Japan’s largest private equity deal ever

After a prolonged period of corporate governance failures, accounting irregularities, and strategic missteps, Toshiba appears to have secured a buyer. On March 23, 2023, the company's Board of Directors approved a $15bn bid from a consortium of 17 domestic firms and six financial institutions, led by Japan Industrial Partners, a Japanese private equity fund. This proposed transaction, if completed, would be the largest take-private deal ever undertaken in the Japanese market. The proposed acquisition is still subject to regulatory approvals and due diligence. If successful, it would also represent a significant shift in ownership for one of Japan's most prominent conglomerates, with potential implications for its future strategy and direction.

The proposed acquisition would bring an end to the years of acrimonious battles between Toshiba's management and activist investors, who had been pushing for management changes and strategy overhauls. However, it remains to be seen whether this change in ownership will lead to a revival of the conglomerate, which never fully recovered from the 2015 accounting scandal.

Despite these challenges, Toshiba remains a significant player in several key industries, including energy, electronics, and infrastructure. According to its 2022 financial report, the company generated revenues

of approximately $45bn, with a net income of $1.7bn. However, it also reported total liabilities of over $28bn, with long-term debt obligations of $16bn.

Toshiba’s history

Toshiba Corporation is a Japanese multinational conglomerate that has been in operation for over 146 years. It was founded in 1875 as Tanaka Seizo-sho, a manufacturer of telegraph equipment, by Hisashige Tanaka. The company has since expanded into various industries, including electronics, energy, infrastructure, and healthcare.

In 1890, Tanaka Engineering Works, one of the company's subsidiaries, built Japan's first incandescent electric lamp. A few years later, in 1899, the company produced Japan's first electric power plant. In the early 1900s, the company began producing consumer electronics, including radios and televisions.

During World War II, Toshiba was involved in the development of military technology, including radar and communication equipment. After the war, the company shifted its focus to civilian products, including home appliances and electronics.

In the 1950s, Toshiba began producing semiconductors, and in 1959, it developed Japan's first transistorized computer. The company continued to innovate in the electronics industry, producing Japan's first color TV in 1960 and the world's first laptop computer in 1985.

Toshiba has also been involved in the nuclear power industry, providing equipment and technology for power plants. However, in 2015, the company faced a major scandal when it was revealed that it had falsified accounting records for several years to cover up losses in its nuclear operations.

Despite this setback, Toshiba has continued to innovate and evolve. In recent years, the company has focused on renewable energy and energy storage, as well as healthcare technology. In 2018, Toshiba sold its computer business to Sharp Corporation, marking a new chapter in the company's history.

Today, Toshiba remains a major player in the electronics and energy industries, with a strong focus on innovation and sustainability. Its long history of technological innovation and adaptability has enabled it to thrive in a rapidly changing global market.

Accounting Scandal

Toshiba has been involved in a number of accounting scandals over the years. The most notable of these occurred in 2015 when the company was found to have overstated its profits by $1.2 billion over the course of several years. The scandal led to the resignation of the company's CEO and other top executives, as well as a significant drop in the company's stock price. The scandal was a major blow to Toshiba's reputation and raised questions about the company's financial practices.

The accounting misconduct began under CEO Atsutoshi Nishida in 2008 amid a global financial crisis that cut deeply into Toshiba's profitability. It continued unabated under the next CEO, Norio Sasaki, and eventually ended in scandal under Tanaka.

The inappropriate accounting techniques employed at Toshiba varied somewhat between the different business units. Investigators found evidence of booking future profits early, pushing back losses, pushing back charges, and other similar techniques that resulted in overstated profits. The investigative panel concluded that Toshiba's corporate culture, which demanded obedience to superiors, was an important factor enabling the emergence of fraudulent accounting practices. The culture operated on the level of business unit presidents and every level of authority down the chain to the accountants who ultimately employed the accounting techniques.

The investigative panel also pointed to weak corporate governance and a poorly functioning system of internal controls at every level of the Toshiba conglomerate. Internal controls in the finance division, the corporate auditing division, the risk management division, and the securities disclosure committee did not function properly to identify and stop the inappropriate behaviors

In the aftermath of the scandal, Toshiba implemented a number of reforms aimed at improving its accounting practices and restoring investor confidence. These reforms included the creation of a new auditing committee, the establishment of a new code of conduct for employees, and the implementation of a new system for monitoring and reporting financial information.

