Introduction

While the stock market continues to trade at all-time highs, two of the most prominent Wall Street banks, Goldman Sachs and JP Morgan, have stated that the forgotten commodity asset class is finally ready to come back under the spotlight. With copper prices at 4.1 USD per pound (as of 03/03/2021) and iron ore almost reaching a 90% increase YoY, metals have proven to be a juicy investment for the investors participating in the recent rally. However, metals are not the only commodity to have shown an almost unbelievable surge in prices; indeed, oil traded last week above $61.5 a barrel on the back of a terrible winter storm that is currently hitting Texas. And it is not over yet; corn, soybean and wheat futures are crushing their previous levels and are respectively 46.3%, 57.4% and 26.7% YoY. Is this commodity bonanza here to stay? Analysts believe it is, and they are already talking about the rise of a new commodity supercycle. If you are wondering what a commodity supercycle is and why it is coming in this peculiar time, no worries, we are here to help. In this brief article, we will try to explain why commodities are experiencing such outstanding performance and we will analyze an investment strategy whose aim is to exploit the current economic environment.

What is a commodity supercycle?

First of all, it seems appropriate to define the so-called commodity supercycle phenomenon and at the same time consider this event from a historical perspective. Starting from the former, it is generally recognized that natural resources are at the basis of economic growth in many countries around the world. Consequently, it is not surprising that in periods of strong economic expansion, also commodities experience a sustained increase in demand, followed by a surge in prices. More precisely, researchers agree on the high correlation between business cycles and commodity ones and clarify that during times of prosperity the competition for productive inputs represents the main driver in price inflation. The opposite happens during periods of stagnation, in which weak output growth depresses prices. The commodity supercycle, then, can be defined as above-trend movements in a broad range of material prices (e.g. agricultural, metals, energy) usually lasting decades. If we consider the US commodity price index ranging from 1795 to the present, it is possible to clearly visualize the succession of highs and lows.

Source: Janus Henderson Investor

Looking at the past, some examples of cycles include the industrialization of the United States at the end of the 19th century; the post-WWII recovery in Europe and Japan; and the previous cycle, mainly driven by China’s rapid growth, started in the late 1990s, peaking in 2008, before the beginning of the Great Financial Crisis.

The current outlook

Source: JP Morgan

Focusing now on the present day, it is interesting to analyze what are the reasons that have pushed commodities to the moon. Firstly, briefly after the correction on March 17th, the global economy has been on a firm bull run. Equities have been soaring, specifically, the S&P Asia 50 has almost doubled since March-lows. This economic optimism has been greatly aided by government expenditure. On March 27th, 2020, the US Congress passed a $2.2 trillion stimulus check, the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The check was essential for redistributing wealth among low-income households. Around 20% of welfare losses were mitigated by passing the CARES Act. Despite the rise of unemployment, people have been spending much less, meaning there is a large amount of liquidity in the market. With an economic optimism detached from the global pandemic, commodities have also been soaring along with standard equities. Asia has had the biggest contribution to commodity production, spending over $140 billion on commodity development projects from 2018-2020. Supply chains have still not recovered completely during the pandemic, making commodities even more expensive to transport. This in turn also increases their rarity and price. With a rise of vulnerability in the market, commodities such as gold (+25% YTD) and silver (+53% YTD) are seen as great assets to have in order to counter inflation. With a continuation of government expenditure, demand for commodities is looking strong. Moreover, as wages increase, there will be more expenditure on infrastructure in which commodities play an essential role.

When the global financial crisis occurred in 2008, China doubled down on infrastructure and construction sectors while the rest of the world was dealing with huge amounts of debt. Three decades of gains were erased during those following 10 years as commodities fell a total of 60%. COVID-19 has emphasized the importance of clean energy and commodities like copper will play a quintessential role in this transition. China has also promised to go carbon neutral by 2060. If government expenditure continues to increase along with demand for commodities, we could be looking at a potential new boom in commodity prices.

When the global financial crisis occurred in 2008, China doubled down on infrastructure and construction sectors while the rest of the world was dealing with huge amounts of debt. Three decades of gains were erased during those following 10 years as commodities fell a total of 60%. COVID-19 has emphasized the importance of clean energy and commodities like copper will play a quintessential role in this transition. China has also promised to go carbon neutral by 2060. If government expenditure continues to increase along with demand for commodities, we could be looking at a potential new boom in commodity prices.

