Japan has been attracting the interest of Private Equity Investors for quite a while now. In the last 15 years, many of the big players – KKR, Bain Capital among the others – have opened offices in the country, being followed right away by medium players. If 15 years ago the choice was progressive, now it is perfectly reasonable. Japan is the home of big conglomerates such as Toshiba and Panasonic that have been operating in many sectors, not admitting a distinction between core and non-core businesses for a long time. Until recently, when one by one the industrial giants have recognised the need to draw a line in the number of their business lines and the natural choice of selling the non-core businesses.

This creates huge opportunities of Private Equity players, especially for the ones that have already a foot in Japan and are familiar with the functioning of the Japanese market and with the proper way to conduct business in japan, creating a considerable first-mover advantage. Moreover, the quality of the deals is guaranteed by the fact that the non-core businesses are being sold not because unsuccessful but because of the lack of synergies generation with the main business. Example of this strategy is Bain Capital’s $18 billion deal in 2018, which has bought the memory chip business from Toshiba.

However, carve-outs from big Japanese conglomerates are not the only element generating potential for the Private Equity field. In 2019, there are 2.5 million small and medium firms that are dealing with succession and corporate governance issues, representing the perfect entry point both for local and foreign actors.

The interest in Japan is explained also by the positive effects of Shinzo Abe’s policies and finally the Country represents a location which is promising for corporates and for foreign investors, attracted from the increased requirements in terms governance and transparency. Foreign Private Equity firms would also come and fill the voids of the local players: the Japanese market is in fact mostly a buyout market and currently lacking of sector-specific players.

This creates huge opportunities of Private Equity players, especially for the ones that have already a foot in Japan and are familiar with the functioning of the Japanese market and with the proper way to conduct business in japan, creating a considerable first-mover advantage. Moreover, the quality of the deals is guaranteed by the fact that the non-core businesses are being sold not because unsuccessful but because of the lack of synergies generation with the main business. Example of this strategy is Bain Capital’s $18 billion deal in 2018, which has bought the memory chip business from Toshiba.

However, carve-outs from big Japanese conglomerates are not the only element generating potential for the Private Equity field. In 2019, there are 2.5 million small and medium firms that are dealing with succession and corporate governance issues, representing the perfect entry point both for local and foreign actors.

The interest in Japan is explained also by the positive effects of Shinzo Abe’s policies and finally the Country represents a location which is promising for corporates and for foreign investors, attracted from the increased requirements in terms governance and transparency. Foreign Private Equity firms would also come and fill the voids of the local players: the Japanese market is in fact mostly a buyout market and currently lacking of sector-specific players.

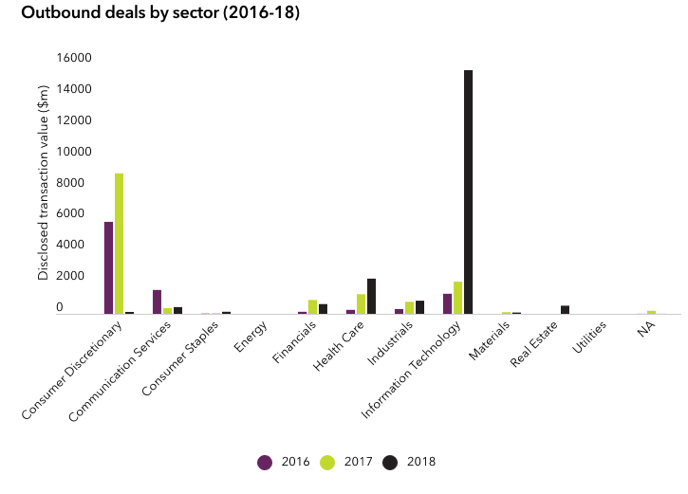

The sectors that look most attractive are information technology, healthcare, consumer discretionary and services and industrial. Those are in fact the one that have been more active in terms of PE deals between 2016 and 2017 in terms of deal value. A recent example is the acquisition announced on March 15th 2019 of Blackstone acquiring Ayumi Pharmaceutical Corp, deal that follows the raise of $2.3bn for its first Asia-focused fund.

As for the level of prices, two years ago businesses were regularly sold at 6x EBITDA, considerably lower than in other markets. Now prices have followed to pick up reaching around 8x EBITDA, partly due to the positive results of the Nikkei in the last few years and supporting prices both at the public and private level.

Finally, Japan has the appeal of being a low-risk environment which also represents a perfect source of geographical diversification for the portfolios of Private Equity investors. Now the question is if foreign PE firms will be able to fully exploit the Japanese market and if returns will meet expectations.

Adriana Messina

As for the level of prices, two years ago businesses were regularly sold at 6x EBITDA, considerably lower than in other markets. Now prices have followed to pick up reaching around 8x EBITDA, partly due to the positive results of the Nikkei in the last few years and supporting prices both at the public and private level.

Finally, Japan has the appeal of being a low-risk environment which also represents a perfect source of geographical diversification for the portfolios of Private Equity investors. Now the question is if foreign PE firms will be able to fully exploit the Japanese market and if returns will meet expectations.

Adriana Messina