In recent weeks, the American cultural zeitgeist has had a rather peculiar and specific thing on its mind: the role of private equity in the music industry. This all started on November 14, 2019, when American artist Taylor Swift posted about a recent acquisition partially financed by the private equity firm The Carlyle Group. In said post, Swift named the private equity firm specifically, hoping that trying to influence a significant minority stakeholder would aid her campaign to be able to perform her songs. This tweet sparked response tweets from prominent politicians such as US Senator and Presidential Nominee Elizabeth Warren and New York Representative Alexandria Ocasio-Cortez, as well as backlash towards both sides of the argument.

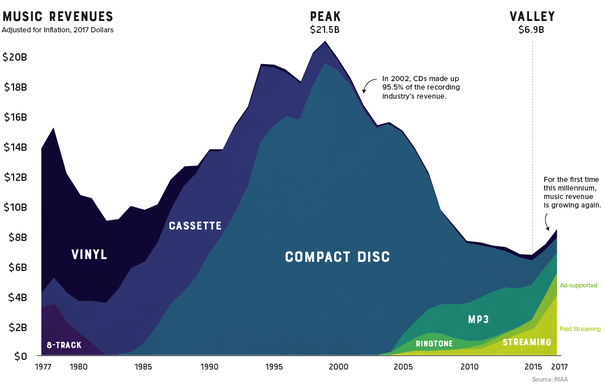

This type of reaction may have been unexpected for The Carlyle Group: it most likely had done its due diligence for the deal, but did not think to anticipate celebrity drama to be a part of the equation. This media circus brought The Carlyle Group into the limelight, and with it a question surfaced: why would a private equity firm be interested in investing in an industry that has seen an almost 70% declines in sales in the past two decades?

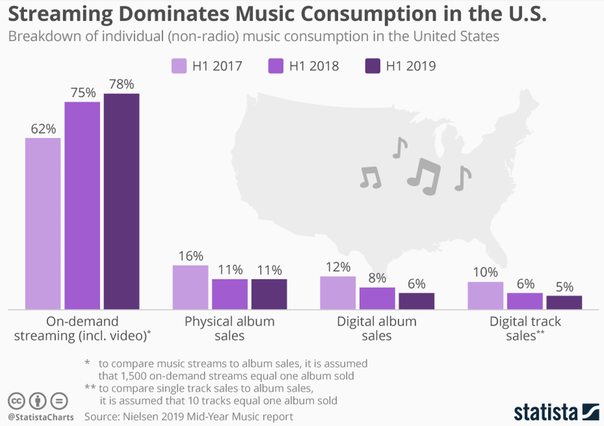

The meteoric fall of sales has been largely supplanted by music streaming, and this has driven revenues for record companies and artists in recent years. With this innovation, investment companies have looked to capitalize with this macro trend by acquiring stakes in the industry.

This type of reaction may have been unexpected for The Carlyle Group: it most likely had done its due diligence for the deal, but did not think to anticipate celebrity drama to be a part of the equation. This media circus brought The Carlyle Group into the limelight, and with it a question surfaced: why would a private equity firm be interested in investing in an industry that has seen an almost 70% declines in sales in the past two decades?

The meteoric fall of sales has been largely supplanted by music streaming, and this has driven revenues for record companies and artists in recent years. With this innovation, investment companies have looked to capitalize with this macro trend by acquiring stakes in the industry.

In its fourth fiscal quarter, Apple’s services business reported an 18% growth in revenue to US$12.5 billion, which includes its streaming service, Apple Music. Details of how much could be attributed to Apple Music, versus other parts of the business such as the App Store or the iTunes Store, is not available.

Streaming services market leader Spotify went public in 2018 and opened with a market valuation of US$29.5 billion. With its 160 million subscribers (70 million premium and 90 million free), in the first three quarters of 2019, Spotify has reported revenues of EUR4.9 billion, although according to the financial statements EUR3.6 billion are paid out as costs of revenue, which includes royalties paid out to artists and record labels.

These types of figures are how the music industry is seeing its revival: easily available platforms on which consumers are able to listen to their music have aided in reducing piracy rates, which was an ongoing problem for record labels and artists in the period of time between the fall in popularity of CDs and the rise of streaming services. Being able to access streaming as a source of revenue has allowed the music industry to project a rosier outlook on its future, thus making it more attractive for investment companies.

In recent years, both institutional and private investors have expressed interest in exploring the industry further. In addition to The Carlyle Group’s previously mentioned investment, Blackrock’s Alternative Investments arm funded Alignment Artist Capital, a financial firm that provides funds to musical artists and songwriters. One year later, AGI Partners launched the Unison Fund aiming to provide funds to assist in touring and album production costs, among other things.

