Introduction and overview of energy sector

The energy sector is one of the most critical industries in the world as it provides the necessary energy needed to power economies and industries worldwide. Its strategic role makes it a matter of particular interest, given the current geopolitical state of affairs.

Lately, there has been a significant change in primary energy consumption due to the Russian invasion of Ukraine, as nations are now trying to diversify their sources of energy and reduce their dependence on Russia. In fact, the import of gas from other regions has increased by 4090 petajoules per year.

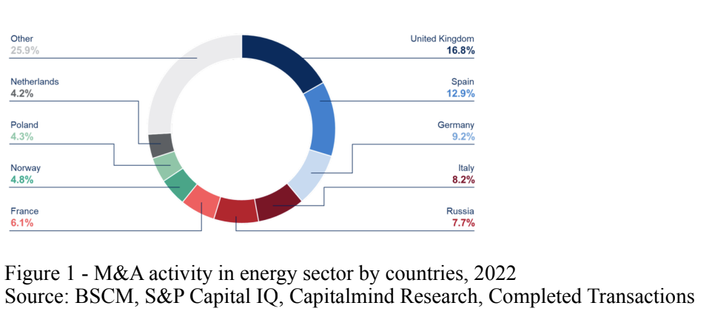

In particular, renewable energy has increasingly become an area of focus in the energy sector, with many countries and companies investing heavily in it: The United States leads the way with 710 M&A transactions, followed by Spain with 253, the UK with 190, Germany with 137, France with 125, Italy with 124, and Australia with 100.

Given the current trajectory of future energy usage, it is likely that energy sources such as wind, solar and hydropower will become increasingly used. Specifically, wind energy is expected to see an increase of 183 petajoules per year, while solar energy is expected to increase by 164 petajoules per year. Hydropower, another renewable energy source, is expected to increase by 131 petajoules per year. In contrast, coal, a non-renewable energy source, is only expected to see a minor increase of 109 petajoules per year. This confirms that the shift towards renewable energy sources in the energy sector (with wind, solar, and hydropower being the primary beneficiaries of this shift) is a trend that is not being reversed. In fact, even though an increase in the usage of coal was necessary to cover the lack of natural gas, its increase was minor compared to the increase in other eco-friendly sources. This is driven by a growing awareness of the negative impacts of non-renewable energy sources on the environment and the need for more sustainable energy sources.

As far as M&A is concerned, the energy sector has remained active. Big companies have acquired a large number of small and innovative competitors, with Sonnedix in France leading the way with 57 acquisitions, Encavis in Germany with 35 acquisitions, and Enel in Italy with 28 acquisitions. Ensuring sustainable energy production. The expected M&A growth for energy companies from 2023 onwards is circa 5%. This sector tends to expand at a low pace, if compared to other sectors such as tech, whose expected growth is around 35%, but it is also steadier than other business areas.

The energy sector is one of the most critical industries in the world as it provides the necessary energy needed to power economies and industries worldwide. Its strategic role makes it a matter of particular interest, given the current geopolitical state of affairs.

Lately, there has been a significant change in primary energy consumption due to the Russian invasion of Ukraine, as nations are now trying to diversify their sources of energy and reduce their dependence on Russia. In fact, the import of gas from other regions has increased by 4090 petajoules per year.

In particular, renewable energy has increasingly become an area of focus in the energy sector, with many countries and companies investing heavily in it: The United States leads the way with 710 M&A transactions, followed by Spain with 253, the UK with 190, Germany with 137, France with 125, Italy with 124, and Australia with 100.

Given the current trajectory of future energy usage, it is likely that energy sources such as wind, solar and hydropower will become increasingly used. Specifically, wind energy is expected to see an increase of 183 petajoules per year, while solar energy is expected to increase by 164 petajoules per year. Hydropower, another renewable energy source, is expected to increase by 131 petajoules per year. In contrast, coal, a non-renewable energy source, is only expected to see a minor increase of 109 petajoules per year. This confirms that the shift towards renewable energy sources in the energy sector (with wind, solar, and hydropower being the primary beneficiaries of this shift) is a trend that is not being reversed. In fact, even though an increase in the usage of coal was necessary to cover the lack of natural gas, its increase was minor compared to the increase in other eco-friendly sources. This is driven by a growing awareness of the negative impacts of non-renewable energy sources on the environment and the need for more sustainable energy sources.

As far as M&A is concerned, the energy sector has remained active. Big companies have acquired a large number of small and innovative competitors, with Sonnedix in France leading the way with 57 acquisitions, Encavis in Germany with 35 acquisitions, and Enel in Italy with 28 acquisitions. Ensuring sustainable energy production. The expected M&A growth for energy companies from 2023 onwards is circa 5%. This sector tends to expand at a low pace, if compared to other sectors such as tech, whose expected growth is around 35%, but it is also steadier than other business areas.

