London has lost crown of biggest European stock market to Paris the morning of 14 November 2022, being worth $2.821 trillion, compared to the French stock market which sits at $2.823 trillion, primarily supported by the resilience of luxury brands.

“It's been a long time in the making. It's not only the problems the UK faces with Brexit,” said Albertina Torsoli, a professional Bloomberg journalist with 22 years covering French companies and financial markets. She also explained how France has seen a form of stability in the last years, which may also improve with another five years of President Emmanuel Macron, making Paris more attractive to foreign investors.

Moreover, the United Kingdom has recently suffered a political storm due to the failure of the Truss’ government and its 'mini budget', which has led to increased investors’ mistrust.

Causes of trouble

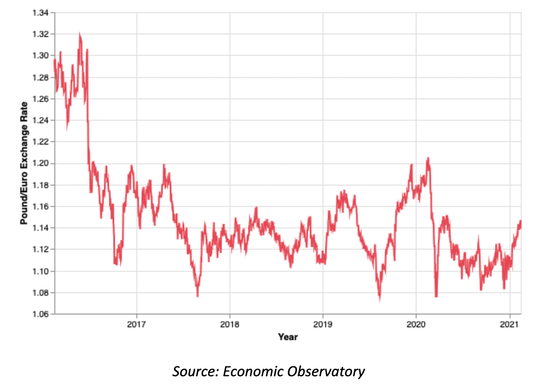

Most speculations that the UK financial services industry would suffer date back to 2016. Helena Vieira, Managing Editor at the LSE Business Review, reports that, when the Centre for Macroeconomics (CFM) administered a survey to a wide array of experts in June 2016, a significant number of answers were extremely worried for both the short-run and long-run consequences of the imminent referendum. 26% believed that the chances that the UK would suffer a major “disruption to financial markets and asset prices” were higher than 70%. The arguments supporting these opinions were mostly regarding the volatility and eventual fall in the sterling.

The fall in pound

As a matter of fact, in 2021, the value of the pound was 15% weaker than the euro, compared to their values before Brexit, and overall, 20% weaker than its value in December 2015, when Brexit received Royal Assent.

“It's been a long time in the making. It's not only the problems the UK faces with Brexit,” said Albertina Torsoli, a professional Bloomberg journalist with 22 years covering French companies and financial markets. She also explained how France has seen a form of stability in the last years, which may also improve with another five years of President Emmanuel Macron, making Paris more attractive to foreign investors.

Moreover, the United Kingdom has recently suffered a political storm due to the failure of the Truss’ government and its 'mini budget', which has led to increased investors’ mistrust.

Causes of trouble

Most speculations that the UK financial services industry would suffer date back to 2016. Helena Vieira, Managing Editor at the LSE Business Review, reports that, when the Centre for Macroeconomics (CFM) administered a survey to a wide array of experts in June 2016, a significant number of answers were extremely worried for both the short-run and long-run consequences of the imminent referendum. 26% believed that the chances that the UK would suffer a major “disruption to financial markets and asset prices” were higher than 70%. The arguments supporting these opinions were mostly regarding the volatility and eventual fall in the sterling.

The fall in pound

As a matter of fact, in 2021, the value of the pound was 15% weaker than the euro, compared to their values before Brexit, and overall, 20% weaker than its value in December 2015, when Brexit received Royal Assent.

In this case, institutions involved in international trade and services are not the only participants to contribute to the sterling’s fall. Another driver is the fact that global financial institutions are not keen on preferring to hold investments in pounds. This is due to financial-asset-related trades of currencies being the largest proportion of currency transactions, and the most important participant in exchange rate changes in the short run.

Moreover, the pound was weakened by high-profile departures from important takeovers. For instance, the RSA Insurance Group is the second-largest general insurer in the UK and was involved in a major acquisition. RSA was listed on the London Stock Exchange before being acquired by two foreign overseas companies: the Intact Financial Corporation, a Canadian multinational property and insurance company, and Tryg A/S, a Scandinavian insurance company whose headquarters are in Denmark). The transaction closed on June 1st, 2021 for a value of approximately £7.2 billion.

