On March 12th, 2024, the financial world witnessed a landmark move as the Bank of Japan ended a 17-year era of negative interest rates by opting for a rate hike. This decision sent shockwaves through currency markets, as a substantial influx of foreign assets streamed back into Japan. Against a backdrop of rising inflation and wages, signalling potential economic rejuvenation, there's a cautious eye on further intervention by the BoJ to manage inflationary pressures. Additionally, the possibility of rate decreases from other international banks looms large, potentially reshaping exchange and forward rates, impacting global capital flows and carry trade strategies. Investors and market participants are on high alert, closely scrutinizing central bank actions and their potential ripple effects on currency markets and interest rate differentials. As the global economic landscape continues to evolve, these factors will remain critical determinants shaping investment strategies and market behaviour.

Interest Rate Trends: History and Current Evolutions

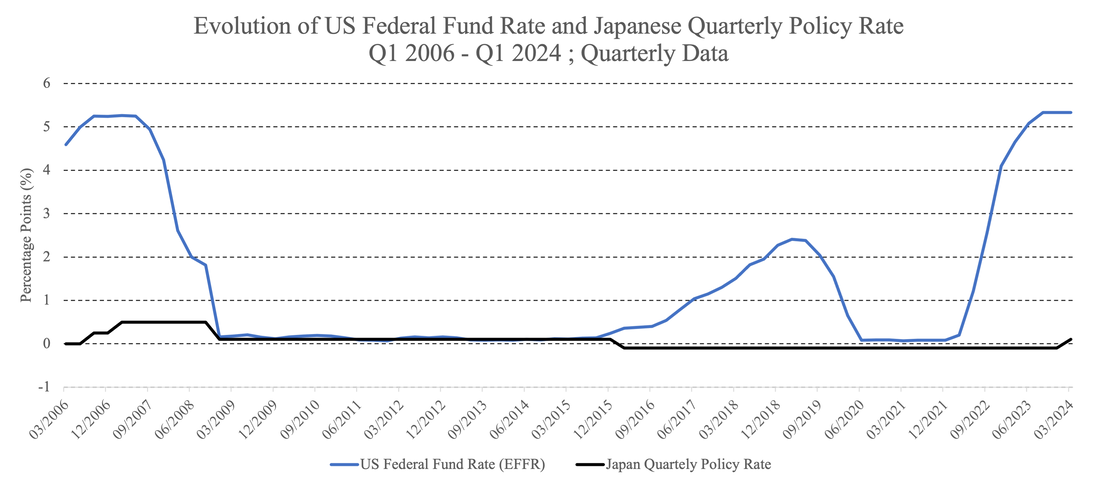

The Bank of Japan (BoJ) has made a landmark decision by discontinuing its negative rate policy, which had been in effect for 17 years, and opting instead for a rate hike. This significant move also marks the conclusion of the Yield Curve Control program (YCC), a strategy involving the purchase of Japanese government bonds to regulate interest rates. Introduced in 2016, the YCC policy has faced criticism for its role in suppressing long-term interest rates and distorting market dynamics. Governor Kazuo Ueda, who assumed office in April of last year, is at the forefront of efforts to normalize monetary policy, driven by concerns over the adverse effects of prolonged easing measures. Under the new framework, the BoJ has established a short-term rate target ranging between 0% and 0.1%, coupled with a 0.1% interest rate on reserves. Despite these adjustments, market analysts anticipate the continuation of accommodative monetary conditions in the near term. The BoJ has reaffirmed its commitment to closely monitoring inflation trends, making its decisions data-dependent and potentially increasing the volatility of the Japanese Yen (JPY).