Source: GlobalData

The causes of the recent surge in commodity prices

Given the general economic environment, it seems appropriate to give a brief snapshot of the causes leading to the surge in prices of some specific commodities:

I. AGRICULTURAL

The UN Food and Agriculture Organization’s food price index (UN FAO food index) has been skyrocketing in the last year reaching its highest level since July 2014. The main drivers behind this price inflation are a strong purchase of corn by China, with the aim of restoring its reserves, and lower production levels in the US. At the same time, also other countries dependent on imports have boosted government spending in agricultural commodities such as grains and soybeans. Moreover, dry weather conditions in South America, one of the main global suppliers of corn and soybeans, and expectations of larger tariffs on Russian wheat, seem to have had a significant impact on exports. If we add to the previous causes an increase in shipping costs resulting from COVID-19, the recipe is finally complete. Experts also believe that agricultural commodities prices increased on the back of rallying equity markets, strong governments stimulus worldwide and higher oil-prices expectations

II. METALS

Analyzing metals such as copper, nickel, silver and platinum, it is impossible not to mention climate change and the energy transition. Indeed, while countries try to reach the net-zero goal within 2050 (China has stated that it will reach this objective in 2060) investments in renewable energy, batteries and electric vehicles have surged. Useless to say, the aforementioned materials are essential in order to develop such green projects and the increase in supply to meet the rising demand will not be immediate. According to Glencore, global demand for copper will increase by 100% by 2050 and current levels of mine investments are insufficient to support the necessary increase in output. At last, miners are looking closer to Biden’s $2 trillion infrastructure plan, which could further increase irons in the fire

III. OIL

With Goldman Sachs and JP Morgan both calling a supercycle for oil, there are still some large concerns. Even though the supply of oil is running out, which could in turn raise its price to over $100 per barrel, the rise of electric vehicles could make the commodity futile. Famous oil analyst Arjun Murti who predicted that the price of oil would go over $150 per barrel believes the supercycle call is a bit premature. With less demand for transport as well as mining capacity decreasing during such a volatile time, oil is most likely a risky asset to currently hold.

When the global financial crisis occurred in 2008, China doubled down on infrastructure and construction sectors while the rest of the world was dealing with huge amounts of debt. Three decades of gains were erased during those following 10 years as commodities fell a total of 60%. COVID-19 has emphasized the importance of clean energy and commodities like copper will play a quintessential role in this transition. China has also promised to go carbon neutral by 2060. If government expenditure continues to increase along with demand for commodities, we could be looking at a potential new boom in commodity prices.

I. AGRICULTURAL

The UN Food and Agriculture Organization’s food price index (UN FAO food index) has been skyrocketing in the last year reaching its highest level since July 2014. The main drivers behind this price inflation are a strong purchase of corn by China, with the aim of restoring its reserves, and lower production levels in the US. At the same time, also other countries dependent on imports have boosted government spending in agricultural commodities such as grains and soybeans. Moreover, dry weather conditions in South America, one of the main global suppliers of corn and soybeans, and expectations of larger tariffs on Russian wheat, seem to have had a significant impact on exports. If we add to the previous causes an increase in shipping costs resulting from COVID-19, the recipe is finally complete. Experts also believe that agricultural commodities prices increased on the back of rallying equity markets, strong governments stimulus worldwide and higher oil-prices expectations

II. METALS

Analyzing metals such as copper, nickel, silver and platinum, it is impossible not to mention climate change and the energy transition. Indeed, while countries try to reach the net-zero goal within 2050 (China has stated that it will reach this objective in 2060) investments in renewable energy, batteries and electric vehicles have surged. Useless to say, the aforementioned materials are essential in order to develop such green projects and the increase in supply to meet the rising demand will not be immediate. According to Glencore, global demand for copper will increase by 100% by 2050 and current levels of mine investments are insufficient to support the necessary increase in output. At last, miners are looking closer to Biden’s $2 trillion infrastructure plan, which could further increase irons in the fire

III. OIL

With Goldman Sachs and JP Morgan both calling a supercycle for oil, there are still some large concerns. Even though the supply of oil is running out, which could in turn raise its price to over $100 per barrel, the rise of electric vehicles could make the commodity futile. Famous oil analyst Arjun Murti who predicted that the price of oil would go over $150 per barrel believes the supercycle call is a bit premature. With less demand for transport as well as mining capacity decreasing during such a volatile time, oil is most likely a risky asset to currently hold.

When the global financial crisis occurred in 2008, China doubled down on infrastructure and construction sectors while the rest of the world was dealing with huge amounts of debt. Three decades of gains were erased during those following 10 years as commodities fell a total of 60%. COVID-19 has emphasized the importance of clean energy and commodities like copper will play a quintessential role in this transition. China has also promised to go carbon neutral by 2060. If government expenditure continues to increase along with demand for commodities, we could be looking at a potential new boom in commodity prices.

Assuming that the commodities boom is finally here, how can we exploit it?

By looking at data from TOGGLE, an innovative AI-powered investment research platform, it is possible to notice how a combined increase in the 2y-10y US treasuries spread (a steepening yield curve) and a decrease in the value of the dollar index (which compares the value of the dollar with a basket of other currencies) are usually associated with an increase in the value of the Bloomberg Commodity Index (one of the three major commodity indices), tracking the prices of a wide range of commodities. This can be explained by the combined effect of an economic boom/recovery (marked by a steepening yield curve) and a dollar devaluation with respect to other currencies (a possible signal of earlier inflation in the US compared to the rest of the world, indicating a faster recovery in the US than overseas).

