Sometimes official statistics do not manage to catch the whole picture of an economic situation. The reliability of GDP as a measure of economic growth has been questioned many times since the 90s. It is not easy to keep track of inflation, too. In fact, indexes are various (the most famous are Consumer Price Index and Producer Price Index), but every economist with little statistical knowledge can build his own index in order to support a specific thesis.

What index should policymakers take into consideration to evaluate real economy?

Fortunately, there are some other interesting means, too. A newsworthy one would be a Confidence Index, which is able to indicate the degree of optimism on the state of the economy expressed by producers or consumers. For instance, Bank of Japan takes seriously into account the Tankan Index. At the very moment, BOJ estimates are deeply influenced by this particular tool. In simple words, a quarterly survey samples more than 10,000 companies. Luckily, because of Japanese solid faith in Institutions, the response rate is of almost 100 per cent, which is the dream of every statistician in the National Bureau of Statistics. The range of index is from -100 to +100. Its construction consists in the subtraction the percentage of respondents reporting bad business conditions from those reporting good. It is very simple but thanks to Japanese corporate culture, it is quite reliable and helpful.

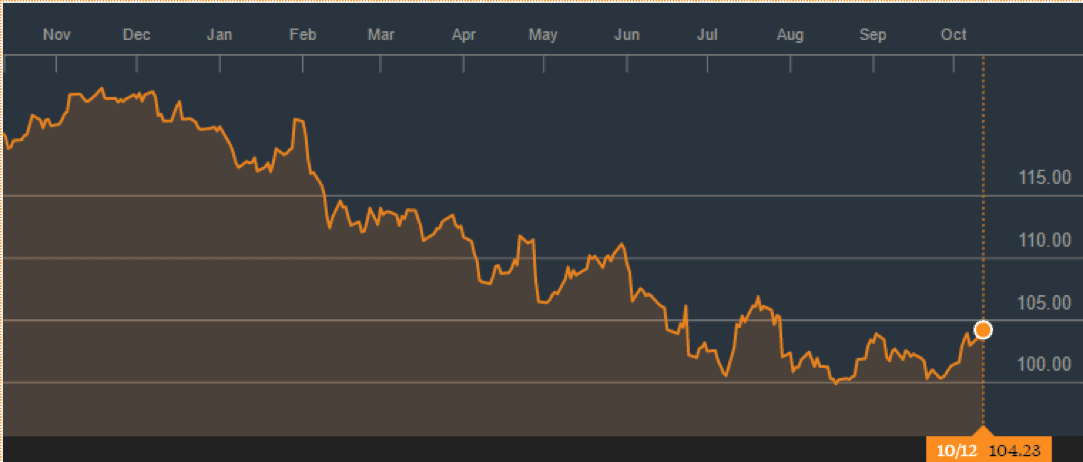

Index for large manufacturers remained stable at +6, while the all-industries index increased slightly from +4 to +5. Marcel Thieliant, economist at Capital Economics, reassures us, “Weak conditions in the manufacturing sector can be explained by the strengthening of the exchange rate since the start of the year”. Companies are just adjusting their expectations to a weaker USD-JPY (i.e. a stronger yen) without losing too much confidence on their long-term views. Basic industries recorded better conditions because of higher commodity prices all around the globe. Iron and steel surged to +12 points from zero. Obviously, Export industries weakened. In particular, shipbuilding industry and heavy machinery recorded -18 points starting from +22. Construction and real estate are very optimistic with readings of +39 and +35 while Retail decreased to +7 points.

What index should policymakers take into consideration to evaluate real economy?

Fortunately, there are some other interesting means, too. A newsworthy one would be a Confidence Index, which is able to indicate the degree of optimism on the state of the economy expressed by producers or consumers. For instance, Bank of Japan takes seriously into account the Tankan Index. At the very moment, BOJ estimates are deeply influenced by this particular tool. In simple words, a quarterly survey samples more than 10,000 companies. Luckily, because of Japanese solid faith in Institutions, the response rate is of almost 100 per cent, which is the dream of every statistician in the National Bureau of Statistics. The range of index is from -100 to +100. Its construction consists in the subtraction the percentage of respondents reporting bad business conditions from those reporting good. It is very simple but thanks to Japanese corporate culture, it is quite reliable and helpful.

Index for large manufacturers remained stable at +6, while the all-industries index increased slightly from +4 to +5. Marcel Thieliant, economist at Capital Economics, reassures us, “Weak conditions in the manufacturing sector can be explained by the strengthening of the exchange rate since the start of the year”. Companies are just adjusting their expectations to a weaker USD-JPY (i.e. a stronger yen) without losing too much confidence on their long-term views. Basic industries recorded better conditions because of higher commodity prices all around the globe. Iron and steel surged to +12 points from zero. Obviously, Export industries weakened. In particular, shipbuilding industry and heavy machinery recorded -18 points starting from +22. Construction and real estate are very optimistic with readings of +39 and +35 while Retail decreased to +7 points.

USD-JPY Time-Series - Source:Bloomberg

Certainly, there is a lack of euphoria but there is no evident sign of any downward trend. Real economy is still making progress. This time, BOJ’s response has been different, promising to overshoot its inflation target of 2 per cent and to cap 10-year government bond yields at zero. The use of unconventional statistical tools for economic valuation seems to be not only a theoretical problem. It seems that it will have consequences in decision-making. Japan is still in need of unorthodox and innovative macroeconomic policies. The time has come.

Nicola Maria Fiore

Certainly, there is a lack of euphoria but there is no evident sign of any downward trend. Real economy is still making progress. This time, BOJ’s response has been different, promising to overshoot its inflation target of 2 per cent and to cap 10-year government bond yields at zero. The use of unconventional statistical tools for economic valuation seems to be not only a theoretical problem. It seems that it will have consequences in decision-making. Japan is still in need of unorthodox and innovative macroeconomic policies. The time has come.

Nicola Maria Fiore