China has recently been at the hearth of some of the most prominent financial scandals that hit various sectors of its economy. First, the fall of big property developers, such as Evergrande. Now inconsistent demand is prompting a deflationary spiral and the post-Covid recovery is slowing down. The aim of this article is to understand how exposed is China’s economy and if it is becoming more fragile.

Economic Insight

China’s central bank has said it would implement “a prudent monetary policy” in its efforts to support economic growth and employment.

It will continue to keep the yuan stable, trying to avoid the risk of large exchange rate fluctuations, as the current external environment has become more complex and trade and investment keep decreasing.

In the meantime several major banks have revised negatively their growth forecast for 2023, but its expansion is still projected at 4.5% year-on-year (Fitch expects a relatively important growth albeit on a slowing trajectory: 4.8% in 2024 and 4.7% in 2025.). Still, momentum has faded sharply in the last months and investors expect other measures to shore up the economy. The outlook is clouded by a housing downturn, aging demographics, consistent debt and geopolitical frictions.

Data gathered since April have reported systemic weaknesses: the manufacturing Purchasing Managers' Index, for example, has been below 50 in the past three months, pointing at a decline in manufacturing activity. China’s exports has decreased 12.4% yoy in June, as weak global demand remains a persistent problem difficult to solve.

Manufacturing activity contracted in October, underlying the difficult tasks policymakers have to face trying to revitalize economic growth in the year end and in 2024.

Housing construction is another sector of concern. Bejing has announced, in this sense, several measures to revive growth, such as ease of borrowing rules and mortgage rate cuts.

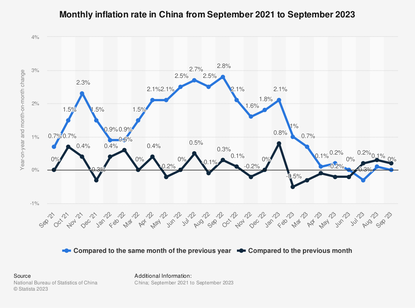

With regards to inflation, China's consumer prices got back to positive territory in August, as deflation pressures weakened amid signs of a more stable environment in the economy. The consumer price index (CPI) increased 0.1% in August from a year earlier. CPI fell 0.3% in July (first of the Group of 20 wealthy nations to report a yoy decline in consumer prices since Japan in August 2021).

The producer price index (PPI) decreased 2.5% from a year earlier, the 12th straight month in negative territory. Core inflation, calculated excluding food and fuel prices, remained unchanged unchanged at 0.8% in August yoy.

"The inflation (rate) still points to weak demand and requires more policy support for the foreseeable future” said Zhou Hao, chief economist at Guotai Junan International.

Economic Insight

China’s central bank has said it would implement “a prudent monetary policy” in its efforts to support economic growth and employment.

It will continue to keep the yuan stable, trying to avoid the risk of large exchange rate fluctuations, as the current external environment has become more complex and trade and investment keep decreasing.

In the meantime several major banks have revised negatively their growth forecast for 2023, but its expansion is still projected at 4.5% year-on-year (Fitch expects a relatively important growth albeit on a slowing trajectory: 4.8% in 2024 and 4.7% in 2025.). Still, momentum has faded sharply in the last months and investors expect other measures to shore up the economy. The outlook is clouded by a housing downturn, aging demographics, consistent debt and geopolitical frictions.

Data gathered since April have reported systemic weaknesses: the manufacturing Purchasing Managers' Index, for example, has been below 50 in the past three months, pointing at a decline in manufacturing activity. China’s exports has decreased 12.4% yoy in June, as weak global demand remains a persistent problem difficult to solve.

Manufacturing activity contracted in October, underlying the difficult tasks policymakers have to face trying to revitalize economic growth in the year end and in 2024.

Housing construction is another sector of concern. Bejing has announced, in this sense, several measures to revive growth, such as ease of borrowing rules and mortgage rate cuts.

With regards to inflation, China's consumer prices got back to positive territory in August, as deflation pressures weakened amid signs of a more stable environment in the economy. The consumer price index (CPI) increased 0.1% in August from a year earlier. CPI fell 0.3% in July (first of the Group of 20 wealthy nations to report a yoy decline in consumer prices since Japan in August 2021).

