Introduction

Almost three years after the beginning of the covid pandemic, the world economy is completely different: the Great Recession and sovereign debt crisis seem to be old memories, while new uncertainties come up. Epidemiological and geopolitical events have reshaped the macro environment and every player must deal with this new, more complex situation. Banks are among the players most affected by changes in the economic environment. Taking the US leading world economy as our point of reference, in this article we will analyze how the largest US banks are impacted and will react to the current and future economic conditions, with a specific focus on AM, M&A, and capital markets activity.

Macro Scenario

After 2020 the US – and the whole world – has changed in a way nobody would have expected. The most relevant among the recent economic trends there is the comeback of persistently high inflation. During 2021 the Consumer Price Index (CPI) rose 7% annually. The upward trend was then confirmed with a peak of 9.1% in June, the highest annual inflation rate since the 1980s. Since then, the increase in the cost of living has slowed down a bit, remaining above 8% (+8.2% in September). These data are impressive if compared with the low inflation of the last decade.

What drove this sharp increase in the inflation rate? To understand the issue it is necessary to focus on two aspects. The first is the Covid pandemic and its consequences, in particular supply chain disruptions. Indeed, these factors are believed to account for almost half of the US inflation hike. For example, chip shortages put the automobile sector in a difficult position, due to their fundamental role as components of vehicles. The covid pandemic brought about a slowing down of the global economy, which in turn created delays and interruptions in the supply chain. Russia's invasion of Ukraine worsened the inflationary situation too, being Russia a leader in exporting natural gas and oil to European countries.

However, there is another factor that played a fundamental role in driving inflation up, and that is increasing demand. Indeed, along with the rise in prices, US import quantities have grown faster than in the past, putting upward pressure on prices and suggesting higher consumer demand as one of the drivers of inflation. At the same time, the US job market reached historically tight levels. The unemployment rate is currently 3.7%, slightly higher than the 3.5% hit in July, but still close to its 50-year low. Nonfarm payrolls surpassed the pre-pandemic peak and, even though companies in certain sectors are announcing future layoffs, the number of vacancies is still high. This resulted in a sharp increase in wages, which further fueled inflation. This also explains why the US inflation rate overtakes the ones of other advanced countries.

The current value of the CPI is well above the Federal Reserve target of an annual 2% inflation rate. Therefore, it is clear that the Fed's intervention is needed to bring inflation down in the shortest time possible. To do that, the central bank, and in particular, its Open Market Committee (FOMC), must enact a contractionary monetary policy. By tightening the money supply, the Fed leads to an increase in interest rate, which in turn slows demand by making borrowing more expensive. The consequence of this process is that the current upward pressure on prices is expected to turn into a downward one. At the same time, slowing demand should lead to higher unemployment, cooling down the labor market. Everything together should bring down inflation. Nevertheless, it must be considered that this will cause a slowdown in economic growth, increasing the likelihood of a future recession.

In March, after almost two years of zero-interest-rate policy to boost the economy after the Covid pandemic, the Fed started to raise interest rates with the first increase of 0.25%. Since then, the interest rate is currently in a range of 3.75-4%, after the fourth consecutive hike of 0.75% on the 2nd of November. Along with rising interest rates, the Fed put an end to the aggressive quantitative easing program that started in 2020. Despite the measures adopted by the US central bank, the inflation problem is far from being solved. It should be underlined, anyway, that each interest rate hike is expected to take over six months to show its effects on the economy.

As stated before, rising interest rates increase the risk of an economic recession; thus, every decision of the Fed is taken trying to find a balance between the need to control inflation and the attempt to avoid an excessive slowdown of the economy. The main current worry for the market is that the Fed raises rates too quickly and too much, pushing the economy into a recession and reversing all the improvements made in the last months. However, as of now, the labor market seems strong enough to let the Fed remain aggressive in its fight against inflation.

It is not surprising that the latest 0.75% hike in interest rate (in November), higher than expectations, has not been well welcomed by investors. But J. Powell seemed confident that a less sharp increase of the rate may be already possible in December or the immediately following meeting. In the latest announcements, the Fed underlined its aim of going on with 'sufficiently restrictive' measures until improvements will finally be noticeable in an economy that is proving to be more resistant than expected to monetary tightening. Indeed, expectations for the next year are further hikes in interest rates to a maximum of 4.75% to make inflation fall back toward the 2% target by the end of 2023.

