As the fast-growing pandemic spreads around the world causing major problems to the healthcare systems of most of the countries of the planet, a threatening economic crisis is just around the corner and both Government and Central Banks are making every effort to narrow its effects.

One of the first moves to avoid coronavirus triggering a credit crunch in Europe has been taken by Europe’s banking regulator, which has demanded that all EU lenders stop their planned dividend payments and share buybacks, but will US banks and big corporates ever take the same decision?

Banks

The first days of April, all the bankers, including Goldman Sachs’ boss David Solomon, Morgan Stanley’s boss James Gorman, and Citigroup’s chief Mike Corbat, expressed their intention to continue paying dividends despite the situation. The decision was supported also by the Federal Reserve’s Chairman Jerome Powell, who reassured that lenders now have enough capital to absorb financial shocks. They argued their decision in many reasonable ways.

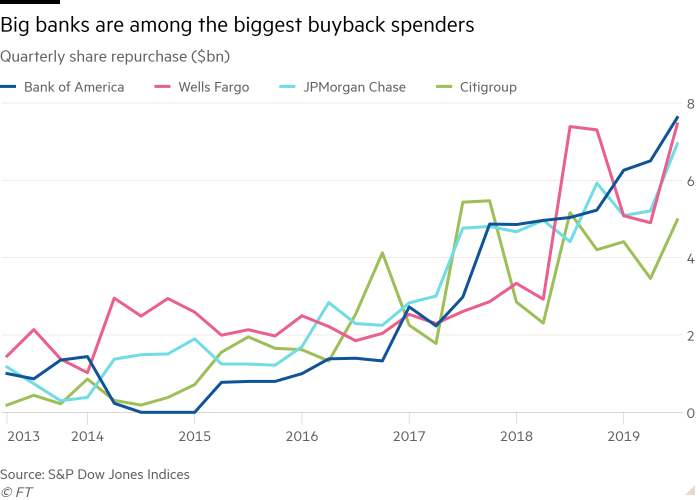

Banks will preserve investor’s confidence and deprive them of their income could be destabilizing for investors who rely on a steady income from stocks, such as pension funds, and increase uncertainty. Moreover, the top 20 US banks have more than $200bn in excess capital and make more than $50bn in profit before loan losses every year, which gives them a large space to cover dividend payouts even if loan losses were as many as the $175bn recorded in 2009. The third reason involves the differences between the European and American payout’ strategy implemented by the banks. The greater part of US’s banks’ payout is in the form of share buybacks and eight of America’s biggest banks have already been suspending voluntarily their program until at least July. That means that US banks have already been demonstrating their intention of maintaining ample capital and liquidity at a time of deep economic uncertainty. In fact, in Europe, share buybacks account for about 10% of capital return, so reducing significantly payouts means cutting dividends.

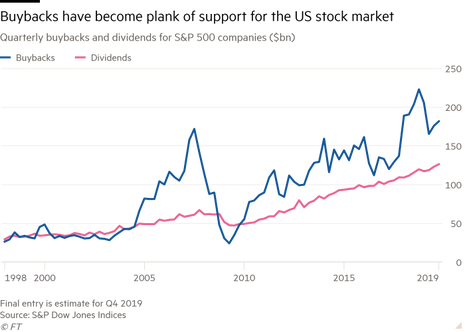

However, the decision of putting share buybacks on hold hasn’t come without worries. In fact, corporate buybacks programs have been an extremely important factor for the market and fewer of those could amplify the downturn and the US stock market will lose one of its most solid sources of finance. Stocks repurchases are theoretically neutral for a company’s value since every dollar handed back to shareholders is a dollar less on its balance sheet. However, it reduces the number of outstanding shares available on the market, making each a greater worth part of the corporation. Multiples such as EPS and P/E get better (the first increases and the second decreases) making the shares more appetible and, also, boosts the pay of employees and managers with stock rewards and stock options. The withdrawal of banks deprives of the market of some of its heaviest spenders and what reduces the buying reduces the price support, even when it is going down.

One of the first moves to avoid coronavirus triggering a credit crunch in Europe has been taken by Europe’s banking regulator, which has demanded that all EU lenders stop their planned dividend payments and share buybacks, but will US banks and big corporates ever take the same decision?