Despite these efforts, Toshiba has continued to face criticism over its accounting practices. In 2017, the company was fined by Japanese regulators for overstating its profits in the previous fiscal year. The company has also faced allegations of accounting irregularities in its nuclear power division. While the firm has taken steps to address these issues, it remains to be seen whether it will be able to fully regain the trust of investors and stakeholders.

Toshiba's successful and unsuccessful investments

Toshiba has a long history of successful and unsuccessful investments. On the one hand, the company has been a pioneer in the technology industry, producing groundbreaking products such as the world's first double-coiled light bulb and the first mass-market laptop. However, in recent years, the company has struggled to keep up with new market trends and has failed to innovate in the face of increased competition from lower-end manufacturers in Taiwan and China. This has led consumers to choose cheaper brands over Toshiba's more prestigious products.

One of Toshiba's most significant and costly investments was the US$4.158 billion acquisition of 77% share of Westinghouse Electric, a nuclear power plant construction firm, in 2006. The purchase was made with the hope of expanding Toshiba's nuclear energy business and tapping into the growing global demand for nuclear power. However, the acquisition turned out to be poorly timed, and the company was hit hard by the Fukushima disaster in 2011, which led to a global shift away from nuclear power (Westinghouse Electric filed for bankruptcy in 2017). This, combined with the high costs of constructing new nuclear power plants, led to significant financial losses for the company.

After a prolonged period of corporate governance failures, accounting irregularities, and strategic missteps, Toshiba appears to have secured a buyer. On March 23, 2023, the company's Board of Directors approved a $15bn bid from a consortium of 17 domestic firms and six financial institutions, led by Japan Industrial Partners, a Japanese private equity fund. This proposed transaction, if completed, would be the largest take-private deal ever undertaken in the Japanese market. The proposed acquisition is still subject to regulatory approvals and due diligence. If successful, it would also represent a significant shift in ownership for one of Japan's most prominent conglomerates, with potential implications for its future strategy and direction.

The proposed acquisition would bring an end to the years of acrimonious battles between Toshiba's management and activist investors, who had been pushing for management changes and strategy overhauls. However, it remains to be seen whether this change in ownership will lead to a revival of the conglomerate, which never fully recovered from the 2015 accounting scandal.

Despite these challenges, Toshiba remains a significant player in several key industries, including energy, electronics, and infrastructure. According to its 2022 financial report, the company generated revenues

of approximately $45bn, with a net income of $1.7bn. However, it also reported total liabilities of over $28bn, with long-term debt obligations of $16bn.

Toshiba’s history

Toshiba Corporation is a Japanese multinational conglomerate that has been in operation for over 146 years. It was founded in 1875 as Tanaka Seizo-sho, a manufacturer of telegraph equipment, by Hisashige Tanaka. The company has since expanded into various industries, including electronics, energy, infrastructure, and healthcare.

In 1890, Tanaka Engineering Works, one of the company's subsidiaries, built Japan's first incandescent electric lamp. A few years later, in 1899, the company produced Japan's first electric power plant. In the early 1900s, the company began producing consumer electronics, including radios and televisions.

During World War II, Toshiba was involved in the development of military technology, including radar and communication equipment. After the war, the company shifted its focus to civilian products, including home appliances and electronics.

In the 1950s, Toshiba began producing semiconductors, and in 1959, it developed Japan's first transistorized computer. The company continued to innovate in the electronics industry, producing Japan's first color TV in 1960 and the world's first laptop computer in 1985.

Toshiba has also been involved in the nuclear power industry, providing equipment and technology for power plants. However, in 2015, the company faced a major scandal when it was revealed that it had falsified accounting records for several years to cover up losses in its nuclear operations.

Despite this setback, Toshiba has continued to innovate and evolve. In recent years, the company has focused on renewable energy and energy storage, as well as healthcare technology. In 2018, Toshiba sold its computer business to Sharp Corporation, marking a new chapter in the company's history.

