Hong Kong has recently become the place with the highest average housing prices per square foot. Extremely unaffordable housing prices force Hong Kong’ citizens to live in the so-called “coffin-houses”, small apartments where there is barely room enough to stand. A combination of both domestic and international factors may slam the market in the foreseeable future.

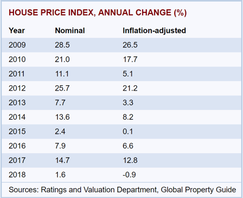

First, the increasing demand is mainly composed of large real estate investors and billionaires who see Hong Kong housing markets as a great investment opportunity. Housing prices in Hong Kong have constantly increased over the last 10 years: people now believe that a buying a house allows to achieve the highest risk-return ratio. Over the past decade, Hong Kong´s residential property prices have skyrocketed by 242% (152.6% inflation-adjusted). This trend has been particularly notable between 2009 and 2012, with an average increase per year equal to 17%. This attractive investment opportunity, combined with low interest rates, has justified the dramatic increase in prices.

2 HKD-USD exchange rate: the HKD at its lowest value of the last 10 years exchanging at 7.85 per USD- Source: BloombergMarkets

2 HKD-USD exchange rate: the HKD at its lowest value of the last 10 years exchanging at 7.85 per USD- Source: BloombergMarkets

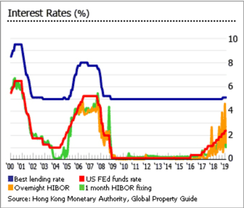

In contrast, real incomes have virtually stagnated in Hong Kong for years: indeed, it is not surprising that a quarter of the under-20 years old Hong Kongers believe they will never be able to afford the purchase of a real estate property. The impossibility to satisfy this increasing demand is mainly due to the morphology of the territory, which poses an obstacle to the expansion to inhabited areas. In addition, a considerable portion of the area of Hong Kong Island and Kowloon peninsula is owned by the government that- under growing pressure from China- does not appear willing to invest in new houses. Secondly, the steep increase in prices has been driven by an excessively affordable debt market that could soon suffer a tighten. The global debt market has reached disproportionate figures, even if compared with the levels before the last recession. This is the case of the Hong Kong real estate market, overloaded to the point that it could collapse if rates were to rise too much or too soon. According to the Telegraph, 90% of local mortgage contracts are floating-rate and tied to the three months HIBOR (Hong Kong Interbank lending rate), which makes them exposed to the interest rate risk. Therefore, as global interbank rates rise and the FED stiffens, Hong Kong is forced to intervene to halt capital outflows and defend its exchange rate. Today, while the Hibor rate is around 1.6%, the Libor rate is at 2.59%, the highest in the last ten years. Sooner or later, the markets will borrow Hibor and invest in Libor: this will likely lead to a massive capital flight. As the graph on the left shows, the HKD is at its lowest level of the last 33 years, suggesting- according to Bloomberg- that HKD demand is already plummeting due to massive capital outflows. This increases the probability of Hong Kong further rising its rates in the foreseeable future, with consequential effects on credit and real estate.

The end of the ultra-low interest rate environment has already started even in Hong Kong, since the HKMA (Hong Kong Monetary Authority) raised its base rate by 25 basis points at the end of last year, following a similar move made by the FED. As a result, the best lending rate in HK increased to 5.13%, up from 5% a year earlier. An additional risk should be accounted for. While local banks are solid and able to overcome a potential storm on the real estate market, the same cannot be said for foreign banks. HSBC and Bank of China are the top mortgage banks, with more than 700 billion total exposure in Hong Kong. In conclusion, the known tendency to give generous credit assessments when the real estate market grows, and the effects of rising rates may further amplify the issue.

Is a big crash in the Hong Kong real estate market about to come? The impact of these factors is difficult to anticipate. Moody’s Investors Service predicted a 15% downfall in house prices and sales over the next 12-18 months; their view is similar to the one of CLSA, UBS and Citibank, which predicted analogous downturns, claiming that the city will face the “worst headwind in 15 years”.

Nicola Bulgarelli.

Is a big crash in the Hong Kong real estate market about to come? The impact of these factors is difficult to anticipate. Moody’s Investors Service predicted a 15% downfall in house prices and sales over the next 12-18 months; their view is similar to the one of CLSA, UBS and Citibank, which predicted analogous downturns, claiming that the city will face the “worst headwind in 15 years”.

Nicola Bulgarelli.