Interest Rate Trends: History and Current Evolutions

The Bank of Japan (BoJ) has made a landmark decision by discontinuing its negative rate policy, which had been in effect for 17 years, and opting instead for a rate hike. This significant move also marks the conclusion of the Yield Curve Control program (YCC), a strategy involving the purchase of Japanese government bonds to regulate interest rates. Introduced in 2016, the YCC policy has faced criticism for its role in suppressing long-term interest rates and distorting market dynamics. Governor Kazuo Ueda, who assumed office in April of last year, is at the forefront of efforts to normalize monetary policy, driven by concerns over the adverse effects of prolonged easing measures. Under the new framework, the BoJ has established a short-term rate target ranging between 0% and 0.1%, coupled with a 0.1% interest rate on reserves. Despite these adjustments, market analysts anticipate the continuation of accommodative monetary conditions in the near term. The BoJ has reaffirmed its commitment to closely monitoring inflation trends, making its decisions data-dependent and potentially increasing the volatility of the Japanese Yen (JPY).

Source: Bloomberg

The expansive monetary policy was implemented following the burst of the housing and stock market bubble in 1992 that created persistent deflationary challenges in Japan. Despite aiming for a 2% inflation target, Japan grappled with subdued inflation or deflation, particularly in the late 1990s as well as before and after the global financial crisis of 2008. Until 2022, Japan consistently fell short of its inflation target, necessitating loose monetary policies. These measures went beyond reducing nominal interest rates to 0%, focusing instead on managing real interest rates, which remained greater due to deflation.

Despite the Bank of Japan's implementation of ultra-loose monetary policy, Japan's economy experienced sluggish growth following the housing bubble burst. Consequently, the period spanning approximately from 1991 to 2001 is often referred to as "the lost decade." Subsequently, average GDP growth remained tepid, providing further justification for maintaining an expansionary monetary policy. However, the landscape shifted in 2022 as the inflation rate surged well above the 2% target. This was primarily attributed to the depreciation of the Yen against major currencies, resulting in increased costs for imported goods. Furthermore, external factors such as the lingering effects of the COVID-19 pandemic and the conflict in Ukraine contributed to rising prices globally. Additionally, negotiations between Japanese workers, unions, and major corporations led to the largest wage increase in 33 years, with the preliminary average hike reaching a record high of 5.28%, significantly surpassing last year's preliminary figure of 3.8%.

Due to the inflation rate being higher than the one targeted for over a year and signs of strong wage growth which potentially leads to consistently growing prices the central bank felt confident to end its unique path and increase interest rates slightly. However, the central bank added that rates will not be drastically hiked in the coming months and therefore the effect on the economy will stay limited. This policy shift is expected to significantly affect Japan's economy and the value of the Yen, which further depreciated to a 34-year low despite the rate hike. Changes in volatility and modestly increased returns for the JPY will also impact its position in carry trade, as the prior stability created by consistent and predictable monetary policy has traditionally made it a key currency for this strategy.

Shifting Tides: The Carry Trade and Currency Exchange Landscape

The concept of the carry trade has sparked considerable discussion in the wake of the Bank of Japan's announcement. But what exactly does this trade entail?

This type of transaction involves borrowing a currency with a near-zero interest rate, converting it into a higher interest rate currency, investing it at the risk-free rate, and then converting it back to the base currency. By engaging in this trade, the investor assumes currency risk. In an efficient market, the interest rate differential between the two currencies is typically balanced out by a decline in the price of the higher interest currency. Consequently, this strategy often involves pairing with a forward contract to hedge the risk, known as Interest Covered Arbitrage. This approach can yield a profit if the higher interest currency depreciates less than the forward rate anticipated. Traders typically seek a differential between the spot and forward rates, although the former entails considerably more risk.

During the period of low exchange rate volatility between 2003 and 2007, carry trades emerged as highly profitable ventures. This trend was exemplified by the appreciation of currencies like the Australian (AUD) and New Zealand (NZD) Dollars against the Yen, attracting traders to the strategy. Financial institutions capitalized on this trend by establishing retail aggregators, offering Japanese traders margin accounts to leverage positions across various currencies against the JPY. These accounts paid interest rate differentials to investors for overnight positions. By September 2008, foreign margin trading had soared to nearly $70 billion, comprising almost 20% of the total turnover in the Japanese currency exchange market. However, despite initial profitability, Japanese retail investors suffered significant losses when carry trades soured after the financial crisis, particularly due to increased risk aversion prompting a flight to safe-haven currencies like the USD and JPY, with the latter being a preferred funding route for governments and companies during times of crisis. Moreover, the liquidity squeeze during the financial crisis exacerbated difficulties in borrowing currencies for carry trades, amplifying currency risk linked to these strategies amidst unpredictable monetary policies.

