Figure 1, Source: Bloomberg and Bank for International Settlements

Figure 1, Source: Bloomberg and Bank for International Settlements

On March 27th, the Hong Kong Monetary Authority announced the issuance of its first batch of digital banking licenses to three companies: Livi VB, jointly owned by Bank of China Hong Kong, JD Digits and Jardines, SC Digital Solutions, owned by Standard Chartered Bank, Hong Kong Telecom, PCCW, and C-trip and, finally, Zhong An Virtual Finance, JV between Zhong An Online and Sinolink. Markets are optimistic: indeed, Zhong An shares rose by 11% following the announcement, the sharpest since October 2017. According to Bloomberg, 29 companies, including Chinese leading third-party payment companies, Tencent and Alibaba's Ant Financial, have applied for the license. The fact that they have not been granted a license in this first-round is unexpected.

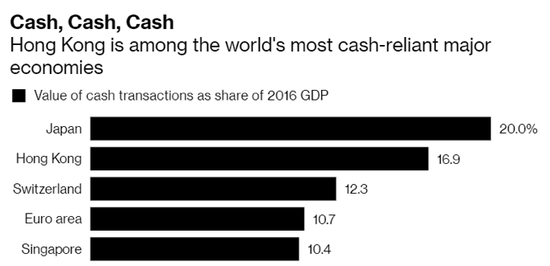

Two years ago, both Alipay and WeChat Pay obtained the first set of the Stored Value Facility (henceforth, SVF) licenses in Hong Kong. Up to now, the Hong Kong Monetary Authority has issued 16 SVF licenses, yet most of the online financial functions, such as Alibaba's personal small loan service "Ant Credit Pay", were not allowed to operate in Hong Kong. While cash-free consumption is a norm in mainland China nowadays, digital payment has not yet become as widespread in Hong Kong.

Two years ago, both Alipay and WeChat Pay obtained the first set of the Stored Value Facility (henceforth, SVF) licenses in Hong Kong. Up to now, the Hong Kong Monetary Authority has issued 16 SVF licenses, yet most of the online financial functions, such as Alibaba's personal small loan service "Ant Credit Pay", were not allowed to operate in Hong Kong. While cash-free consumption is a norm in mainland China nowadays, digital payment has not yet become as widespread in Hong Kong.

Nowadays, Hong Kong users of digital payment methods charge their e-wallets by adding value in convenience stores using cash: this reduces the advantages over traditional payment methods. The mobile wallet with limited functions is only an "electronic debit card", and the deposit service is inconvenient without the support of physical branches. Therefore, electronic payment companies have never been considered official players in the retail banking market. However, the launch of virtual banks could reshape this market outlook. Introducing a whole set of online financial services, including deposit, loan and withdraw services, the virtual banking license would finally unlock the full potential of mobile wallets and bring in more competition to the once-stable market.

Threat or opportunity? Big data used in virtual banking

According to the Hong Kong Monetary Authority definition, a “virtual bank” crucially features retail banking services mainly delivered through different online and electronic channels, rather than through physical branches. This definition suggests that the difference between online banking and traditional banking lies in their operations. However, the revolutionary change brought by digital banking is beyond the annihilation of physical branches. In the spotlight is the application of big data in financial services. By analysing the “big data” accumulated in the internet by means of cloud computing, virtual banks have developed a way to explore the credit status of their financial customers, based on which they could conduct risk pricing and determine the risk status of financial transactions.

Threat or opportunity? Big data used in virtual banking

According to the Hong Kong Monetary Authority definition, a “virtual bank” crucially features retail banking services mainly delivered through different online and electronic channels, rather than through physical branches. This definition suggests that the difference between online banking and traditional banking lies in their operations. However, the revolutionary change brought by digital banking is beyond the annihilation of physical branches. In the spotlight is the application of big data in financial services. By analysing the “big data” accumulated in the internet by means of cloud computing, virtual banks have developed a way to explore the credit status of their financial customers, based on which they could conduct risk pricing and determine the risk status of financial transactions.

Alibaba Group is a pioneer of the technology: with its strong penetration in Chinese e-commerce, social media, payment and other departments of the online ecosystem, the group can now consolidate more than 3,000 data points for every consumer, generating very accurate personal credit profiles.

Nevertheless, cybersecurity remains a strong concern. The credit rating function of Alibaba gained the nickname of "big brother's big data", due to the dystopian associations of the technology. Hong Kong individuals and business owners have exhibited a reluctant attitude towards the big data service, out of the protection of their privacies.

Who is going to be winner: technology companies or traditional consumer banks?

It is worthwhile to note that the Hong Kong Monetary Authority intends to liberalise the restrictions on the financial quality of virtual bank applicants, which gives technology companies, especially mainland Chinese big companies and local start-ups, a chance to participate in the game. Last year, in May, the "Authorisation for Virtual Banks" issued by the Hong Kong Monetary Authority mentioned that the original establishment of a virtual bank in Hong Kong must be held by an officially recognised and reputable bank or financial institution with at least 50% of ownership. However, the new regulations show that non-financial institutions should first register an "intermediate holding company", when setting up a virtual bank. In this way, both financial companies (including existing banks in Hong Kong) and non-financial companies (including technology companies) can apply to hold and operate as virtual banks in Hong Kong.