What drove this sharp increase in the inflation rate? To understand the issue it is necessary to focus on two aspects. The first is the Covid pandemic and its consequences, in particular supply chain disruptions. Indeed, these factors are believed to account for almost half of the US inflation hike. For example, chip shortages put the automobile sector in a difficult position, due to their fundamental role as components of vehicles. The covid pandemic brought about a slowing down of the global economy, which in turn created delays and interruptions in the supply chain. Russia's invasion of Ukraine worsened the inflationary situation too, being Russia a leader in exporting natural gas and oil to European countries.

However, there is another factor that played a fundamental role in driving inflation up, and that is increasing demand. Indeed, along with the rise in prices, US import quantities have grown faster than in the past, putting upward pressure on prices and suggesting higher consumer demand as one of the drivers of inflation. At the same time, the US job market reached historically tight levels. The unemployment rate is currently 3.7%, slightly higher than the 3.5% hit in July, but still close to its 50-year low. Nonfarm payrolls surpassed the pre-pandemic peak and, even though companies in certain sectors are announcing future layoffs, the number of vacancies is still high. This resulted in a sharp increase in wages, which further fueled inflation. This also explains why the US inflation rate overtakes the ones of other advanced countries.

The current value of the CPI is well above the Federal Reserve target of an annual 2% inflation rate. Therefore, it is clear that the Fed's intervention is needed to bring inflation down in the shortest time possible. To do that, the central bank, and in particular, its Open Market Committee (FOMC), must enact a contractionary monetary policy. By tightening the money supply, the Fed leads to an increase in interest rate, which in turn slows demand by making borrowing more expensive. The consequence of this process is that the current upward pressure on prices is expected to turn into a downward one. At the same time, slowing demand should lead to higher unemployment, cooling down the labor market. Everything together should bring down inflation. Nevertheless, it must be considered that this will cause a slowdown in economic growth, increasing the likelihood of a future recession.

In March, after almost two years of zero-interest-rate policy to boost the economy after the Covid pandemic, the Fed started to raise interest rates with the first increase of 0.25%. Since then, the interest rate is currently in a range of 3.75-4%, after the fourth consecutive hike of 0.75% on the 2nd of November. Along with rising interest rates, the Fed put an end to the aggressive quantitative easing program that started in 2020. Despite the measures adopted by the US central bank, the inflation problem is far from being solved. It should be underlined, anyway, that each interest rate hike is expected to take over six months to show its effects on the economy.

As stated before, rising interest rates increase the risk of an economic recession; thus, every decision of the Fed is taken trying to find a balance between the need to control inflation and the attempt to avoid an excessive slowdown of the economy. The main current worry for the market is that the Fed raises rates too quickly and too much, pushing the economy into a recession and reversing all the improvements made in the last months. However, as of now, the labor market seems strong enough to let the Fed remain aggressive in its fight against inflation.

It is not surprising that the latest 0.75% hike in interest rate (in November), higher than expectations, has not been well welcomed by investors. But J. Powell seemed confident that a less sharp increase of the rate may be already possible in December or the immediately following meeting. In the latest announcements, the Fed underlined its aim of going on with 'sufficiently restrictive' measures until improvements will finally be noticeable in an economy that is proving to be more resistant than expected to monetary tightening. Indeed, expectations for the next year are further hikes in interest rates to a maximum of 4.75% to make inflation fall back toward the 2% target by the end of 2023.

US Banks' Performance

Market Performance

Now, let us analyze how US bank stocks performed in the macroeconomic environment described above. To get a clear idea of that, we will consider two different benchmarks for the sake of comparison: the S&P 500 financials and the S&P 500. In this way, we will be able to observe the yield given by the leading US banks compared to the financial industry overall and the rest of American large-cap stocks.

Concerning the S&P financials, the index registered a record of 688.85 in January, following an extremely profitable 2021 for the industry – especially if we refer to the banks that offer advisory services. With the fears of a future recession and the inflation rate that continues to increase, it followed a downward trend during the year. Up to now, the index is down 13.5% YTD. However, it significantly outperformed the S&P 500, which declined by 21% YTD. The two indices followed approximately the same trend, but the financials index grew faster in the last month's stock market rebound, probably fueled by the banks' quarterly results released in October.