New regulations and consequences in the financial services industry

Financial institutions are involved in another aspect of this crisis: the post-Brexit regulations. Among the many reasons for this crisis, these regulations certainly created a hostile environment for UK markets and banks. In fact, the new regulations present deep problematics that already impaired the British economy and will continue to do so in the long run.

It is no secret that after the United Kingdom’s exit from the European Union (EU), foreign corporations and institutions decided to move their branches and offices abroad.

A perfect example is Deutsche Bank, which has been moving jobs from the City to the French capital. Their research paper, Brexit impact on investment banking in Europe, dated back to 2018, analyzes how post-Brexit transactions and operations are now more costly and overall complicated for investment banks and financial institutions in general. While UK banks clearly took advantage of the new regulations, foreign corporations were seriously damaged. However, Bank of England’s data and figures suggest that almost a third of the 2017 fee and commission income of UK banks (total F&C income was at £30 billion) is generated by non-resident banks. Therefore, having Brexit made transactions more expensive for foreign banks and institutions, the post-Brexit revenue generated by the investment banking, underwriting, advisory and brokerage activities carried out by non-resident banks has significantly affected UK banking overall.

Moreover, the pound was weakened by high-profile departures from important takeovers. For instance, the RSA Insurance Group is the second-largest general insurer in the UK and was involved in a major acquisition. RSA was listed on the London Stock Exchange before being acquired by two foreign overseas companies: the Intact Financial Corporation, a Canadian multinational property and insurance company, and Tryg A/S, a Scandinavian insurance company whose headquarters are in Denmark). The transaction closed on June 1st, 2021 for a value of approximately £7.2 billion.

New regulations and consequences in the financial services industry

Financial institutions are involved in another aspect of this crisis: the post-Brexit regulations. Among the many reasons for this crisis, these regulations certainly created a hostile environment for UK markets and banks. In fact, the new regulations present deep problematics that already impaired the British economy and will continue to do so in the long run.

It is no secret that after the United Kingdom’s exit from the European Union (EU), foreign corporations and institutions decided to move their branches and offices abroad.

A perfect example is Deutsche Bank, which has been moving jobs from the City to the French capital. Their research paper, Brexit impact on investment banking in Europe, dated back to 2018, analyzes how post-Brexit transactions and operations are now more costly and overall complicated for investment banks and financial institutions in general. While UK banks clearly took advantage of the new regulations, foreign corporations were seriously damaged. However, Bank of England’s data and figures suggest that almost a third of the 2017 fee and commission income of UK banks (total F&C income was at £30 billion) is generated by non-resident banks. Therefore, having Brexit made transactions more expensive for foreign banks and institutions, the post-Brexit revenue generated by the investment banking, underwriting, advisory and brokerage activities carried out by non-resident banks has significantly affected UK banking overall.

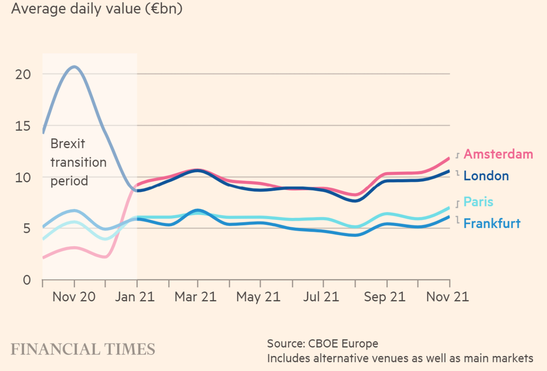

The post-Brexit trade deal struck in late 2020 made precious little provision for financial services, and since then Brussels has refused to offer London anything like the same market access arrangements — or equivalence — that financial centers including New York, Tokyo or Hong Kong enjoy.

Paris has attracted 2,800 UK employees since Britain voted to leave the EU in 2016, according to EY. The bulk of roles are in trading, as France capitalizes on the existing expertise of its main banks in many derivatives markets. Several US banks have also chosen Paris as one of their EU bases, among them JPMorgan, which is due to increase its staff from 250 to 800 people in France this year. A further 20 to 30 per cent of the new jobs are linked to investment funds — hedge funds such as Citadel have set up shop or expanded their teams in Paris — while the rest are made up of fintech and insurance companies, according to Arnaud de Bresson, the managing director of lobby group Paris Europlace.

