Monte dei Paschi di Siena, after some unsuccessful operations, followed by the financial crisis of 2008, started experiencing major issues with its financial positions. This situation led, in 2017, to the urge of receiving more than 5 billion in help from the Italian Minister of Economics and Finance, making it the firm’s first shareholder and causing issues with EU competition policies. A possible offer to acquire the firm was made in July by Unicredit but recent news reports the definitive abandonment of the negotiations. Failure to bridge a multi-billion-euro valuation gap between the parties leaves Italy unable to complete the restructuring of its banking system which started six years ago. Rome will now seek an extension of deadlines agreed with European Union authorities to re-privatise the world’s oldest bank.

Industry overview

After 1990, year of the Amato-Carli Law, regarding the privatization of public banks, the Italian banking system went through a long period of radical changes in its structure.

Till the end of the decade, 566 aggregations were carried out taking the number of operating banks from 1,100 to 829, despite over 200 new firms being created. The crisis of 2008 had a devastating impact on the Italian banking sector, and the credit crunch severely damaged the Italian economy, which is mainly based on the bank credit, causing a more than 10% decrease of the national GDP.

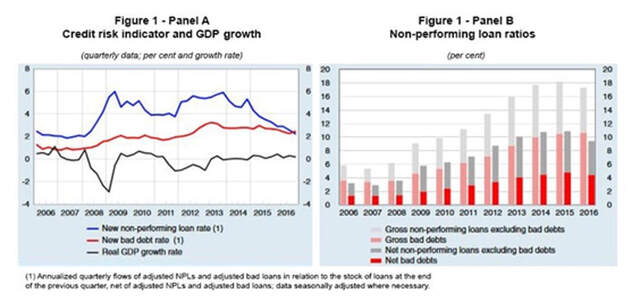

From that moment on, the banking system had to face several issues regarding toxic assets and non-performing loans (NPLs), the latter being exposure to debtors who are no longer able to meet all or part of their contractual obligations due to a deterioration in their financial situations. That is still one of the main issues for Italian banks.

Between 2008 and 2014, Italy was hit by a double dip recession that had a strong impact on Italian banks’ balance sheets and loan quality. The first phase was the direct consequence of the collapse of the US subprime mortgage market and the subsequent crisis in structured products, to which Italian banks had little exposure, being mostly invested in real economy assets. The deterioration of customers' economic and financial situation in the following years led to a significant increase in the flow of new NPLs and in their stock. The second phase of the financial crisis began in 2011 with the Italian sovereign debt crisis, which led to a further decrease in customers' ability to pay back their debts, causing a new rise in the amount of NPLs.

Industry overview

After 1990, year of the Amato-Carli Law, regarding the privatization of public banks, the Italian banking system went through a long period of radical changes in its structure.

Till the end of the decade, 566 aggregations were carried out taking the number of operating banks from 1,100 to 829, despite over 200 new firms being created. The crisis of 2008 had a devastating impact on the Italian banking sector, and the credit crunch severely damaged the Italian economy, which is mainly based on the bank credit, causing a more than 10% decrease of the national GDP.

From that moment on, the banking system had to face several issues regarding toxic assets and non-performing loans (NPLs), the latter being exposure to debtors who are no longer able to meet all or part of their contractual obligations due to a deterioration in their financial situations. That is still one of the main issues for Italian banks.

Between 2008 and 2014, Italy was hit by a double dip recession that had a strong impact on Italian banks’ balance sheets and loan quality. The first phase was the direct consequence of the collapse of the US subprime mortgage market and the subsequent crisis in structured products, to which Italian banks had little exposure, being mostly invested in real economy assets. The deterioration of customers' economic and financial situation in the following years led to a significant increase in the flow of new NPLs and in their stock. The second phase of the financial crisis began in 2011 with the Italian sovereign debt crisis, which led to a further decrease in customers' ability to pay back their debts, causing a new rise in the amount of NPLs.

As shown in the graph, the breakdown of gross Bad Loans by economic sector shows that Real Estate and Construction accounts for 34.7% followed by manufacturing products (34.0%) and wholesale and retail trade (14.0%).

The Italian banking system started manifesting the necessity for a comprehensive reform addressing structural inefficiencies and structural rigidities. A new wave of M&As operations began, having as main object especially minor and local banks which, in 2018, still constituted the majority of the 486 operating firms (whose only 29 were listed on the stock exchange), and were mainly involved in relationship banking activities, being particularly close to Italian families and small businesses.

