The disruption caused by Covid-19 has little precedent. The pandemic has had a severe impact on the globally integrated luxury good industry. As the fashion sales fall off millions of jobs are at risk. In an increasingly challenging environment, how will Covid-19 reshape the fashion luxury market?

In 2019 the overall luxury market grew by a 4 percent rate, accounting approximately for $247 billion aggregate luxury goods sales. After an extraordinary positive start in January, the first threat came with the virus spread in Mainland China, a market that delivers the majority of the market growth. Brands operating in China had to temporarily close stores and limit working hours, luxury goods companies had to shut their shops in the world’s second-largest economy. The luxury market in Europe and the USA had been stable in the first month, although, from January 17 to March 11, the MSCI Europe Textiles, Apparel & Luxury Goods fell 23%, seeing a market value of $152 billion erased.

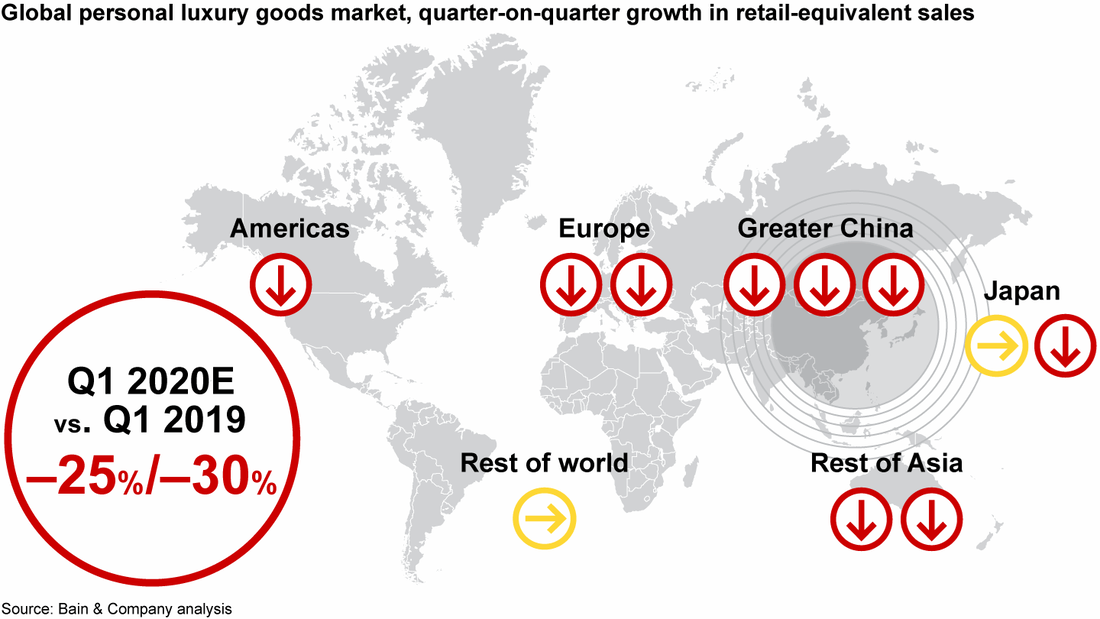

As Italy has been put into lockdown, the headquarters of Prada, Versace, Armani, and the other international brands relying on Italy for manufacturing, including Louis Vuitton and Stella McCartney, have been directly hit by the spread of the pandemic virus. Luxury retailers faced a double whammy of falling demand from Chinese buyers and disruptions of the supply chain. Bain has predicted a contraction among 15%-35% in this year for personal luxury goods, while analysts forecast a faster and the strongest recovery in China and in the broader Asian market in comparison to Europe and Americas that will experience a more prolonged impact.

However, consumers may return faster than expected to luxury stores in China. As the coronavirus lockdown measures are being eased in Asia, retail shops are reopening for business. WWD reported that the Birkin bag maker, Hermes recorded, just a day after the reopening, $2.7 million in sales in the flagship store in Guangzhou. The highest daily haul for a single boutique in China may hint for a potentially recover of businesses that have been hardly hit by the coronavirus spread. Does this case represent an efficient barometer for the post-pandemic luxury shopping or just an isolated form of “revenge spending”?