The producer price index (PPI) decreased 2.5% from a year earlier, the 12th straight month in negative territory. Core inflation, calculated excluding food and fuel prices, remained unchanged unchanged at 0.8% in August yoy.

"The inflation (rate) still points to weak demand and requires more policy support for the foreseeable future” said Zhou Hao, chief economist at Guotai Junan International.

In general, recent indicators are more encouraging as signs of stabilization have appeared in the world's second-largest economy, supported by a stream of policy support measures, although a continued real estate crisis and inconsistent global demand stay major headwinds.

China’s public investments: The key role of infrastructure and real estate sectors.

Public spending is a fundamental tool that governments use to pursue their economic and social objectives. They influence resource allocation, income distribution and aggregate demand. The level and efficiency of public spending affect various aspects of a country's economy, including its ability to meet economic growth targets, control inflation and sustain the quality of life of its citizens.

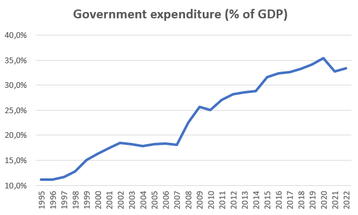

Chinese government has always recognized the central role of public spending and in the last years public spending has increased consistently, from 6,969,848 to 13,404,998 mln RMB.

Thanks to public spending, the Chinese government has allowed the economy to grow significantly, becoming the second largest economy in the world after the United States. However, these levels of public spending are now raising debates on whether they are sustainable. Indeed, spending is significantly higher now relative to GDP than it was in the 1990s even though the economic growth is slowing down.

The following graph shows the trend of the public spending relative to GDP from 1995 to 2022:

China’s public investments: The key role of infrastructure and real estate sectors.

Public spending is a fundamental tool that governments use to pursue their economic and social objectives. They influence resource allocation, income distribution and aggregate demand. The level and efficiency of public spending affect various aspects of a country's economy, including its ability to meet economic growth targets, control inflation and sustain the quality of life of its citizens.

Chinese government has always recognized the central role of public spending and in the last years public spending has increased consistently, from 6,969,848 to 13,404,998 mln RMB.

Thanks to public spending, the Chinese government has allowed the economy to grow significantly, becoming the second largest economy in the world after the United States. However, these levels of public spending are now raising debates on whether they are sustainable. Indeed, spending is significantly higher now relative to GDP than it was in the 1990s even though the economic growth is slowing down.

The following graph shows the trend of the public spending relative to GDP from 1995 to 2022:

Source: International Monetary Fund

If the reader is wondering where the Chinese government allocates most of its public spending, the answer is infrastructure. Just to give an idea, China’s infrastructure spending in 2021 was 4.8% of its GDP, which is significantly higher than anywhere else in the world. The reason is that in the past investments in infrastructure have been revealed as being very useful for the government as they have boosted the growth of the country. China has formulated a comprehensive five-year plan for transport infrastructure investment, which will maintain substantial spending on motorways, high-speed railways and airports. The goal of the strategy is to expand the motorway network under the jurisdiction of the central government to 130,000 kilometers by the end of 2027, an increase of 11% compared to the end of 2021.

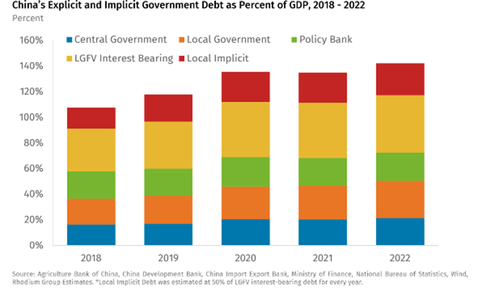

However, many analysts think that if in the past such expensive policies could have worked because of the low debt level and the massive growth potential, nowadays the situation is different. China is indeed much more indebted than past years even though data could seem to show the opposite conclusion. Observing the central government debt-to-GDP ratio of 21.3%, it could be thought that China has a low level of debt compared to the GDP, but this is not the reality. The reason is that this way of measuring debt does not take into account the implicit government debt raised by local government, policy bank and by local government financing vehicle as well as other implicit debt raised by the educational and health care system.