Italy was not the only European country undergoing a formal restructuring of its banking system but the scale and the intensity of the process had a bigger impact compared to other EU countries.

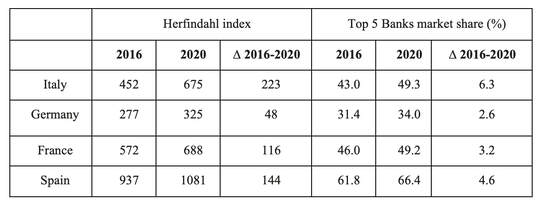

To have a clearer vision of the Italian system structure it is useful to compare its Herfindahl index with the one of the other major economies in the European Union and to underline its evolution in the years included between 2015 and 2021.

The Herfindahl-Hirschman Index is a commonly accepted measure of market concentration, calculated by squaring the market share of each firm competing in a market and then summing the resulting numbers. By doing this, the index can range from close to 0 to 10.000, depending on the level of competition of the considered sector.

The Italian banking system started manifesting the necessity for a comprehensive reform addressing structural inefficiencies and structural rigidities. A new wave of M&As operations began, having as main object especially minor and local banks which, in 2018, still constituted the majority of the 486 operating firms (whose only 29 were listed on the stock exchange), and were mainly involved in relationship banking activities, being particularly close to Italian families and small businesses.

Italy was not the only European country undergoing a formal restructuring of its banking system but the scale and the intensity of the process had a bigger impact compared to other EU countries.

To have a clearer vision of the Italian system structure it is useful to compare its Herfindahl index with the one of the other major economies in the European Union and to underline its evolution in the years included between 2015 and 2021.

The Herfindahl-Hirschman Index is a commonly accepted measure of market concentration, calculated by squaring the market share of each firm competing in a market and then summing the resulting numbers. By doing this, the index can range from close to 0 to 10.000, depending on the level of competition of the considered sector.

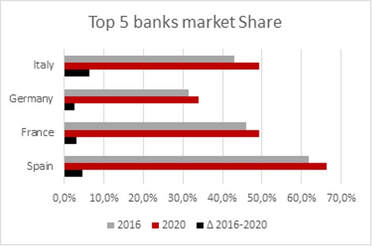

At the end of 2016, first five Italian banks individually held a market share of 43%, a value very close to top five French banks (46%), lower than Spain (61.8%) but higher than Germany (31.4%), which differs that much from other EU countries due to the presence of numerous small local cooperative or public institutions, strongly linked to the federal decentralized administrative structure.

It’s important to point out that the main Italian banking groups held a bigger market share by considering that these are not consolidated values. At the end of 2020 the market share of the first institutions in Italy was 49.3%, 49.2% in France, 34.8% in Germany and 66.4% in Spain: the main trend is clearly in the direction of restructuring and concentration for main EU countries.

Similar conclusions are reached by examining the Herfindahl indices, with the Italian one going from 452 to 675 and all the other ones growing at a slower but steady rate.

M&A operations in the Italian scenario aimed not only to enforce the sector by creating bigger banks, able to compete with the biggest continental players and to succeed also in foreign countries, but often they really became rescuing operations towards firms facing severe financial issues due to UTPs and NPLs heavy presence, which causes what International Monetary Fund calls the “weak profitability problem”.

Between 2015 and 2017 three different operations involved seven banks that were experiencing major strains. The first intervention required the resolution of four small and medium sized regional banks that led to the formation of the so-called “bridge banks” in charge of continuing operations. By doing that, 12 billion euros in savings of about 1 million customers were rescued.

The resolution procedures ended in 2017 with the sale of three “bridge banks” to a UBI in April and the acquisition of the fourth one by BPER in June. Such resolution did not imply any State direct or indirect aid, thus requiring a major effort by the banking sector. The private sector provided 4.7 billion euros to avoid bankruptcy, preserving the issue of loans to over 200,000 small and medium-sized businesses.

More recently, after the ECB recognized Banca Popolare di Vicenza and Veneto Banca as “failing or likely to fail”, Italian Government intervention was addressed to the liquidation of the two banks, assisted by public resources combined with the sale of some assets and liabilities to Intesa Sanpaolo. For that purpose, the Government committed around 4.8 billion euros in cash and around 12 billion euros as a guarantee.