In 2019 the overall luxury market grew by a 4 percent rate, accounting approximately for $247 billion aggregate luxury goods sales. After an extraordinary positive start in January, the first threat came with the virus spread in Mainland China, a market that delivers the majority of the market growth. Brands operating in China had to temporarily close stores and limit working hours, luxury goods companies had to shut their shops in the world’s second-largest economy. The luxury market in Europe and the USA had been stable in the first month, although, from January 17 to March 11, the MSCI Europe Textiles, Apparel & Luxury Goods fell 23%, seeing a market value of $152 billion erased.

As Italy has been put into lockdown, the headquarters of Prada, Versace, Armani, and the other international brands relying on Italy for manufacturing, including Louis Vuitton and Stella McCartney, have been directly hit by the spread of the pandemic virus. Luxury retailers faced a double whammy of falling demand from Chinese buyers and disruptions of the supply chain. Bain has predicted a contraction among 15%-35% in this year for personal luxury goods, while analysts forecast a faster and the strongest recovery in China and in the broader Asian market in comparison to Europe and Americas that will experience a more prolonged impact.

However, consumers may return faster than expected to luxury stores in China. As the coronavirus lockdown measures are being eased in Asia, retail shops are reopening for business. WWD reported that the Birkin bag maker, Hermes recorded, just a day after the reopening, $2.7 million in sales in the flagship store in Guangzhou. The highest daily haul for a single boutique in China may hint for a potentially recover of businesses that have been hardly hit by the coronavirus spread. Does this case represent an efficient barometer for the post-pandemic luxury shopping or just an isolated form of “revenge spending”?

Luxury brands aren’t simply protecting their employees and customers, through nationally imposed store closures and other necessary measures. Far from being frivolous, they are helping in frontline producing hand sanitizer and protective clothing. Bulgari converted its production to hand sanitizer, Ferrari is working on transforming Maranello factory to assembly respirators, Prada is producing surgical masks.

Beyond the incredible reaction, luxury goods and services will face the serious threat of the plunge of the consumer willingness to spend: the consumer confidence has been hardly reshaped by the lockdown, and the severe constraints regarding the domestic product, the employment rate, and the financial markets. Moreover, the travel restrictions are waiving off a great percentage of the sales made by tourists.

Almost a quarter of the luxury industry is in the hands of a global consumer, with sales generated by purchasing outside their home countries. The wealthy Chinese accounted the 90% of the global luxury market growth in 2019 and represented approximately 35% of the global personal luxury market. Travel restrictions are chocking off the established duo of global traveler/local shopper. The travel experience not only allowed to benefit of lower prices in a local atelier in Europe but, even more important, tourists were incentivized by the unique experience and the sense of authenticity of buying a brand in its origin country, bringing home a more expensive and exclusive souvenir.

The Covid-19 crisis will function as an accelerator of change for brands, that will need to rethink their approach, strengthening the digital and e-commerce challenges.

Despite this challenging environment, global crises can create new opportunities for growth through strategic decisions in M&A. Analysis of the past demonstrates that the through-cycle in M&A has the potentiality of creating value during the crisis. M&A and partnership opportunities may enable us to shape the postcrisis scenario. Managers are now called to make a strategic decision regarding the implementation of vertical integration, acquisitions, empowering partnerships with the technology arena. After the crisis, acquisition opportunities for highly capitalized groups will confirm the already existent trend of industry consolidation in the personal luxury market.

To benefit from the quicker, and strongest rebound of the Chinese market, brands need to engage in creating a tailored experience, while being respectful of the restrictions by the governments. As the anxiety about infections persist, fittings in-store may be perceived as not safe. Therefore, it’s more likely that luxury brands relying more on accessories, rather than clothes, will have a quicker rebound.

The digitalization end-to-end of the supply chain already appeared to be a remarkable component of the long-term strategies. Now, the channel shift needs to be implemented in short times. To leverage the relationship with the costumers and to ensure the greatest loyalty, it’s urgent the disposal of personalized omni-channel services.

Other the past few decades the cost of production, the low regulations regarding environment and employers, caused a complete reliance on China with many production sites and supply chains located in the Mainland. Agility and resiliency in management are acquiring an increased value. The pandemic is accelerating ongoing positive changes. Social issues and sustainability will be key words of the luxury sector in the following years.

Greis Gaeta

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.