On October 10th, the Japanese paper manufacturer Nippon Paper Industries announced the acquisition of the fibre and packaging business of Orora Limited, an Australian based packaging company, which, among other items, produces 60% of the countries wine bottles and is a leading manufacturer of aluminium cans in the region. Taking an enterprise value of A$1,720 million (€1,080 million), the scope of the deal will include the purchase of fibre converting, specialty packaging, carton and the packaging distribution network from Orora, while Orora will continue to maintain its other business operations, such as boxing and glass production. The transaction is expected to take place through a subsidiary of Nippon Paper Industries, Australian Paper, and the assets will then be integrated into the existing operations.

Following the announcement of the sale, Orora’s shares surged by more than 20%. The deal is also expected to bring in a net gain of A$225 million for the company, which will continue to independently operate its glass bottle and boxing business in Australasia and North America. The Chairman of the company, Chris Roberts, has stated that Nippon’s offer “represents compelling value for shareholders” and both parties “will now benefit from the synergies and other value enhancements available”. The acquisition also comes during a time in which Orora has struggled to please investors. Sluggish earnings from its North America business caused its shares to drop to a three-year low of $2.69 in August, with the company also having seen a change in leadership, as Brian Lowe took over as CEO in September. The cash proceeds and surge in share price are therefore a welcome sign for both investors and the company management.

For Nippon Paper Industries, the deal comes as part of a larger and comprehensive strategic expansion. The company had obtained stakes in a Malaysian packaging company earlier this year and intends to boost its presence in Australia and sustainability efforts through the gained assets. Funding for the transaction will be provided by Mizuho Bank and integration into the subsidiary, Australian Paper, is expected to increase market presence and allow expansion into new sectors. Being one of the world’s largest papers and packaging producers, the purchase also highlights the necessity for Nippon Papers to respond to increased demand as well as competition, while expanding outside of a matured Japanese market. The deal has already received approval from both of the companies’ Boards, but is still waiting on regulatory approval and expected to be completed in early 2020.