Eventually, the precautionary recapitalization of Monte dei Paschi di Siena was approved by the European Commission, as part of the restructuring plan 2017-2021, including the disposal of 28.6 billion euros of gross bad loans.

The urge for a recapitalization was motivated by the need to put the bank in conditions of successfully facing the adverse scenario of the stress tests that the ECB ran in 2016. The precautionary recapitalization included 3.9 billion euros of direct capital injection and up to 1.5 billion euros of compensation in favor of retail subordinated bondholders, meeting specific conditions, whose bonds are mandatorily converted into equity. With an investment of 5.4 billion, the Italian State became a major shareholder, by owning 64% of MPS’ shares.

Main involved parties

Monte Dei Paschi is the oldest bank in Italy and in the world still in business. It returned to negotiations in Piazza Affari on 25 October 2017, after a forced break ordered by Consob. Since 2011 it has been affected by a profound financial crisis (mainly due to the acquisition of the Antonveneta bank for 9 billion euros). Despite various restructuring plans and failed capital increases, the bank needed government intervention to be rescued and was bailed by the government with the bailout decree.

Unicredit is a European commercial bank, with a perfectly integrated Corporate & Investment Banking division. Unicredit responds to the concrete clients’ needs with concrete solutions that exploit the synergies between their businesses: Corporate & Investment Banking, Commercial Banking and Wealth Management. Unicredit was interested in the commercial network of Monte dei Paschi, which would bring to the Gae Aulenti group approximately 4 million new customers, 80 billion euros in customer loans and over 80 billion euros in deposits. The Unicredit’s aim was to acquire the Sienese assets with a strong public contribution that would have neutralized the patrimonial impacts and favored the rationalization of costs.The operation would allow the group to strengthen its competitive positioning in Italy and in particular in the Centre-North, where 77% of Mps' branches are located.

The Treasury, after having prevented Mps default, became itself a shareholder with 64% of the shares of the historic bank of Siena. Currently Mef is looking around the Italian banking scene to try to sell MPS and privatize it. The acquisition by Unicredit seemed to be the best solution for the Italian state but several differences on the amount of the bank recapitalization by the treasury made the parties move away from the deal.

The Conflict

In a joint statement, the Ministry of Economy and Finance and UniCredit announced the suspension of negotiations for the potential acquisition of a defined perimeter of Banca Monte dei Paschi di Siena. "Despite the efforts of both sides... the negotiations pertaining to the potential acquisition of a defined perimeter of Banca Monte dei Paschi di Siena will no longer continue," UniCredit and the Treasury said in a joint statement.

The government considers the recapitalization requested by the Piazza Gae Aulenti institute, worth over 7 billion euros, to be "too punitive" for taxpayers.

As a result, it appears impossible to conclude the agreement on the terms agreed upon in July. Unicredit agreed in the summer to begin exclusive negotiations for the purchase of "some selected assets" of Mps, which is controlled by the Mef with a 64% stake following the 2017 bailout. One of the main prerequisites was the transaction's neutrality on the Unicredit group's capital, as well as a significant increase in EPS after accounting for potential net synergies, and, in any case, the maintenance of current levels of EPS even before accounting for potential synergies in 2023.

The amount Orcel requested was too high for the Treasury, all of which came from taxpayers. Unicredit requested that the State subscribe to a capital increase of 6,3 billion euros for the entire MPS, plus 2.2 billion tax credits (the so-called 'Dta') for a total public commitment of 8.5 billion euros. The Sienese have been repeating a 2.5 billion deficit for months.

This is excessive for the Treasury, which should have used these funds to save a bank, and not just any bank, but Montepaschi, whose history has long been intertwined with politics. As a result, Siena remains in the Treasury's belly.

Furthermore, the Sienese bank, which is 64% state-owned, calculated in January that it needed 2.5 billion euros to strengthen its capital. 7,000 more job cuts should be added to Orcel's account, leaving the State with non-performing loans and legal pending, a burdensome request for the State, which has already injected 5.4 billion euros into the coffers of the Sienese bank just four years ago.

According to the Treasury's opinion, UniCredit requested 6.3 billion euros in capital based on its more conservative risk models, but Treasury objected, estimating the value to be between 3.6 billion and 4.8 billion euros compared to 600 million euros in annual net income. This resulted in a huge disparity with UniCredit's 1.3 billion euro valuation of the same assets.