What can be observed, however, is the performance of pure investment banks compared to those that offer other services. After an extremely profitable 2021, Goldman Sachs stocks went down by 5%, thus performing significantly better during this period than the vast majority of banks and also than the S&P 500. Another example in this sense can be Morgan Stanley, which, although it does not obtain results as satisfactory as Goldman Sachs, manages to beat both benchmarks, experiencing a stock price decline of 13%.

On the other hand, balance sheet banks such as JP Morgan Chase & Co. or Bank of America could match the performance of their competitors offering a much smaller range of services. They both registered a loss of approximately 17%; the performance of their shares is better than the S&P 500 but slightly worse than other financials.

However, based on future data, it will be possible to find out if inflation will start following a downward trend. In this case, a market recovery can be expected, because although before the peak of inflation the entire market tends to fall, as it happened in the first half of 2022, after the peak, there is more variance and on average, the market does recover. This statement can be supported by the fact that after the 13 periods of persistent inflation we went through since 1951, the market was at a higher level 12 months later in nine cases.

Concerning the S&P financials, the index registered a record of 688.85 in January, following an extremely profitable 2021 for the industry – especially if we refer to the banks that offer advisory services. With the fears of a future recession and the inflation rate that continues to increase, it followed a downward trend during the year. Up to now, the index is down 13.5% YTD. However, it significantly outperformed the S&P 500, which declined by 21% YTD. The two indices followed approximately the same trend, but the financials index grew faster in the last month's stock market rebound, probably fueled by the banks' quarterly results released in October.

What can be observed, however, is the performance of pure investment banks compared to those that offer other services. After an extremely profitable 2021, Goldman Sachs stocks went down by 5%, thus performing significantly better during this period than the vast majority of banks and also than the S&P 500. Another example in this sense can be Morgan Stanley, which, although it does not obtain results as satisfactory as Goldman Sachs, manages to beat both benchmarks, experiencing a stock price decline of 13%.

On the other hand, balance sheet banks such as JP Morgan Chase & Co. or Bank of America could match the performance of their competitors offering a much smaller range of services. They both registered a loss of approximately 17%; the performance of their shares is better than the S&P 500 but slightly worse than other financials.

However, based on future data, it will be possible to find out if inflation will start following a downward trend. In this case, a market recovery can be expected, because although before the peak of inflation the entire market tends to fall, as it happened in the first half of 2022, after the peak, there is more variance and on average, the market does recover. This statement can be supported by the fact that after the 13 periods of persistent inflation we went through since 1951, the market was at a higher level 12 months later in nine cases.

Q3 Earnings

Macroeconomic pressures are reflected not only in the stock market performances but also in the financial results that banks have released for Q3. A prime example in this sense can be Morgan Stanley, which obtained a series of lower results compared to analysts' estimates. It recorded Revenues of $12.99 bn, 2.33% lower than forecasted, while Earnings Per Share were $1.47 compared to the estimate of $1.49, representing a 29% decrease from a year earlier. Moreover, we can observe a significant decrease compared to 2021 when it comes to the revenue brought by the investment banking division, which dropped by 55%, but also by the investment management division, which fell by 20%. On the other hand, a positive result can be associated with the trading division, which registered an increase of 16.42% in revenues. In particular, Fixed Income revenue rose by 33%, reflecting strength in macro products on high clients' engagement and volatility in the markets.

A series of similar results for Q3 of 2022 can also be seen at Goldman Sachs, recording an Earnings Per Share of $8.25 compared to $14.93 last year. The Investment Banking division obtained revenues 57% lower than in Q3 2021, thus confirming the negative trend of advisory services. Similarly to Morgan Stanley, the Asset Management division recorded a loss of 20%. On the contrary, revenues in the Global Markets division rose by 11%. Again, this result was driven mainly by FICC, while equities lost ground.

As for JP Morgan Chase & Co, analysts' estimates were exceeded; the bank made $33.49 bn in revenues compared to the estimate of $32.1 billion, while Earnings Per Share were $3.12 compared to a $2.88 estimate. Stocks reacted with a 2.6% gain. Looking at the single divisions, we observe a significant decrease in the net income generated by the Corporate and Investment Banking division, a 37.45% decline compared to the previous year. However, in this case, we can notice an improvement in the net income generated by the Asset & Wealth Management division, 1.92% more than in Q3 2021.

