Indonesia’s ride-hailing giant Gojek has raised $1.2 billion for expansion and increased its Series F round total to just under $3 billion, according to an internal memo sent by its co-CEOs on March 17th. The new financing was finalized just over the past week, when the Covid-19 outbreak quickened its spread and triggered market routs across the globe.

This deal is relevant for several reasons:

The company and the market

Gojek was first established in Indonesia in 2010 as a call center to connect consumers to courier delivery and two-wheeled ride-hailing services. It launched its app in 2015 offering only few services. Today Gojek provides more than 20 services and operates multiple businesses across ride-hailing, food delivery, logistics, digital payment services and others.

The company’s rapid growth and success attracted investments from both private equity funds (e.g. Sequoia India) and tech giants (e.g. Google and Tencent), driving the company’s valuation up to $10 billion (full cap tables are still undisclosed). Moreover, the company’s growth has been fueled by several acquisitions, to expand the range of services, such as Loker.com, which is one of Indonesia’s biggest online ticket booking company.

However, Gojek is not profitable and has been burning a lot of cash. This is the consequence of the battle for market share with the rival ride-hailing group Grab, in the race to dominate across a range of services in Singapore, Vietnam and Thailand as well as in Indonesia. Both companies have expanded beyond ride-hailing, and are trying to create unique "super apps" that offer customers everything from food delivery to financial services.

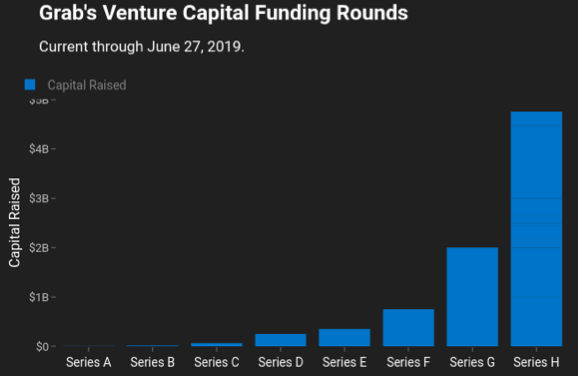

Together with Gojek, Grab is Indonesia’s most valuable start-up at $14 billion (see the chart below that illustrates the capital raised by Grab so far), backed by powerful shareholders, including Microsoft and SoftBank, which invested more than $2 billion through its Vision Fund. This is relevant, since both Gojek and Grab have many common characteristics: they are active in the same markets, they are not profitable, and they are backed by very big and influential shareholders, who either want to stem the losses or exit their investments profitably. As a matter of fact, the FT recently reported that shareholders of both are pushing for a tie-up between the two companies. In particular SoftBank, Grab’s biggest shareholder, which is under pressure to prove the valuation of many of its tech startups, following the failed IPO of WeWork.

This deal is relevant for several reasons:

- It represents one of the largest deals to emerge since the coronavirus erupted in central China in January, exacerbating economic uncertainty and chilling deal activity over the world and in particular in Asia, as Southeast Asia’s venture capital and startup industry braces itself for a harsh fundraising environment in 2020

- It comes at a time investors have grown increasingly wary about tech valuations. For example, the public expose of WeWork’s accounting practices last year has triggered deeper scrutiny over startup financials, several of which are under increasing pressure to reduce cash burn and show clear paths to profitability. Gojek isn’t an exception.

- The new capital puts Gojek in a stronger position in any negotiations with Grab. More money would allow Gojek to negotiate from a position of strength if they do decide to swap assets in certain countries or proceed with a full-blown merger.

The company and the market

Gojek was first established in Indonesia in 2010 as a call center to connect consumers to courier delivery and two-wheeled ride-hailing services. It launched its app in 2015 offering only few services. Today Gojek provides more than 20 services and operates multiple businesses across ride-hailing, food delivery, logistics, digital payment services and others.

The company’s rapid growth and success attracted investments from both private equity funds (e.g. Sequoia India) and tech giants (e.g. Google and Tencent), driving the company’s valuation up to $10 billion (full cap tables are still undisclosed). Moreover, the company’s growth has been fueled by several acquisitions, to expand the range of services, such as Loker.com, which is one of Indonesia’s biggest online ticket booking company.

However, Gojek is not profitable and has been burning a lot of cash. This is the consequence of the battle for market share with the rival ride-hailing group Grab, in the race to dominate across a range of services in Singapore, Vietnam and Thailand as well as in Indonesia. Both companies have expanded beyond ride-hailing, and are trying to create unique "super apps" that offer customers everything from food delivery to financial services.

Together with Gojek, Grab is Indonesia’s most valuable start-up at $14 billion (see the chart below that illustrates the capital raised by Grab so far), backed by powerful shareholders, including Microsoft and SoftBank, which invested more than $2 billion through its Vision Fund. This is relevant, since both Gojek and Grab have many common characteristics: they are active in the same markets, they are not profitable, and they are backed by very big and influential shareholders, who either want to stem the losses or exit their investments profitably. As a matter of fact, the FT recently reported that shareholders of both are pushing for a tie-up between the two companies. In particular SoftBank, Grab’s biggest shareholder, which is under pressure to prove the valuation of many of its tech startups, following the failed IPO of WeWork.

Source: Crunchbase news

From a business point of view, Gojek-Grab merger makes sense. The possible combination between the two companies could be worth far more that the combined $23 billion valuation the two have today. However, this would not be straight forward because of several factors. Regulators in Singapore, Indonesia and other countries are likely to oppose any deal that reduces competition. Any tie-up in Indonesia would face antitrust hurdles that could lead to fines for Gojek and Grab or even a deal being blocked. For example, Uber and Grab were fined $13m by Singapore’s competition watchdog for their 2018 merger in south-east Asia.

Nonetheless, industry experts report that both companies are trying to carve out certain sections of their business to achieve a possible truce. For instance, Gojek could limit its operations to Indonesia, Southeast Asia’s largest market, and exit other countries in the region. Meanwhile, Grab could limit its Indonesia presence to the lucrative payments business. Gojek has already been cutting back on some of its ancillary units such as laundry services and hairstyling.

However, at the moment, both companies have denied talks and plans for any sort of combination.

Massimiliano Radogna

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

Nonetheless, industry experts report that both companies are trying to carve out certain sections of their business to achieve a possible truce. For instance, Gojek could limit its operations to Indonesia, Southeast Asia’s largest market, and exit other countries in the region. Meanwhile, Grab could limit its Indonesia presence to the lucrative payments business. Gojek has already been cutting back on some of its ancillary units such as laundry services and hairstyling.

However, at the moment, both companies have denied talks and plans for any sort of combination.

Massimiliano Radogna

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.