Precisely because of these models, some argue that it was the banker who left the table first, days ago, because the estimate made by Bofa (Treasury advisor) on MPS credits was much higher than that of Unicredit, which used its own internal capital reserve models, which were more conservative.

The deal is over based on these assessment distances and the various obstacles and frictions.

The Treasury is "confident" that "conditions exist to obtain an extension" of deadlines agreed upon in Brussels, and thus to extend the time for the sale of MPS. Mef will petition the EU Antitrust Commission for at least six months, during which time Italy has promised to sell Mps. Other smaller banks, such as Banco Bpm or Bper Banca, could enter the fray during this brief period. As a result, the Treasury will continue to do its part to recapitalize MPS and improve the balance sheet it provided to UniCredit after MPS emerged as the eurozone's most vulnerable lender.

Andrea Orcel made it clear, however, that an agreement would have been possible if it had not been detrimental to the bank's capital base and resulted in an increase in profits.

Deal rationale

A potential transaction that would allow the Group to accelerate its organic growth plans and facilitate the achievement of sustainable returns above the cost of capital. Mps could contribute, subject to the definition of the perimeter of the operation, approximately 3.9 million customers, 80 bln euros in loans to customers, 87 bln in customer deposits, 62 bln in assets under management and 42 bln in assets under administration. The operation would allow the group to strengthen its competitive positioning in Italy and in particular in the Centre-North, where 77% of Mps' branches are located, contributing among other things to a growth in market share in Tuscany of 17 percentage points, in Lombardy and Emilia Romagna of 4 percentage points and in Veneto of 8 percentage points. Moreover, this operation would also bring a significant increase in prospective profitability, while preserving the capital position and improving the asset quality and risk profile of the group on a pro forma basis. Any potential transaction would take place within the context of the group's existing focus on internal value release, which remains and will remain a priority.

The exclusion of impaired loans and the adequate coverage of any further credit risks that may be identified also following the due diligence through modalities to be defined and the agreement on the management of the staff according to the compendium inherent to the commercial activities, in order to ensure a smooth, rapid and effective integration of the business into the group

Deal hypothetical structure

The main prerequisites agreed with the MEF to assess the feasibility of the transaction from an economic and financial perspective include but are not limited to the following:Capital neutrality of the transaction on the capital position of the Group on a pro forma basis;

There are two knots to unravel. First, the redundancies. Out of 21 thousand Mps employees, the unions estimate that up to 7 thousand will leave, on a voluntary basis and paid by a redundancy fund for up to seven years. On the subject, the PD and Letta have been asking for weeks to minimize the impact on workers and the city-bank, which will be converted. In the absence of other buyers, however, and having Mps a capital deficit of 2.5 billion, the possible "precautionary" recapitalization of the Treasury shareholder, in the framework of European state aid, would imply the dismissal of workers outright.

The second node is the past legal risks. Mps has 6.2 billion of them and is working to avoid the "joint and several liability" - provided for by the Civil Code - whereby whoever buys Mps assets could be liable for the old lawsuits. The Treasury is preparing a hold harmless, but before that Mps could close two or three individual settlements to reduce total litigation.

Market reaction

After having asked for an extension to the EU to postpone for at least six months the agreed privatization and a new partner to be found in the medium term, the merger between Unicredit and Monte dei Paschi di Siena will not take place: the interruption of negotiations was in the air and was made official on October 23rd 2021, even by the Treasury, which has 64% of Siena and for the EU commitment must return to privatize the bank by the end of the year. The divergence in valuations would be linked above all to restructuring charges. According to Unicredit, the approximately 7,000 redundancies envisaged in the privatization plan would cost more than the system average due to the relatively low age of Montepaschi personnel, which has already undergone significant restructuring in recent years. To facilitate the exits, therefore, it would take longer than the five and perhaps even seven years initially envisaged, with an estimated cost of almost 3.5 billion lire that Unicredit does not want to take on. Another element of strong divergence has been that relative to the valuation of the perimeter: Unicredit would have in fact fixed the bar in zone 1,3 billion, little more than the double of the expected profit (600 million), a multiple judged by Rome too low also in comparison to the average of the market.