The following graph shows the amount of explicit and implicit debt of China as percent of GDP from 2018 to 2022:

If the reader is wondering where the Chinese government allocates most of its public spending, the answer is infrastructure. Just to give an idea, China’s infrastructure spending in 2021 was 4.8% of its GDP, which is significantly higher than anywhere else in the world. The reason is that in the past investments in infrastructure have been revealed as being very useful for the government as they have boosted the growth of the country. China has formulated a comprehensive five-year plan for transport infrastructure investment, which will maintain substantial spending on motorways, high-speed railways and airports. The goal of the strategy is to expand the motorway network under the jurisdiction of the central government to 130,000 kilometers by the end of 2027, an increase of 11% compared to the end of 2021.

However, many analysts think that if in the past such expensive policies could have worked because of the low debt level and the massive growth potential, nowadays the situation is different. China is indeed much more indebted than past years even though data could seem to show the opposite conclusion. Observing the central government debt-to-GDP ratio of 21.3%, it could be thought that China has a low level of debt compared to the GDP, but this is not the reality. The reason is that this way of measuring debt does not take into account the implicit government debt raised by local government, policy bank and by local government financing vehicle as well as other implicit debt raised by the educational and health care system.

The following graph shows the amount of explicit and implicit debt of China as percent of GDP from 2018 to 2022:

The graph clearly shows that in reality the situation is much more complicated than what could be imagined from a high-level analysis of the economic situation.

Furthermore, in the context of public spending, another important role should be recognised for the real estate industry, which will be analysed in the following section.

China’s real Estate Bonds

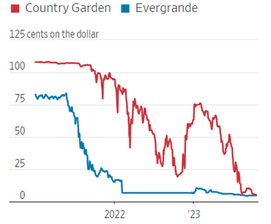

When we take a look at China's real estate market, a downward trend is clearly visible. Since September 2021, when Evergrande, one of China's largest real estate companies, got into significant financial difficulties due to massive debt problems, other real estate giants have started to follow in its footsteps, most notably Country Garden, KWG Group and China Aouyan Group.

According to data from S&P Global Ratings, the extended deceleration in the country's real estate industry has created significant challenges for the economy, causing defaults on approximately USD 81 billion worth of international bonds issued by Chinese developers from 2021 to 2022. Many distressed-debt funds found the surge of defaults in the industry too irresistible to be ignored. These funds acquired the bonds or loans of struggling companies, frequently at a significant discount, and engage in negotiations with the companies to establish a debt restructuring strategy.

However, the distressed-debt playbook is not working in China. Over the past twenty-four months, dozens of Chinese real estate companies have defaulted on their bond payments, yet only a small number have fully repaid their investors. This September, Evergrande withdrew from a USD 35 billion debt restructuring proposal that it had eventually reached with certain investors following prolonged discussions. These days, most dollar bonds sold by Chinese properties companies are sold below 10 cents on the dollar, and several are trading at less than 5 cents, an exponentially lower price compared to early 2021 when bonds were selling for around 90-100 cents on the dollar.

Furthermore, in the context of public spending, another important role should be recognised for the real estate industry, which will be analysed in the following section.

China’s real Estate Bonds

When we take a look at China's real estate market, a downward trend is clearly visible. Since September 2021, when Evergrande, one of China's largest real estate companies, got into significant financial difficulties due to massive debt problems, other real estate giants have started to follow in its footsteps, most notably Country Garden, KWG Group and China Aouyan Group.

According to data from S&P Global Ratings, the extended deceleration in the country's real estate industry has created significant challenges for the economy, causing defaults on approximately USD 81 billion worth of international bonds issued by Chinese developers from 2021 to 2022. Many distressed-debt funds found the surge of defaults in the industry too irresistible to be ignored. These funds acquired the bonds or loans of struggling companies, frequently at a significant discount, and engage in negotiations with the companies to establish a debt restructuring strategy.