The Yen has long been a favoured currency for funding carry trades, but the recent interest rate hike by the BoJ may have altered the landscape. In theory, carry trades should be unwinding in anticipation of further rate hikes from Japan’s central bank. However, despite the significant shift in interest rates, the BoJ remains committed to maintaining "accommodative financial conditions," signalling a continued dovish stance. Nonetheless, Japan still maintains the lowest interest rates among G10 countries by a wide margin. In the days following the announcement, there was evident market activity reflecting a rush to borrow Yen for carry trades. The Yen has weakened significantly, reaching a 16-year low against the dollar, its lowest level against the EUR in 16 years, and its lowest against the sterling since 2015. In essence, the carry trade has remained largely unaffected, and the Yen continues to depreciate.

Although investors could start to face changes to the current environment, Naoki Tamura, a member of the BoJ's policy board, emphasized that if the Yen persists in depreciating, the BoJ has been clear: further hikes will come. Tamura declared, "Promising to continue with accommodative monetary policy won’t necessarily conflict with the need to raise interest rates, if the positive economic cycle were to strengthen. I am hoping we can raise interest rates to levels where market function recovers.” In the case of additional signalling of hikes in rates from Japan’s Bank or decreases in interest rates from the European Central Bank (ECB) or U.S. Federal Reserve (FED), carry trade positions could quickly start to unwind.

In the scenario of a decrease in rates from the ECB or FED alongside hikes from the BoJ within a short timeframe, significant ramifications could shift the attractiveness of the market environment. The transition from negative interest rates policy by the BoJ will impact global liquidity, potentially prompting new outflows from Japanese investors. Market expectations currently anticipate ECB rate cuts to approximately 3% by year-end and BoJ hikes to 0.25%. Many investors, including life insurers, utilize derivatives contracts to safeguard substantial portions of their investments from currency fluctuations on foreign bonds. However, the cost of hedging this risk is amplified by the interest rate differential. Consequently, risk-averse investors may lean towards investing significant portions of their liquidity in Eurozone bonds due to this expectation. Simultaneously, Japanese investors, who traditionally seek higher returns overseas, may find diminished incentives to invest in Europe and the US owing to a reduced interest rate differential.

Global Repatriation and the Impact on Liquidity

Another aspect to consider is the effect of repatriation, which involves converting foreign currency into the home currency. Repatriation entails bringing back funds invested abroad to the home country's assets and can be influenced by various factors, including market volatility and changes in interest rate differentials.

In many cases, repatriation occurs due to the anticipation of the base currency strengthening against the foreign one. This expectation prompts investors to close carry trade positions, thereby mitigating exchange rate risk. Additionally, if further interest rate hikes are expected from the respective central bank, investors may repatriate funds to capitalize on higher yields in their home country's currency.

For Japan, this process involves selling foreign assets, converting the proceeds into Yen, and repatriating the capital back to Japan. The mechanics behind repatriation are underpinned by a set of interconnected factors:

- Interest rate differential: Even a modest increase of, say, 20 basis points in Japan's interest rates begins to narrow the previously wide gap between domestic and foreign returns. This diminishes the allure for Japanese investors to pursue higher yields abroad, especially if further rate hikes are anticipated.

- Currency valuation: Typically, higher interest rates strengthen a currency. Consequently, a stronger Yen reduces the attractiveness of foreign investments when converted back into domestic currency. This effect can be heightened by expectations of sustained rate hikes.

- Economic outlook: A central bank's willingness to raise rates often reflects an improved domestic economic outlook. This fosters investor confidence and a preference for domestic assets.

