financial data showed.

How did the financial crisis affect the hedge fund industry in Asia?

Funds that are concentrated in the APAC region suffered their worst year in history in 2008, underperforming the ones in the West, as markets cratered and investors requested their money back. The size of the region’s hedge fund industry peaked in December 2007, reaching US$176 billion but the combined effect of withdrawals and performance-based losses brought the assets under management down to US$105 billion in April 2009. Asian hedge funds faced net outflows of US$19.1 billion in 2009. The list of funds that have closed includes: the Melchior Japan Fund, which was run by Dalton Strategic Partnership and The APAC Greater China Fund, which used to manage, at its peak, around US$55 million. In Singapore, Tantallon Capital liquidated one of its funds, which was known for managing US$18 million.

Around a decade ago, hedge funds managers used to typically earn the bulk of their fees by topping previous highs — levels that have been even harder to reach after the 2008’s dismal performance. These changes lead to even more fund closures. Nearly 900 hedge funds closed globally only in 2008, with Asian hedge funds making up to 20% of the total closure. Unfortunately, this trend continued also in 2009.

The level of Asian startups almost halved in 2008, from 157 in 2007. Moreover, while it is true that a bull market can breed laxity, it had also been proven that fund managers and investors tend to be more accurate and careful during rough times. Industry experts revealed that transparency and frequent communication between managers and investors were at a premium at that time.

Ana Cosciceru