The world is currently facing one of the most difficult times in history. Italy was the first European country to be hit by the Coronavirus crisis, now being on the 3rd place by the number of cases, right after the USA and Spain.

Even though the number of worldwide coronavirus cases and deaths seem to be growing at lower rates than just a few weeks ago, the worldwide economy, however, is not seeing any improvements. The eurozone GDP fell by 3.8 percent in the first quarter compared with the previous quarter. Italy's GDP alone fell by 4.7% in the first quarter, according to data from ISTAT, the national statistics office. Fortunately, this was a bit less than economists had predicted but still the largest contraction since the records began (1996) and even steeper than the 2.8% contraction in the first quarter of 2009.

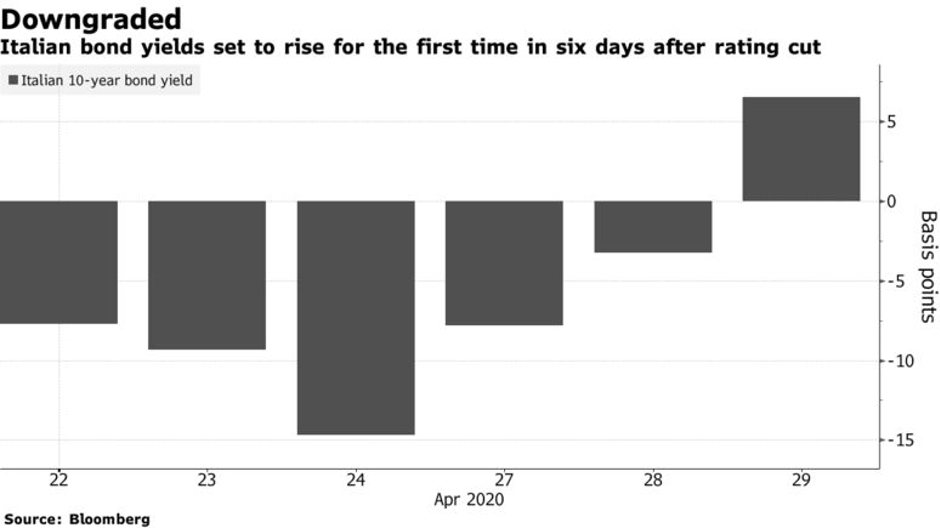

On the 29th of April 2020, Fitch has downgraded Italy's credit rating to a single notch above "junk", reaching this way BBB-.

Fitch Ratings Inc. is an American credit rating agency and is one of the "Big Three credit rating agencies", the other two being Moody and Standard & Poor. The agency believes that the abrupt jump in debt levels resulting from the coronavirus crisis will increase uncertainty regarding the borrowing sustainability of the country.

The recent update on Italy's creditworthiness comes as a surprise for everybody, three months ahead of its next scheduled review, which was supposed to be on July 10th. The company noted that recent developments in the country -- including the significant impact of the global Covid-19 pandemic -- necessitated action sooner and prompted them to release this result now.

Analysts from the industry are expecting the country's ratio of debt-to-GDP to rise by about 20% this year to 155 percent, as a surge in spending combined with an 8% contraction in the economy.

The unexpected downgrade of ratings puts pressure on political leaders to make sure that fiscal deficits don't get out of hand, and on the European Union to provide even greater support.

Surprisingly, officials from the Italian Government seem to be more optimistic about the economic situation, saying that the rationing does not take into account all the variables. The Italian finance minister, Roberto Gualtieri, replied to Fitch's decision by saying that "the fundamentals of Italy's economy and public finances are solid". In a statement, Mr. Gualtieri claimed that Fitch's resolution did not consider decisions taken by the EU, its member states or its institutions.: "In particular, the strategic orientation of the European Central Bank does not seem to be adequately valued".

Italy's 10-year yield escalated 0.09 percentage points to 1.81 percent, having hit a one-month high of more than 2.2 percent. The borrowing costs are up since early March. Investors tend to be worried about an overflow of new debt issuance to fund the response to the pandemic, and the hesitation of other eurozone members, maybe less affected by the pandemic, to share the financial burden of fighting the crisis. Italy's yield premium over Germany has widened this month, much as 11 basis points to 231 basis points.