In practice, however, technology companies are still facing a number of barriers. Firstly, traditional banking companies are ambitious to enter the market and gain their dominance. The Hong Kong Monetary Authority also showed a cautious attitude in the release of its first batch of licenses, by putting the joint ventures of Bank of China Hong Kong and the one of Standard Chartered ahead than other applicants. According to Goldman Sachs, Bank of China Hong Kong, Standard Chartered and HSBC (including Hang Seng Bank) jointly account for about 66% of the retail loan market in Hong Kong, and for 77% of the total mortgages. By launching the app "PayMe", HSBC successfully digitalized part of its retail banking services, yet did not participate in the application activities of the virtual banking license. With Bank of China Hong Kong and Standard Chartered also ready to join the game in about nine months, technology companies are facing difficulties to shake their dominance. Secondly, with the well-developed credit card network and the payment tool Octopus for small-amount payments, technology companies solely may find it difficult to open the market. According to a survey conducted by the Hong Kong Productivity Council, the proportion of citizens who use mobile payments only amounts 20%, whilst credit card payments account for 53%. More than 95% of the citizens often use Octopus and cash.

Regarding the competitive advantages, Mainland China analysts commented that financial institutions are familiar with regulatory policies, but are not sufficiently efficient and responsive. In contrast, technology companies have a large advantage in operational efficiency and cost, by using big data analysis in risk pricing. At the same time, the establishment of virtual banks requires large input to develop the technology and build the network foundation, technology companies have a natural advantage in this regard.

While successful financial applicants all decided to cooperate with tech companies, Alibaba tried to apply for the license solely and to on board partners later on, but ultimately failed to obtain a license, during this first round. This may hint that, right now, neither big consumer banks nor tech giants are seen as adequate to play the game alone. Although the positions of financial and non-financial institutions in the competitive landscape are still under debate, cooperation between tech and financial companies, e.g. in the form of joint ventures, is still the most possible format of running a digital bank. Given that mobile payments, in Hong Kong, are still not as widespread as in mainland China, services such as insurance ones could represent a good entry point to start this process of digitalisation.

Catherine Shirui Chen

Nevertheless, cybersecurity remains a strong concern. The credit rating function of Alibaba gained the nickname of "big brother's big data", due to the dystopian associations of the technology. Hong Kong individuals and business owners have exhibited a reluctant attitude towards the big data service, out of the protection of their privacies.

Who is going to be winner: technology companies or traditional consumer banks?

It is worthwhile to note that the Hong Kong Monetary Authority intends to liberalise the restrictions on the financial quality of virtual bank applicants, which gives technology companies, especially mainland Chinese big companies and local start-ups, a chance to participate in the game. Last year, in May, the "Authorisation for Virtual Banks" issued by the Hong Kong Monetary Authority mentioned that the original establishment of a virtual bank in Hong Kong must be held by an officially recognised and reputable bank or financial institution with at least 50% of ownership. However, the new regulations show that non-financial institutions should first register an "intermediate holding company", when setting up a virtual bank. In this way, both financial companies (including existing banks in Hong Kong) and non-financial companies (including technology companies) can apply to hold and operate as virtual banks in Hong Kong.

In practice, however, technology companies are still facing a number of barriers. Firstly, traditional banking companies are ambitious to enter the market and gain their dominance. The Hong Kong Monetary Authority also showed a cautious attitude in the release of its first batch of licenses, by putting the joint ventures of Bank of China Hong Kong and the one of Standard Chartered ahead than other applicants. According to Goldman Sachs, Bank of China Hong Kong, Standard Chartered and HSBC (including Hang Seng Bank) jointly account for about 66% of the retail loan market in Hong Kong, and for 77% of the total mortgages. By launching the app "PayMe", HSBC successfully digitalized part of its retail banking services, yet did not participate in the application activities of the virtual banking license. With Bank of China Hong Kong and Standard Chartered also ready to join the game in about nine months, technology companies are facing difficulties to shake their dominance. Secondly, with the well-developed credit card network and the payment tool Octopus for small-amount payments, technology companies solely may find it difficult to open the market. According to a survey conducted by the Hong Kong Productivity Council, the proportion of citizens who use mobile payments only amounts 20%, whilst credit card payments account for 53%. More than 95% of the citizens often use Octopus and cash.

Regarding the competitive advantages, Mainland China analysts commented that financial institutions are familiar with regulatory policies, but are not sufficiently efficient and responsive. In contrast, technology companies have a large advantage in operational efficiency and cost, by using big data analysis in risk pricing. At the same time, the establishment of virtual banks requires large input to develop the technology and build the network foundation, technology companies have a natural advantage in this regard.

While successful financial applicants all decided to cooperate with tech companies, Alibaba tried to apply for the license solely and to on board partners later on, but ultimately failed to obtain a license, during this first round. This may hint that, right now, neither big consumer banks nor tech giants are seen as adequate to play the game alone. Although the positions of financial and non-financial institutions in the competitive landscape are still under debate, cooperation between tech and financial companies, e.g. in the form of joint ventures, is still the most possible format of running a digital bank. Given that mobile payments, in Hong Kong, are still not as widespread as in mainland China, services such as insurance ones could represent a good entry point to start this process of digitalisation.

Catherine Shirui Chen