On March 13th 2020, President Trump held a conference where he announced a ban on flights from European Countries to the United States for a 30-day period, as a precautionary measure in order to protect the U.S. from the coronavirus outbreak already widespread in the Schengen area. However, after Mr. Trump’s declaration, confusion started to reign among travellers, who were struggling to better understand the consequences of this ban.

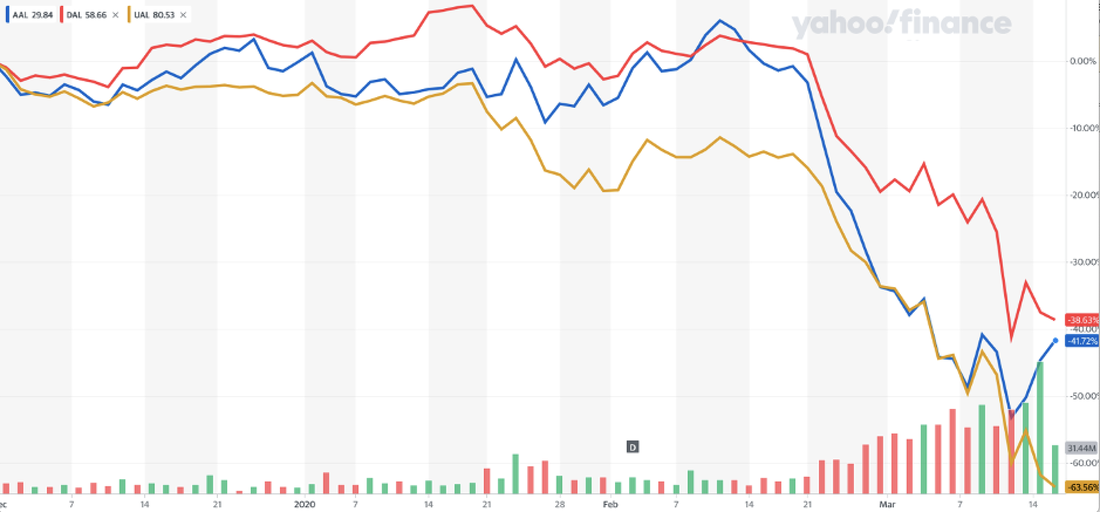

It goes without saying that the main U.S. airline companies, such as United, Delta and American airlines, were seriously hit by this declaration. By looking at the stock price analysis between December 1st and March 16th, United lost 63.56% of its equity value, Delta shares closed down 38.63%, whereas American decreased by more than 40%. Although these flight companies were already facing a sharp decline in bookings because of the coronavirus outbreak, the trans-Atlantic flights block, which accounts for a big portion of their businesses, has further contributed to a dramatic downturn in the industry.

It goes without saying that the main U.S. airline companies, such as United, Delta and American airlines, were seriously hit by this declaration. By looking at the stock price analysis between December 1st and March 16th, United lost 63.56% of its equity value, Delta shares closed down 38.63%, whereas American decreased by more than 40%. Although these flight companies were already facing a sharp decline in bookings because of the coronavirus outbreak, the trans-Atlantic flights block, which accounts for a big portion of their businesses, has further contributed to a dramatic downturn in the industry.

Source: Yahoo Finance

According to the U.S. government data, travel and tourism between the United States and Europe, including areas not covered by the ban, is a business earning approximately $130 billion annually. In 2019, the International Air Transport Association (IATA) reported that about 200 000 flights carried passengers between the United States and the countries targeted in Mr. Trump’s order, averaging about 550 flights carrying 125,000 travellers per day. Ms. Sara Nelson, president of the Association of Flight Attendants, commented the president conference as ‘a creation of a pandemonium’. Furthermore, she added that the trend that the sector is currently following goes beyond the fear of growing unemployment. Because travellers are afraid to flight, companies are troubled on whether or not they will be able to continue to operate.

