Not only US, 2017 has been an incredible year for Emerging Markets too.

In particular, investors have seen the best return on high yield bonds in 6 years - 10% on local currency bonds and 7.6% on dollar-denominated ones - while European funds operating in EM debt have increased their masses by $63.4 bn.

Between 2013 and 2015 Chinese economy slowdown, oil price fall and foreseen tightening of FED monetary policy caused a huge outflow of capital from emerging countries. Investors feared that governments and companies would not be able to face their debt obligations because of a weaker currency and less income from commodities. Eventually it has not happened and, after the oil price recovery in the second half of 2016, investors rushed again at their high yield bonds.

In particular, investors have seen the best return on high yield bonds in 6 years - 10% on local currency bonds and 7.6% on dollar-denominated ones - while European funds operating in EM debt have increased their masses by $63.4 bn.

Between 2013 and 2015 Chinese economy slowdown, oil price fall and foreseen tightening of FED monetary policy caused a huge outflow of capital from emerging countries. Investors feared that governments and companies would not be able to face their debt obligations because of a weaker currency and less income from commodities. Eventually it has not happened and, after the oil price recovery in the second half of 2016, investors rushed again at their high yield bonds.

These new capital inflows have been also due to many structural reforms that several emerging countries are implementing, in order to make their national economic framework more solid and sustainable. In fact, in its last World Economic Outlook IMF recognized stronger fundamental conditions among developing economies and forecast growth rates of 5% over the medium term. Another positive factor for people who are willing to invest in EM bonds is the reduced gap between developing countries and advanced economies’ inflation rates, which seems to be bound to shrink further in the future.

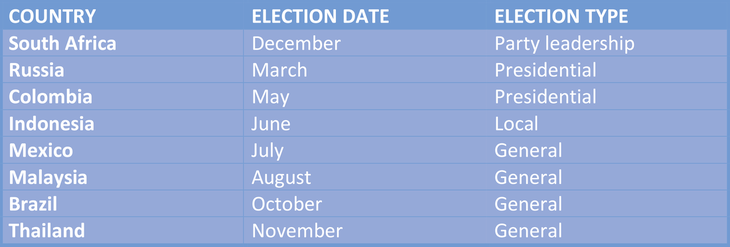

However, investors should neither rest on their laurels nor be too confident, since several risks looms for next year. First of all, in 2018 many emerging countries will hold national elections, which in the past have often resulted in high volatility. While predictable pools outcomes in countries like Russia and Malaysia are not going to impact the current trends, some others, like Mexican and Brazilian ones, are likely to strongly destabilize markets.

A meaningful ‘appetizer’ is what happened a month ago after Chilean presidential election when Sebastian Pinera, who was supposed to be cruising to victory, got much fewer votes than expected, giving a chance to the opposite coalition to reverse the results in the second round scheduled for December the 17th. Pinera pledged a consistent tax cut to favourite investments, so the consequences of the pools outcome - only 73 seats out of 155 in the lower house for his supporters - have been a 5.9% loss of IPSA and a Peso’s 1.7% drop. At the same time a fiscal deterioration in pre-election period must be taken into account, especially in contexts like South Africa and Indonesia, causing a further increase in national debt that might make investors nervous.

However, investors should neither rest on their laurels nor be too confident, since several risks looms for next year. First of all, in 2018 many emerging countries will hold national elections, which in the past have often resulted in high volatility. While predictable pools outcomes in countries like Russia and Malaysia are not going to impact the current trends, some others, like Mexican and Brazilian ones, are likely to strongly destabilize markets.

A meaningful ‘appetizer’ is what happened a month ago after Chilean presidential election when Sebastian Pinera, who was supposed to be cruising to victory, got much fewer votes than expected, giving a chance to the opposite coalition to reverse the results in the second round scheduled for December the 17th. Pinera pledged a consistent tax cut to favourite investments, so the consequences of the pools outcome - only 73 seats out of 155 in the lower house for his supporters - have been a 5.9% loss of IPSA and a Peso’s 1.7% drop. At the same time a fiscal deterioration in pre-election period must be taken into account, especially in contexts like South Africa and Indonesia, causing a further increase in national debt that might make investors nervous.

Created by Lorenzo Monticone

Secondly the debt risk cannot be underestimated when planning to invest in EM, as Venezuela current situation proves.