UK’s lack of political credibility: Liz Truss and the new government

In September 2022, while the energy crisis was hindering the whole population and inflation rates were as high as in the 1980s, the newly appointed Prime Minister Liz Truss was on the verge of facing one of the worst set of hurdles in decades. Truss’ longing to be the heir to Boris Johnson’s politics would soon be destroyed. Her ideas and plans were quite similar to those of her successor, with the difference that Johnson financed public spending through an increase in taxes, while Truss strongly wanted to cut taxes for wealthy corporations, in order for the economy to spur.

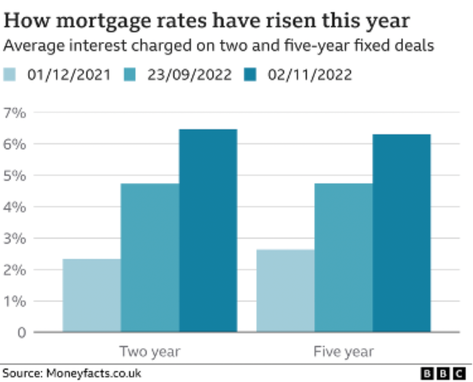

This was part of Truss’ mini “Budget” (also known as The Growth Plan), a wider set of economic policies and tax cuts: the plan included the reversal of a 2021 measure to increase corporation tax from 16% to 25% from April 2023, a cut in the basic rate of income tax to 19%, the reversal of the 2022 increase in the National Insurance, and more. After the announcement of the mini “Budget”, the sterling fell, losing 0.75% against the Euro and 3% against the US dollar. However, in late October, the sterling rose to $1.146, as it was in mid-September. Moreover, banks withdrew mortgages because of the spike of interest rates. In an article published on November 16th 2022, BBC reported that “an average two-year fixed deal, which was 2.29% in November 2021, is now 6.47%”.

Paris has attracted 2,800 UK employees since Britain voted to leave the EU in 2016, according to EY. The bulk of roles are in trading, as France capitalizes on the existing expertise of its main banks in many derivatives markets. Several US banks have also chosen Paris as one of their EU bases, among them JPMorgan, which is due to increase its staff from 250 to 800 people in France this year. A further 20 to 30 per cent of the new jobs are linked to investment funds — hedge funds such as Citadel have set up shop or expanded their teams in Paris — while the rest are made up of fintech and insurance companies, according to Arnaud de Bresson, the managing director of lobby group Paris Europlace.

UK’s lack of political credibility: Liz Truss and the new government

In September 2022, while the energy crisis was hindering the whole population and inflation rates were as high as in the 1980s, the newly appointed Prime Minister Liz Truss was on the verge of facing one of the worst set of hurdles in decades. Truss’ longing to be the heir to Boris Johnson’s politics would soon be destroyed. Her ideas and plans were quite similar to those of her successor, with the difference that Johnson financed public spending through an increase in taxes, while Truss strongly wanted to cut taxes for wealthy corporations, in order for the economy to spur.

This was part of Truss’ mini “Budget” (also known as The Growth Plan), a wider set of economic policies and tax cuts: the plan included the reversal of a 2021 measure to increase corporation tax from 16% to 25% from April 2023, a cut in the basic rate of income tax to 19%, the reversal of the 2022 increase in the National Insurance, and more. After the announcement of the mini “Budget”, the sterling fell, losing 0.75% against the Euro and 3% against the US dollar. However, in late October, the sterling rose to $1.146, as it was in mid-September. Moreover, banks withdrew mortgages because of the spike of interest rates. In an article published on November 16th 2022, BBC reported that “an average two-year fixed deal, which was 2.29% in November 2021, is now 6.47%”.