Another US bank that manages to exceed analysts' estimates is Bank of America. The bank made $24 bn in revenues compared to a $23.5 bn forecast. Earnings Per Share reached $0.81, beating the analysts' estimate of $0.78. Again, the market reacted positively to the news. Regarding the results of the Global Banking division, an annual decrease of 20.13% can be observed, which is still a significantly better result compared to the previously presented banks. Also, we can note that the Global Markets division performed very well, with profits 14.35% higher than a year ago. On the other hand, the Global Wealth and Investment Management division recorded a loss of 2.94%, thus confirming the negative trend followed by the Asset Management sector.

A series of similar results for Q3 of 2022 can also be seen at Goldman Sachs, recording an Earnings Per Share of $8.25 compared to $14.93 last year. The Investment Banking division obtained revenues 57% lower than in Q3 2021, thus confirming the negative trend of advisory services. Similarly to Morgan Stanley, the Asset Management division recorded a loss of 20%. On the contrary, revenues in the Global Markets division rose by 11%. Again, this result was driven mainly by FICC, while equities lost ground.

As for JP Morgan Chase & Co, analysts' estimates were exceeded; the bank made $33.49 bn in revenues compared to the estimate of $32.1 billion, while Earnings Per Share were $3.12 compared to a $2.88 estimate. Stocks reacted with a 2.6% gain. Looking at the single divisions, we observe a significant decrease in the net income generated by the Corporate and Investment Banking division, a 37.45% decline compared to the previous year. However, in this case, we can notice an improvement in the net income generated by the Asset & Wealth Management division, 1.92% more than in Q3 2021.

Another US bank that manages to exceed analysts' estimates is Bank of America. The bank made $24 bn in revenues compared to a $23.5 bn forecast. Earnings Per Share reached $0.81, beating the analysts' estimate of $0.78. Again, the market reacted positively to the news. Regarding the results of the Global Banking division, an annual decrease of 20.13% can be observed, which is still a significantly better result compared to the previously presented banks. Also, we can note that the Global Markets division performed very well, with profits 14.35% higher than a year ago. On the other hand, the Global Wealth and Investment Management division recorded a loss of 2.94%, thus confirming the negative trend followed by the Asset Management sector.

Current and Future Outlook

Portfolio Allocation

Considering these data, we can note two important aspects. Banks are experiencing a new financial environment compared with the previous decade and are reacting to these new market trends by shifting their portfolio choices.

According to PIMCO, "inflation poses a "stealth" threat to investors because it chips away at real savings and investment returns. Most investors aim to increase their long-term purchasing power. Inflation puts this goal at risk because investment returns must first keep up with the rate of inflation in order to increase real purchasing power. [...] Very high inflation tends to have a negative impact on assets such as stocks and bonds. Maintaining a constant allocation to inflation-hedging assets can help investors cushion their portfolios against unexpected spikes.”

Similarly, Blackrock highlights that the macro-environment "reinforces a significant asset reallocation in favor of equities and away from fixed income. Commodities, infrastructure, and real estate have generally outperformed traditional equity and fixed-income indices in periods of high inflation. We remain underweight bonds as we see long-term yields climbing further."

According to Credit Suisse, overall, "investors react to meaningful changes in inflation through security selection and asset allocation shifts. Changing inflation expectations naturally coincide with shifting economic regimes, and unsurprisingly 2021 witnessed meaningful factor rotations. [...] Many valuation strategies favor near-term cash flows over long-term cash flows and are implicitly short-duration/synthetic steepeners. The performance of these strategies often correlates positively with inflation changes and levels. [...] Changes in inflation expectations are directly at odds with pricing efficiency, and carry strategies can be susceptible to loss as inflation expectations increase both outright and via substitution effects, particularly fixed income and commodity carry strategies".

Blackrock's research team analyzes ways to address inflation within portfolios. "The current environment is creating opportunities for fixed-income investors, especially in short-term and high-quality assets. Investors have been overweight cash allocations, which has helped preserve capital for future buying opportunities at better prices." In particular, "inflation-linked bonds and unconstrained strategies may outperform traditional government bonds. Traditional fixed-income assets are expected to generate a negative real yield over the medium term. Consider unconstrained strategies for greater flexibility in capturing opportunities across different sectors to achieve a positive real yield.