Even if governments have been doing quite well at reducing primary deficit and at strengthening growth forecasts, emerging countries’ sovereign and corporates debt situation is still matter of concerns. The Institute of International Finance has recently estimated that the whole EM debt has reached a value of $59 tn. The interest showed by investors have led governments and companies in emerging markets to issue $252.7 bn of speculative grade bonds this year through November 14 - $172.1 bn sold in 2016, according to Dealogic.

Even if governments have been doing quite well at reducing primary deficit and at strengthening growth forecasts, emerging countries’ sovereign and corporates debt situation is still matter of concerns. The Institute of International Finance has recently estimated that the whole EM debt has reached a value of $59 tn. The interest showed by investors have led governments and companies in emerging markets to issue $252.7 bn of speculative grade bonds this year through November 14 - $172.1 bn sold in 2016, according to Dealogic.

Source: Dealogic, edited by Financial Times

For example, Tajikistan - not a model of wealth – issued a $500 million bond debt in September, which is more than 7% of its GDP.

This surge in debt makes the whole economy quite sensible to any exogenous shock which may occur in the future, and we should learn from Venezuelan case that coming to the rescue with late debt restructuration attempts might not always work.

Moreover, only the 26% of this huge debt is dollar-denominated (4% euro-denominated). As a consequence, FED and ECB monetary policy tightening might turn out to be a serious threat for local currency bonds.

Lastly, EME results are strongly influenced by Chinese economy performance and the Prime Minister Li Keqiang seems now more interested in cooling down real estate sector and reducing corporate debt instead of seeking a stronger growth.

Furthermore, last IMF projections expect India to grow at 6.7% in 2017 and 7.4% in 2018, which are 0.5 and 0.3 percentage points below what had been projected at the beginning of the year. This growth slowing-down reflects the impact of the demonetisation reform and the uncertainty about the introduction of the new common “Goods and Services Tax”. If Chinese and Indian economies slow down it will be difficult to the other emerging countries to maintain the current growth pace.

Once considered all the previous elements, investors should understand that a headlong rush into these investment opportunities – which really look like easy money for free - is not a wise move. On the contrary, a careful analysis might suggest short term bonds, maybe dollar-denominated in order to avoid exchange risk.

Hopefully, IMF forecasts are correct and the good momentum will last for a while, but there is still some evidence of an intrinsic fragility in emerging economies that advise against long portfolios duration.

Just a quick reminder: in the early February 2013, Venezuela’s 9.5% fixed-rate bond with a 30-year maturity was worth about 103 basis points. It seemed to everyone that everything would have gone smoothly.

Lorenzo Monticone

This surge in debt makes the whole economy quite sensible to any exogenous shock which may occur in the future, and we should learn from Venezuelan case that coming to the rescue with late debt restructuration attempts might not always work.

Moreover, only the 26% of this huge debt is dollar-denominated (4% euro-denominated). As a consequence, FED and ECB monetary policy tightening might turn out to be a serious threat for local currency bonds.

Lastly, EME results are strongly influenced by Chinese economy performance and the Prime Minister Li Keqiang seems now more interested in cooling down real estate sector and reducing corporate debt instead of seeking a stronger growth.

Furthermore, last IMF projections expect India to grow at 6.7% in 2017 and 7.4% in 2018, which are 0.5 and 0.3 percentage points below what had been projected at the beginning of the year. This growth slowing-down reflects the impact of the demonetisation reform and the uncertainty about the introduction of the new common “Goods and Services Tax”. If Chinese and Indian economies slow down it will be difficult to the other emerging countries to maintain the current growth pace.

Once considered all the previous elements, investors should understand that a headlong rush into these investment opportunities – which really look like easy money for free - is not a wise move. On the contrary, a careful analysis might suggest short term bonds, maybe dollar-denominated in order to avoid exchange risk.

Hopefully, IMF forecasts are correct and the good momentum will last for a while, but there is still some evidence of an intrinsic fragility in emerging economies that advise against long portfolios duration.

Just a quick reminder: in the early February 2013, Venezuela’s 9.5% fixed-rate bond with a 30-year maturity was worth about 103 basis points. It seemed to everyone that everything would have gone smoothly.

Lorenzo Monticone