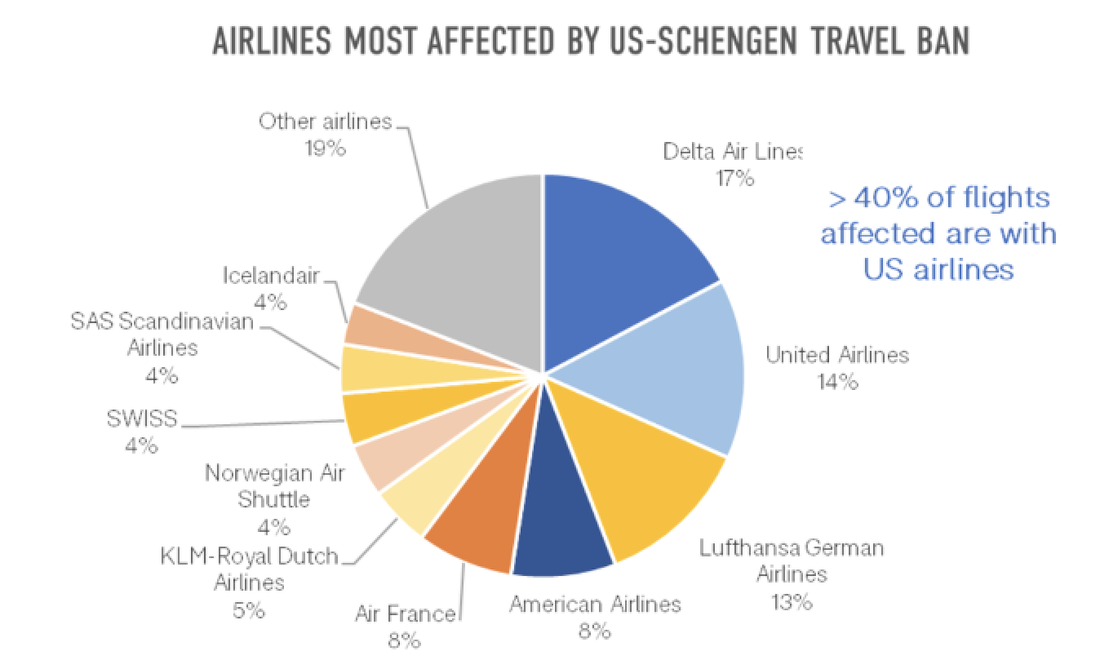

Source: OAG

OAG, an aviation data provider, forecasted that over the month, the US ban would affect more than 6,700 flights in each direction. Surprisingly, the most affected airlines from these events are the American carriers, which cover more than 40% of the total trans-Atlantic flights. Namely, Delta will undoubtedly be the most suffering as it provides more than 15% of the US-Schengen flights , followed by United Airlines and American Airlines with 14% and 8% respectively.

Despite the chaotic atmosphere described, the chief executives of these three companies, during an investor conference, explained that their experience in the sector had prepared them to overcome the issues of a potential incoming crisis. In fact, experts have confirmed that American carriers are more qualified than their European competitors. Their strategies are designed to hoard liquidity in response to an outbreak that has drawn comparisons to the worst events that the industry has faced in recent decades, including the 2007 financial crisis and the Sept. 11th World Trade Center attacks. However, industry analysts argue the airlines may have learned their lesson.

In order to manage a sharp decrease in net new bookings, Delta proposed to diminish international capacity by 20-25% whereas domestic services, which accredit for nearly 75% of its earnings, would be lowered among 10-15%. Furthermore, the airline company is undertaking initiatives such as offering employees voluntary leave and re-evaluate early retirement of older aircraft as measures that would reduce overall costs.

Similarly, American Airline has proposed to reduce international service during the peak summer season by about 10%, including more than half of its trans-Pacific flights. The airline has also proposed to cut domestic service by 7.5% over these period.

During the first week of March, United has registered a 100% decline in net bookings to Asia and Europe, whereas domestically net bookings are down about 70%. As such, the company is beating to this challenging situation by adjusting its operating expenditures, capital expenditures, and liquidity position. In addition, the company has decided to cancel flights for 90-day basis until there are signs of a recovery in demand. As an immediate action, United Airline announced that its chief executive, Oscar Munoz, and its CEO Scott Kirby, would renounce their base salaries at least through June.

In conclusion, even though the consequences of the virus outbreak might seem pessimistic according to recent numbers, Mr. Kirby and other experts are confident the airline industry will get through this crisis without affecting the long-term financial prospects.

Guglielmo Lucio Palmieri

Despite the chaotic atmosphere described, the chief executives of these three companies, during an investor conference, explained that their experience in the sector had prepared them to overcome the issues of a potential incoming crisis. In fact, experts have confirmed that American carriers are more qualified than their European competitors. Their strategies are designed to hoard liquidity in response to an outbreak that has drawn comparisons to the worst events that the industry has faced in recent decades, including the 2007 financial crisis and the Sept. 11th World Trade Center attacks. However, industry analysts argue the airlines may have learned their lesson.

In order to manage a sharp decrease in net new bookings, Delta proposed to diminish international capacity by 20-25% whereas domestic services, which accredit for nearly 75% of its earnings, would be lowered among 10-15%. Furthermore, the airline company is undertaking initiatives such as offering employees voluntary leave and re-evaluate early retirement of older aircraft as measures that would reduce overall costs.

Similarly, American Airline has proposed to reduce international service during the peak summer season by about 10%, including more than half of its trans-Pacific flights. The airline has also proposed to cut domestic service by 7.5% over these period.

During the first week of March, United has registered a 100% decline in net bookings to Asia and Europe, whereas domestically net bookings are down about 70%. As such, the company is beating to this challenging situation by adjusting its operating expenditures, capital expenditures, and liquidity position. In addition, the company has decided to cancel flights for 90-day basis until there are signs of a recovery in demand. As an immediate action, United Airline announced that its chief executive, Oscar Munoz, and its CEO Scott Kirby, would renounce their base salaries at least through June.

In conclusion, even though the consequences of the virus outbreak might seem pessimistic according to recent numbers, Mr. Kirby and other experts are confident the airline industry will get through this crisis without affecting the long-term financial prospects.

Guglielmo Lucio Palmieri