- Risk management: A more hawkish central bank stance may prompt investors to reassess risk, particularly in carry trades reliant on low-cost borrowing in their home currency.

The global liquidity landscape has relied heavily on significant capital flows seeking higher returns in foreign markets. Japan's Negative Interest Rate Policy (NIRP) has played a pivotal role in this landscape, with Japanese investors being significant lenders in international bond and equity markets. If these investors start to repatriate their capital back to Japan, the immediate consequence could be a surge in bond yields in countries where Japanese investment has been substantial. This shift in investment patterns may lead to a reduction in liquidity as demand for Treasuries and other assets declines.

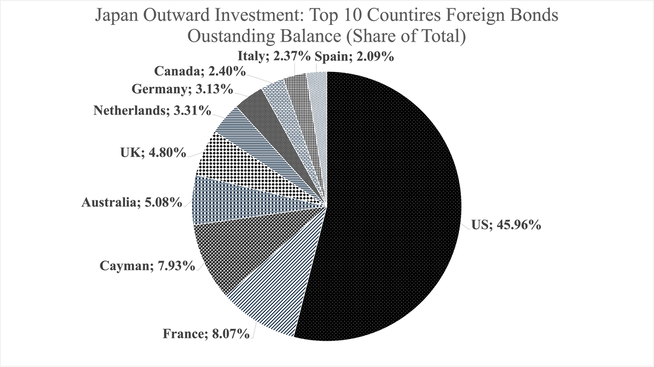

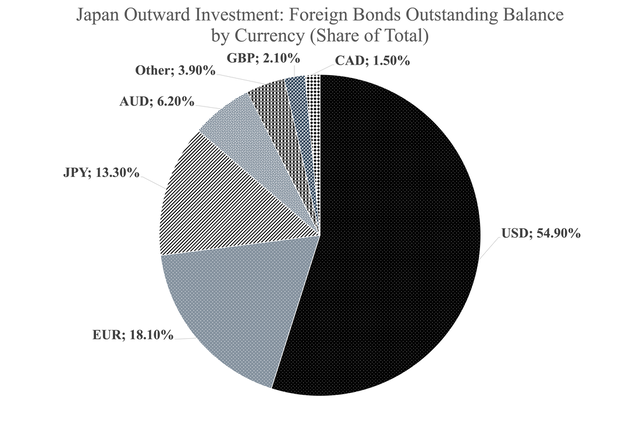

Japan’s exit from its NIRP marks this significant turning point that could ripple through global liquidity channels, reshaping capital flows and, as discussed above, influence the carry trade landscape. The graphs below illustrate Japan’s latest available data for outward investment as of the end of 2022, detailing the Top 10 Countries Foreign Bonds Outstanding Balances and by currency. Japan is one of the world's biggest holders of foreign debt, with the total outstanding balance amounting to 287 trillion Yen (1.9 trillion USD). The distribution of Japan’s foreign bond holdings reveals the extent to which a policy shift by the BoJ might impact international financial markets, with, most notably, nearly half of these holdings being concentrated in U.S. Treasuries (46%) and with the USD denomination representing 55% of the total bond holdings. European countries altogether make up about a third of all bonds holdings (31%) but the EUR denomination only accounts for 18% of the outstanding balance. France, Netherlands, Germany, Italy, and Spain respectively represent the biggest share within Europe at 8.1%, 3.3%, 3.1%, 2.4% and 2.1%.

Source: Bloomberg

While the initial rate hike from the Bank of Japan may seem modest, the signalling of a new trajectory towards normalization could bring about a reassessment of risk and return profiles on a global scale. Japanese investors, confronting a changing domestic market landscape, may opt to reduce their exposure to foreign bonds, as highlighted in the distributions above, in anticipation of more favourable returns and reduced risk domestically. This process would entail divesting these holdings, resulting in increased supply and potentially higher yields in those markets. The impact on liquidity would be twofold—directly, through the sale of bonds, and indirectly, through the alteration in carry trade dynamics as interest rate differentials narrow.