This joint effect might lead to an increase in commodity prices, justified by investors betting on an early economic cycle.

To verify our hypotheses, we analysed what happened in the past taking as input values latest changes in the two parameters considered.

As indicated by TOGGLE PRO platform, a combined and simultaneous decrease in the dollar index (DXY) of -1.66% in 31 days and a rise in 2y-10y US yield curve spread of 0.41% (with the values of the spread increasing between 79 and 125 basis points), usually brought the Bloomberg Commodity Index to rise on average by 22% in the following six months (the purple line/confidence intervals indicating the forecast based on past occurrences).

This joint effect might lead to an increase in commodity prices, justified by investors betting on an early economic cycle.

To verify our hypotheses, we analysed what happened in the past taking as input values latest changes in the two parameters considered.

As indicated by TOGGLE PRO platform, a combined and simultaneous decrease in the dollar index (DXY) of -1.66% in 31 days and a rise in 2y-10y US yield curve spread of 0.41% (with the values of the spread increasing between 79 and 125 basis points), usually brought the Bloomberg Commodity Index to rise on average by 22% in the following six months (the purple line/confidence intervals indicating the forecast based on past occurrences).

Source: TOGGLE (https://toggle.ai/)

How to implement the strategies analyzed?

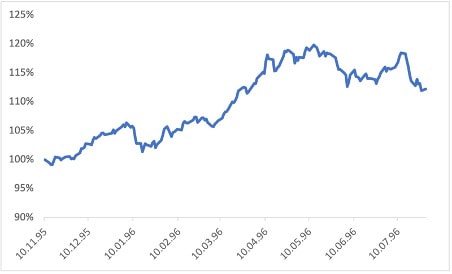

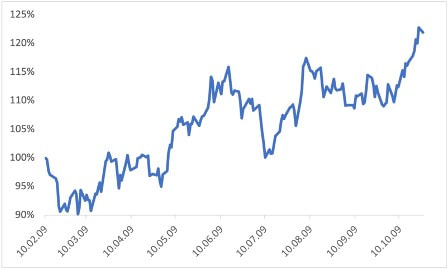

On the basis of our TOGGLE Analysis, we backtested a strategy with the following constraints: we expected the dollar to devalue at least 1.5% in terms of the dollar index within 30 days. Furthermore, the 10 to 2-year treasury spread had to widen by at least 40% over 60 days, with the difference between the ten- and two-year yield at least above 0.79% and 1.25%. The backtest was performed on data going back to 1991. We observed overall 9 periods of varying length in which the conditions in the capital markets were favourable for our trade. Each time we initiated the trade at the beginning of the period, once conditions met our constraints and held a position in the Bloomberg Commodity-Index for 180 days (by closing the trade after 90 days if we were above 0% return) . In the most basic setting, we had 4 winnings and 5 losing trades. The winning trades returned 28% p.a. on average, compared with -12% for losing trades.

Charts of the two best trades that would have been obtained with the strategy in the past (in 1995-1996 and in 2009)

What are the risks of the strategy?

Now that we have discussed in depth the positive aspects of this investment, we will focus also on some of the potential risks. We have considered as a key contributor to the increase in the price of commodities the economic recovery that is likely to follow from the end of the Covid crisis. However, there is still no precise timing for this recovery and the emergence of new Covid variants might delay the whole process and potentially postpone the start of the commodity super-cycle. Another risk factor is given by the increase in the production of clean energy which might turn out to be a double-edged sword for commodities. While as we mentioned before a transition towards clean energy will be beneficial for commodities as they will serve as construction materials, it might make other commodities such as oil, less demanded by the market, the net effect would therefore be uncertain. However, it can be confidently argued that in the short to medium run it is likely that the first positive effect will outweigh the second negative one, indicating that this source of risk shouldn’t be an issue for commodity prices, at least in the near term. Finally, there is some uncertainty tied to the price of the dollar, an increase in the currency value could lead to a negative effect on commodity prices (by reducing demand for those assets). Nonetheless, if there is a solid economic recovery, the overall effect on commodity prices is likely to be positive independently from the effect of other macro variables.

Conclusions

Having analyzed all factors it becomes easier to understand why two of the most prominent Wall Street banks, Goldman Sachs and JP Morgan, have stated that the forgotten commodity asset class is finally ready to come back under the spotlight. Many underlying conditions are pointing towards what seems to be an inevitable commodity super-cycle. From the macroeconomic conditions to the demand for clean energy infrastructure, we could see in the upcoming months for commodities a record increase in prices, similar to what happened during other commodity super-cycles in the past.

BSCM would like to thank TOGGLE for giving us access to their AI-powered investment research platform and providing charts and data.

Federico Adorini

Mattia Degiovanni

Filippo Lisanti

Tobias Schmidt

Mattia Degiovanni

Filippo Lisanti

Tobias Schmidt

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.