One investment that made waves in recent months involves one of the three major players in the American music industry – the Universal Music Group. Chinese tech company Tencent Corp. finalized a deal to acquire a 10% share in UMG from parent company Vivendi for US$3.3 billion, which puts the company’s value at US$33 billion, about 32x EBITDA per its 2018 financial figures. This recent valuation is about four and a half times its valuation at 2013 - US$7.2 billion. This increase in valuation is an indicator of how much streaming has changed the landscape in the music industry.

This trend extends to other forms of media – podcasts startups have been seeing acquisitions by companies. Private equity firms like TPG and Blackstone Group Inc have invested in streaming services like Spotify, as well as in publishing rights groups and in movie production companies.

Another small trend that has seen popularity in the wake of the streaming boom is the music-royalty fund. There is about US$3.2 billion invested in funds focused on music royalties, one of the most prominent of which is Hipgnosis Songs Fund (LON:SONG), which is listed on the London Stock Exchange. The attraction to this type of funds stems from a trend that shows that royalty yields have historically shown independence from other markets. This trend makes this type of fund attractive to investors looking to diversify, and investors that have a longer investment horizon, like insurance companies, endowments and pension funds. The aforementioned Hipgnosis Songs Fund reported a yield of 6.1% on its assets invested in its first three months of being a publicly traded fund. Massarsky Consulting specializes in music catalog valuation and states that catalogs can accrue between 5% and 20% annual yields, with some genres like hip-hop and country having higher yields, and better known songs having lower yields but less volatility.

In short, streaming services have breathed some fresh air into the music industry, and this has caught the attention of investors. There are multiple types of investments an investor can make to get involved with this industry – stakes in the streaming platforms themselves, or towards a record label, or funds with yields based on royalties from popular songs.

Streaming services market leader Spotify went public in 2018 and opened with a market valuation of US$29.5 billion. With its 160 million subscribers (70 million premium and 90 million free), in the first three quarters of 2019, Spotify has reported revenues of EUR4.9 billion, although according to the financial statements EUR3.6 billion are paid out as costs of revenue, which includes royalties paid out to artists and record labels.

These types of figures are how the music industry is seeing its revival: easily available platforms on which consumers are able to listen to their music have aided in reducing piracy rates, which was an ongoing problem for record labels and artists in the period of time between the fall in popularity of CDs and the rise of streaming services. Being able to access streaming as a source of revenue has allowed the music industry to project a rosier outlook on its future, thus making it more attractive for investment companies.

In recent years, both institutional and private investors have expressed interest in exploring the industry further. In addition to The Carlyle Group’s previously mentioned investment, Blackrock’s Alternative Investments arm funded Alignment Artist Capital, a financial firm that provides funds to musical artists and songwriters. One year later, AGI Partners launched the Unison Fund aiming to provide funds to assist in touring and album production costs, among other things.

One investment that made waves in recent months involves one of the three major players in the American music industry – the Universal Music Group. Chinese tech company Tencent Corp. finalized a deal to acquire a 10% share in UMG from parent company Vivendi for US$3.3 billion, which puts the company’s value at US$33 billion, about 32x EBITDA per its 2018 financial figures. This recent valuation is about four and a half times its valuation at 2013 - US$7.2 billion. This increase in valuation is an indicator of how much streaming has changed the landscape in the music industry.

This trend extends to other forms of media – podcasts startups have been seeing acquisitions by companies. Private equity firms like TPG and Blackstone Group Inc have invested in streaming services like Spotify, as well as in publishing rights groups and in movie production companies.

Another small trend that has seen popularity in the wake of the streaming boom is the music-royalty fund. There is about US$3.2 billion invested in funds focused on music royalties, one of the most prominent of which is Hipgnosis Songs Fund (LON:SONG), which is listed on the London Stock Exchange. The attraction to this type of funds stems from a trend that shows that royalty yields have historically shown independence from other markets. This trend makes this type of fund attractive to investors looking to diversify, and investors that have a longer investment horizon, like insurance companies, endowments and pension funds. The aforementioned Hipgnosis Songs Fund reported a yield of 6.1% on its assets invested in its first three months of being a publicly traded fund. Massarsky Consulting specializes in music catalog valuation and states that catalogs can accrue between 5% and 20% annual yields, with some genres like hip-hop and country having higher yields, and better known songs having lower yields but less volatility.

In short, streaming services have breathed some fresh air into the music industry, and this has caught the attention of investors. There are multiple types of investments an investor can make to get involved with this industry – stakes in the streaming platforms themselves, or towards a record label, or funds with yields based on royalties from popular songs.

Lawin Miclat - 31/12/2019