However, the distressed-debt playbook is not working in China. Over the past twenty-four months, dozens of Chinese real estate companies have defaulted on their bond payments, yet only a small number have fully repaid their investors. This September, Evergrande withdrew from a USD 35 billion debt restructuring proposal that it had eventually reached with certain investors following prolonged discussions. These days, most dollar bonds sold by Chinese properties companies are sold below 10 cents on the dollar, and several are trading at less than 5 cents, an exponentially lower price compared to early 2021 when bonds were selling for around 90-100 cents on the dollar.

Source: WSJ

This dramatic decline was not anticipated even by the world's largest investment funds, such as Apollo Global Management or Vontobel Asset Management, which acquired Evergrande's bonds at the end of 2021. At that time, the bonds were bought at around 20 cents on the dollar and are now trading at just 2.5 cents on the dollar. The distressed-debt investors who bought Evergrande’s bonds after the company defaulted were hoping for a rational, market-driven restructuring. Unfortunately, the restructuring of such a large company depends a lot on the government and its vision for the future of the company, and things don't seem to be moving. Furthermore, the prolonged slowdown in the property sector is not helpful in this regard, making it difficult for companies to estimate the cash flow they need to pay investors in the future, given that sales for China's 100 largest developers are down 30% from last year.

In the current context, distressed-debt investors are finding negotiations increasingly difficult due to Chinese state intervention, which wants to avoid further economic problems from the collapse of the property market. As Jean-Charles Sambor, head of emerging markets fixed income at BNP Asset Management said, “The market is showing all the signs that it’s lost patience […] When you see these bonds now trading below 10 cents on the dollar, it tells you that investors expect a very low recovery, or total liquidation in some cases.”, most investors are expecting an extremely sluggish recovery, with the possibility of prices continuing to fall in the near future.

On the other hand, there exists some more optimistic views, such as Robert Koenigsberger, founder and chief investment officer at Gramercy Funds Management, who argues that distressed debt investing still has potential in China. He believes that after the wave of defaults in 2021, many investors rushed into investing and paid a high price “They made the first classic mistake in distressed investing: They bought it because it was cheaper than it used to be, not cheap relative to what it was worth.” An example that validates Koenisberger’s vision can be the new restructuring plan of Sunac China, a large developer that defaulted in May 2022. It won court approval for its multi-billion dollars restructuring plan, covering an estimated USD 10.2 billion of creditor claims, USD 5.7 billion of which will be compensated with new dollar bonds and the remainder with shares of its property-management arm and convertible notes. Thus, Sumac China will become the first major developer in China which manages to overcome such liabilities. As a result, Sunac's dollar bonds have experienced a few points increase in the past weeks, although their current trading value remains approximately 15 cents on the dollar.

China’s foreign investments: will China be able to cover it?

In the current status quo China's real estate crisis and its impact on the economy, consumer confidence, and foreign investments are creating challenges for investors and potentially leading to a shift away from China in emerging markets. The real-estate crisis has witnessed Chinese private developers accumulate too much debt and hoard land and apartments which has led to a policy-engineered bankruptcy. This along with uncertainties surrounding government policies and the China-U.S. tension, has led to a lack of confidence and unexpected challenges for investors.

China's real estate crisis is different from other countries due to its reliance on exporting and improving corporate profits, leading to a shift in foreign investments to Vietnam, India, and Indonesia, while China's central bank faces the challenge of maintaining control over the exchange rate and supporting domestic employment. Furthermore it is causing investors to reconsider investing in emerging markets, leading to potential removal of China from portfolios, while the US offers better growth opportunities in AI innovation and Nvidia may be a safer option for growth. With recent developments the country’s old economic model of relying on investments in real estate has “run its course” and the government needs to consider boosting consumption to drive recovery, according to the IMF.

Upon analyzing the investment trends over the years investment into China’s property market nosedived throughout 2022. Overall, it fell by 10% from a year earlier, according to figures from the country’s national bureaus of statistics. This is the first time property investment recorded an annual decline since records began in 2019. Markets have reacted with disappointment to economic developments and the government’s response so far.