At the reopening of trading, the securities of both institutions suffer: Mps in particular, which also goes through suspension. After a partial recovery, the Monte ended the day losing 2.3% and Unicredit - arrived to turn positive for a few junctures - marked a final decline of 1.72% against a positive list of 0.9%. In view of a precautionary recapitalization of Monte, it is above all the subscribers of the four subordinated bonds issued by Mps, for a total countervalue of 1.75 billion euros, who are suffering. In fact, subordinated bonds closed with a sharp drop: the 750 million bond maturing in 2028 lost 8.8%, the 300 million bond maturing in 2029 lost 17.1% and the 400 and 300 million bonds maturing in 2030 lost 11.9%.

Advisors

During the deal negotiation, Credit Suisse and Mediobanca acted as financial advisors to the Board of Montepaschi while Bofa Merrill Lynch acted as financial advisor to the Treasury.

Sources

by Giorgio Gusella, Lorenzo Bernareggi, Leonardo Grandini

It’s important to point out that the main Italian banking groups held a bigger market share by considering that these are not consolidated values. At the end of 2020 the market share of the first institutions in Italy was 49.3%, 49.2% in France, 34.8% in Germany and 66.4% in Spain: the main trend is clearly in the direction of restructuring and concentration for main EU countries.

Similar conclusions are reached by examining the Herfindahl indices, with the Italian one going from 452 to 675 and all the other ones growing at a slower but steady rate.

M&A operations in the Italian scenario aimed not only to enforce the sector by creating bigger banks, able to compete with the biggest continental players and to succeed also in foreign countries, but often they really became rescuing operations towards firms facing severe financial issues due to UTPs and NPLs heavy presence, which causes what International Monetary Fund calls the “weak profitability problem”.

Between 2015 and 2017 three different operations involved seven banks that were experiencing major strains. The first intervention required the resolution of four small and medium sized regional banks that led to the formation of the so-called “bridge banks” in charge of continuing operations. By doing that, 12 billion euros in savings of about 1 million customers were rescued.

The resolution procedures ended in 2017 with the sale of three “bridge banks” to a UBI in April and the acquisition of the fourth one by BPER in June. Such resolution did not imply any State direct or indirect aid, thus requiring a major effort by the banking sector. The private sector provided 4.7 billion euros to avoid bankruptcy, preserving the issue of loans to over 200,000 small and medium-sized businesses.

More recently, after the ECB recognized Banca Popolare di Vicenza and Veneto Banca as “failing or likely to fail”, Italian Government intervention was addressed to the liquidation of the two banks, assisted by public resources combined with the sale of some assets and liabilities to Intesa Sanpaolo. For that purpose, the Government committed around 4.8 billion euros in cash and around 12 billion euros as a guarantee.

Eventually, the precautionary recapitalization of Monte dei Paschi di Siena was approved by the European Commission, as part of the restructuring plan 2017-2021, including the disposal of 28.6 billion euros of gross bad loans.

The urge for a recapitalization was motivated by the need to put the bank in conditions of successfully facing the adverse scenario of the stress tests that the ECB ran in 2016. The precautionary recapitalization included 3.9 billion euros of direct capital injection and up to 1.5 billion euros of compensation in favor of retail subordinated bondholders, meeting specific conditions, whose bonds are mandatorily converted into equity. With an investment of 5.4 billion, the Italian State became a major shareholder, by owning 64% of MPS’ shares.

Main involved parties

Monte Dei Paschi is the oldest bank in Italy and in the world still in business. It returned to negotiations in Piazza Affari on 25 October 2017, after a forced break ordered by Consob. Since 2011 it has been affected by a profound financial crisis (mainly due to the acquisition of the Antonveneta bank for 9 billion euros). Despite various restructuring plans and failed capital increases, the bank needed government intervention to be rescued and was bailed by the government with the bailout decree.

Unicredit is a European commercial bank, with a perfectly integrated Corporate & Investment Banking division. Unicredit responds to the concrete clients’ needs with concrete solutions that exploit the synergies between their businesses: Corporate & Investment Banking, Commercial Banking and Wealth Management. Unicredit was interested in the commercial network of Monte dei Paschi, which would bring to the Gae Aulenti group approximately 4 million new customers, 80 billion euros in customer loans and over 80 billion euros in deposits. The Unicredit’s aim was to acquire the Sienese assets with a strong public contribution that would have neutralized the patrimonial impacts and favored the rationalization of costs.The operation would allow the group to strengthen its competitive positioning in Italy and in particular in the Centre-North, where 77% of Mps' branches are located.