Today, Toshiba remains a major player in the electronics and energy industries, with a strong focus on innovation and sustainability. Its long history of technological innovation and adaptability has enabled it to thrive in a rapidly changing global market.

Accounting Scandal

Toshiba has been involved in a number of accounting scandals over the years. The most notable of these occurred in 2015 when the company was found to have overstated its profits by $1.2 billion over the course of several years. The scandal led to the resignation of the company's CEO and other top executives, as well as a significant drop in the company's stock price. The scandal was a major blow to Toshiba's reputation and raised questions about the company's financial practices.

The accounting misconduct began under CEO Atsutoshi Nishida in 2008 amid a global financial crisis that cut deeply into Toshiba's profitability. It continued unabated under the next CEO, Norio Sasaki, and eventually ended in scandal under Tanaka.

The inappropriate accounting techniques employed at Toshiba varied somewhat between the different business units. Investigators found evidence of booking future profits early, pushing back losses, pushing back charges, and other similar techniques that resulted in overstated profits. The investigative panel concluded that Toshiba's corporate culture, which demanded obedience to superiors, was an important factor enabling the emergence of fraudulent accounting practices. The culture operated on the level of business unit presidents and every level of authority down the chain to the accountants who ultimately employed the accounting techniques.

The investigative panel also pointed to weak corporate governance and a poorly functioning system of internal controls at every level of the Toshiba conglomerate. Internal controls in the finance division, the corporate auditing division, the risk management division, and the securities disclosure committee did not function properly to identify and stop the inappropriate behaviors

In the aftermath of the scandal, Toshiba implemented a number of reforms aimed at improving its accounting practices and restoring investor confidence. These reforms included the creation of a new auditing committee, the establishment of a new code of conduct for employees, and the implementation of a new system for monitoring and reporting financial information.

Despite these efforts, Toshiba has continued to face criticism over its accounting practices. In 2017, the company was fined by Japanese regulators for overstating its profits in the previous fiscal year. The company has also faced allegations of accounting irregularities in its nuclear power division. While the firm has taken steps to address these issues, it remains to be seen whether it will be able to fully regain the trust of investors and stakeholders.

Toshiba's successful and unsuccessful investments

Toshiba has a long history of successful and unsuccessful investments. On the one hand, the company has been a pioneer in the technology industry, producing groundbreaking products such as the world's first double-coiled light bulb and the first mass-market laptop. However, in recent years, the company has struggled to keep up with new market trends and has failed to innovate in the face of increased competition from lower-end manufacturers in Taiwan and China. This has led consumers to choose cheaper brands over Toshiba's more prestigious products.

One of Toshiba's most significant and costly investments was the US$4.158 billion acquisition of 77% share of Westinghouse Electric, a nuclear power plant construction firm, in 2006. The purchase was made with the hope of expanding Toshiba's nuclear energy business and tapping into the growing global demand for nuclear power. However, the acquisition turned out to be poorly timed, and the company was hit hard by the Fukushima disaster in 2011, which led to a global shift away from nuclear power (Westinghouse Electric filed for bankruptcy in 2017). This, combined with the high costs of constructing new nuclear power plants, led to significant financial losses for the company.

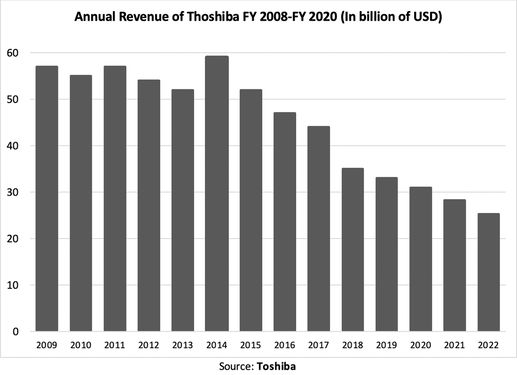

In addition, Toshiba’s revenue has started to dwindle in recent years, decreasing from almost $60 billion in the 2008 fiscal year to just half of that in 2019 and even less expected for 2020. As seen in the data, Toshiba could not benefit from the consumer electronics gold rush of the COVID-19 pandemic, as it (successfully) spun off its semiconductor segment into Kioxia in 2018 and sold most of its laptop business the same year. Sharp acquired the remaining share of around 20 percent in mid-2020, ending the personal computer business for the company that was one of the laptop pioneers of 1980.