Deglobalisation and reinforcement of European energy production

As previously mentioned, subsequent to Russia’s invasion of Ukraine in late February last year, European countries have tried to reshape their energy supply chain, and divest from affected sectors. To cope with the surge in energy prices, most countries in the EU realigned their policies to bolster their internal energy production, and maximize renewable energy output. These events may reaffirm a belief that many economists and policymakers share about current market dynamics, more specifically about the globalisation phenomenon. In fact, following the Great Reccesion, Covid, and now the Russia-Ukraine War, the globalisation process that has defined socio-economic growth for the past half millenia seems to have slowed, and increasingly fragmented.

Despite many opposing views related to the issue of deglobalisation, the latest developments further signal a regionalization of trade contracts, supply chains, and technology. To begin with, protectionism, within EU and its allies, has been more active than ever, as it has been clearly displayed by the US-China trade war, Biden administration’s trade restrictions, Brexit, and the WTO negotiations. Moreover, the concern for climate change has prompted governments to move towards circular economies and decrease the exposure to global supply chains with large carbon footprints. Lastly, the development of advanced technologies and automatization processes has allowed to increase workers' productivity with marginal costs, thus heavily limiting the developed countries’ reliance on outsourcing labor offshore.

Circling back to the energy sector, efforts to decouple from Russia had left European countries amidst a cost of living crisis with historically high inflation rates. Fortunately, effective policies, heavy investments in wind and solar capacity, and a mild winter helped economies avoid, what was considered by most, an impending recession. In the remainder of this article we’ll take a deep-dive on how Spain addressed these issues, focusing on some of the main obstacles it had to surmount to achieve a cleaner, more sustainable energy industry, and we’ll also look at a recent deal that displays the country’s commitment to renewables.

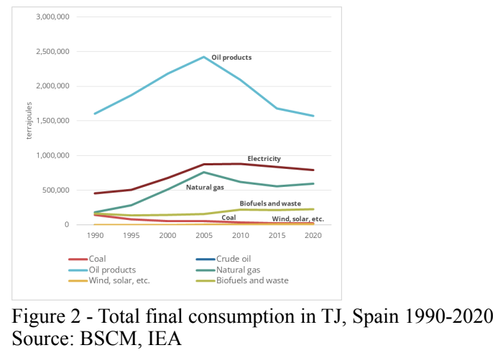

In particular, Spain’s price level was extremely sensitive to the surge in gas prices last year, mainly due to short term contracts and its reliance on fossil fuels and natural gas imports (Figure 1). Despite being at the core of inflation for the past year and a half, the fast response time to wholesale market moves proved to be beneficial in the ending of Q1 2023, as March CPI’s indicated an inflation rate of 3.1%, halving values from February.

As previously mentioned, subsequent to Russia’s invasion of Ukraine in late February last year, European countries have tried to reshape their energy supply chain, and divest from affected sectors. To cope with the surge in energy prices, most countries in the EU realigned their policies to bolster their internal energy production, and maximize renewable energy output. These events may reaffirm a belief that many economists and policymakers share about current market dynamics, more specifically about the globalisation phenomenon. In fact, following the Great Reccesion, Covid, and now the Russia-Ukraine War, the globalisation process that has defined socio-economic growth for the past half millenia seems to have slowed, and increasingly fragmented.

Despite many opposing views related to the issue of deglobalisation, the latest developments further signal a regionalization of trade contracts, supply chains, and technology. To begin with, protectionism, within EU and its allies, has been more active than ever, as it has been clearly displayed by the US-China trade war, Biden administration’s trade restrictions, Brexit, and the WTO negotiations. Moreover, the concern for climate change has prompted governments to move towards circular economies and decrease the exposure to global supply chains with large carbon footprints. Lastly, the development of advanced technologies and automatization processes has allowed to increase workers' productivity with marginal costs, thus heavily limiting the developed countries’ reliance on outsourcing labor offshore.

Circling back to the energy sector, efforts to decouple from Russia had left European countries amidst a cost of living crisis with historically high inflation rates. Fortunately, effective policies, heavy investments in wind and solar capacity, and a mild winter helped economies avoid, what was considered by most, an impending recession. In the remainder of this article we’ll take a deep-dive on how Spain addressed these issues, focusing on some of the main obstacles it had to surmount to achieve a cleaner, more sustainable energy industry, and we’ll also look at a recent deal that displays the country’s commitment to renewables.

In particular, Spain’s price level was extremely sensitive to the surge in gas prices last year, mainly due to short term contracts and its reliance on fossil fuels and natural gas imports (Figure 1). Despite being at the core of inflation for the past year and a half, the fast response time to wholesale market moves proved to be beneficial in the ending of Q1 2023, as March CPI’s indicated an inflation rate of 3.1%, halving values from February.