Banks

The first days of April, all the bankers, including Goldman Sachs’ boss David Solomon, Morgan Stanley’s boss James Gorman, and Citigroup’s chief Mike Corbat, expressed their intention to continue paying dividends despite the situation. The decision was supported also by the Federal Reserve’s Chairman Jerome Powell, who reassured that lenders now have enough capital to absorb financial shocks. They argued their decision in many reasonable ways.

Banks will preserve investor’s confidence and deprive them of their income could be destabilizing for investors who rely on a steady income from stocks, such as pension funds, and increase uncertainty. Moreover, the top 20 US banks have more than $200bn in excess capital and make more than $50bn in profit before loan losses every year, which gives them a large space to cover dividend payouts even if loan losses were as many as the $175bn recorded in 2009. The third reason involves the differences between the European and American payout’ strategy implemented by the banks. The greater part of US’s banks’ payout is in the form of share buybacks and eight of America’s biggest banks have already been suspending voluntarily their program until at least July. That means that US banks have already been demonstrating their intention of maintaining ample capital and liquidity at a time of deep economic uncertainty. In fact, in Europe, share buybacks account for about 10% of capital return, so reducing significantly payouts means cutting dividends.

However, the decision of putting share buybacks on hold hasn’t come without worries. In fact, corporate buybacks programs have been an extremely important factor for the market and fewer of those could amplify the downturn and the US stock market will lose one of its most solid sources of finance. Stocks repurchases are theoretically neutral for a company’s value since every dollar handed back to shareholders is a dollar less on its balance sheet. However, it reduces the number of outstanding shares available on the market, making each a greater worth part of the corporation. Multiples such as EPS and P/E get better (the first increases and the second decreases) making the shares more appetible and, also, boosts the pay of employees and managers with stock rewards and stock options. The withdrawal of banks deprives of the market of some of its heaviest spenders and what reduces the buying reduces the price support, even when it is going down.

As the first chart show, in 2019 the count of buybacks for S&P 500 companies was $730bn, not far off the record $806bn of 2018. Just the 4 big banks mentioned in the second graph repurchased shares for more than $27bn in the last quarter of 2019 (almost 4% of the total). Source: Financial Times

A week after the biggest US banks defended their plan to continue paying payouts, the one which is showing a more cautious tone than its Wall Street rivals is JPMorgan that has not denied a scenario where a historic dividend suspension could happen. The bank, in March alone, has approved more than $25bn of new credit extensions, loaned $1.9bn to hospitals and healthcare companies, $360m to non-profit organizations, and $240m to local governments and it is planning to lend an additional $150bn to clients. That means at the moment banks are helping both businesses and customers in need, but in case of a massive recession, at the same time, are exposing themselves to billions of dollars of additional credit losses.

The good news, for JPMorgan, is that it is also a giant trading firm that is in the business of buying stocks and bonds that customers want to sell and selling stocks and bonds that customers want to buy, and when markets are really volatile, banks’ trading operations are supposed to do well: banks are in the business of providing liquidity and when markets are crazy, liquidity is very valuable and banks can charge a lot for it. This tends to make banks safer in a crisis.

Corporates

The unhappy outlook for payouts reflects the pain the global economy is facing, and ditching dividends is not confined only to the banking world. Goldman Sachs analysts predict that shares buybacks made by big US companies will drop by 50% this year compared with 2019. The companies in the S&P 500 will spend $371bn on share repurchases from $730bn spent last year and the payout recovery is expected to take longer than after the 2008 crisis.

According to bets in the futures market, the corporate payouts’ will suffer the biggest hit since WWII, seeing as a dividend paid by big US companies are expected to recover from the downturn caused by the pandemic in nine years. This situation, in fact, has forced many companies to cut dividend payments to shareholders and preserve payments to workers and other stakeholders. A consequence of this measure is that holding stocks will be less attractive than in the previous years and it is not a good sign for the financial stability of a firm, but this situation has become an extreme circumstance.

Last year has seen nearly half a trillion dollars in dividend payments by American companies, or $56 per share, the eighth consecutive year of record payment, during a strong year for US stocks which climbed to new peaks. 2020 was expected to mark a new high in the dividend growth and investors were betting the S&P 500 companies would deliver a record $61 per share in payouts. That expectation now stands at $40 per share.

Some of the companies that entered this crisis without big cash reserves sent much of the cash they produced from operations to shareholders, as dividends, and the ones that went into this situation with relatively limited cash balances became more vulnerable to this shock.

Edoardo Zanetta

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.