The current environment suggests that while the immediate impact on global liquidity may be limited, the strategic responses of Japanese investors to further expected rate hikes, along with accommodative policies from the FED and ECB, will mould the capital flow landscape. The recalibration of Japanese outward investment strategy could, over time, result in a noteworthy alteration in global liquidity, particularly if other investors recalibrate their risk appetite in concert with these movements. Thus, the data presented in this article not only highlights Japan's current outward investment distribution but also serves as a map of potential liquidity shifts in global financial markets.

Another key side of the global liquidity implications driven by the BoJ’s policies falls on foreign issuers of Samurai Bonds – which are Yen-denominated bonds issued in the Tokyo market by non-Japanese entities – often popular in developing countries. As the BoJ brings rates higher, future Samurai Bonds will likely carry higher yields, increasing borrowing costs for those countries. Additionally, the prospect of an appreciating Yen exacerbates the debt service burden, as repayments become more expensive in home currency terms. Countries like Indonesia and the Philippines, notable issuers of Samurai Bonds, may face heightened refinancing risk and elevated hedging costs. Overall, the BoJ’s pivot could signal a tightening of global credit conditions and compel a strategic review for countries that have and relying on low borrowing costs in the Samurai Bond market.

Insights into Japan’s Macro Outlook

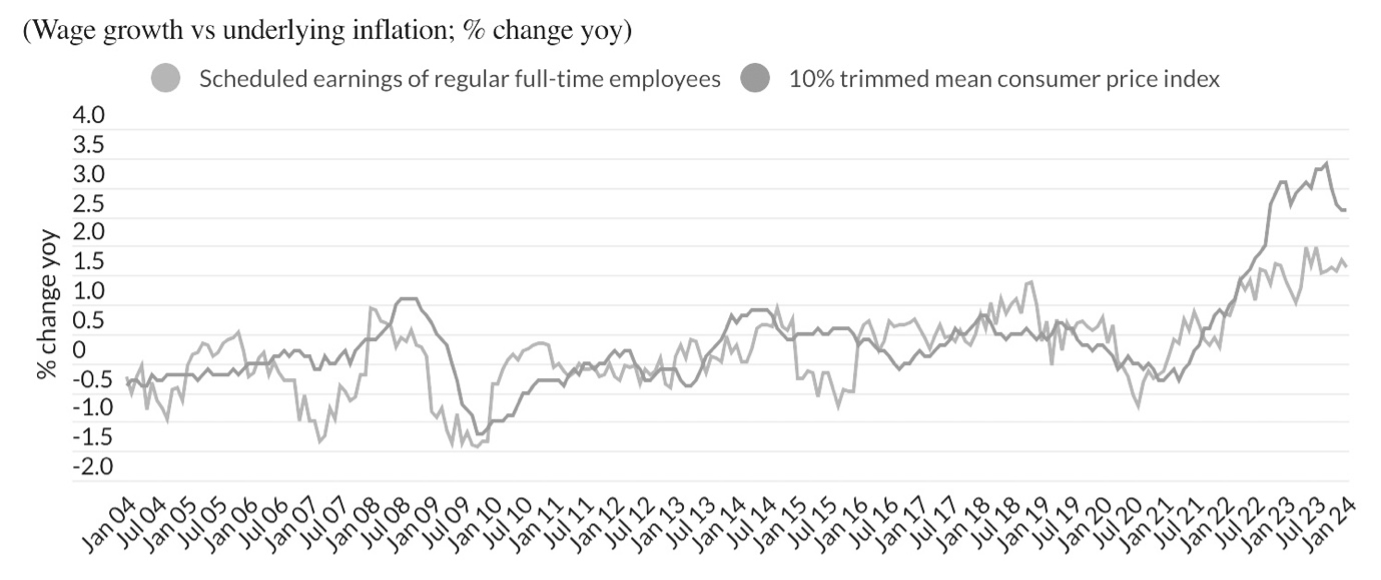

Taking a look at the overall macroeconomic impact, inflation is at the heart of the discussion. As shown below, wages and consumer prices had broken out of historic patterns in the past two years, dampening consumption. With the Shunto wage negotiations this year providing the sharpest wage spike in over three decades, wages are moving up in line with inflation. This could signal a healthy wage-price cycle taking root in Japan, allowing the BoJ to have the confidence to begin raising rates and adopt a so-called ‘normal’ monetary policy.