Foreign investors have been exiting Chinese equity positions

The Chinese authorities have been working to restore confidence in the economy, especially among foreign businesses and investors. The latest policy move is a raft of 24 measures aimed at attracting foreign capital. However, it seems that there has been a lack of attention on these measures, and it is still unclear how far they will go in drawing investments back. The release of the 24 measures was somewhat untimely. The day before the policy was announced, leading real estate developer Country Garden announced the suspension of trading for 11 of its onshore bonds, intensifying the market’s concerns about real estate companies’ debt risks. Furthermore, economic indicators released in July showed a decline across the board, indicating a difficult start for the economy in the second half of the year, while the official suspension on publishing the rising youth unemployment rate has further damaged investor confidence.

Amid sluggish exports and lackluster domestic demand recovery in China, the importance of boosting foreign investments is evident. But with growing geopolitical tensions and slowing economic recovery, foreign investors’ confidence in the world’s second largest economy continues to wane. The allure of the Chinese market depends on how officials will reassure investors and protect the rights and interests of foreign enterprises in China.

Conclusions

As we have seen, high government spending and interventions, extremely useful in the past to boost economic growth, are now riskier due to the high debt that China has accumulated over the years. Furthermore, as the country is moving away from its status of developing country (even though it represents the second world economy) its public investments cannot yield the result they did in the past and are raising debates on whether they are sustainable in the long term.

The situation was worsened by the Covid pandemic that hit its economy and now, after an initial recovery, the momentum is fading and various crises, especially in manufacturing and real estate (data point at inconsistent and decreasing demand), are spreading in the country.

For instance, the government’s efforts and interventions in the property market with the aim to stop the crisis from spreading further are making life difficult for distressed-debt investors involved in the restructuring of the defaulted real estate giants, such as Evergrande and Country Garden.

This unstable situation has prompted foreign investors to shift away from China and its old economic model of relying on real estate investments and interjections in the private sector.

Even though policies aimed at boosting investments were recently approved, investors’ confidence continues to wane and it’s unclear how the country will manage to overcome this unprecedented crisis of its once prosperous economy.

Written by Vittorio Granuzzo, Gauri Gupta, Emanuele Lamberti, Laurian Pop

This dramatic decline was not anticipated even by the world's largest investment funds, such as Apollo Global Management or Vontobel Asset Management, which acquired Evergrande's bonds at the end of 2021. At that time, the bonds were bought at around 20 cents on the dollar and are now trading at just 2.5 cents on the dollar. The distressed-debt investors who bought Evergrande’s bonds after the company defaulted were hoping for a rational, market-driven restructuring. Unfortunately, the restructuring of such a large company depends a lot on the government and its vision for the future of the company, and things don't seem to be moving. Furthermore, the prolonged slowdown in the property sector is not helpful in this regard, making it difficult for companies to estimate the cash flow they need to pay investors in the future, given that sales for China's 100 largest developers are down 30% from last year.

In the current context, distressed-debt investors are finding negotiations increasingly difficult due to Chinese state intervention, which wants to avoid further economic problems from the collapse of the property market. As Jean-Charles Sambor, head of emerging markets fixed income at BNP Asset Management said, “The market is showing all the signs that it’s lost patience […] When you see these bonds now trading below 10 cents on the dollar, it tells you that investors expect a very low recovery, or total liquidation in some cases.”, most investors are expecting an extremely sluggish recovery, with the possibility of prices continuing to fall in the near future.

On the other hand, there exists some more optimistic views, such as Robert Koenigsberger, founder and chief investment officer at Gramercy Funds Management, who argues that distressed debt investing still has potential in China. He believes that after the wave of defaults in 2021, many investors rushed into investing and paid a high price “They made the first classic mistake in distressed investing: They bought it because it was cheaper than it used to be, not cheap relative to what it was worth.” An example that validates Koenisberger’s vision can be the new restructuring plan of Sunac China, a large developer that defaulted in May 2022. It won court approval for its multi-billion dollars restructuring plan, covering an estimated USD 10.2 billion of creditor claims, USD 5.7 billion of which will be compensated with new dollar bonds and the remainder with shares of its property-management arm and convertible notes. Thus, Sumac China will become the first major developer in China which manages to overcome such liabilities. As a result, Sunac's dollar bonds have experienced a few points increase in the past weeks, although their current trading value remains approximately 15 cents on the dollar.