Toshiba's memory chip business sale in 2018 to Bain Consortium was another significant investment decision that proved successful in helping to pay down the company's debt. However, the decision to sell off such a valuable asset also highlights the company's financial struggles and the need to make tough decisions to stay afloat in the global economy.

Investor bidding and selection process

As a result of poor performance in recent years, the conglomerate has become the target of hedge funds, activist investors, and private equity groups, trying to gain control of the company in the hopes of turning around its operations and profiting from the process. Although the company had received a buyout offer from a prominent private equity fund in the year before, the deal fell through as the board of directors was divided on the issue of selling the Japanese company with a long history to a foreign private equity fund manager. Conflicts around the bid led to a boardroom coup and the ejection of the company’s chief executive. As a result, the bidding process to take one of the largest Japanese

companies private only began in April of 2022. The process had two rounds, with only the best offers making it into the second round, which took place in the summer of 2022.

In the first round of bidding, eight competing offers were submitted by large cap buyout funds as well as two offers for capital tie-ups which would have meant a partial investment in the firm keeping it public. The initial investment managers that submitted offers were some of the largest private equity funds such as Bain Capital together with Blackstone, JIP, CVC and KKR. Of these funds, only three made it to the second round of bidding, Bain Capital, which had previously acquired the firm’s chip producingoperation, JIP, a Japanese Private Equity group backed by a consortium of Japanese firms and other financial institutions, and CVC which had sparked the whole bidding process after submitting an unsolicited bid first in 2021. Although Blackstone attempted to stay in the race by approaching KKR to launch a joint bid, KKR decided to back out from the process.

In the second round, JIP was flagged as the preferred buyer by the board of Toshiba, and the board ended up accepting the fund manager’s bid of 35 dollars per share, a 9.7% premium compared to the previous days’ closing price, for a total value of USD 15 billion in March of 2023. Though the bid was approved by the board, it was not recommended to shareholders, and the acquisition is likely to take place in the summer in the form of a tender offer to the shareholders. Following the news, Toshiba’s share price jumped to USD 33.4 and has hovered around 34 dollars per share since, signaling that the market is confident the sale is going to go through.

Deal structure

JPI has obtained commitments for investment and lending of more than ¥2 trillion to acquire a controlling stake of 66.7% in Toshiba through its bidding group, TB Investment Limited Partnership (TBLPS). The consortium aims to purchase 432,630,045 Toshiba shares at ¥4,620 per share, amounting to Yen ($15 billion), with a minimum requirement of 288,564,300 shares. If the minimum threshold is not achieved, no shares will be purchased.

Initially, JPI offered ¥5,200 per share when it was selected as the preferred bidder in November 2022. However, due to a decline in Toshiba's earnings forecast, the offer price was first reduced to ¥4,710 and then further decreased to ¥4,620. Despite this, the offer still represents a 10% premium over the closing price of ¥4,213 as of 23rd March. Furthermore, it is higher than the six-month average share price of ¥4,683 before CVC Capital Partners' offer in April 2021, which significantly increased Toshiba's price. However, the current offer is still 15% lower than the price before the accounting scandal in December 2014 and 22% lower than the all-time high in June 2022.

Deal rational

The impact of activist investors has been a significant driving force in the sale of Toshiba. In the wake of the company's accounting scandal and financial crisis, investors such as Elliott Management and Farallon Capital acquired substantial stakes in the firm, representing around 10% of its shares each. Collectively, activist shareholders control approximately 25% of Toshiba.

When Toshiba proposed splitting the company into three separate entities, it faced opposition from these investors. They argued that a full sale of the company would be a more effective way to realise value for shareholders. In fact, a spokesperson for Elliott Management stated that "the only viable option for Toshiba is to pursue a full sale of the company".

Ultimately, Toshiba's plan to split the company was voted down by shareholders, opening the door for a sale. Activist investors have continued to play a role in the process, with the appointment of two new board members from Elliott Management and Farallon Capital and a pledge from Toshiba to carry out a fair and transparent bidding process.