Source: Fitch Ratings

Although inflation is showing positive signs, the Japanese economy is far from free of its deflationary worries, and there is no expectation of drastic rate hikes coming. Private consumption is a key concern, as it accounts for over half of GDP and has been falling for three consecutive quarters. The lack of an existing wage-price cycle in the country means that dampened demand could slip the economy back into deflation.

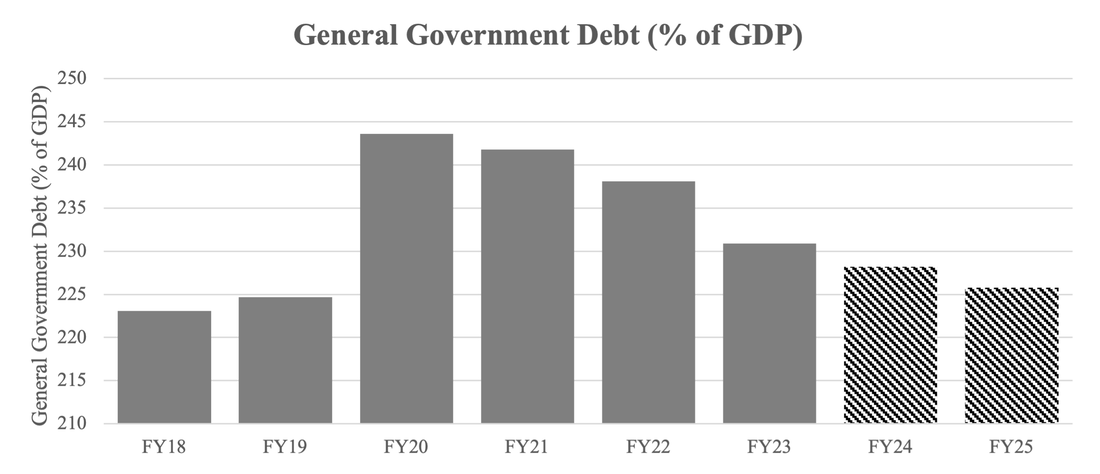

Another aspect to consider is Japan’s high government debt-to-GDP ratio, as shown below. This is a growing concern for the country, as interest payment on government debt is expected to more than double by 2034, reaching 24.8 trillion Yen, from 9.83 trillion in the fiscal year ending March 2025. With inflation on the rise, a stronger deflator and higher tax revenue will help the ratio. Further rate hikes leading to higher borrowing costs could worsen this ratio in the long-run, with the average maturity of Japan’s debt stock being over nine years, potentially compounded by the country’s rising ageing-related costs.

Source: Fitch Ratings

Along with the departure from NIRP, the BoJ also announced it will discontinue purchases of Exchange-Traded Funds (ETFs) and Japan Real Estate Investment Trusts (J-REITs), while gradually reducing the amount of purchases of CP and corporate bonds to its discontinuation in around a year. This being said, purchases of Japanese Government Bonds (JGBs) will remain the same, and such purchases will be used to control long-term interest rates in the case of rapid increase. This hints at the BoJ’s focus on not having a damaging spike in borrowing costs, as well as maintaining accommodative financial conditions in the economy.

This suggests there will not be any drastic rate hikes in the foreseeable future, with any hikes likely to be gradual and moderate – Fitch Ratings only expects a policy rate raise to 0.25% by 2025. This is, of course, dependent on a number of factors. For instance, if trend inflation continues to escalate, further rate hikes will be more probable. The actions taken by other central banks are equally crucial, as mentioned earlier, with the FED and the ECB poised to begin lowering rates. If the FED indeed implements rate cuts while the Bank of Japan proceeds with further rate hikes, the Yen could experience a swift appreciation, exerting a significant impact on the economy.