The Treasury, after having prevented Mps default, became itself a shareholder with 64% of the shares of the historic bank of Siena. Currently Mef is looking around the Italian banking scene to try to sell MPS and privatize it. The acquisition by Unicredit seemed to be the best solution for the Italian state but several differences on the amount of the bank recapitalization by the treasury made the parties move away from the deal.

The Conflict

In a joint statement, the Ministry of Economy and Finance and UniCredit announced the suspension of negotiations for the potential acquisition of a defined perimeter of Banca Monte dei Paschi di Siena. "Despite the efforts of both sides... the negotiations pertaining to the potential acquisition of a defined perimeter of Banca Monte dei Paschi di Siena will no longer continue," UniCredit and the Treasury said in a joint statement.

The government considers the recapitalization requested by the Piazza Gae Aulenti institute, worth over 7 billion euros, to be "too punitive" for taxpayers.

As a result, it appears impossible to conclude the agreement on the terms agreed upon in July. Unicredit agreed in the summer to begin exclusive negotiations for the purchase of "some selected assets" of Mps, which is controlled by the Mef with a 64% stake following the 2017 bailout. One of the main prerequisites was the transaction's neutrality on the Unicredit group's capital, as well as a significant increase in EPS after accounting for potential net synergies, and, in any case, the maintenance of current levels of EPS even before accounting for potential synergies in 2023.

The amount Orcel requested was too high for the Treasury, all of which came from taxpayers. Unicredit requested that the State subscribe to a capital increase of 6,3 billion euros for the entire MPS, plus 2.2 billion tax credits (the so-called 'Dta') for a total public commitment of 8.5 billion euros. The Sienese have been repeating a 2.5 billion deficit for months.

This is excessive for the Treasury, which should have used these funds to save a bank, and not just any bank, but Montepaschi, whose history has long been intertwined with politics. As a result, Siena remains in the Treasury's belly.

Furthermore, the Sienese bank, which is 64% state-owned, calculated in January that it needed 2.5 billion euros to strengthen its capital. 7,000 more job cuts should be added to Orcel's account, leaving the State with non-performing loans and legal pending, a burdensome request for the State, which has already injected 5.4 billion euros into the coffers of the Sienese bank just four years ago.

According to the Treasury's opinion, UniCredit requested 6.3 billion euros in capital based on its more conservative risk models, but Treasury objected, estimating the value to be between 3.6 billion and 4.8 billion euros compared to 600 million euros in annual net income. This resulted in a huge disparity with UniCredit's 1.3 billion euro valuation of the same assets.

Precisely because of these models, some argue that it was the banker who left the table first, days ago, because the estimate made by Bofa (Treasury advisor) on MPS credits was much higher than that of Unicredit, which used its own internal capital reserve models, which were more conservative.

The deal is over based on these assessment distances and the various obstacles and frictions.

The Treasury is "confident" that "conditions exist to obtain an extension" of deadlines agreed upon in Brussels, and thus to extend the time for the sale of MPS. Mef will petition the EU Antitrust Commission for at least six months, during which time Italy has promised to sell Mps. Other smaller banks, such as Banco Bpm or Bper Banca, could enter the fray during this brief period. As a result, the Treasury will continue to do its part to recapitalize MPS and improve the balance sheet it provided to UniCredit after MPS emerged as the eurozone's most vulnerable lender.

Andrea Orcel made it clear, however, that an agreement would have been possible if it had not been detrimental to the bank's capital base and resulted in an increase in profits.

Deal rationale

A potential transaction that would allow the Group to accelerate its organic growth plans and facilitate the achievement of sustainable returns above the cost of capital. Mps could contribute, subject to the definition of the perimeter of the operation, approximately 3.9 million customers, 80 bln euros in loans to customers, 87 bln in customer deposits, 62 bln in assets under management and 42 bln in assets under administration. The operation would allow the group to strengthen its competitive positioning in Italy and in particular in the Centre-North, where 77% of Mps' branches are located, contributing among other things to a growth in market share in Tuscany of 17 percentage points, in Lombardy and Emilia Romagna of 4 percentage points and in Veneto of 8 percentage points. Moreover, this operation would also bring a significant increase in prospective profitability, while preserving the capital position and improving the asset quality and risk profile of the group on a pro forma basis. Any potential transaction would take place within the context of the group's existing focus on internal value release, which remains and will remain a priority.