With nominal government bond yields less sensitive than in the past to higher inflation expectations and actual inflation, inflation-linked bonds can provide resilience and help protect against further inflation surprises." For instance, investors should "consider Treasury inflation-protected securities (TIPS). The rate of return on TIPS is adjusted following the CPI. This can result in a somewhat more reliable performance than other types of bonds and asset classes. However, TIPS returns and income tend to be relatively low.

According to PIMCO, "inflation poses a "stealth" threat to investors because it chips away at real savings and investment returns. Most investors aim to increase their long-term purchasing power. Inflation puts this goal at risk because investment returns must first keep up with the rate of inflation in order to increase real purchasing power. [...] Very high inflation tends to have a negative impact on assets such as stocks and bonds. Maintaining a constant allocation to inflation-hedging assets can help investors cushion their portfolios against unexpected spikes.”

Similarly, Blackrock highlights that the macro-environment "reinforces a significant asset reallocation in favor of equities and away from fixed income. Commodities, infrastructure, and real estate have generally outperformed traditional equity and fixed-income indices in periods of high inflation. We remain underweight bonds as we see long-term yields climbing further."

According to Credit Suisse, overall, "investors react to meaningful changes in inflation through security selection and asset allocation shifts. Changing inflation expectations naturally coincide with shifting economic regimes, and unsurprisingly 2021 witnessed meaningful factor rotations. [...] Many valuation strategies favor near-term cash flows over long-term cash flows and are implicitly short-duration/synthetic steepeners. The performance of these strategies often correlates positively with inflation changes and levels. [...] Changes in inflation expectations are directly at odds with pricing efficiency, and carry strategies can be susceptible to loss as inflation expectations increase both outright and via substitution effects, particularly fixed income and commodity carry strategies".

Blackrock's research team analyzes ways to address inflation within portfolios. "The current environment is creating opportunities for fixed-income investors, especially in short-term and high-quality assets. Investors have been overweight cash allocations, which has helped preserve capital for future buying opportunities at better prices." In particular, "inflation-linked bonds and unconstrained strategies may outperform traditional government bonds. Traditional fixed-income assets are expected to generate a negative real yield over the medium term. Consider unconstrained strategies for greater flexibility in capturing opportunities across different sectors to achieve a positive real yield.

With nominal government bond yields less sensitive than in the past to higher inflation expectations and actual inflation, inflation-linked bonds can provide resilience and help protect against further inflation surprises." For instance, investors should "consider Treasury inflation-protected securities (TIPS). The rate of return on TIPS is adjusted following the CPI. This can result in a somewhat more reliable performance than other types of bonds and asset classes. However, TIPS returns and income tend to be relatively low.

According to Wells Fargo, after the Fed announcement of 2nd November "investors may want to consider locking in a portion of their fixed-income portfolio in longer-term maturities at current yield levels."

Morgan Stanley analysts "reiterate [...] preference for credit over duration in fixed income portfolios." Moreover, they believe "investors can also look for opportunities in extending from money market funds to short-duration bond funds that have started to reflect future rate hikes and higher yields. While yield curves may steepen, excess global liquidity and persistent demand from pension funds and foreign buyers should keep a lid on long-end yields".

Regarding equities, "value stocks from companies with strong pricing power can combat rising costs and beat earnings expectations. We see pricing power and asset-light operations as key components of stock price success during inflationary periods. [...] Profitable blue-chips with stable earnings and low debt can serve as a natural ballast to value stocks because of their ability to absorb higher input costs while utilizing their pricing power to increase market share."

Moreover, "commodity futures and commodity-related equities enhance portfolio resiliency and strengthen commodities exposure. Commodities historically outperform during periods of high inflation. As demand for goods and services increases, so does the price of the commodities used to produce them."

On the contrary, Lazard points to the fact that "high inflation, rising interest rates, and falling growth expectations have proven to be a particularly difficult recipe for balanced portfolios, as both equities and bonds have suffered." They suggest a focus on real assets which are considered better suited for times of high inflation and "have outperformed during this period and provided valuable hedges against uncertainty."