The European Central Bank's €750bn emergency asset-purchase program has helped the stabilization of sell-off with heavy buying of Italian bonds. This way, it also managed to ease the concerns that the eurozone is headed for a new debt crisis. Fitch said that the support of the central bank should keep borrowing costs "at very low levels", assessing a stable outlook to Italy's rating. Nonetheless, it is possible that the downgrade would add pressure on the ECB to signal further stimulus. The ECB said that it would accept junk debt as collateral for loans, while sub-investment grade Greek bonds are eligible for the pandemic bond-buying program.

Giuseppe Conte, the Prime Minister of Italy, now has to contend also with the prospect of a mass investor exodus. Finance Minister Roberto Gualtieri said in a statement that Italy will initiate an agenda of reforms and investments to raise the nation's growth potential and lower debt. The government forecasts that GDP will shrink 8% this year. Conte pledged a new stimulus worth around 50 Billion euros, having more liquidity measures for businesses after the government agreed on an initial 25 billion euro package just one month ago.

Ana Cosniceru

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

Even though the number of worldwide coronavirus cases and deaths seem to be growing at lower rates than just a few weeks ago, the worldwide economy, however, is not seeing any improvements. The eurozone GDP fell by 3.8 percent in the first quarter compared with the previous quarter. Italy's GDP alone fell by 4.7% in the first quarter, according to data from ISTAT, the national statistics office. Fortunately, this was a bit less than economists had predicted but still the largest contraction since the records began (1996) and even steeper than the 2.8% contraction in the first quarter of 2009.

On the 29th of April 2020, Fitch has downgraded Italy's credit rating to a single notch above "junk", reaching this way BBB-.

Fitch Ratings Inc. is an American credit rating agency and is one of the "Big Three credit rating agencies", the other two being Moody and Standard & Poor. The agency believes that the abrupt jump in debt levels resulting from the coronavirus crisis will increase uncertainty regarding the borrowing sustainability of the country.

The recent update on Italy's creditworthiness comes as a surprise for everybody, three months ahead of its next scheduled review, which was supposed to be on July 10th. The company noted that recent developments in the country -- including the significant impact of the global Covid-19 pandemic -- necessitated action sooner and prompted them to release this result now.

Analysts from the industry are expecting the country's ratio of debt-to-GDP to rise by about 20% this year to 155 percent, as a surge in spending combined with an 8% contraction in the economy.

The unexpected downgrade of ratings puts pressure on political leaders to make sure that fiscal deficits don't get out of hand, and on the European Union to provide even greater support.

Surprisingly, officials from the Italian Government seem to be more optimistic about the economic situation, saying that the rationing does not take into account all the variables. The Italian finance minister, Roberto Gualtieri, replied to Fitch's decision by saying that "the fundamentals of Italy's economy and public finances are solid". In a statement, Mr. Gualtieri claimed that Fitch's resolution did not consider decisions taken by the EU, its member states or its institutions.: "In particular, the strategic orientation of the European Central Bank does not seem to be adequately valued".

Italy's 10-year yield escalated 0.09 percentage points to 1.81 percent, having hit a one-month high of more than 2.2 percent. The borrowing costs are up since early March. Investors tend to be worried about an overflow of new debt issuance to fund the response to the pandemic, and the hesitation of other eurozone members, maybe less affected by the pandemic, to share the financial burden of fighting the crisis. Italy's yield premium over Germany has widened this month, much as 11 basis points to 231 basis points.

The European Central Bank's €750bn emergency asset-purchase program has helped the stabilization of sell-off with heavy buying of Italian bonds. This way, it also managed to ease the concerns that the eurozone is headed for a new debt crisis. Fitch said that the support of the central bank should keep borrowing costs "at very low levels", assessing a stable outlook to Italy's rating. Nonetheless, it is possible that the downgrade would add pressure on the ECB to signal further stimulus. The ECB said that it would accept junk debt as collateral for loans, while sub-investment grade Greek bonds are eligible for the pandemic bond-buying program.

Giuseppe Conte, the Prime Minister of Italy, now has to contend also with the prospect of a mass investor exodus. Finance Minister Roberto Gualtieri said in a statement that Italy will initiate an agenda of reforms and investments to raise the nation's growth potential and lower debt. The government forecasts that GDP will shrink 8% this year. Conte pledged a new stimulus worth around 50 Billion euros, having more liquidity measures for businesses after the government agreed on an initial 25 billion euro package just one month ago.

Ana Cosniceru

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.