London is losing its position because of the unstable environment and less flexible economy. Under this scenario, we are seeing sales and trading moving to the Frankfurt stock exchange and Swiss exchange. This year, one of the largest IPO worth 72 billion euros, Porsche, chose the Frankfurt stock exchange. Furthermore, the launch of Global Depositary Receipt, a financing activity of issuing negotiable financial instruments among Chinese listed companies and Europe stock exchanges, has mostly chosen the Swiss Stock exchange. Among the seven companies that are already listed, only one chose the London Stock exchange, while 6 others chose the Swiss Exchange. Companies listed at Swiss exchange include Guoxuan High-Tech, Gem, and Ningbo Shanshan. The company listed at the London exchange is called MingYang Smart Energy Group Limited. Furthermore, among 25 companies preparing for GDR now, 20 chose the Swiss Stock exchange, and only 2 made a final announcement that they will choose London Stock Exchange. The major reason behind the choice is because of policy. Listing on the Swiss Stock exchange takes a shorter time, which usually takes 1.5-2 months, while the London exchange takes over 3 months. Furthermore, the tax policy of issuing in the Swiss Stock Exchange is more favorable.

Asset management transition

In the Asset Management section, the action of moving out of London to Dublin and Luxemburg started after Brexit. In 2016, after the announcement of Brexit, M&G, Columbia Threadneedle, Legg Mason, Fidelity International, and T Rowe Price had all outlined intentions to move staff out of the UK capital or set up fund ranges in neighboring EU countries in fear of being locked out of European fundraising according to DPN. Currently, companies are still influenced by an unstable environment. According to the latest data from the EY Financial Services Brexit Tracker, 44% (97 out of 222) of financial services firms have moved or planned to move some UK operations and staff to the EU since the referendum.

Launch of GDR of Chinese stock in Europe

A GDR is a certificate, issued by a custodian bank, representing shares of a foreign security on two or more global markets. In China, GDRs represent certificates of A shares traded in foreign markets, denominated in yuan.

In recent months, Chinese companies have accelerated the pace of issuing global depositary receipts in major European markets.

The growing interest of A-share companies in issuing GDRs in European stock exchanges is linked to the benefits that can be derived from the change in the management regulations of GDRs. The regulations, as part of China's stock connect programmes, were published in February by the China Securities Regulatory Commission.

In the past, only Shanghai-listed companies were allowed to submit such applications and the London Stock Exchange was the only option for GDR issuances in Europe, while recently Switzerland and Germany have been included in the stock connect mechanism for listed companies.

As a result, more and more Chinese companies are choosing to list their certificates on European or Swiss stock exchanges, so that of the last seven Chinese GDR issues, only one took place on the London Stock Exchange.

Where is London still strong?

International banks borrowing and lending

A modest trickle of migration from the City to other European financial capitals has occurred due to the Covid-19 freeze on executive relocations as well as ECB and European Commission’s actions demanding lenders to move more financial resources in the EU, resulting in close to €1tn of assets moved from the UK to the EU in recent years.

However, bank supervisors are becoming more and more strict with banks that want to do a lot of business in the single market without maintaining substantial physical operations there with plenty of staff, requiring banks to add hundreds of extra staff and billions of euros of additional capital to their operation and making the transition more difficult and expensive.

Moreover, most banks rely on “back-to-back models”, complex structures to run their European operations out of London which allow the risk of EU trades to be transferred to the UK, suggesting that international bank lending and borrowing will stay strong in the UK.

Asset management transition

In the Asset Management section, the action of moving out of London to Dublin and Luxemburg started after Brexit. In 2016, after the announcement of Brexit, M&G, Columbia Threadneedle, Legg Mason, Fidelity International, and T Rowe Price had all outlined intentions to move staff out of the UK capital or set up fund ranges in neighboring EU countries in fear of being locked out of European fundraising according to DPN. Currently, companies are still influenced by an unstable environment. According to the latest data from the EY Financial Services Brexit Tracker, 44% (97 out of 222) of financial services firms have moved or planned to move some UK operations and staff to the EU since the referendum.

Launch of GDR of Chinese stock in Europe

A GDR is a certificate, issued by a custodian bank, representing shares of a foreign security on two or more global markets. In China, GDRs represent certificates of A shares traded in foreign markets, denominated in yuan.