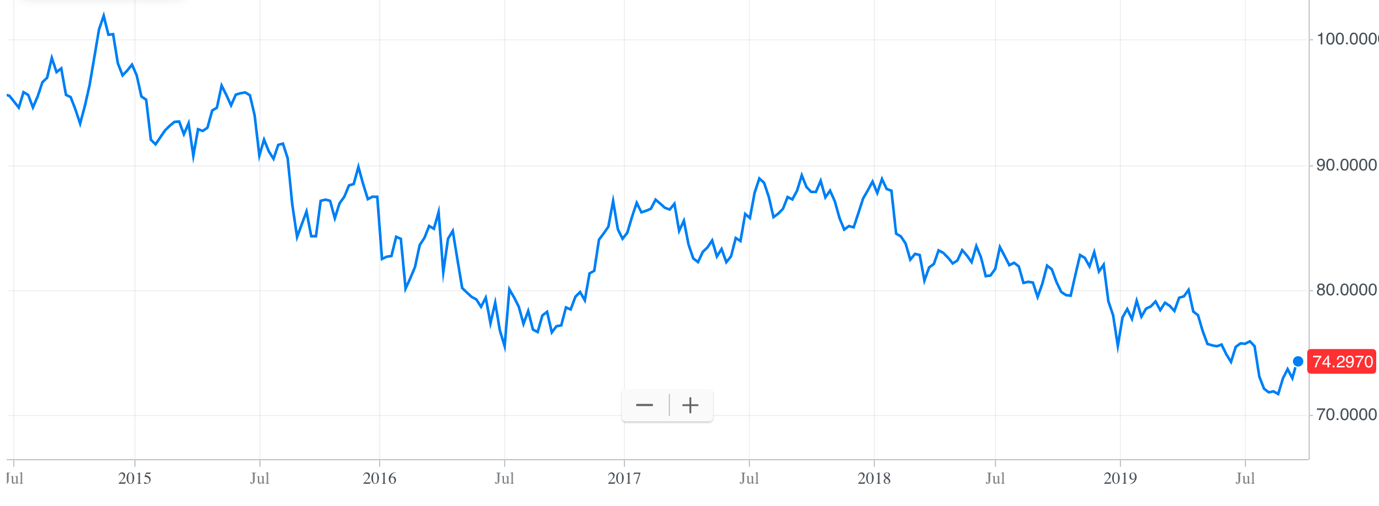

The acquisition by Nippon Paper is also synonymous for a larger trend of Japanese firms expanding their business operations in the region. Earlier this year, the Japanese brewer Asahi agreed to take over the Australian brewing company Carlton & United Breweries for A$16 billion, while Japan’s Nippon Paint bought Australia’s largest paint producer, the DuluxGroup, for A$3.8 billion. This surge in M&A activity can be attributed to several factors. Firstly, the Japanese market is in many ways matured and undergoing a demographic transition with an ageing population. The Australasia region on the other hand is benefitting from continuous growth and especially Australia is known for higher priced consumer goods, allowing higher margins. Furthermore, political stability and a weak Australian Dollar (see chart) add to the attractiveness and means that Japanese companies get more added value from such deals. This helps explain both the recent increase in Japanese buyouts and a drive for companies to continue expanding outside the domestic market.

Australian Dollar to Japanese Yen exchange rate development over five years (Yahoo Finance)

Nevertheless, Japan is also facing increasing worries of an economic downturn. In line with global developments, exports have shown a significant weakness in recent months by continually decreasing, partly a result of the US-China trade war. The government has already downgraded its economic outlook three times this year and a recent sales tax increase has caused a bigger than expected hit. However, despite these trends and sluggish growth, the expansion of Japanese firms into foreign markets continues and it will remain to be seen whether this trend continues to develop in the upcoming months.

Maximilian Lessing

Following the announcement of the sale, Orora’s shares surged by more than 20%. The deal is also expected to bring in a net gain of A$225 million for the company, which will continue to independently operate its glass bottle and boxing business in Australasia and North America. The Chairman of the company, Chris Roberts, has stated that Nippon’s offer “represents compelling value for shareholders” and both parties “will now benefit from the synergies and other value enhancements available”. The acquisition also comes during a time in which Orora has struggled to please investors. Sluggish earnings from its North America business caused its shares to drop to a three-year low of $2.69 in August, with the company also having seen a change in leadership, as Brian Lowe took over as CEO in September. The cash proceeds and surge in share price are therefore a welcome sign for both investors and the company management.

For Nippon Paper Industries, the deal comes as part of a larger and comprehensive strategic expansion. The company had obtained stakes in a Malaysian packaging company earlier this year and intends to boost its presence in Australia and sustainability efforts through the gained assets. Funding for the transaction will be provided by Mizuho Bank and integration into the subsidiary, Australian Paper, is expected to increase market presence and allow expansion into new sectors. Being one of the world’s largest papers and packaging producers, the purchase also highlights the necessity for Nippon Papers to respond to increased demand as well as competition, while expanding outside of a matured Japanese market. The deal has already received approval from both of the companies’ Boards, but is still waiting on regulatory approval and expected to be completed in early 2020.

The acquisition by Nippon Paper is also synonymous for a larger trend of Japanese firms expanding their business operations in the region. Earlier this year, the Japanese brewer Asahi agreed to take over the Australian brewing company Carlton & United Breweries for A$16 billion, while Japan’s Nippon Paint bought Australia’s largest paint producer, the DuluxGroup, for A$3.8 billion. This surge in M&A activity can be attributed to several factors. Firstly, the Japanese market is in many ways matured and undergoing a demographic transition with an ageing population. The Australasia region on the other hand is benefitting from continuous growth and especially Australia is known for higher priced consumer goods, allowing higher margins. Furthermore, political stability and a weak Australian Dollar (see chart) add to the attractiveness and means that Japanese companies get more added value from such deals. This helps explain both the recent increase in Japanese buyouts and a drive for companies to continue expanding outside the domestic market.

Australian Dollar to Japanese Yen exchange rate development over five years (Yahoo Finance)

Nevertheless, Japan is also facing increasing worries of an economic downturn. In line with global developments, exports have shown a significant weakness in recent months by continually decreasing, partly a result of the US-China trade war. The government has already downgraded its economic outlook three times this year and a recent sales tax increase has caused a bigger than expected hit. However, despite these trends and sluggish growth, the expansion of Japanese firms into foreign markets continues and it will remain to be seen whether this trend continues to develop in the upcoming months.

Maximilian Lessing