In order to address the aforementioned issue of unsustainable energy sources, the country has established a National Energy and Climate Plan. On par with other EU nations, Spain is on track to reach the 2030 and 2050 energy transition target. In 2012, the country’s main energy source were oil, coal, natural gas, and nuclear. During that same time, Spain’s energy system also accumulated a deficit of over 30 billion euros. This longstanding issue was mainly caused by subsidies for renewable that were as high as 6.3 billions euros in 2008. Since 2013, they have managed to offset a part of these tariff deficits, and registered a surplus throughout 2014-2018. Additionally, EU legislation prompted Spanish authorities to shut down all the coal mines, bringing Spain’s reliance on coal power generation down from 40% in 1990 to 5% in 2019. The last International Energy Agency’s in-depth Energy Policy Review from 2021 reports a 60% increase in the share of renewables in the national electricity mix from 2009 and 2019, and other promising plans such as the shutting down of its nuclear plants starting in 2027.

Another development that will strengthen Spain’s position in the green energy sector is the H2Med, initially named BarMar, which is an undersea pipeline that will transport hydrogen between Spain and France. The ambitious project will cost around 2.5 billion euros, and will help expedite the transitioning process to this alternative energy source, aiming to reduce greenhouse gas emission by more than 55% in 2030 compared to their 1990 level. Alongside all these government mega-projects, Spain’s private market has also been extremely involved in the transitioning process, with intense M&A activity in the energy sector. A relevant transaction that has been recently announced is that of Repsol Renovables.

Repsol Renovables transaction

Bank insurance group Crédit Agricole Assurances and energy investor Energy Infrastructure Partners (EIP) have reached an agreement for the acquisition of a 25% stake in Repsol Renovables, a subsidiary of Repsol. The value of the company including debt has been set at 4.39 billion euros. As a result, the Spanish group has pegged the sale at 905 million euros. The transaction, subject to the usual closing conditions and regulatory approval, is expected to be completed in the fourth quarter of this year. Repsol Renovables currently has more than 1.6 GW of installed renewable capacity. This portfolio is made up of wind farms, solar assets and hydroelectric plants in Spain, Chile and the USA. The firm aims to reach 20 GW in 2030, working together with its new partners. Furthermore, Crédit Agricole Assurances and EIP plan to further diversify assets with a view to entering new markets and incorporating other alternative technologies, such as offshore wind.

In addition to the Spanish company's soundness, the new partners were attracted by other factors, such as its long-term power purchase agreements with large companies such as Microsoft and Amazon, which shield it from the volatility of the energy markets. Repsol explains that the Madrid-based company will still control the division. Repsol Renovables and its subsidiaries will thereby continue to be consolidated within the Spanish group's accounts.

Philippe Dumont, CEO at Crédit Agricole Assurances, explained, “Fully in line with Crédit Agricole Group’s commitments to prevent climate change, Crédit Agricole Assurances is actively contributing to a low-carbon economy through its investments in the energy transition. This investment alongside Repsol and EIP is a new step in this, contributing to reach our objective of 14 GW of installed capacity by 2025.”

EIP Managing Partner Roland Dörig is clearly proud of the deal, “We are pleased to provide our investors with the opportunity to participate in a renewables platform of this size and calibre”. Peter Schümers, Co-Head of Investments added that “working together with Repsol will help us to realise our ambitious plans for growth, and for further expanding EIP’s footprint in the Americas.”

Repsol CEO Josu Jon Imaz concluded, “Having partners with the prestige of Crédit Agricole Assurances and EIP join Repsol Renovables reinforces the validity of our strategy and our ambition to be a major player in the energy transition, as well as fulfilling our expectations in this important process. Our goal is to reach an installed capacity of 6 GW by 2025, and 20 GW by 2030. As partners, they share our strategic vision for growth in renewables, as well as contributing their expertise and underlining the value of our growth platform”.

Conclusions

The recent macroeconomic uncertainty, volatility in the energy markets and energy transition has created an environment that will favor smaller deals that carry less risk than larger transformational deals. The Russian invasion of Ukraine and ongoing war has placed pressure on European countries to reduce their energy dependence on Russia and seek alternative energy sources. This has contributed to the volatility in prices, provided new opportunities for growth and expansion, but also has marked the beginning of a more fragmented world. As a result, the deglobalization phenomenon and geopolitical instability has led to a regionalization of trade contracts and supply chains within Europe. In 2022, the O&G industry experienced historically high and volatile energy and commodity prices, leading to record profits and a strengthened balance sheet. This has provided greater incentive and financial strength for companies to invest and engage in M&A activity. Deloitte identified five key drivers of strategic M&A, in Q1 2023, for the O&G industry: energy security, operational excellence, energy transition, partnerships and strategic alliances and governance and compliance. The energy transition presents a new area of opportunity for oil and gas companies globally to diversify their business and prepare for a low-carbon future. Spain has demonstrated its focus on addressing climate change and shifting towards renewable energy through investments in wind and solar and establishing a National Energy and Climate Plan that sets specific low-carbon economy targets. Spain’s actions are emblematic of the EU and other western countries who are concentrating their attention on achieving a low carbon economy as well as diversifying their energy consumption.

Sources

- Deloitte

- PWC

- Reuters

- Repsol

- Credite Agricole

- IEA

- WRI

- Financial Times

- The Economist