Since the Covid-19 crossed the borders of the Hubei district, the economic scenario experienced significant changes. The world is approaching to a new form of recession, which is concerning to both demand and supply. In addition, it has not been generated within the financial system, such as the 1929 crash or the 2008 financial crisis, but indeed brought out by an exogenous factor. Due to this black swan, markets operators are witnessing alarming behaviours in assets’ movements. In particular, one is correlation between stocks, bonds and currencies, which has increased, thus compressing opportunities of diversification in portfolio construction process.

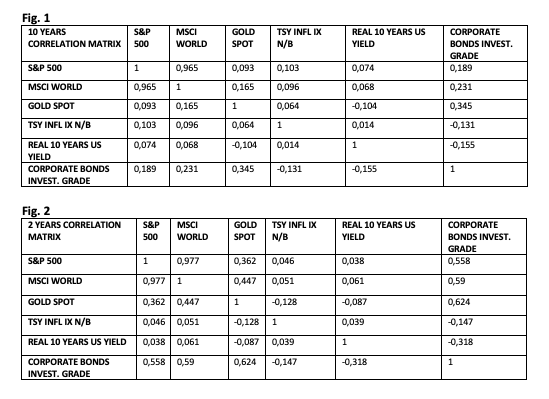

Fig 1 and 2 show the correlation matrices between different types of asset returns, given a long-term perspective of 10 years and a short-term perspective of 2 years.

Fig 1 and 2 show the correlation matrices between different types of asset returns, given a long-term perspective of 10 years and a short-term perspective of 2 years.

Data clearly explain and confirm the polarization of investment and risk management strategies: for example, if we look at the 10 years correlation between the S&P 500 index and the Investment grade corporate bonds, it is around 0.19, which means that these assets are uncorrelated. But if we consider a 2 years period, it’s 0.56 and a same phenomenon can be observed between the MSCI World index and Corporate bonds. Another instance is the dependence between corporate bonds and real 10 years yields of US bonds: their inverse correlation has doubled, from -0.155 to -0,318. These numbers perfectly reflect the general “humor” of investors, characterized by high risk adversity and therefore an obstinate search for “safe-haven assets”, that has led to big sell-offs in equities and great interest for government bonds.

Another alarming signal is that correlations between investment grade bonds, equity indexes (like MSCI or S&P) and gold, have significantly increased over the short term. For instance correlation between the precious metal and MSCI world equity index reached a peak of 0.447, which indicates that even the inverse relationship of gold, considered as the safe-haven asset par excellence, is no longer valid.

However, it should be remembered that this is in part due to leverage used by investors: during markets slumps, they suffer from heavy losses, so when they receive margin calls from banks they sell gold to cope with the requests, further increasing the selling pressure. Often margin positions are even closed automatically by the banks in case of spikes in volatility and investors’ liquidity deemed not to be sufficient, and this again exacerbate the slump, leading to other margin calls in a self-sustaining process.

In conclusion, the tighter and sometimes counterintuitive dependency between assets classes, in addition to a high volatility, has made in present times even more difficult to build a solid portfolio strategy and interpreting markets movements.

Matteo Girello

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here

Another alarming signal is that correlations between investment grade bonds, equity indexes (like MSCI or S&P) and gold, have significantly increased over the short term. For instance correlation between the precious metal and MSCI world equity index reached a peak of 0.447, which indicates that even the inverse relationship of gold, considered as the safe-haven asset par excellence, is no longer valid.

However, it should be remembered that this is in part due to leverage used by investors: during markets slumps, they suffer from heavy losses, so when they receive margin calls from banks they sell gold to cope with the requests, further increasing the selling pressure. Often margin positions are even closed automatically by the banks in case of spikes in volatility and investors’ liquidity deemed not to be sufficient, and this again exacerbate the slump, leading to other margin calls in a self-sustaining process.

In conclusion, the tighter and sometimes counterintuitive dependency between assets classes, in addition to a high volatility, has made in present times even more difficult to build a solid portfolio strategy and interpreting markets movements.

Matteo Girello

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here