In recent months, Chinese companies have accelerated the pace of issuing global depositary receipts in major European markets.

The growing interest of A-share companies in issuing GDRs in European stock exchanges is linked to the benefits that can be derived from the change in the management regulations of GDRs. The regulations, as part of China's stock connect programmes, were published in February by the China Securities Regulatory Commission.

In the past, only Shanghai-listed companies were allowed to submit such applications and the London Stock Exchange was the only option for GDR issuances in Europe, while recently Switzerland and Germany have been included in the stock connect mechanism for listed companies.

As a result, more and more Chinese companies are choosing to list their certificates on European or Swiss stock exchanges, so that of the last seven Chinese GDR issues, only one took place on the London Stock Exchange.

Where is London still strong?

International banks borrowing and lending

A modest trickle of migration from the City to other European financial capitals has occurred due to the Covid-19 freeze on executive relocations as well as ECB and European Commission’s actions demanding lenders to move more financial resources in the EU, resulting in close to €1tn of assets moved from the UK to the EU in recent years.

However, bank supervisors are becoming more and more strict with banks that want to do a lot of business in the single market without maintaining substantial physical operations there with plenty of staff, requiring banks to add hundreds of extra staff and billions of euros of additional capital to their operation and making the transition more difficult and expensive.

Moreover, most banks rely on “back-to-back models”, complex structures to run their European operations out of London which allow the risk of EU trades to be transferred to the UK, suggesting that international bank lending and borrowing will stay strong in the UK.

Clearing Houses

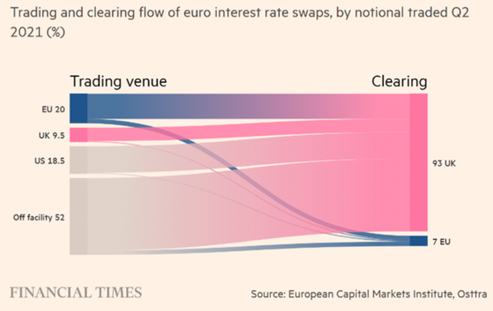

A clearing house is a financial institution formed to facilitate the exchange of payments, securities, or derivatives transactions. The clearing house stands between two clearing firms. Its purpose is to reduce the risk of a member firm failing to honour its trade settlement obligations.

Clearing houses are so important in the capital markets industry that can be considered a real financial infrastructure that face heavy regulation and attention.

A clearing house is a financial institution formed to facilitate the exchange of payments, securities, or derivatives transactions. The clearing house stands between two clearing firms. Its purpose is to reduce the risk of a member firm failing to honour its trade settlement obligations.

Clearing houses are so important in the capital markets industry that can be considered a real financial infrastructure that face heavy regulation and attention.

As show in the picture, UK processed 93% of euro interest swaps in Q2 2021 showing absolute dominance of the clearing market, subtracting their regulation from the EU authorities.

EU politicians have long wanted to pull clearing of euro-denominated derivatives from London, where the majority of the €90tn business is handled. But the huge costs involved in transferring positions reflects the barely immobility of the market.

Esma, the pan-European securities regulator, wants the commission to consider measures such as tougher bank capital requirements to force firms to park more business in the eurozone. “What we intend with this is that the clearing volumes will migrate from the UK to the EU clearing houses, and as such the huge dependencies are reduced,” says Froukelien Wendt, a member of Esma’s clearing house supervisory committee.

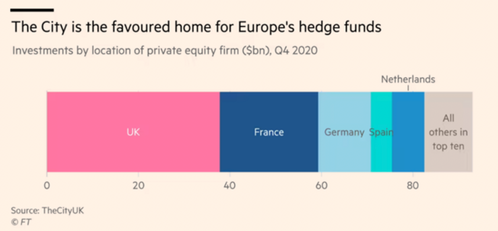

Hedge funds

A hedge fund is a pooled investment fund that trades in relatively liquid assets and can make extensive use of more complex trading, portfolio-construction, and risk management techniques to improve performance, such as short selling, leverage, and derivatives.