The exclusion of impaired loans and the adequate coverage of any further credit risks that may be identified also following the due diligence through modalities to be defined and the agreement on the management of the staff according to the compendium inherent to the commercial activities, in order to ensure a smooth, rapid and effective integration of the business into the group

Deal hypothetical structure

The main prerequisites agreed with the MEF to assess the feasibility of the transaction from an economic and financial perspective include but are not limited to the following:Capital neutrality of the transaction on the capital position of the Group on a pro forma basis;

- In 2023, a significant accretion of the Group earnings per share when including the after-tax synergies deriving from the transaction, provided that the Group earnings per share shall remain at least unaffected if synergies are not factored in;

- Exclusion of all the extraordinary litigations not related to the ordinary banking activity and all relevant legal risks, actual or potential;

- Exclusion of NPEs and adequate protection from other potential credit risks, which may be identified also during the due diligence process, through actions to be defined;

- Agreement on the management of personnel, consistently with the perimeter of the going concern relating to the commercial activities, with the aim of ensuring a seamless, quick and effective integration into the Group.

There are two knots to unravel. First, the redundancies. Out of 21 thousand Mps employees, the unions estimate that up to 7 thousand will leave, on a voluntary basis and paid by a redundancy fund for up to seven years. On the subject, the PD and Letta have been asking for weeks to minimize the impact on workers and the city-bank, which will be converted. In the absence of other buyers, however, and having Mps a capital deficit of 2.5 billion, the possible "precautionary" recapitalization of the Treasury shareholder, in the framework of European state aid, would imply the dismissal of workers outright.

The second node is the past legal risks. Mps has 6.2 billion of them and is working to avoid the "joint and several liability" - provided for by the Civil Code - whereby whoever buys Mps assets could be liable for the old lawsuits. The Treasury is preparing a hold harmless, but before that Mps could close two or three individual settlements to reduce total litigation.

Market reaction

After having asked for an extension to the EU to postpone for at least six months the agreed privatization and a new partner to be found in the medium term, the merger between Unicredit and Monte dei Paschi di Siena will not take place: the interruption of negotiations was in the air and was made official on October 23rd 2021, even by the Treasury, which has 64% of Siena and for the EU commitment must return to privatize the bank by the end of the year. The divergence in valuations would be linked above all to restructuring charges. According to Unicredit, the approximately 7,000 redundancies envisaged in the privatization plan would cost more than the system average due to the relatively low age of Montepaschi personnel, which has already undergone significant restructuring in recent years. To facilitate the exits, therefore, it would take longer than the five and perhaps even seven years initially envisaged, with an estimated cost of almost 3.5 billion lire that Unicredit does not want to take on. Another element of strong divergence has been that relative to the valuation of the perimeter: Unicredit would have in fact fixed the bar in zone 1,3 billion, little more than the double of the expected profit (600 million), a multiple judged by Rome too low also in comparison to the average of the market.

At the reopening of trading, the securities of both institutions suffer: Mps in particular, which also goes through suspension. After a partial recovery, the Monte ended the day losing 2.3% and Unicredit - arrived to turn positive for a few junctures - marked a final decline of 1.72% against a positive list of 0.9%. In view of a precautionary recapitalization of Monte, it is above all the subscribers of the four subordinated bonds issued by Mps, for a total countervalue of 1.75 billion euros, who are suffering. In fact, subordinated bonds closed with a sharp drop: the 750 million bond maturing in 2028 lost 8.8%, the 300 million bond maturing in 2029 lost 17.1% and the 400 and 300 million bonds maturing in 2030 lost 11.9%.

Advisors

During the deal negotiation, Credit Suisse and Mediobanca acted as financial advisors to the Board of Montepaschi while Bofa Merrill Lynch acted as financial advisor to the Treasury.

Sources

- Banca d’Italia

- www.dirittobancario.it

- Fisac-cgil

- OECD

- Corriere

- Sole 24 Ore

- Wall Street Italia

- Rai News

by Giorgio Gusella, Lorenzo Bernareggi, Leonardo Grandini