The support of these investors will be critical for the latest JIP proposal to go through. However, it remains to be seen how they will respond to the $15bn offer and whether they believe it represents fair value for Toshiba's shareholders.

There are several reasons why an only Japanese investment consortium was considered for the acquisition of Toshiba. Toshiba has critical businesses such as nuclear and defense technology that are seen as strategic assets of Japan. The transfer of such sensitive technologies to foreign ownership may raise national security concerns. Therefore, the Japanese government and regulatory bodies have expressed a preference for a domestic consortium to acquire Toshiba.

Moreover, Japanese companies have a tradition of fostering long-term relationships with suppliers, customers, and stakeholders. By bringing together a consortium of domestic companies and financial institutions, the acquisition of Toshiba can leverage these relationships and build a stronger domestic industrial ecosystem. This is seen as an important element of promoting economic growth and enhancing Japan's competitiveness in the global market.

In addition, the Japanese government has been actively encouraging private equity investment as a way to stimulate economic growth and create jobs. The government has introduced tax incentives for private equity firms and taken steps to ease regulations. The combination of low interest rates and government support has made private equity also an increasingly attractive investment option in Japan.

The future of Toshiba

Looking forward, it will be intriguing to observe the impact of Toshiba's new private ownership on the company's decision-making process and its capacity to revive itself. The investment consortium is expected to prioritize restructuring Toshiba's business lines to ensure sustained profitability, with the goal of establishing stable management and a united shareholder base.

It is noteworthy that JIP, the private equity fund leading the takeover, has not previously acquired a company of this magnitude, presenting an element of uncertainty regarding its ability to revive Toshiba. Additionally, JIP's proximity to the government and trade ministry

raises questions regarding the fund's capacity to bring about the required changes to turn the company around.

The specific businesses the consortium will focus on, as well as the ones it will consider divesting, remain to be seen. However, given Toshiba's history of shedding non-core businesses in recent years, it is likely that the consortium will continue this trend and concentrate on the company's primary businesses, such as energy, infrastructure, and electronic devices.

Written by Domenico Destito, Máté Mangoff, David Overbeck and Ruben van der Lubbe

Toshiba's memory chip business sale in 2018 to Bain Consortium was another significant investment decision that proved successful in helping to pay down the company's debt. However, the decision to sell off such a valuable asset also highlights the company's financial struggles and the need to make tough decisions to stay afloat in the global economy.

Investor bidding and selection process

As a result of poor performance in recent years, the conglomerate has become the target of hedge funds, activist investors, and private equity groups, trying to gain control of the company in the hopes of turning around its operations and profiting from the process. Although the company had received a buyout offer from a prominent private equity fund in the year before, the deal fell through as the board of directors was divided on the issue of selling the Japanese company with a long history to a foreign private equity fund manager. Conflicts around the bid led to a boardroom coup and the ejection of the company’s chief executive. As a result, the bidding process to take one of the largest Japanese

companies private only began in April of 2022. The process had two rounds, with only the best offers making it into the second round, which took place in the summer of 2022.

In the first round of bidding, eight competing offers were submitted by large cap buyout funds as well as two offers for capital tie-ups which would have meant a partial investment in the firm keeping it public. The initial investment managers that submitted offers were some of the largest private equity funds such as Bain Capital together with Blackstone, JIP, CVC and KKR. Of these funds, only three made it to the second round of bidding, Bain Capital, which had previously acquired the firm’s chip producingoperation, JIP, a Japanese Private Equity group backed by a consortium of Japanese firms and other financial institutions, and CVC which had sparked the whole bidding process after submitting an unsolicited bid first in 2021. Although Blackstone attempted to stay in the race by approaching KKR to launch a joint bid, KKR decided to back out from the process.

In the second round, JIP was flagged as the preferred buyer by the board of Toshiba, and the board ended up accepting the fund manager’s bid of 35 dollars per share, a 9.7% premium compared to the previous days’ closing price, for a total value of USD 15 billion in March of 2023. Though the bid was approved by the board, it was not recommended to shareholders, and the acquisition is likely to take place in the summer in the form of a tender offer to the shareholders. Following the news, Toshiba’s share price jumped to USD 33.4 and has hovered around 34 dollars per share since, signaling that the market is confident the sale is going to go through.