China’s foreign investments: will China be able to cover it?

In the current status quo China's real estate crisis and its impact on the economy, consumer confidence, and foreign investments are creating challenges for investors and potentially leading to a shift away from China in emerging markets. The real-estate crisis has witnessed Chinese private developers accumulate too much debt and hoard land and apartments which has led to a policy-engineered bankruptcy. This along with uncertainties surrounding government policies and the China-U.S. tension, has led to a lack of confidence and unexpected challenges for investors.

China's real estate crisis is different from other countries due to its reliance on exporting and improving corporate profits, leading to a shift in foreign investments to Vietnam, India, and Indonesia, while China's central bank faces the challenge of maintaining control over the exchange rate and supporting domestic employment. Furthermore it is causing investors to reconsider investing in emerging markets, leading to potential removal of China from portfolios, while the US offers better growth opportunities in AI innovation and Nvidia may be a safer option for growth. With recent developments the country’s old economic model of relying on investments in real estate has “run its course” and the government needs to consider boosting consumption to drive recovery, according to the IMF.

Upon analyzing the investment trends over the years investment into China’s property market nosedived throughout 2022. Overall, it fell by 10% from a year earlier, according to figures from the country’s national bureaus of statistics. This is the first time property investment recorded an annual decline since records began in 2019. Markets have reacted with disappointment to economic developments and the government’s response so far.

Foreign investors have been exiting Chinese equity positions

The Chinese authorities have been working to restore confidence in the economy, especially among foreign businesses and investors. The latest policy move is a raft of 24 measures aimed at attracting foreign capital. However, it seems that there has been a lack of attention on these measures, and it is still unclear how far they will go in drawing investments back. The release of the 24 measures was somewhat untimely. The day before the policy was announced, leading real estate developer Country Garden announced the suspension of trading for 11 of its onshore bonds, intensifying the market’s concerns about real estate companies’ debt risks. Furthermore, economic indicators released in July showed a decline across the board, indicating a difficult start for the economy in the second half of the year, while the official suspension on publishing the rising youth unemployment rate has further damaged investor confidence.

Amid sluggish exports and lackluster domestic demand recovery in China, the importance of boosting foreign investments is evident. But with growing geopolitical tensions and slowing economic recovery, foreign investors’ confidence in the world’s second largest economy continues to wane. The allure of the Chinese market depends on how officials will reassure investors and protect the rights and interests of foreign enterprises in China.

Conclusions

As we have seen, high government spending and interventions, extremely useful in the past to boost economic growth, are now riskier due to the high debt that China has accumulated over the years. Furthermore, as the country is moving away from its status of developing country (even though it represents the second world economy) its public investments cannot yield the result they did in the past and are raising debates on whether they are sustainable in the long term.

The situation was worsened by the Covid pandemic that hit its economy and now, after an initial recovery, the momentum is fading and various crises, especially in manufacturing and real estate (data point at inconsistent and decreasing demand), are spreading in the country.

For instance, the government’s efforts and interventions in the property market with the aim to stop the crisis from spreading further are making life difficult for distressed-debt investors involved in the restructuring of the defaulted real estate giants, such as Evergrande and Country Garden.

This unstable situation has prompted foreign investors to shift away from China and its old economic model of relying on real estate investments and interjections in the private sector.

Even though policies aimed at boosting investments were recently approved, investors’ confidence continues to wane and it’s unclear how the country will manage to overcome this unprecedented crisis of its once prosperous economy.

Written by Vittorio Granuzzo, Gauri Gupta, Emanuele Lamberti, Laurian Pop

Sources

- Reuters

- IMF

- Bloomberg

- The Financial Times

- Fitch Ratings

- The Guardian

- The Wall Street Journal

- Forbes

- Scmp

- Ice

- ThinkChina