Morgan Stanley analysts "reiterate [...] preference for credit over duration in fixed income portfolios." Moreover, they believe "investors can also look for opportunities in extending from money market funds to short-duration bond funds that have started to reflect future rate hikes and higher yields. While yield curves may steepen, excess global liquidity and persistent demand from pension funds and foreign buyers should keep a lid on long-end yields".

Regarding equities, "value stocks from companies with strong pricing power can combat rising costs and beat earnings expectations. We see pricing power and asset-light operations as key components of stock price success during inflationary periods. [...] Profitable blue-chips with stable earnings and low debt can serve as a natural ballast to value stocks because of their ability to absorb higher input costs while utilizing their pricing power to increase market share."

Moreover, "commodity futures and commodity-related equities enhance portfolio resiliency and strengthen commodities exposure. Commodities historically outperform during periods of high inflation. As demand for goods and services increases, so does the price of the commodities used to produce them."

On the contrary, Lazard points to the fact that "high inflation, rising interest rates, and falling growth expectations have proven to be a particularly difficult recipe for balanced portfolios, as both equities and bonds have suffered." They suggest a focus on real assets which are considered better suited for times of high inflation and "have outperformed during this period and provided valuable hedges against uncertainty."

M&A and Capital Markets

After a record year for dealmaking in 2021, many companies are pausing acquisitions because of macro trends. The value of global M&As dropped by 34% during the first nine months of 2022, the largest year-over-year drop since 2009. According to Matt Toole, director of deals intelligence at Refinitiv, "all signs are pointing to this resetting stage, where companies have taken a pause on what their M&A playbook might look like". Moreover, a weaker economy could change the nature of the deals. For example, a stronger US dollar could make cross-border acquisitions more attractive for US companies. However, companies with available cash and financing may value the projected benefits of an acquisition more than the fears of a recession. This is the case for the acquisition of Figma by Adobe Inc. Furthermore, according to S&P's "2023 M&A outlook", this trend is not likely to change in the short term, also because of reduced confidence among executives.

However, opinions are discordant as, according to a Grant Thornton report, "professionals expect an increase in deals over the next six months despite rising interest rates threatening access to capital and uncertainty about a potential increase in capital gains taxes."

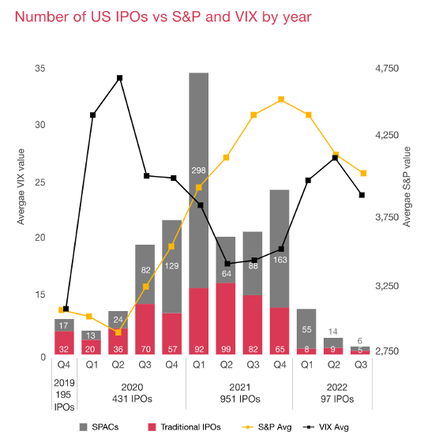

IPOs face a similar situation. While in 2021 U.S.-listed companies raised over $155 billion in proceeds through their initial public offerings, in the first half of 2022, they only raised $4.8 billion. Rachel Gerring, IPO leader at EY Americas, says that "investors are really risk averse at this moment, and that's what's really impacting the lack of activity that we're seeing". Moreover, according to a recent empirical paper on IPOs variability to economic conditions, we can expect increasing IPOs variability due to inflation.

However, opinions are discordant as, according to a Grant Thornton report, "professionals expect an increase in deals over the next six months despite rising interest rates threatening access to capital and uncertainty about a potential increase in capital gains taxes."

IPOs face a similar situation. While in 2021 U.S.-listed companies raised over $155 billion in proceeds through their initial public offerings, in the first half of 2022, they only raised $4.8 billion. Rachel Gerring, IPO leader at EY Americas, says that "investors are really risk averse at this moment, and that's what's really impacting the lack of activity that we're seeing". Moreover, according to a recent empirical paper on IPOs variability to economic conditions, we can expect increasing IPOs variability due to inflation.