Hedge funds tend to use huge amount of leverage, resulting in a risk for financial institutions which finance their operations.

As shown in the picture, the EU is failing to attract speculative capital, resulting in close to 40% of Europe’s Hedge Funds choosing London as their location, with huge consequences on regulation.

More than 500 hedge funds have been set up in London since 2019, according to a report by City AM. With the city being home to more than 500 firms.

Investors in a hedge fund are taxed on the shares of the partnership profits as if they hold the underlying investments. UK investors are liable for tax on all hedge fund income that’s distributed and reported to them, regardless of whether they’ve received it or not. UK bond fund rules also mean that distributions to UK investors from funds primarily invested over 60% in debt-like assets are treated as interest, which is taxable.

Consequently, most hedge funds are going to stay in the UK considering lower taxes that can improve real investors’ returns.

Moreover, London is home to many professionals (around 56000) that work in the industry, resulting in a great pool of talent that is crucial for fund’s success.

EU politicians have long wanted to pull clearing of euro-denominated derivatives from London, where the majority of the €90tn business is handled. But the huge costs involved in transferring positions reflects the barely immobility of the market.

Esma, the pan-European securities regulator, wants the commission to consider measures such as tougher bank capital requirements to force firms to park more business in the eurozone. “What we intend with this is that the clearing volumes will migrate from the UK to the EU clearing houses, and as such the huge dependencies are reduced,” says Froukelien Wendt, a member of Esma’s clearing house supervisory committee.

Hedge funds

A hedge fund is a pooled investment fund that trades in relatively liquid assets and can make extensive use of more complex trading, portfolio-construction, and risk management techniques to improve performance, such as short selling, leverage, and derivatives.

Hedge funds tend to use huge amount of leverage, resulting in a risk for financial institutions which finance their operations.

As shown in the picture, the EU is failing to attract speculative capital, resulting in close to 40% of Europe’s Hedge Funds choosing London as their location, with huge consequences on regulation.

More than 500 hedge funds have been set up in London since 2019, according to a report by City AM. With the city being home to more than 500 firms.

Investors in a hedge fund are taxed on the shares of the partnership profits as if they hold the underlying investments. UK investors are liable for tax on all hedge fund income that’s distributed and reported to them, regardless of whether they’ve received it or not. UK bond fund rules also mean that distributions to UK investors from funds primarily invested over 60% in debt-like assets are treated as interest, which is taxable.

Consequently, most hedge funds are going to stay in the UK considering lower taxes that can improve real investors’ returns.

Moreover, London is home to many professionals (around 56000) that work in the industry, resulting in a great pool of talent that is crucial for fund’s success.

Conclusion

Despite all this, the City of London remains the continent’s most important financial hub across swaths of activity. Moreover Brexit-related job moves from the UK to the EU total less than 7,400, according to EY figures tracking announcements up to December — far short of the tens of thousands predicted after the 2016 referendum. Indeed, London employs more than 418,000 people in financial services, UK government data shows, and it remains the dominant hub for trading currencies and derivatives, clearing, insurance and private equity funds. London is still the main place to raise equity in Europe and has just enjoyed its strongest year since 2007.

London is in fact looking strong and it will not lose its crown in the short-medium term.

By Lorenzo Moretti, Matilde Chiavenato, Yuxi Cheng

Despite all this, the City of London remains the continent’s most important financial hub across swaths of activity. Moreover Brexit-related job moves from the UK to the EU total less than 7,400, according to EY figures tracking announcements up to December — far short of the tens of thousands predicted after the 2016 referendum. Indeed, London employs more than 418,000 people in financial services, UK government data shows, and it remains the dominant hub for trading currencies and derivatives, clearing, insurance and private equity funds. London is still the main place to raise equity in Europe and has just enjoyed its strongest year since 2007.

London is in fact looking strong and it will not lose its crown in the short-medium term.

By Lorenzo Moretti, Matilde Chiavenato, Yuxi Cheng

Sources:

Financial Times

WSJ

The Guardian

EY

BBC

Financial Times

WSJ

The Guardian

EY

BBC