After 2008, financial world deeply changed. The great illusion of uncontrolled, self-regulating free market has been put aside, at least for the moment. Political world is now demanding more regulation and governance, as we can see from the latest recommendations for the banking industry (e.g. Basel Accords). Even economists of the major international institutions are now taking into consideration neo-Keynesian theories.

Consequently, Central Bankers are now playing a greater role in shaping the business world. What do they do in simple words? Some would think that they use quantitative easing or any other monetary policies.

Actually, their most powerful tool is the so-called “Verbal Intervention”. In the reality, ethereal words do not move the markets unless you exploit the greatest assets of every Central Bank. Credibility and consistency. You cannot find them on the balance sheet. The main duty of Central Bankers is what they call “Management of Expectations”.

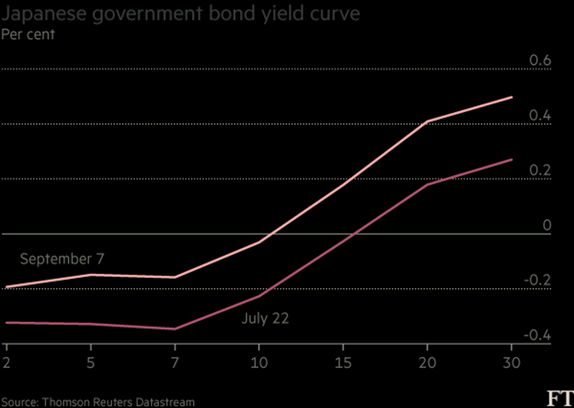

Unfortunately, it is not the case for Bank of Japan. Few weeks ago, BOJ gave a series of shady speeches that left markets confused. Haruhiko Kuroda (BOJ Governor) stated his “comprehensive assessment” of policy, his goals: 2 per cent inflation and management of negative interest rates in future. What did the analysts understand? Some of them are 100% sure BOJ will abandon the “freezing” strategy under the zero while others would definitely bet on a further cut. There is also problem of communication, given the obscure academic language used in statements. In addition, BOJ does not respect its promises over the time. Its monetary actions missed the aim of 2 per cent inflation in “about 2 years”. Even Mr Kuroda understood the vital importance of public expectations, because they are often self-fulfilling.

Furthermore, a stronger yen is now pushing down internal prices but also exports levels so that another stimulating easing seems unavoidable. When it rains, it pours. What should they do now? Negative interest rates cause lowers profits for banks and pension funds and Mr Kuroda recognized that the benefits really depend on the duration of the policy. Japan is apparently stuck, and so does its entrepreneurial culture. There is a true need of a valid alternative. A sort of “fresh monetary magic”. In fact in Mr Kuroda words “other new ideas should not be off the table”. At the very moment, he is not committed to do “whatever it takes” but, in a more Eastern style, he vowed his “utmost efforts” to reach the finishing line of 2 per cent inflation at the earliest time possible. Could believe it or not?

Let’s hope for the best

Consequently, Central Bankers are now playing a greater role in shaping the business world. What do they do in simple words? Some would think that they use quantitative easing or any other monetary policies.

Actually, their most powerful tool is the so-called “Verbal Intervention”. In the reality, ethereal words do not move the markets unless you exploit the greatest assets of every Central Bank. Credibility and consistency. You cannot find them on the balance sheet. The main duty of Central Bankers is what they call “Management of Expectations”.

Unfortunately, it is not the case for Bank of Japan. Few weeks ago, BOJ gave a series of shady speeches that left markets confused. Haruhiko Kuroda (BOJ Governor) stated his “comprehensive assessment” of policy, his goals: 2 per cent inflation and management of negative interest rates in future. What did the analysts understand? Some of them are 100% sure BOJ will abandon the “freezing” strategy under the zero while others would definitely bet on a further cut. There is also problem of communication, given the obscure academic language used in statements. In addition, BOJ does not respect its promises over the time. Its monetary actions missed the aim of 2 per cent inflation in “about 2 years”. Even Mr Kuroda understood the vital importance of public expectations, because they are often self-fulfilling.

Furthermore, a stronger yen is now pushing down internal prices but also exports levels so that another stimulating easing seems unavoidable. When it rains, it pours. What should they do now? Negative interest rates cause lowers profits for banks and pension funds and Mr Kuroda recognized that the benefits really depend on the duration of the policy. Japan is apparently stuck, and so does its entrepreneurial culture. There is a true need of a valid alternative. A sort of “fresh monetary magic”. In fact in Mr Kuroda words “other new ideas should not be off the table”. At the very moment, he is not committed to do “whatever it takes” but, in a more Eastern style, he vowed his “utmost efforts” to reach the finishing line of 2 per cent inflation at the earliest time possible. Could believe it or not?

Let’s hope for the best

Nicola Maria Fiore