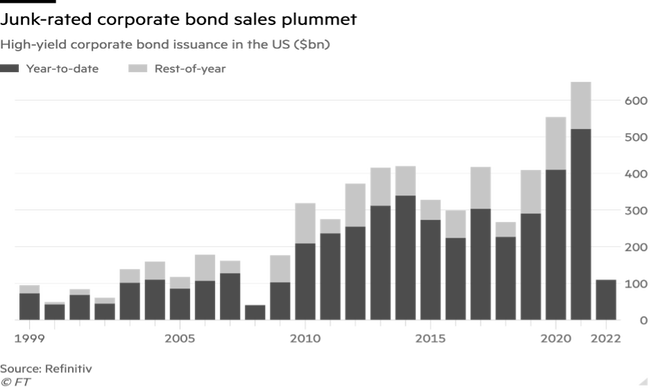

Debt capital markets activity slowed down across the investment grade, high yield and leveraged loan markets as issuance declined to $356 billion in Q3. Looking at the near term, in a market environment still dominated by persistent volatility, issuers should be tactical and opportunistic when open window periods arise.

Future Trends

Overall, predictions of future economic trends are challenging from a theoretical point of view. In general, the change in the economic regime has caused an increase in uncertainty and therefore prudency. However, equities are likely to remain preferred in the short term.

"Low interest rates", say an LGT report, "have supported equity markets by making cheap finance available to companies, fueling their expansion. Higher rates are dampening this effect – although many argue this has simply made prices more realistic. [...] But market sentiment in reaction to events such as central bank action is also a key price driver. Joe Nellis, professor of global economy at Cranfield School of Management, said if the market is not confident central banks can control inflation, that increases its perception of risk.". For instance, Freedman, Chief Investment Officer at U.S. Bank Wealth Management notes that his bank has shifted its position from a "pro-growth" mentality to a more balanced outlook for the short term.

While Morgan Stanley believes that "the path and trajectory of US interest rates remains an open question" they "continue to favor credit risk over interest rate risk, which has worked well for investors this year." Also, portfolios "continue to favor more credit sensitive areas of the market, as well as bonds with stronger structures, meaning less sensitivity to extension risk."

To conclude, according to Deloitte's "2023 banking and capital markets outlook", investment banks are likely to face "a unique set of challenges" in the next year. While in the last two years they posted record profits, volatility across markets "could create headwinds for prospective deal-making and underwriting and also stress capital and liquidity buffers". It is significant that commercial banks, while enjoying improving net interest income as central banks raise rates, "will likely face fierce competition to win a greater share of corporate clients' wallet". While in the short-term both commercial and investment banks are likely to focus on reacting to macro-trends, in the long run, they should focus on the green economy and modernization through digitalization.

"Low interest rates", say an LGT report, "have supported equity markets by making cheap finance available to companies, fueling their expansion. Higher rates are dampening this effect – although many argue this has simply made prices more realistic. [...] But market sentiment in reaction to events such as central bank action is also a key price driver. Joe Nellis, professor of global economy at Cranfield School of Management, said if the market is not confident central banks can control inflation, that increases its perception of risk.". For instance, Freedman, Chief Investment Officer at U.S. Bank Wealth Management notes that his bank has shifted its position from a "pro-growth" mentality to a more balanced outlook for the short term.

While Morgan Stanley believes that "the path and trajectory of US interest rates remains an open question" they "continue to favor credit risk over interest rate risk, which has worked well for investors this year." Also, portfolios "continue to favor more credit sensitive areas of the market, as well as bonds with stronger structures, meaning less sensitivity to extension risk."

To conclude, according to Deloitte's "2023 banking and capital markets outlook", investment banks are likely to face "a unique set of challenges" in the next year. While in the last two years they posted record profits, volatility across markets "could create headwinds for prospective deal-making and underwriting and also stress capital and liquidity buffers". It is significant that commercial banks, while enjoying improving net interest income as central banks raise rates, "will likely face fierce competition to win a greater share of corporate clients' wallet". While in the short-term both commercial and investment banks are likely to focus on reacting to macro-trends, in the long run, they should focus on the green economy and modernization through digitalization.

By Francesco Doga, Chiara Evangelisti, and Laurian David Pop

Sources

- Bank of America

- Blackrock

- Bloomberg

- CNBC

- Deloitte

- The Economist

- EY

- Financial Times

- Goldman Sachs

- Grand Thronton

- JP Morgan

- Morgan Stanley

- PIMCO

- PWC

- Reuters

- S&P Global

- Statista

- Wells Fargo

- Yahoo Finance