Conclusion: The Implied Road Ahead

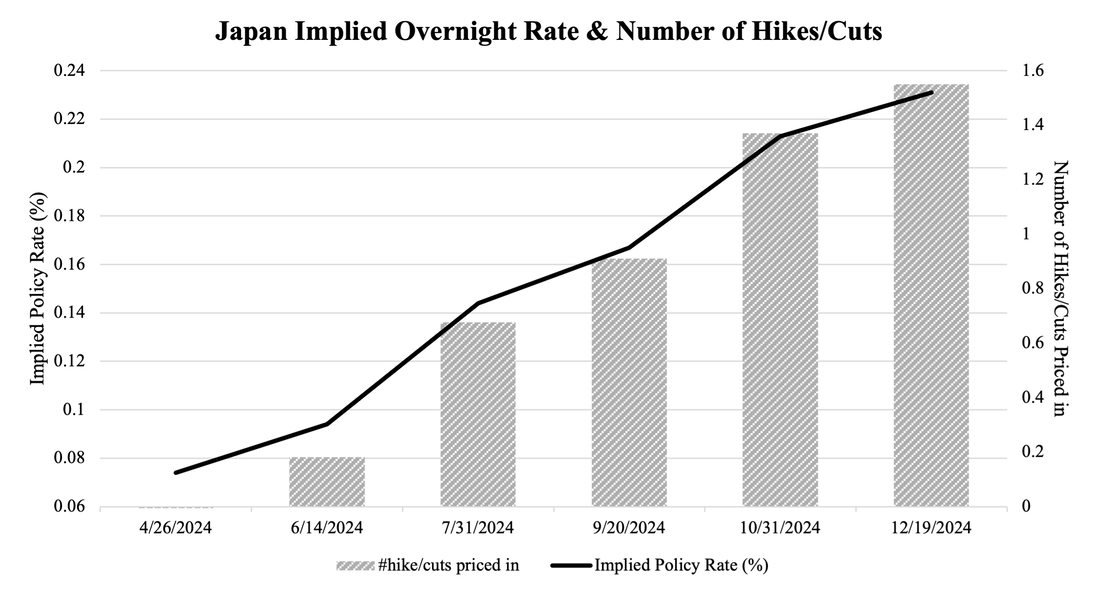

All in all, considering market reactions, broker and rating agencies takes in the week following the BoJ’s exit from NIRP, the move is couched in a dovish context, with continued commitments to Japanese Government Bond (JGB) purchases and effective Quantitative Easing (QE). This nuanced approach suggests a gradual path to normalisation, tempering expectations of a rapid unwinding of carry trades, as the Yen’s depreciation persists. Governor Ueda's emphasis on accommodative conditions until inflation is firmly anchored at 2%, and the reluctance to define a terminal rate, have contributed to the continuation of the Yen’s slide against major currencies. However, it is key to note that markets are in a jittery stage where they view the Yen as an attractive funding currency but have been warned of potential foreign exchange interventions signalled by the Ministry of Finance (MoF), with USD/JPY movements past the 155 mark potentially triggering policy responses. Despite the FED’s less dovish outlook hinting at a wider interest rate differential, the slow pace of BoJ rate increases (image below showing market implied rate & hike path by meeting for 2024) suggests the Yen may continue to weaken in the near-term. The close watch on the MoF's rhetoric and BoJ's JGB operations will guide market participants through volatile trading, with the Yen expected to maintain its role in carry trades against a backdrop of shifting global liquidity dynamics widely dependent on scenarios for the pace and size of future policy rate increases.

Source: Bloomberg

By Leo Antlitz, Maya Doyle, Orestas Freigofas, Giulio Losano

Sources:

- Financial Times

- Bloomberg

- Bank of Japan

- Fitch Ratings

- Reuters

- Deloitte

- The Economist

- BBC