BSCM would like to thank FactSet for providing charts and data. The FactSet platform has been extremely useful in all the stages of the draft of this analysis.

On October 21st, Iberdrola, the Spanish utility giant, announced an $8.3bn (debt included) deal for the acquisition of PNM Resources. The deal will enhance Iberdrola position in the US. Moreover, after the acquisition, PNM Resources will become part of Avangrid (i.e., Iberdrola North America branch in which the Spanish company holds an 81.5% stake) giving birth to the third-largest renewable energy operator.

The Buyer

Iberdrola is a multinational electricity company based in Bilbao (Spain) and highly focused on renewable energy which supplies 100 million people all over the world. Moreover, it is one of the world’s biggest companies in terms of market capitalization in its industry. Due to its high commitment towards green energy, Iberdrola has recently become an international benchmark for companies with low carbon emission.

Moreover, despite the COVID-19 crisis, the company managed to increase both EBITDA and Net Income and has confirmed its €10bn 2020 investment plan, which will result in 4,000 new MW of installed capacity. While increasing the investments, Iberdrola will maintain the modus operandi it has implemented until today, i.e. buying smaller entities and build infrastructure around them. As assessed by CEO Ignacio Galan, such a strategy consists of “friendly transactions, focused on regulated businesses and renewable energy, in countries with good credit ratings and legal and regulatory stability, offering opportunities for future growth”. As a matter of fact, the Spanish company has already invested more than € 6 bn since the beginning of the year in different geographic areas, such as France (Aalto Power and Saint-Brieuc), Australia (Infigen Energy), Sweden (Svea Vind Offshore AB) and Japan (Acacia Renewables).

In this expansion context, the PNM deal aims to consolidate Iberdrola’s influence in the United States by expanding its operations beyond the already well-served Northeastern area of the US. The merger between Avangrid and PNM will create an entity that operates in 24 states and with a combined market value of $20 bn. Moreover, both for the Spanish giant and for many other utility companies, M&A represents a means of defense from the pandemic, thanks to cost synergies. Eventually, the Spanish company expects to benefit also from the EU COVID Recovery Fund, since the latter gives priority to clean energy transition.

The target

On the other side, PNM Resources is an energy company based in Albuquerque, founded 100 years ago. It operates in New Mexico and Texas, serving 790 thousand households and businesses. However, its main energy sources are not only renewable energies but also fossil fuels. In fact, about 60% of PNM’s capacity is made up of gas and coal. Thus, Iberdrola has been criticized since this acquisition does not fit properly with its €10 bn clean energy investment plan. Nevertheless, the Spanish company justifies the choice stating that PNM would put an end to its coal interests in the following years and that it is difficult to find utilities that do not own gas assets in North America. Eventually, PNM Resources would undoubtedly benefit from Iberdrola renewable energy expertise in achieving its emission-free goal set by 2040.

The deal

The Spanish company stated that it will be an only cash deal, paying $4.3 bn to PNM’s shareholders and that the total deal, including debt, will amount to $8.3 bn. These figures imply a $50.3 price per share and reflect a premium of about 10% with respect to the latest close price before the announcement. Furthermore, the acquisition will be financed through an Avangrid capital increase (Iberdrola will maintain its original stake in the North American company) and the issuance of $700 m of debt. Such an offer is considered “in line with other integrated US utilities” by Barclays analyst.

Speaking in terms of synergies, according to Iberdrola estimates, the merger will generate an extra €500 m EBITDA and €120 m of net profit. Moreover, the company would have $40 bn worth of assets and generate a total net profit of $850 m.

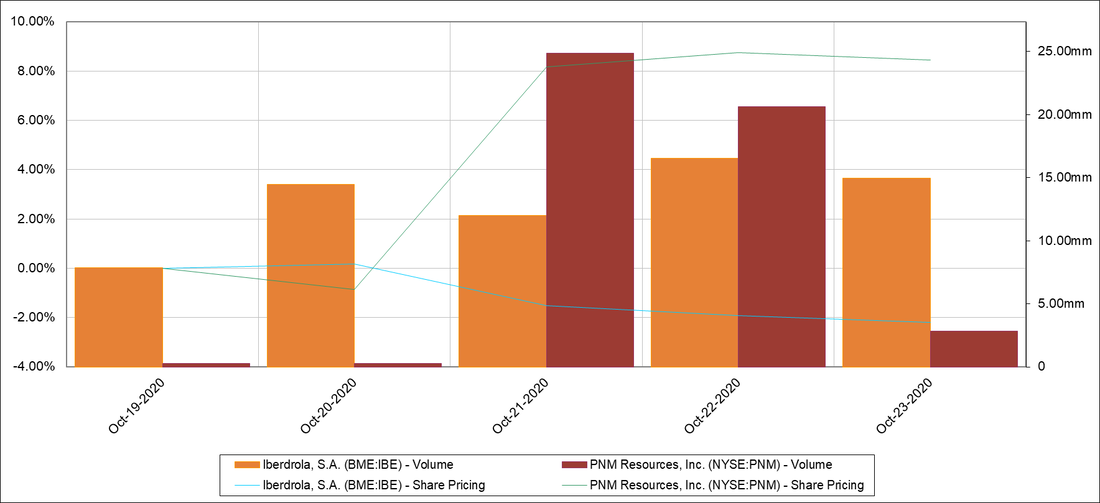

On the day of the announcement, Iberdrola shares went down by 0.5% against a market losing 0.14%. On the other hand, PNM stock price saw a 9% jump. The deal is now subject to approval by PNM shareholders and Iberdrola expects to close it in 2021 and that it will yield the forecasted results from the first year. However, as stated by analysts at Barclays, we cannot exclude the possibility of modifications to the offer.