Deal structure

JPI has obtained commitments for investment and lending of more than ¥2 trillion to acquire a controlling stake of 66.7% in Toshiba through its bidding group, TB Investment Limited Partnership (TBLPS). The consortium aims to purchase 432,630,045 Toshiba shares at ¥4,620 per share, amounting to Yen ($15 billion), with a minimum requirement of 288,564,300 shares. If the minimum threshold is not achieved, no shares will be purchased.

Initially, JPI offered ¥5,200 per share when it was selected as the preferred bidder in November 2022. However, due to a decline in Toshiba's earnings forecast, the offer price was first reduced to ¥4,710 and then further decreased to ¥4,620. Despite this, the offer still represents a 10% premium over the closing price of ¥4,213 as of 23rd March. Furthermore, it is higher than the six-month average share price of ¥4,683 before CVC Capital Partners' offer in April 2021, which significantly increased Toshiba's price. However, the current offer is still 15% lower than the price before the accounting scandal in December 2014 and 22% lower than the all-time high in June 2022.

Deal rational

The impact of activist investors has been a significant driving force in the sale of Toshiba. In the wake of the company's accounting scandal and financial crisis, investors such as Elliott Management and Farallon Capital acquired substantial stakes in the firm, representing around 10% of its shares each. Collectively, activist shareholders control approximately 25% of Toshiba.

When Toshiba proposed splitting the company into three separate entities, it faced opposition from these investors. They argued that a full sale of the company would be a more effective way to realise value for shareholders. In fact, a spokesperson for Elliott Management stated that "the only viable option for Toshiba is to pursue a full sale of the company".

Ultimately, Toshiba's plan to split the company was voted down by shareholders, opening the door for a sale. Activist investors have continued to play a role in the process, with the appointment of two new board members from Elliott Management and Farallon Capital and a pledge from Toshiba to carry out a fair and transparent bidding process.

The support of these investors will be critical for the latest JIP proposal to go through. However, it remains to be seen how they will respond to the $15bn offer and whether they believe it represents fair value for Toshiba's shareholders.

There are several reasons why an only Japanese investment consortium was considered for the acquisition of Toshiba. Toshiba has critical businesses such as nuclear and defense technology that are seen as strategic assets of Japan. The transfer of such sensitive technologies to foreign ownership may raise national security concerns. Therefore, the Japanese government and regulatory bodies have expressed a preference for a domestic consortium to acquire Toshiba.

Moreover, Japanese companies have a tradition of fostering long-term relationships with suppliers, customers, and stakeholders. By bringing together a consortium of domestic companies and financial institutions, the acquisition of Toshiba can leverage these relationships and build a stronger domestic industrial ecosystem. This is seen as an important element of promoting economic growth and enhancing Japan's competitiveness in the global market.

In addition, the Japanese government has been actively encouraging private equity investment as a way to stimulate economic growth and create jobs. The government has introduced tax incentives for private equity firms and taken steps to ease regulations. The combination of low interest rates and government support has made private equity also an increasingly attractive investment option in Japan.

The future of Toshiba

Looking forward, it will be intriguing to observe the impact of Toshiba's new private ownership on the company's decision-making process and its capacity to revive itself. The investment consortium is expected to prioritize restructuring Toshiba's business lines to ensure sustained profitability, with the goal of establishing stable management and a united shareholder base.

It is noteworthy that JIP, the private equity fund leading the takeover, has not previously acquired a company of this magnitude, presenting an element of uncertainty regarding its ability to revive Toshiba. Additionally, JIP's proximity to the government and trade ministry

raises questions regarding the fund's capacity to bring about the required changes to turn the company around.

The specific businesses the consortium will focus on, as well as the ones it will consider divesting, remain to be seen. However, given Toshiba's history of shedding non-core businesses in recent years, it is likely that the consortium will continue this trend and concentrate on the company's primary businesses, such as energy, infrastructure, and electronic devices.

Written by Domenico Destito, Máté Mangoff, David Overbeck and Ruben van der Lubbe

Sources:

Toshiba

Encyclopedia Britannica

Reuters

Financial Times

Statista

Toshiba

Encyclopedia Britannica

Reuters

Financial Times

Statista