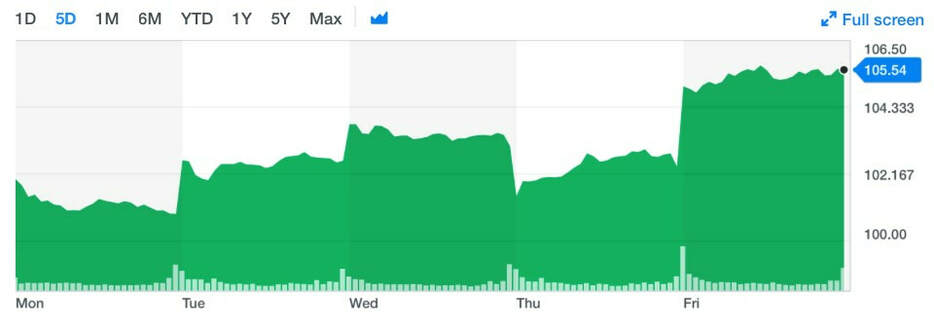

J.P. Morgan share price performance in the past week. Source: Yahoo Finance

J.P. Morgan share price performance in the past week. Source: Yahoo Finance

J.P. Morgan Chase will be the first major U.S. bank to create its own cryptocurrency. In trials set to start in a few months, a tiny fraction of the $6 trillion the bank lends to corporations will be processed over something called 'JPM Coin.' The digital token created by the engineers at the New York-based bank is meant to instantly settle payments between clients. Only the banks’ big institutional clients who have completed regulatory checks will be able to use this token. Moreover, the value of this token is fixed, each coin is redeemable for a single US dollar.

This may come as a surprise to many, as J.P Morgan’s CEO Jamie Dimon has always criticized Bitcoins, even defining them a fraud. He admitted the potential of the blockchain system, but at the same time he expressed doubts on non-fiat cryptocurrencies, whose value is aleatory and difficult to assess. Nonetheless, the company’s managers have consistently stated that blockchain and regulated digital currencies did hold some promise. This trial represents the first real-world use of a digital coin by a major U.S. bank. There already are cryptocurrencies which are pegged to the dollar, Tether is a popular example. It seems likely, tough, that J.P. Morgan entrance in this market will bring rapid and abrupt changes in the world payment system, with its competitors quickly following through. It may well be that in a couple of years there will be also a Bank of America cryptocurrency, a Citi cryptocurrency and many others, in a world dominated by digital currencies.

J.P. Morgan is preparing for a future in which parts of the essential underpinning of global capitalism, from cross-border payments to corporate debt issuance, move through blockchain. But in order for that future to happen, the bank needed a way to transfer money at the dizzying speed as those smart contracts closed, rather than relying on old technology like wire transfers. The advantage of such a token, as said by Mr. Farooq, head of J.P. Morgan's blockchain projects, is speed. Clients that want to move huge sums of money would traditionally need to do so via wire transfer, a process that could take hours or even days. With international transfers, changes in currency exchange rates during the long lag times could end up adding to customers’ costs.

"So anything that currently exists in the world, as that moves onto the blockchain, this would be the payment leg for that transaction," said Umar Farooq. "The applications are frankly quite endless; anything where you have a distributed ledger which involves corporations or institutions can use this". JPMorgan will control the JPM Coin ledger, and each coin will be backed by a dollar in JPMorgan accounts, giving the coins a stable value. That means JPM Coin will not be subject to the wild price volatility that has drawn speculators to other cryptocurrencies. JPMorgan’s version will be less useful than other similar products because it will not be possible to move it outside the firm’s own systems, at least initially.

Another peculiarity is that Mr. Farooq said JPMorgan’s offering would be useful for big clients, but not for the smaller speculators who have typically taken an interest in cryptocurrencies. “This is designed specifically for institutional use cases on blockchain,” he said. “It’s not created to be for public investment.” There are several other uses for this new digital coin. The first is for international payments for large corporate clients, which now typically happen using wire transfers between financial institutions on decades-old networks like Swift. The second is for securities transactions. In April, J.P. Morgan tested a debt issuance on the blockchain, creating a virtual simulation of a $150 million certificate of deposit for a Canadian bank. Rather than relying on wires to buy the issuance — resulting in a time gap between settling the transaction and being paid for it — institutional investors can use the J.P. Morgan token, resulting in instant settlements.