In the transaction, PNM Resources has been assisted by Evercore as financial advisor and Troutman Pepper as legal advisor. On the other side of the deal, Avangrid (Iberdrola) was represented by BNP Paribas as financial advisor and Latham & Watkins as legal advisor.

Dario Spinelli

On October 21st, Iberdrola, the Spanish utility giant, announced an $8.3bn (debt included) deal for the acquisition of PNM Resources. The deal will enhance Iberdrola position in the US. Moreover, after the acquisition, PNM Resources will become part of Avangrid (i.e., Iberdrola North America branch in which the Spanish company holds an 81.5% stake) giving birth to the third-largest renewable energy operator.

The Buyer

Iberdrola is a multinational electricity company based in Bilbao (Spain) and highly focused on renewable energy which supplies 100 million people all over the world. Moreover, it is one of the world’s biggest companies in terms of market capitalization in its industry. Due to its high commitment towards green energy, Iberdrola has recently become an international benchmark for companies with low carbon emission.

Moreover, despite the COVID-19 crisis, the company managed to increase both EBITDA and Net Income and has confirmed its €10bn 2020 investment plan, which will result in 4,000 new MW of installed capacity. While increasing the investments, Iberdrola will maintain the modus operandi it has implemented until today, i.e. buying smaller entities and build infrastructure around them. As assessed by CEO Ignacio Galan, such a strategy consists of “friendly transactions, focused on regulated businesses and renewable energy, in countries with good credit ratings and legal and regulatory stability, offering opportunities for future growth”. As a matter of fact, the Spanish company has already invested more than € 6 bn since the beginning of the year in different geographic areas, such as France (Aalto Power and Saint-Brieuc), Australia (Infigen Energy), Sweden (Svea Vind Offshore AB) and Japan (Acacia Renewables).

In this expansion context, the PNM deal aims to consolidate Iberdrola’s influence in the United States by expanding its operations beyond the already well-served Northeastern area of the US. The merger between Avangrid and PNM will create an entity that operates in 24 states and with a combined market value of $20 bn. Moreover, both for the Spanish giant and for many other utility companies, M&A represents a means of defense from the pandemic, thanks to cost synergies. Eventually, the Spanish company expects to benefit also from the EU COVID Recovery Fund, since the latter gives priority to clean energy transition.

The target

On the other side, PNM Resources is an energy company based in Albuquerque, founded 100 years ago. It operates in New Mexico and Texas, serving 790 thousand households and businesses. However, its main energy sources are not only renewable energies but also fossil fuels. In fact, about 60% of PNM’s capacity is made up of gas and coal. Thus, Iberdrola has been criticized since this acquisition does not fit properly with its €10 bn clean energy investment plan. Nevertheless, the Spanish company justifies the choice stating that PNM would put an end to its coal interests in the following years and that it is difficult to find utilities that do not own gas assets in North America. Eventually, PNM Resources would undoubtedly benefit from Iberdrola renewable energy expertise in achieving its emission-free goal set by 2040.

The deal

The Spanish company stated that it will be an only cash deal, paying $4.3 bn to PNM’s shareholders and that the total deal, including debt, will amount to $8.3 bn. These figures imply a $50.3 price per share and reflect a premium of about 10% with respect to the latest close price before the announcement. Furthermore, the acquisition will be financed through an Avangrid capital increase (Iberdrola will maintain its original stake in the North American company) and the issuance of $700 m of debt. Such an offer is considered “in line with other integrated US utilities” by Barclays analyst.

Speaking in terms of synergies, according to Iberdrola estimates, the merger will generate an extra €500 m EBITDA and €120 m of net profit. Moreover, the company would have $40 bn worth of assets and generate a total net profit of $850 m.

On the day of the announcement, Iberdrola shares went down by 0.5% against a market losing 0.14%. On the other hand, PNM stock price saw a 9% jump. The deal is now subject to approval by PNM shareholders and Iberdrola expects to close it in 2021 and that it will yield the forecasted results from the first year. However, as stated by analysts at Barclays, we cannot exclude the possibility of modifications to the offer.

In the transaction, PNM Resources has been assisted by Evercore as financial advisor and Troutman Pepper as legal advisor. On the other side of the deal, Avangrid (Iberdrola) was represented by BNP Paribas as financial advisor and Latham & Watkins as legal advisor.

Dario Spinelli