The final use would be for huge corporations that use J.P Morgan's treasury services business to replace the dollars they hold in subsidiaries across the world. Unseen by retail customers, the business handles a significant chunk of the world's regulated money flows for companies from Honeywell International to Facebook, moving dollars for activities like employee and supplier payments. It generated $9 billion in revenue last year for the bank.

JPMorgan said it hoped to increase its coin’s versatility. Over time, for instance, it could be expanded to represent currencies beyond the dollar. First, though, the testing phase must be competed.

Daniel Sacco

This may come as a surprise to many, as J.P Morgan’s CEO Jamie Dimon has always criticized Bitcoins, even defining them a fraud. He admitted the potential of the blockchain system, but at the same time he expressed doubts on non-fiat cryptocurrencies, whose value is aleatory and difficult to assess. Nonetheless, the company’s managers have consistently stated that blockchain and regulated digital currencies did hold some promise. This trial represents the first real-world use of a digital coin by a major U.S. bank. There already are cryptocurrencies which are pegged to the dollar, Tether is a popular example. It seems likely, tough, that J.P. Morgan entrance in this market will bring rapid and abrupt changes in the world payment system, with its competitors quickly following through. It may well be that in a couple of years there will be also a Bank of America cryptocurrency, a Citi cryptocurrency and many others, in a world dominated by digital currencies.

J.P. Morgan is preparing for a future in which parts of the essential underpinning of global capitalism, from cross-border payments to corporate debt issuance, move through blockchain. But in order for that future to happen, the bank needed a way to transfer money at the dizzying speed as those smart contracts closed, rather than relying on old technology like wire transfers. The advantage of such a token, as said by Mr. Farooq, head of J.P. Morgan's blockchain projects, is speed. Clients that want to move huge sums of money would traditionally need to do so via wire transfer, a process that could take hours or even days. With international transfers, changes in currency exchange rates during the long lag times could end up adding to customers’ costs.

"So anything that currently exists in the world, as that moves onto the blockchain, this would be the payment leg for that transaction," said Umar Farooq. "The applications are frankly quite endless; anything where you have a distributed ledger which involves corporations or institutions can use this". JPMorgan will control the JPM Coin ledger, and each coin will be backed by a dollar in JPMorgan accounts, giving the coins a stable value. That means JPM Coin will not be subject to the wild price volatility that has drawn speculators to other cryptocurrencies. JPMorgan’s version will be less useful than other similar products because it will not be possible to move it outside the firm’s own systems, at least initially.

Another peculiarity is that Mr. Farooq said JPMorgan’s offering would be useful for big clients, but not for the smaller speculators who have typically taken an interest in cryptocurrencies. “This is designed specifically for institutional use cases on blockchain,” he said. “It’s not created to be for public investment.” There are several other uses for this new digital coin. The first is for international payments for large corporate clients, which now typically happen using wire transfers between financial institutions on decades-old networks like Swift. The second is for securities transactions. In April, J.P. Morgan tested a debt issuance on the blockchain, creating a virtual simulation of a $150 million certificate of deposit for a Canadian bank. Rather than relying on wires to buy the issuance — resulting in a time gap between settling the transaction and being paid for it — institutional investors can use the J.P. Morgan token, resulting in instant settlements.

The final use would be for huge corporations that use J.P Morgan's treasury services business to replace the dollars they hold in subsidiaries across the world. Unseen by retail customers, the business handles a significant chunk of the world's regulated money flows for companies from Honeywell International to Facebook, moving dollars for activities like employee and supplier payments. It generated $9 billion in revenue last year for the bank.

JPMorgan said it hoped to increase its coin’s versatility. Over time, for instance, it could be expanded to represent currencies beyond the dollar. First, though, the testing phase must be competed.

Daniel Sacco